Exploring the Memecoin Investment Framework: Unveiling the Secrets of High Returns.

Author: Michael Nadeau

Source: The DeFi Report

Translation: Baihua Blockchain

Why Choose Memes?

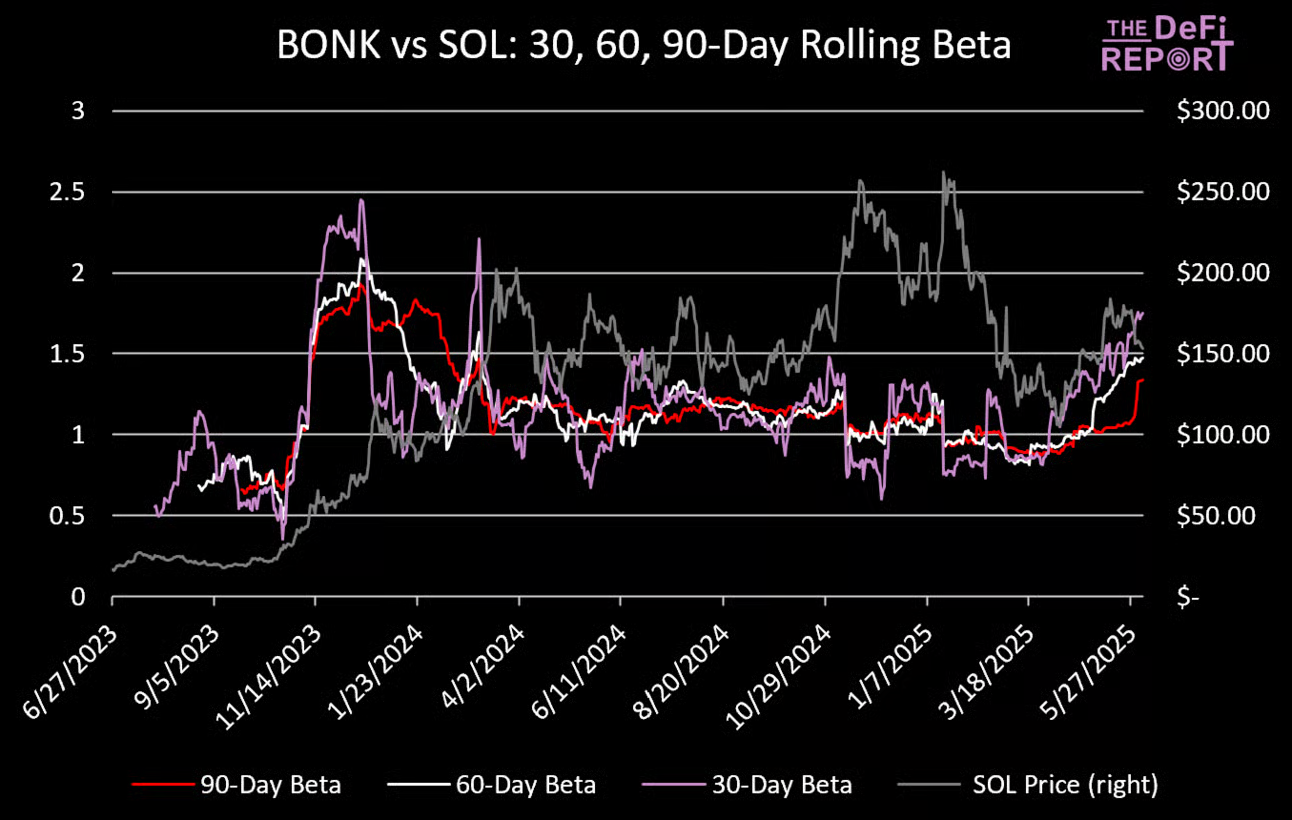

Beta

We like certain memecoins simply because they have high beta relative to Layer 1 (L1) assets. In simple terms, a small allocation to a memecoin like BONK (the cultural coin of the Solana ecosystem) can provide leverage to L1 assets without actually using leverage (avoiding liquidation risk).

Data: The DeFi Report

Data: The DeFi Report

The signal we look for is when the 30-day (pink) rolling beta exceeds the 90-day rolling beta (red - last occurred on April 1). When this happens, BONK's average 30-day and 60-day returns are 124% and 413% respectively (with medians of 45% and 57%).

