Circle Internet Financial (NYSE: CRCL) has drawn substantial investor interest, with its value climbing swiftly. Notably, Ark Invest acquired 4.48 million CRCL shares across three of its funds. The company’s public offering priced shares at $31 apiece, yet by Friday at 1:07 p.m. Eastern, shares had climbed beyond $120.51—marking a 288% gain since launch.

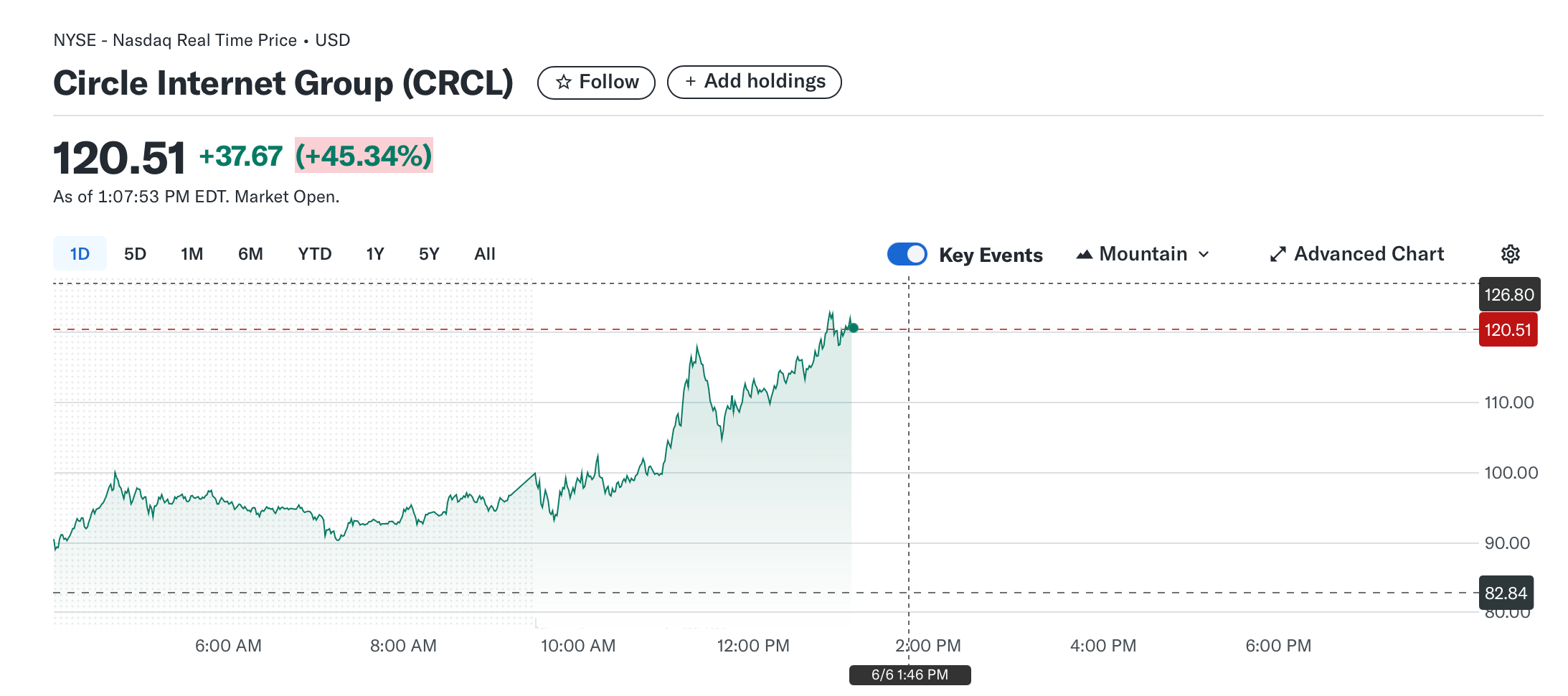

Circle Internet (NYSE: CRCL) on June 6, 2025.

With shares jumping over 45% on Friday alone, Circle’s market capitalization has now exceeded $23 billion. CRCL registered $41.8 million in trading volume between the market’s open and just after 1 p.m. Eastern on Friday. The previous day’s close was $82.84 per CRCL. The IPO’s momentum has triggered speculation about whether this rally signals a durable vote of investor confidence or simply echoes the kind of transient enthusiasm that fueled Coinbase’s 2021 frenzy.

Social platforms like X have buzzed with commentary on Circle’s IPO. One user, with IPO pricing experience at Goldman Sachs, cautioned against jumping in immediately following a steep climb. They emphasized that early gains are often orchestrated to generate excitement, advising patience. “Wait 90-180 days after IPO to invest,” the X account Dom suggested. “Not just to allow for price discovery, but because that’s typically when the lockup period ends,” the individual added.

Some observers now predict that Circle’s performance could spark a wave of IPOs from other crypto ventures eager to tap public markets. “After the Circle IPO performance, there is a large probability every equity business with [more than] $50m revenue and any sort of moat or edge to go public,” the X account Solana Legend wrote. “I’m talking about Moonpay, Gemini, Kraken, Phantom, etc…,” the individual added.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。