GMX and dYdX have long fallen from the "Holy Grail," but decentralized derivatives should still have new tickets to ride.

Written by: Web3 Farmer Frank

Which on-chain derivatives protocols have you used recently?

This is pretty much the awkward footnote of the DeFi derivatives track. To be honest, without the "best on-chain spokesperson" James Wynn backing Hyperliquid, the once "Holy Grail" status of dYdX and GMX has long faded over the past two years, and their rapid decline has nearly ended the on-chain derivatives narrative.

The reason is simple: they have long been trapped in the identity of "CEX imitators": replicating the contract logic and leverage mechanisms of centralized platforms, but bearing higher risk exposure and lower user experience. There are still significant gaps in key dimensions such as liquidation mechanisms, matching efficiency, and trading depth compared to CEX, until the emergence of Hyperliquid, which restructured product forms and user value based on on-chain characteristics, thus preserving the possibility for further evolution in this track:

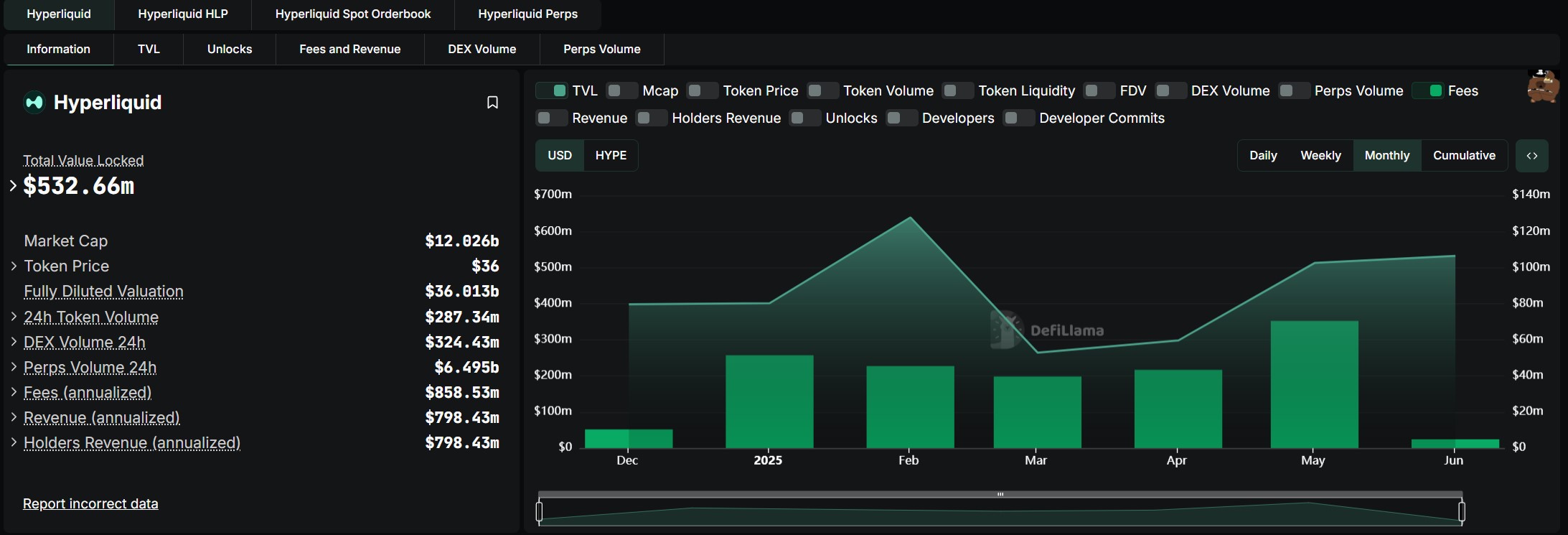

In the past May, Hyperliquid's perpetual contract trading volume reached $24.8295 billion, setting a record for the highest monthly volume in history, equivalent to 42% of Coinbase's spot trading volume during the same period, with protocol revenue also reaching $70.45 million, simultaneously breaking records.

However, from a longer-term perspective, Hyperliquid still adopts a typical contract trading model; it has only taken the first step from optimizing "existing solutions" to exploring "native solutions." This article also aims to delve into deeper issues from the predicament of on-chain derivatives and the development context of Hyperliquid:

The next step for on-chain derivatives is to continue optimizing centralized logical templates, or to leverage the openness of the chain and the characteristics of long-tail assets to pursue a more differentiated product innovation path?