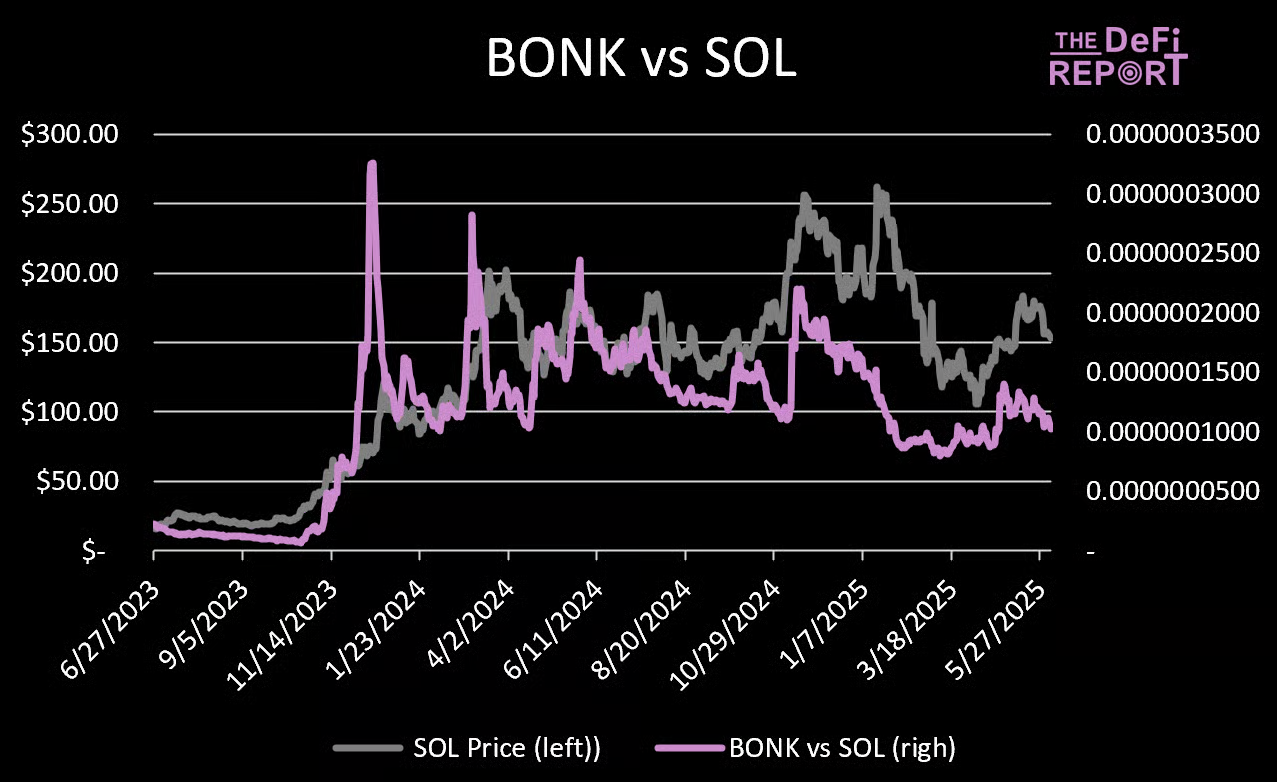

Price: Bonk vs SOL

Data: The DeFi Report

Data: The DeFi Report

We can see that shifts in risk appetite often happen quickly, with BONK significantly outperforming in a short time. This highlights the importance of buying at the right inflection point (which we will discuss later in the report).

BONK's surges typically occur alongside SOL rising +5% within a week. Here are BONK's average returns in such cases:

Average 1-week return 26%, median 14%* Average 30-day return 141%, median 11%

Average 60-day return 512%, median 27%

In about 1/3 of the cases, BONK actually declines—indicating that SOL's performance does not guarantee BONK's exceptional performance. Nevertheless, most of these cases occurred before BONK's explosive rise at the end of 2023.

