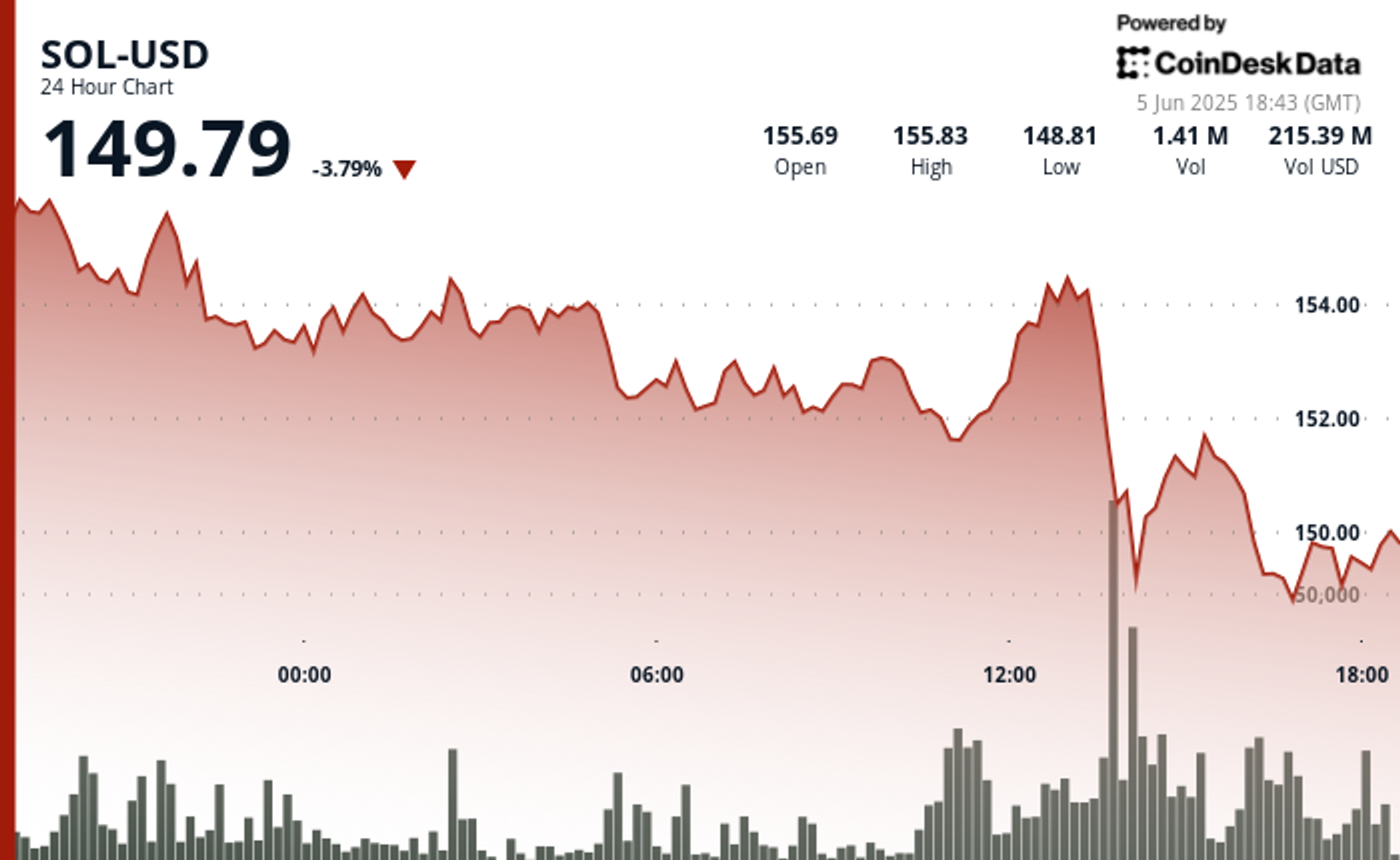

Solana (SOL) continues to face mounting bearish pressure as the price slid below the psychological $150 level, marking a 5.2% drop in the past 24 hours.

The sell-off intensified during the early afternoon session with high-volume trades flooding exchanges. Analysts attribute the decline to more than 3 million SOL tokens being transferred to centralized platforms over the past three days, coinciding with more than $468 million in estimated outflows.

This significant shift in on-chain activity has cast doubt on short-term recovery prospects, even as the Solana network continues to post strong usage metrics.

With over 100 million transactions and 7 million daily active addresses, the fundamentals suggest long-term strength, but price action remains disconnected from protocol performance.

Analysts say reclaiming resistance at $153 and stabilizing above $150 is now critical to preventing a deeper retracement.

Technical Analysis Highlights

- SOL-USD posted a $8.19 range from the high of $157.98 to a low of $149.79.

- Price breached psychological support at $150 during a massive 182K volume spike at 13:56.

- Resistance remained firm at $153.00 as repeated recovery attempts failed during the late session.

- A descending channel has developed with lower highs and lower lows dominating the chart.

- Volume surges at 13:39 (21K), 13:45 (66K), 13:51 (89K), and 13:56 (182K) confirm aggressive selling.

- Modest buy interest is emerging around $149.50-$150.60, but downside risk persists if bulls cannot hold the current floor.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。