The "New Ticket" for Decentralized Derivatives

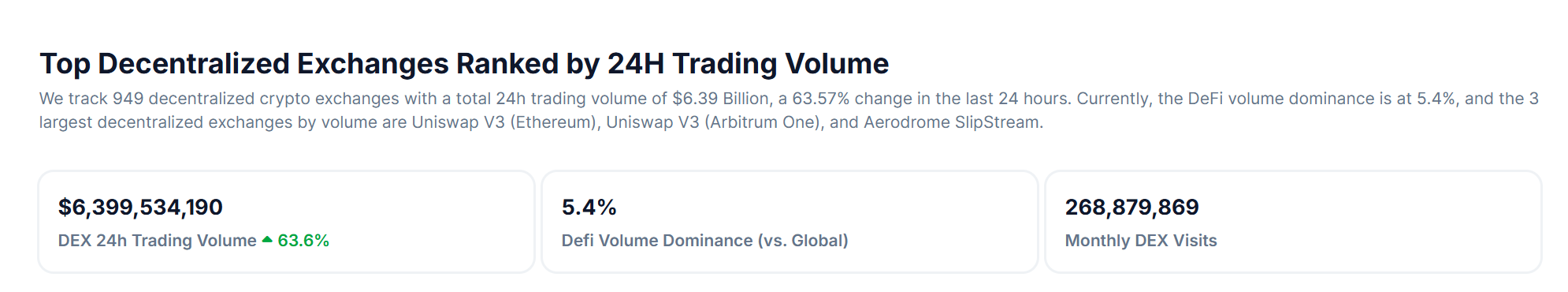

From a data perspective, regardless of how the market fluctuates, cryptocurrency derivatives have always been a super-sized cake with continuously expanding volume—only the knife and fork for slicing the cake are still firmly held in the hands of CEX.

Since 2020, CEX has gradually restructured the previously spot-dominated market landscape by using contract futures as an entry point. According to the latest data from Coinglass, in the past 24 hours, the trading volume of the top five CEX contract futures has reached the level of tens of billions of dollars, with Binance alone surpassing $60 billion.

If we broaden our perspective, we can more intuitively perceive the penetration of derivatives trading. For example, TokenInsight's statistics show that currently, Binance's derivatives daily trading volume accounts for 78.16% of the total daily trading volume (which is $500 billion) of spot and derivatives combined, and this ratio continues to rise. In simple terms, the current daily trading volume of CEX derivatives is almost four times that of spot trading.

However, on-chain, although DEX spot trading volume remains in the tens of billions, decentralized derivatives have never managed to break into the market gap: dYdX's average daily trading volume is about $19 million, and the once-prominent GMX has seen both its open interest and 24-hour trading volume drop below $10 million, nearly forgotten by the market.