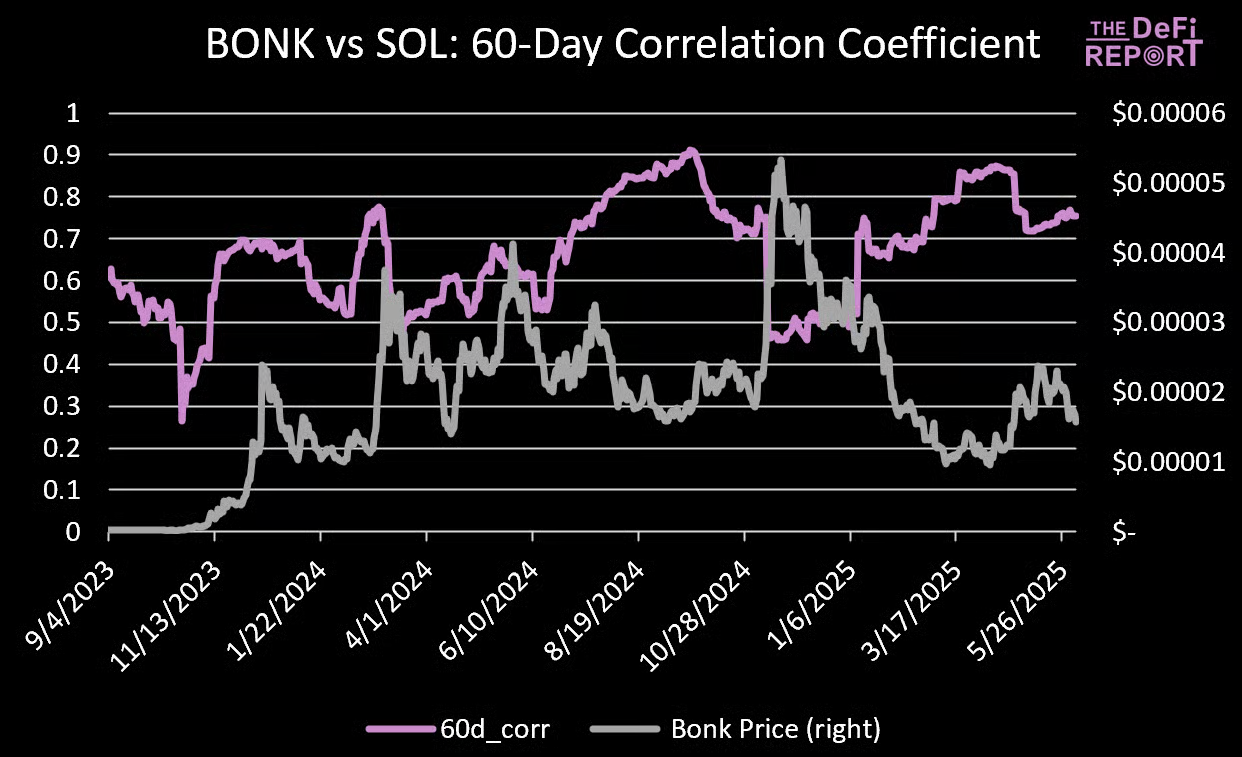

Bonk vs SOL Correlation

As shown in the chart below, BONK is generally correlated with SOL. However, during periods when BONK performs well (Q4 2023, Q1 2024, Q4 2024, and this April), this correlation often weakens.

Data: The DeFi Report

Data: The DeFi ReportKey Points:

BONK has high beta against SOL over 30-day, 60-day, and 90-day rolling periods, with higher beta from an absolute return perspective. This means that BONK's price movements typically far exceed those of SOL—making it a high-risk/high-reward asset.

We view BONK as a leveraged bet on SOL, but without the burden of leverage (liquidation risk).

We use BONK/SOL as a data example, but the same conditions apply to other "blue-chip" memecoins and their relationships with L1 assets, such as PEPE/ETH.

Next, we turn to on-chain data analysis…

On-Chain Data

In addition to understanding the performance of memecoins relative to their L1 counterparts, we also like to use on-chain data for quantitative analysis.

This can tell us about the relative quality and conviction of the holder base.

Below, we compare some top "blue-chip" memecoins to identify outliers.

