Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.34 trillion, with BTC accounting for 61.55%, amounting to $2.06 trillion. The market cap of stablecoins is $249.1 billion, with a recent 7-day increase of 0.72%, of which USDT accounts for 62.05%.

This week, BTC's price has shown range-bound fluctuations, currently priced at $103,655; ETH has also shown range-bound fluctuations, currently priced at $2,481.

Among the top 200 projects on CoinMarketCap, a small number have risen while most have fallen, including: SKY with a 7-day increase of 10%, LA with a 7-day increase of 183.83%, MASK with a 7-day increase of 47.53%, and ANIME with a 7-day increase of 37.33%.

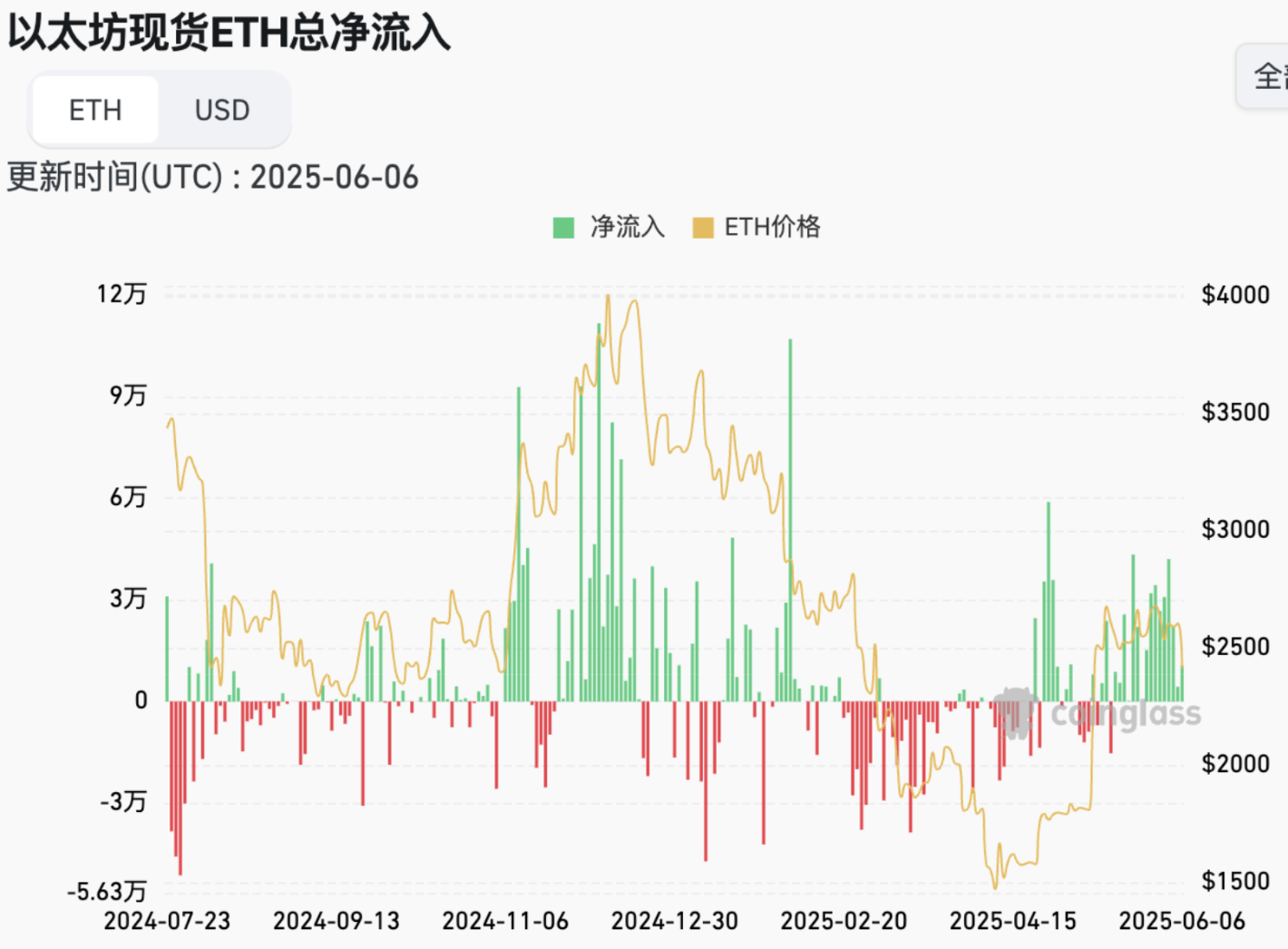

This week, there was a net outflow of $130.8 million from the U.S. Bitcoin spot ETF; the U.S. Ethereum spot ETF saw a net inflow of $280.8 million.

