Trump and Musk's Public Feud Temporarily Pauses, Market Rebounds; Institutional BTC ETF Holdings Value Experiences First Quarterly Decline

The article was written on June 6 and delayed for publication due to an inability to enter the release window.

Macroeconomic Interpretation: Last night, the public dispute between Trump and Musk on social media ignited a powder keg in the financial markets. Tesla's stock faced an epic sell-off, with a single-day market value evaporating by over $150 billion, and panic quickly spread to the U.S. stock market, which in turn affected the crypto market, causing Bitcoin to plummet, with prices nearing the psychological threshold of $100,000. A drop of over 5% within 24 hours resulted in significant losses for leveraged traders, with nearly $1 billion in contracts being forcibly liquidated. This market tsunami triggered by personal statements starkly exposed the extreme sensitivity of crypto assets to political risks.

Interestingly, the roots of this storm had long been sown. Musk has recently been vocal about the U.S. debt crisis, stating that "national bankruptcy will make everything irrelevant," and his call for both parties to stop infighting and address the deficit directly counters Trump's push for tariff policies. Furthermore, the latest statements from Federal Reserve officials added to the gloom—Governor Cook and Kansas City Fed President George both emphasized that inflation remains a serious concern, and high interest rates will be maintained for the long term. George even warned that "tariffs may continue to push prices higher in the coming months," suggesting that policymakers are constrained by the specter of inflation.

The market's nerves were somewhat eased this afternoon by a piece of news: Musk accepted a peace proposal, and Trump indicated he would arrange a call. Tesla's stock rebounded by 5% in pre-market trading, and U.S. stock futures turned positive. However, deeper data revealed that the crisis had not dissipated. According to CoinAnk, institutional investors' exposure to Bitcoin plummeted by 23% in the first quarter, with capital outflows reaching $6.2 billion. Some institutions believe that Bitcoin's upward momentum has significantly waned, and cracks are appearing in U.S. economic data. When the market discovered the positive news of Trump Media Group submitting a Bitcoin ETF application (code-named DJT), it was still unable to offset the macroeconomic clouds, leading investors to vote with their feet—Polymarket data shows that the probability of "Trump being impeached this year" has quietly risen to 10%.

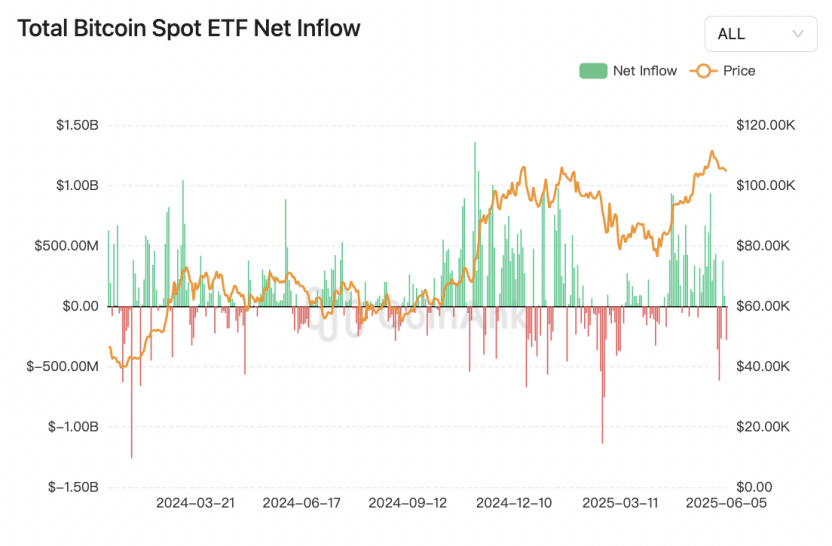

The current crypto market faces a policy prisoner’s dilemma, with the Federal Reserve caught between sticky inflation and economic slowdown, and expectations for interest rate cuts continuously delayed. Trump's tariff policies act like a double-edged sword, potentially reshaping trade dynamics while also reigniting inflationary pressures. Additionally, there is a migration of capital seeking safety: institutional funds are quietly shifting. Data shows that the myth of inflows into Bitcoin ETFs has been shattered, with corporate treasury allocations replacing short-term arbitrage as the new mainline, reflecting smart money's wariness of volatility. Leverage risks have also become apparent, as Bitcoin's daily fluctuations exceeded $5,000, with on-chain data showing liquidation amounts soaring to multi-month highs. High leverage, in the face of political black swans, can quickly turn from a profit-making tool into a self-destructive fuse.

Today, the market holds its breath for U.S. non-farm payroll data, which may become a short-term emotional turning point. However, a deeper warning has already emerged: when Bitcoin can be easily shaken by a public spat between Trump and Musk, causing a 10% drop in market value, and when institutional funds collectively retreat due to policy uncertainty, the narrative foundation of crypto assets' so-called "safe-haven properties" is beginning to erode. In the arena of traditional financial giants and political forces, cryptocurrencies remain the most vulnerable pawn—this market earthquake triggered by a reality-show-style conflict merely reveals the tip of the risk iceberg.

BTC Data Analysis:

CoinAnk data shows that in the first quarter of 2025, institutional investors' allocation to Bitcoin significantly contracted, decreasing by $6.2 billion, a drop of 23%, marking the first quarterly decline since the launch of the U.S. spot Bitcoin ETF. Market dynamics indicate that this capital withdrawal is the result of both price corrections and long-term holders cashing out. Notably, the previous quarter's growth momentum primarily stemmed from publicly traded companies incorporating Bitcoin into their balance sheet allocations, rather than from professional asset management institutions through ETF channels, reflecting a shift in market participants from short-term arbitrage to strategic reserves.

In-depth analysis reveals that this capital outflow is closely related to dramatic changes in the macro environment. At the beginning of 2025, Bitcoin faced multiple pressures: Trump's tariff policies raised economic concerns, the $1.5 billion hacking incident at Bitget exchange shook market confidence, and large-scale liquidations of "cash arbitrage" trades collectively triggered historic outflows from ETFs. Despite the short-term volatility, structural changes still present positive signals—during the quarter, the number of institutions holding Bitcoin ETFs increased by 30%, indicating that the long-term allocation logic has not fundamentally shifted. From a market impact perspective, ETFs serve as a compliant channel for traditional capital entry, and their capital flows have formed a strong correlation with Bitcoin prices. Although this adjustment may exacerbate short-term volatility, it could encourage the market to establish a healthier value discovery mechanism. Historical experience shows that institutional funds often return in a more sustainable manner after market consolidation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。