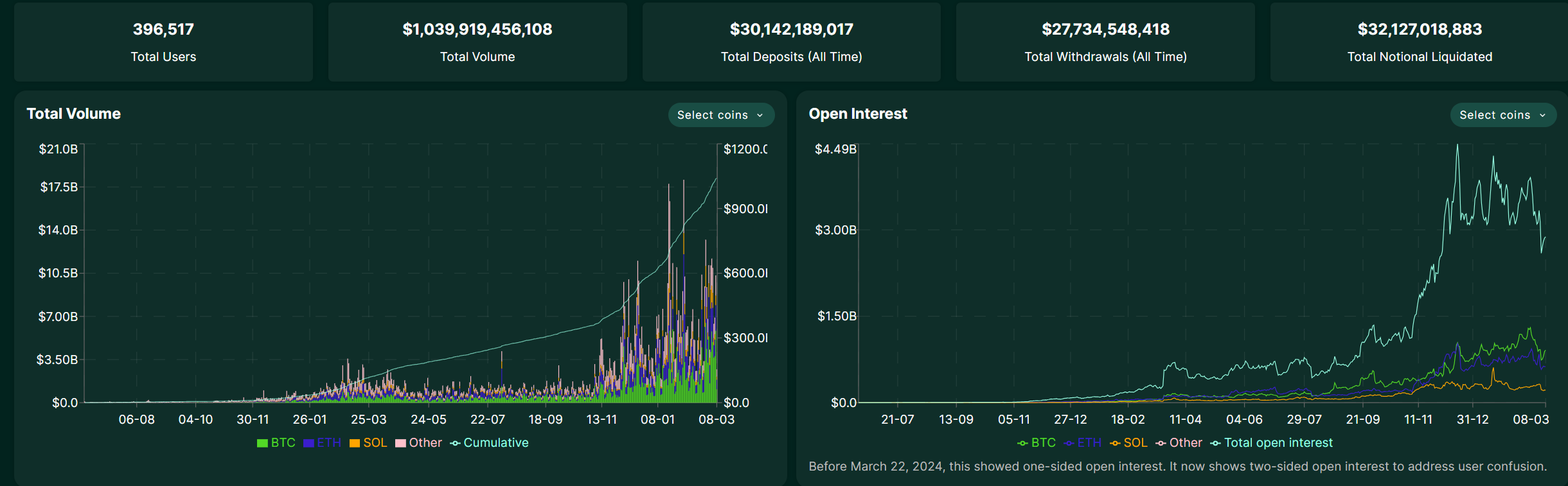

The only surprising development is the recent emergence of Hyperliquid, seen as a "victory of progressive decentralization"—breaking the deadlock with the posture of the "new king" of on-chain derivatives, with daily trading volume once exceeding $18 billion, capturing over 60% of the on-chain perpetual contract market share.

Its revenue scale even surpasses that of most second-tier CEXs, maintaining a month-on-month growth rate of over 50% for three consecutive months. If we closely observe the rise of Hyperliquid, we will find that its key breakthrough lies in its reconstruction of value logic through a vertically integrated architecture:

By deeply integrating the order book engine with the smart contract platform, on-chain derivatives can now compete directly with CEX in terms of trading speed and cost, establishing structural advantages in dimensions such as cost, auditability, and composability (I personally think this is somewhat similar to the structural advantages BYD has in the new energy market).

This also proves that on-chain derivatives are not lacking in demand, but rather in truly DeFi-compatible product forms. In simple terms, traditional perpetual contracts rely on margin mechanisms, and high leverage leads to frequent liquidations, making it difficult for users to control risk. Previous on-chain derivatives have failed to create value that CEX cannot replace.

Once users realize that trading on dYdX/GMX involves the same liquidation risks but lacks the liquidity depth and trading experience of Binance, their willingness to migrate naturally drops to zero.

For this reason, decentralized derivatives inevitably lost their "Holy Grail" allure in the last narrative, and their decline essentially reflects a deep-seated contradiction between the decentralized framework and the demand for financial products—there is a narrative of decentralization, but no product ticket that users feel they "must use." This is also the core reason why Hyperliquid has been able to overtake the competition.

So, on the surface, the crushing advantage of CEX comes from its user base and liquidity depth, but the deeper contradiction lies in the fact that on-chain derivatives have never been able to solve a core question: how to balance risk, efficiency, and user experience within a decentralized framework? Especially as the industry enters the deep waters of derivatives innovation, how to minimize the entry barriers for new users and maximize asset efficiency?

In fact, the "event contracts" recently launched by Binance provide a new reference point—essentially a variant of options products, confirming the market's strong demand for simple, easy-to-use, and "non-linear returns."