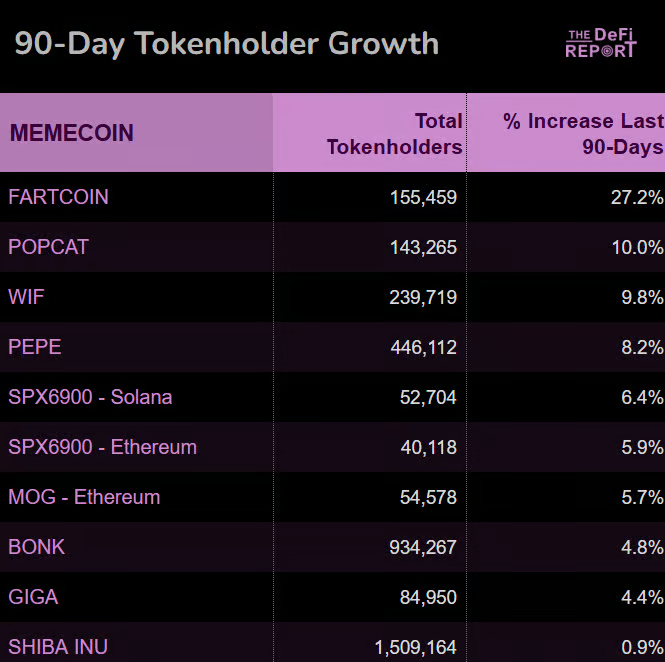

Token Holder Growth (90 Days)

Token holder growth provides insight into the recent popularity and viral spread of the token.

Data: The DeFi ReportMedian vs Average Holdings

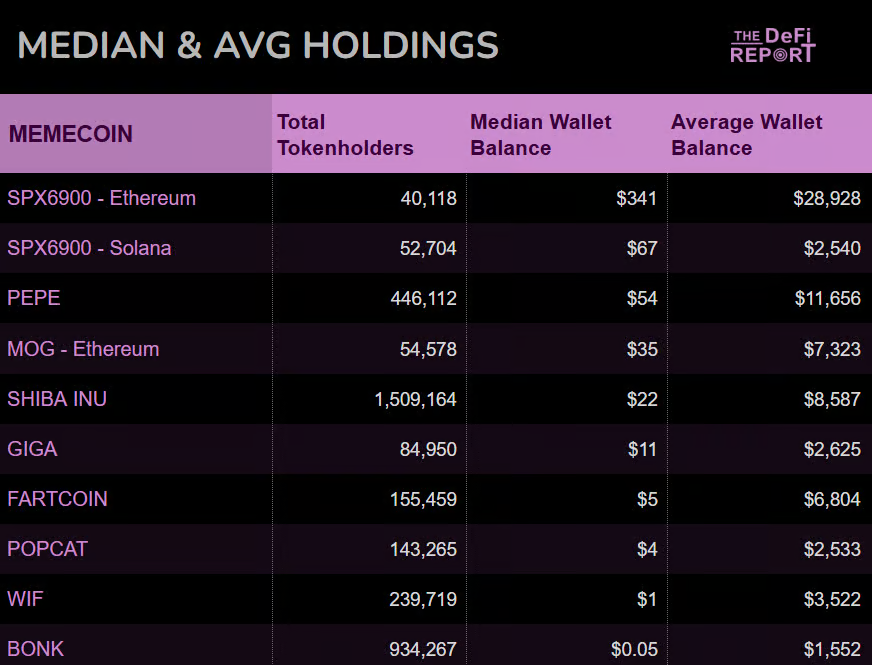

This helps us understand the conviction of median and average token holders. Note that some memecoin communities are more centralized than others. For these tokens, you will notice lower median holdings due to a large number of small airdrop distributions to many wallets.

