Today, a large trader was caught in a squeeze, losing tens of thousands of dollars, which has raised concerns among everyone about being squeezed.

Regarding issues like slippage and squeezes, I found that many people are not very clear about them. So, today I will write an article to explain these concepts and also point out areas that need attention.

- What is Slippage

When trading, the first thing to set is slippage. So, what is slippage? For example, if you want to buy a coin called DSB, and the price is $1. Even if you have the fastest fingers after being single for 30 years, the price may change from the moment you click submit to the final confirmation of the trade. The slippage you set is the allowable price range. If you set the slippage to 5%, it means you are willing to buy if the price goes up to $1.05. If it exceeds that, you are not willing to buy. Therefore, when a new coin opens and the price rises quickly, trades are likely to fail.

Many people set their slippage on Alpha very low, which ensures the buying price but makes trades very likely to fail because the price movement exceeds 0.01%.

- What is a Squeeze

Now there is a shameless person who is just watching on-chain. When they find a fool willing to buy DSB at a maximum of $1.05 while the current price is $1, they take action. The order of transactions on-chain is prioritized based on gas fees. This shameless person pays a slightly higher gas fee to prioritize their transaction, pushing the price of DSB up to $1.05. Then, when it’s the fool's turn, their transaction is executed at $1.05. Because of this buying action, the price of DSB continues to rise (for example, to $1.06). Then this shameless person immediately sells all their DSB at $1.06, realizing a risk-free profit.

So, this shameless squeeze does not target all transactions; it ensures that profits are guaranteed because it needs to pay the cost of higher gas fees.

- TVL of Trading Pairs

The TVL (Total Value Locked) of trading pairs, commonly referred to as pool thickness, affects the likelihood of being squeezed.

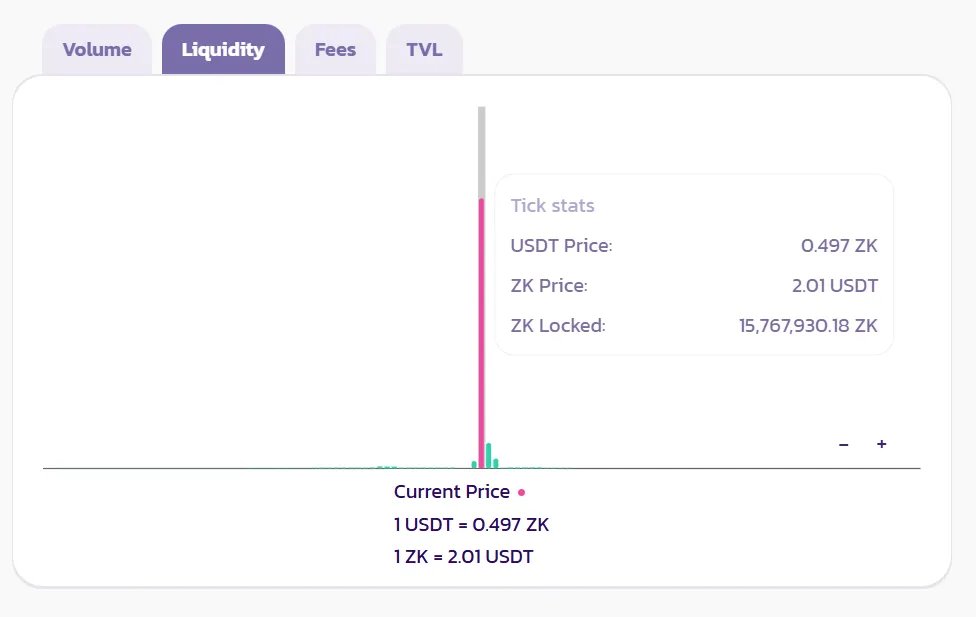

When the pool is very large, there is almost no need to worry about being squeezed because the cost required is very high. The image below shows the USDT/ZK LP pool. In Cake's V3, it allows setting a price range for investment, similar to a box format.

In simple terms, the current price of ZK is in a box at $2.01 USDT. To move to the next price range, all ZK in this box must be bought out. And how much is in the current box? There are 15.76 million ZK, worth about $30 million.

So, if a smart trader uses $1,000 and sets slippage to 1% to buy ZK, the shameless person would need to spend over $30 million to buy ZK and push the price to $1.01 to earn a $10 profit. Clearly, this is not a profitable business and carries a high risk. It’s very likely that before they sell ZK, the market maker has already withdrawn from the pool.

This is why the larger the pool, the lower the probability of being squeezed.

- Explaining Some Reasons for Being Squeezed and Low Losses

Most situations claimed to be squeezed may just be due to price fluctuations. Because the price box has a price range, even if the range is small, if it’s $10,000 and the price range is one-thousandth, there can still be a $10 fluctuation. Sometimes buying high and selling low can lead to significant changes in the price range.