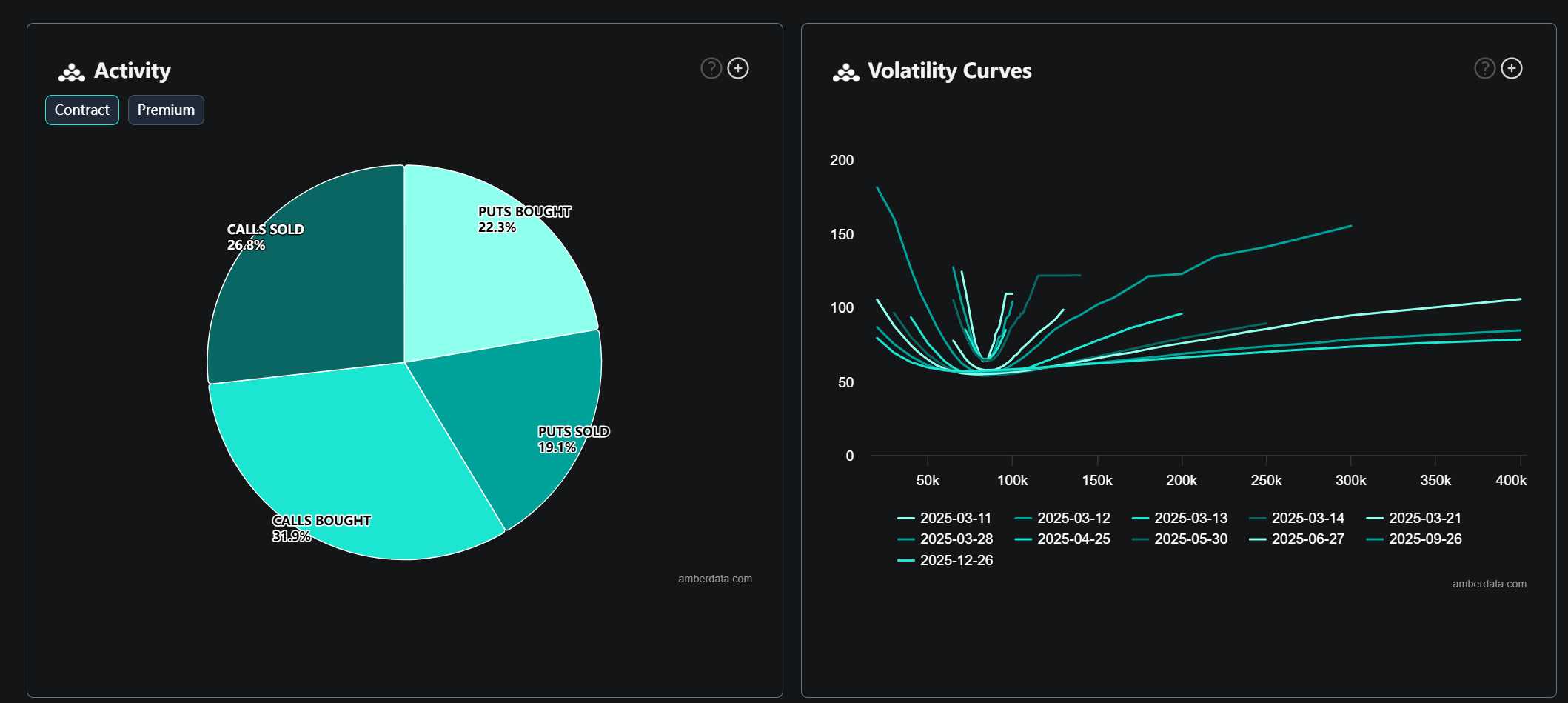

From my personal perspective, if we want to escape the competitive red sea of perpetual contracts, options may be a more suitable remedy for the characteristics of on-chain—its "non-linear return" feature (limited losses for buyers, unlimited potential gains) naturally aligns with the high volatility of cryptocurrencies, while the "small upfront premium" mechanism can significantly meet the simple trading needs of the general public.

From Contracts to Options: The Promised Land of On-Chain Derivatives?

Objectively speaking, in the field of on-chain derivatives, options with "non-linear returns" are actually the most suitable product form: not only do they naturally avoid liquidation risks, but they also achieve a better risk-reward ratio than futures contracts through "time value leverage."

However, due to the complexity of options, such as expiration dates and strike prices, they are not as intuitive for retail investors as perpetual contracts, especially since the complex exercise rules of traditional options (such as expiration dates and spread combinations) always present a structural contradiction with retail investors' pursuit of simplicity and immediate trading, and this mismatch is particularly evident in on-chain scenarios.

Therefore, for decentralized options products, the challenge lies in how to build an on-chain options system that balances "crypto capital efficiency" and "product friendliness." This is where Fufuture's proposed "crypto-based perpetual options" mechanism is worth discussing—attempting to reshape the underlying logic of on-chain derivatives through "de-complexification" and "asset efficiency revolution."

If we break down the structure of "crypto-based perpetual options," the key points are actually in its literal meaning: "crypto-based" and "perpetual options."