Data: The DeFi Report

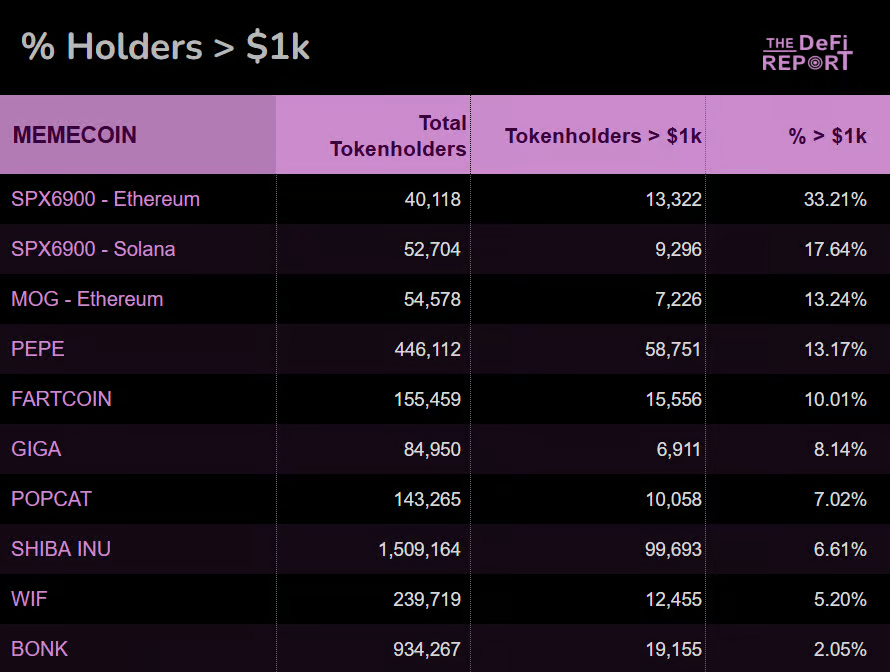

Data: The DeFi ReportHolders with > $1000 (%)

This again provides us with a perspective on the holder base. We want to see a higher proportion of wallets holding > $1k as an indicator of interest and conviction.

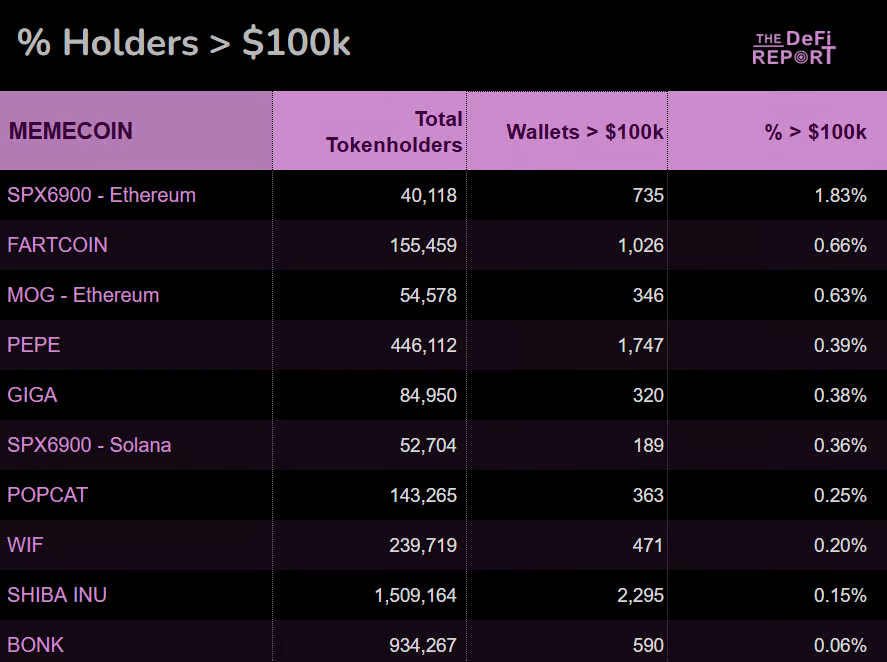

Holders with > $100k (%)

This gives us insight into the relative interest and conviction of large holders in the token, relative to the total number of holders.