Most low-loss strategies seen online are nonsense. They may just be coincidental, with prices rising. If you try at a different time, the results can be completely different. The only two conditions that can truly minimize losses are: 1) The pool is thick enough, so price fluctuations are very small, and the risk of being squeezed is low; 2) Low trading fees, which are the costs incurred for each trade.

- Finally, Discussing the Incident of a Large Trader Being Squeezed Today

Many people are worried about today’s incident. However, in reality, it may be due to the wallet using the wrong routing.

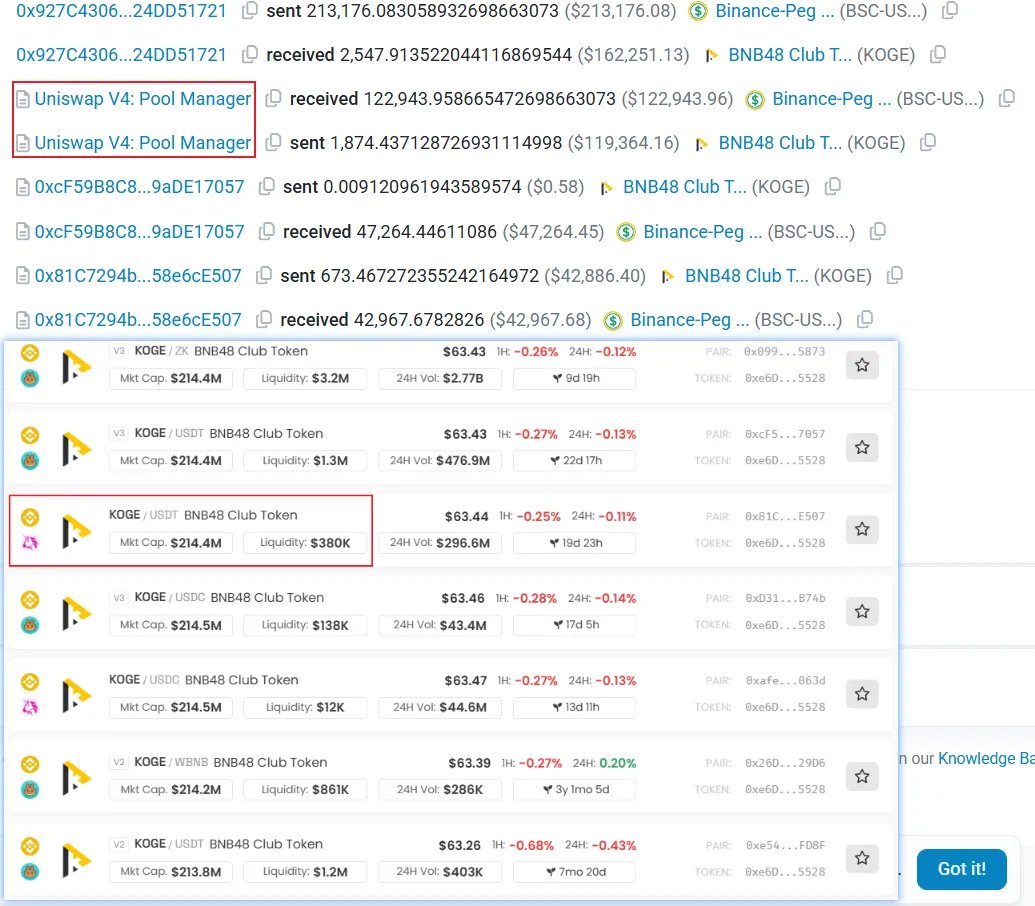

What is routing? For example, when you look at the Koge token, there are several pools, including USDC/WBNB/USDT/ZK trading pairs, as well as different exchanges like Cake and Uniswap. So, when you want to trade Koge, which pool (or routing) should you use? Generally, it is provided by the DEX you are using, or there are dedicated routing aggregation platforms like 1inch, Jup, etc. These places usually default to choosing the shortest path and the thickest pool for your trades.

Routing is often overlooked because it cannot be set. The website you are trading on automatically provides it. When trading with Binance Wallet, it will give you options for aggregation platforms. However, when the amount is particularly large, you need to pay special attention to routing. Because a single large amount may trade across multiple pools to minimize price impact.

In the case of the large trader being squeezed, it is clear that there was a problem with the routing. Looking at the Koge pools, the screenshot shows that the liquidity in the Uniswap pool is very small, while the PancakeSwap pool is the thickest. However, the routing chose to trade on Uniswap, and its slippage was not set properly, leading to this painful loss.

In summary, setting a very small slippage can prevent being squeezed, but it also carries the risk of trade failure. When the pool is particularly large, the risk of being squeezed is very low. You can mindlessly set the slippage to 0.01%. If you are not afraid, you can do as I do and trade in large pools like ZKJ with a default slippage of 1%.

As for today’s large trader being squeezed, it should be due to their own settings issue, as they did not set slippage. At the same time, the DEX routing they used also had problems.

If you think my article is good, please comment, like, and share. Your support is my greatest motivation to continue sharing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。