On June 6, the "Fear & Greed Index" was at 46 (lower than last week), indicating a neutral sentiment over the past week.

Market Forecast:

This week, stablecoins continue to be issued, with a net outflow from the U.S. Bitcoin spot ETF continuing the trend from last week, while the Ethereum spot ETF saw a net inflow. Both BTC and ETH remain in a range-bound fluctuation. The RSI index is at 49.59, indicating neutrality, while the altcoin season index is at 18. This week, the U.S. reported that May's adjusted non-farm payrolls exceeded expectations, with the "small non-farm" employment index showing the smallest increase since March 2023. The fear and greed index remains neutral.

The probability of the Federal Reserve cutting rates by 25 basis points in June is only 2.6%, with expectations for rate cuts to begin in Q3 of this year. The market shows two conditions: listed companies "rushing to buy BTC" and profit-takers and spot ETF sell-offs. If there are no major events or new liquidity inflows, BTC is expected to remain fluctuating around $100,000 to $105,000 next week. Attention can be paid to the progress of the relationship with Chuanma.

Understanding Now

Review of Major Events of the Week

On June 2, according to Cointelegraph, at the ETHGlobal Prague conference, Ethereum founder Vitalik stated that Ethereum will scale L1 by about 10 times within a year, and then "take a breath" before the next leap;

On June 3, the U.S. Securities and Exchange Commission is seeking opinions on whether to amend rules to allow the WisdomTree Bitcoin Fund to create and redeem physical assets;

On June 3, according to South Korea's JTBC television, Democratic Party candidate Lee Jae-myung was elected President of South Korea. Lee has promised to push for the approval of a cryptocurrency spot ETF and proposed issuing a stablecoin based on the Korean won;

On June 4, documents showed that Trump's social media platform Truth Social submitted a Bitcoin ETF application;

On June 4, according to Decrypt, Ethereum co-founder and Consensys CEO Joe Lubin stated that his company is negotiating with a "very powerful" country's "major sovereign wealth funds and banks" regarding potential construction based on Ethereum;

On June 4, Donald Trump Jr., the eldest son of Trump and co-founder of WLFI, clarified in a post that "the Trump Organization has no connection to this wallet product (developed in collaboration with Magic Eden and TRUMP Meme). Eric Trump and I know nothing about this. Stay tuned — World Liberty Financial, which we have been working hard to advance, will soon launch our official wallet";

On June 5, according to CoinDesk, stablecoin issuer Circle completed its IPO on the New York Stock Exchange at $31 per share, exceeding the original expected pricing range ($24-$26), raising $1.1 billion, with a valuation of $6.2 billion. The stock code is "CRCL" and will begin trading on Thursday. The IPO originally planned to issue 24 million shares but expanded to over 34 million shares due to surging demand. Circle's USDC is the second-largest stablecoin in the U.S., and its listing comes as U.S. lawmakers push for stablecoin regulatory legislation;

On June 5, YZi Labs announced an investment in OneKey. OneKey is an open-source hardware wallet project focused on enhancing the security of crypto assets and empowering global users to manage their assets independently;

On June 5, the Federal Reserve's Beige Book reported that the U.S. economy has declined over the past six weeks, hiring has slowed, and consumers and businesses are worried about price increases related to tariffs. Regarding inflation, the report stated that prices are "moderately rising," but there is a general expectation among businesses that future costs and prices will rise at a faster pace;

On June 5, according to the Wall Street Journal, after Musk criticized the Republican Party's massive tax and spending bill, Trump seems to have lost patience with Musk. Meanwhile, Musk is frustrated with Trump's decision to withdraw the nomination of a key ally to lead NASA. A senior White House official stated that Trump is unhappy with Musk's decision to criticize the bill he signed, expressing confusion over Musk's increased criticism after working closely with him for four months. The official noted that Trump's senior advisors were caught off guard by Musk's latest offensive.