Data: The DeFi Report, Dune

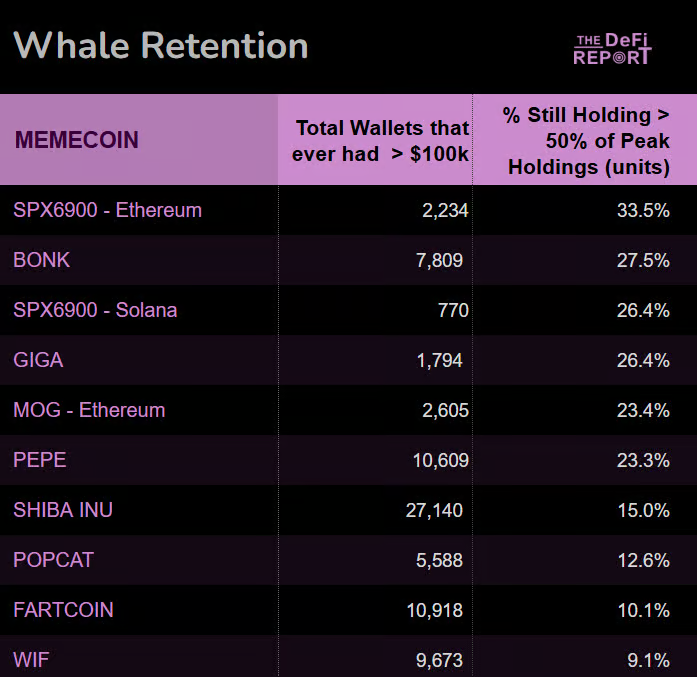

Data: The DeFi Report, DuneWhale Retention Rate

Through this metric, we look at all wallets that have ever held > $100k in tokens and still hold more than 50% of their peak unit count (to filter out noise from price fluctuations).

This helps us gauge the conviction of the largest holders.

Data: The DeFi Report, DuneWhales: DEX Net Inflows/Outflows

Here we filter all wallets that have ever held > $100k in tokens and analyze their inflows/outflows to DEX.

This provides insight into whether the largest holders are buying more tokens or exiting the project.

Data: The DeFi Report, Dune

Data: The DeFi Report, DuneOther Factors

In addition to on-chain data, we are only interested in memecoins that have sufficient trading liquidity and have experienced multiple pullbacks of over 50%.

Note that our data only looks at on-chain activity and does not include tokens held on centralized exchanges (approximately 20% for BONK).

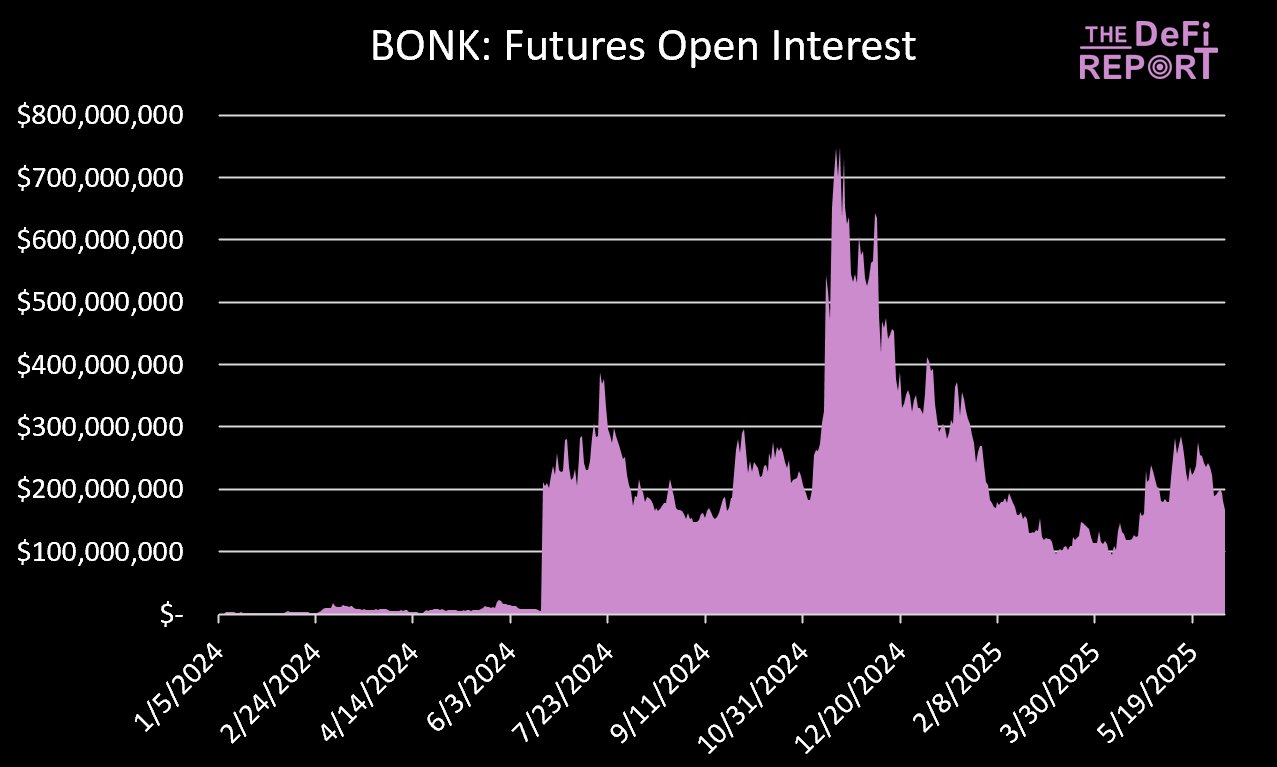

For tokens traded on major exchanges, we like to look at open interest. The open interest shown below primarily comes from Bybit.

Data: Glassnode, The DeFi Report

Data: Glassnode, The DeFi ReportCommunity/Belief

Here, more crypto-native intuition begins to play a role, involving monitoring social media activity and sentiment.

We like to filter through the "potential audience interest" of memecoins. For example, it must be something that can be accepted globally (like SPX6900's "disrupting the stock market"—sounds silly, but has the potential to attract attention/form a movement).

What we look for:

Resonant good narratives + community slogans. You don’t have to agree with it, just see others accepting it.

Signs of strong conviction and a sense of community (which can turn holders into evangelists).

Signs of leadership and coordination (we observe this in memecoins like BONK, SPX6900, and Giga).

Signs of cultural embedding (the Pepe Meme is an example).

We are starting to notice that some communities are now promoting projects through TikTok to reach a younger potential crypto user base.

The best memecoin communities are often excellent marketers.

Fair Value

How do you know if you bought in at "fair value"?

We believe the clearest way is to understand the relationship between realized value (the proxy for the cost basis of all tokens in circulation) and market value.

When the MVRV ratio is below 1, it indicates that holders (on average) are in an unrealized loss state—suggesting that we may be close to a local bottom, assuming bullish market conditions will persist.

BONK's realized price is currently $0.0002. At the time of writing, the token is trading at $0.0000145—indicating that this may be a good entry price.

*As mentioned earlier, the realized price does not account for the token supply on trading platforms. According to data from Solscan, we estimate that about 20% of the BONK supply is held on centralized exchanges (BN, Robinhood, Coinbase, Kraken, etc.).

MVRV

Data: Glassnode, The DeFi Report

Data: Glassnode, The DeFi Report

Momentum

In the absence of fundamentals, another way to assess "fair value" is to look at momentum indicators.

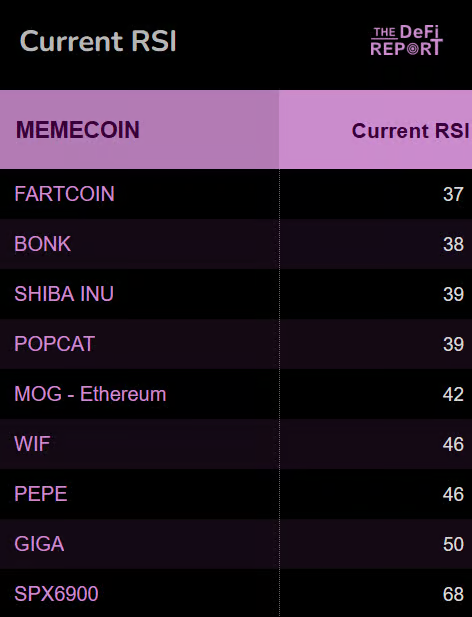

Relative Strength Index (RSI)

RSI helps us understand whether the token is overbought or oversold in recent momentum.

An RSI close to or below 30 indicates an "oversold" condition.

An RSI close to or above 70 indicates an "overbought" condition.

Data: The DeFi Report

Moving Averages

Another way to view recent momentum is to analyze the price relative to key moving averages. We want to buy into strength when the price breaks through key support areas, provided we have confidence in a 3-6 month time frame.