Macroeconomics

On June 4, the U.S. ADP employment number for May recorded an increase of 37,000, the smallest increase since March 2023, with market expectations at 110,000;

On June 5, the European Central Bank lowered the deposit facility rate by 25 basis points to 2%, in line with market expectations, marking the seventh consecutive meeting of rate cuts. The main refinancing rate and marginal lending rate were lowered from 2.4% and 2.65% to 2.15% and 2.4%, respectively;

On June 6, according to CME's "FedWatch": The probability of the Federal Reserve maintaining interest rates in June is 97.4%, while the probability of a 25 basis point rate cut is 2.6%;

On June 6, the U.S. adjusted non-farm payrolls for May were 139,000, with expectations of 130,000, and the previous value was revised from 177,000 to 147,000;

On June 7, according to official data from the People's Bank of China, China's gold reserves at the end of May were reported at 73.83 million ounces (approximately 2,296.37 tons), an increase of 60,000 ounces (approximately 1.86 tons) month-on-month, marking the seventh consecutive month of gold accumulation.

ETF

According to statistics, from June 2 to June 6, there was a net outflow of $130.8 million from the U.S. Bitcoin spot ETF; as of June 6, GBTC (Grayscale) had a total outflow of $23.208 billion, currently holding $19.327 billion, while IBIT (BlackRock) currently holds $69.137 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $128.868 billion.

The U.S. Ethereum spot ETF saw a net inflow of $280.8 million.

Envisioning the Future

Event Preview

NFT NYC 2026 will be held in New York, USA from June 23 to 25, 2025;

Permissionless IV will be held in New York, USA from June 24 to 26, 2025;

EthCC 8 will be held in Cannes, France from June 30 to July 3, 2025;

IVS2025 KYOTO will be held in Kyoto, Japan from July 2 to 4, 2025;

The "OpenLedger China Tour" Hong Kong stop will be held on June 13 (Friday) from 18:30 to 21:30. This series of events will successively visit five cities (Hong Kong, Shanghai, Hangzhou, Shenzhen, and Chengdu).

Project Progress

The chain Skate, aimed at connecting all VMs, will release its publication on X on June 9 along with a promotional video, possibly hinting at the TGE date;

The Base ecosystem social prediction market Upside is set to launch on June 10.

Important Events

Circle has frozen 58 million USDT related to the Libra scandal. The crypto law firm Burwick Law stated that it has applied for a temporary restraining order in the Southern District of New York Federal Court and has received approval, planning to hold a preliminary injunction hearing on June 9;

French Hill, Chairman of the U.S. House Financial Services Committee, has set the review date for the House cryptocurrency market structure bill for June 10.

Token Unlocking

GMT (GMT) will unlock 85.97 million tokens on June 9, valued at approximately $4.33 million, accounting for 1.43% of the circulating supply;

Vana (VANA) will unlock 14.8 million tokens on June 12, valued at approximately $94.48 million, accounting for 12.33% of the circulating supply;

Immutable (IMX) will unlock 24.52 million tokens on June 13, valued at approximately $12.72 million, accounting for 1.23% of the circulating supply;

Starknet (STRK) will unlock 163 million tokens on June 15, valued at approximately $21.59 million, accounting for 1.63% of the circulating supply;

Sei (SEI) will unlock 224 million tokens on June 15, valued at approximately $42.61 million, accounting for 2.25% of the circulating supply;

Horizen (ZEN) will unlock 810,000 tokens on June 15, valued at approximately $8.28 million, accounting for 3.89% of the circulating supply.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend assessment + value excavation + real-time tracking" integrated service system. Through in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluation of potential projects, and all-weather market volatility monitoring, combined with our weekly dual-updates of the "Hotcoin Selected" strategy live broadcast and the "Blockchain Today Headlines" daily news brief, we provide precise market interpretations and practical strategies for investors at different levels. Relying on cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors make investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。