Data: The DeFi Report

Data: The DeFi Report

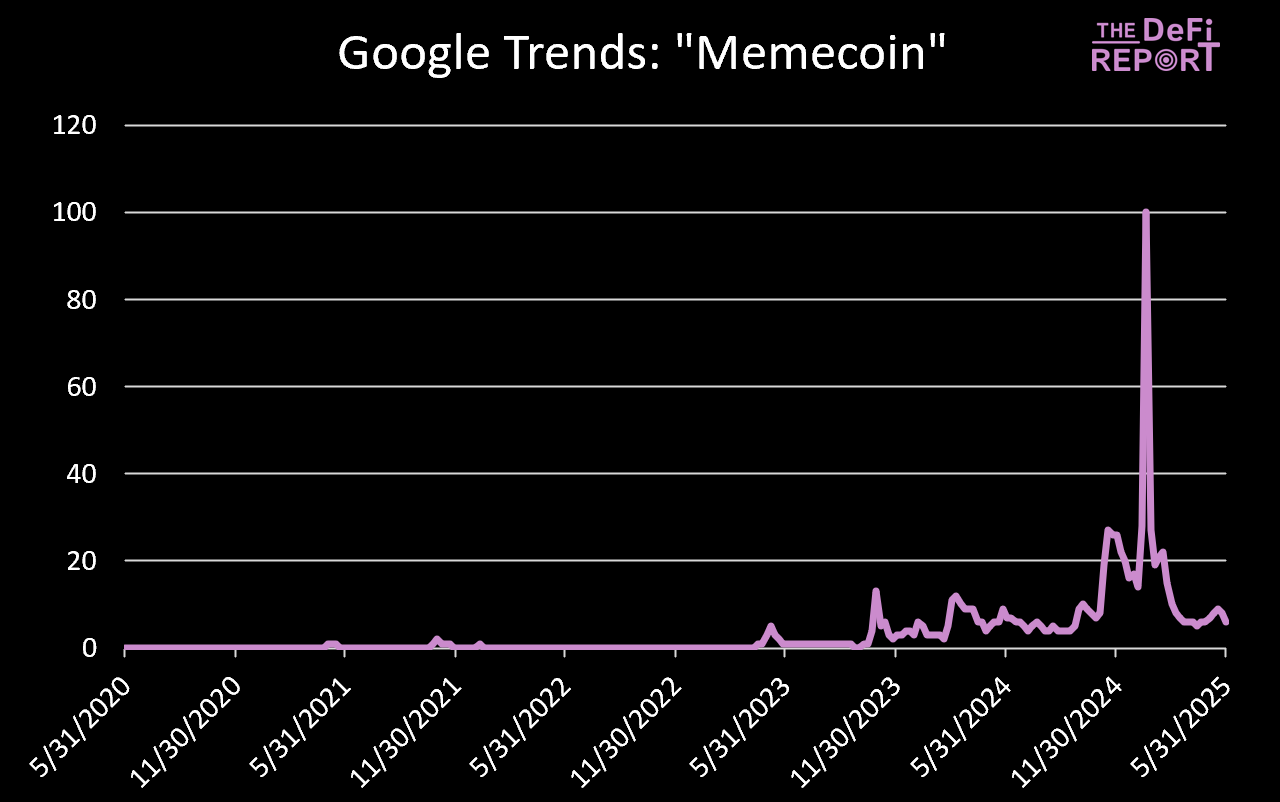

Google Search

Finally, analyzing Google Trends and other social sentiment indicators can help us understand when to buy/sell.

Data: Google, The DeFi Report

Data: Google, The DeFi Report

Liquidity Cycle/Macro

We must mention that memecoins are at the far end of the risk spectrum. It is well known that BTC relies on liquidity conditions, and memecoins even more so. Favorable liquidity/economic environments, combined with "risk appetite" sentiment and a return of "animal spirits," are key to your allocation to memecoins.

Summary Thoughts

In summary, you will have a framework that covers the following:

- Why we like certain memecoins (beta) as a tiny part of the portfolio.

- How to identify memecoins with strong "fundamentals" (on-chain data).

- How to measure "fair value" (MVRV).

- When to buy (inflection points/macroeconomics/momentum).

- When to sell (momentum/RSI).

Of course, this does not make the framework foolproof. There are no easy returns in investing. Outperformance can only come with higher risks.

Nevertheless, having a system should help you navigate the wild west of memecoins.

Article link: https://www.hellobtc.com/kp/du/06/5887.html

Source: https://s.c1ns.cn/alwgP

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。