Maximizing the Capital Efficiency of "Long-Tail Assets"

The core starting point of "crypto-based" is to maximize the capital efficiency of users' on-chain crypto assets. After all, in the context of the meme coin wave and the explosion of multi-chain ecosystems, most users' on-chain assets exhibit a high degree of fragmentation, such as being scattered across different chains and long-tail token assets.

However, existing protocols often require settlement in stablecoins, which forces users holding long-tail assets like BTC, ETH, or even meme coins to either be unable to participate in trading directly or to passively bear exchange losses (currently, mainstream CEXs also use USDT/USDC as settlement currencies, and all have minimum trading limits), which fundamentally contradicts the DeFi principle of "asset sovereignty freedom."

Take Fufuture, a decentralized crypto-based options protocol currently exploring similar products, as an example. It allows users to directly use any on-chain token as collateral to participate in BTC/ETH index options trading, aiming to eliminate the exchange step and activate the derivative value of dormant assets—such as users holding meme coins being able to hedge market volatility risks without liquidating their assets, or even amplifying returns through high leverage.

From a data perspective, as of May 2025, the margin trading supported by Fufuture shows that the total margin positions of meme coins like Shiba Inu (SHIB) and PEPE account for a high proportion of the platform's active positions, proving that users indeed have a strong demand to participate in options hedging and speculation using non-stablecoin assets, which also indirectly validates that "crypto-based" margin is indeed a significant market pain point.

The Ultimate Leverage Idea of "Expiration Options" Perpetualization

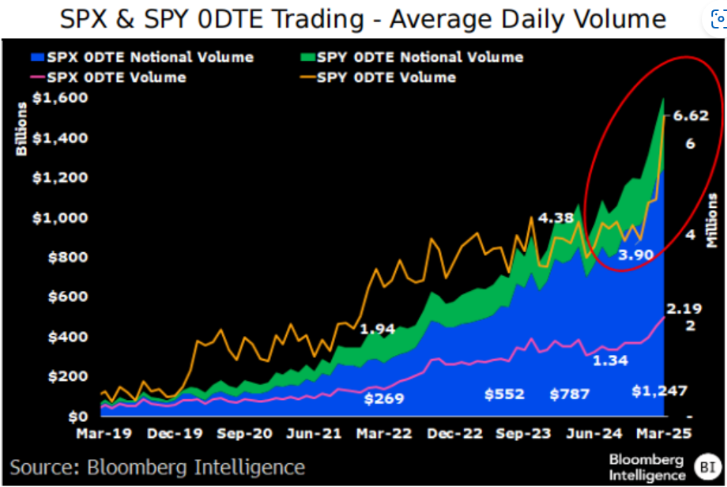

On another dimension, in recent years, there has been an increasing preference for high-odds short-term trading of expiration options—since 2016, small trading users have begun to flock to options, with the proportion of 0 DTE options trading in the total SPX options volume rising from 5% to 43%.

Source: moomoo.com

The "perpetualization" of expiration options actually provides users with the opportunity to continuously bet on high-odds "expiration options."

After all, the "expiration date" setting of traditional options is severely mismatched with most users' short-term trading habits, and the frequent opening of "expiration options" can be overwhelming. Still, taking Fufuture's introduction of a perpetual mechanism in options products as an example—it cancels the fixed expiration date and instead adjusts the holding cost through a dynamic funding rate.

This means that users can hold bearish/bullish options positions indefinitely, only needing to pay a minimal daily funding cost (far lower than the financing rates of CEX perpetual contracts). This allows users to extend their holding periods indefinitely, transforming the high odds characteristic of "expiration options" into a sustainable strategy while avoiding passive losses due to time decay (Theta).

An example may help illustrate this point: when a user opens a 24-hour BTC put option using USDT or another long-tail asset as collateral, if the BTC price continues to decline, their position can be held long-term to capture greater profits; if the judgment is incorrect, the maximum loss is limited to the initial margin, with no need to worry about liquidation risk—meanwhile, at the 24-hour expiration, they can freely choose whether to continue the extension.

This combination of "limited losses + unlimited gains + time freedom" essentially transforms options into a "low-risk version of perpetual contracts," significantly lowering the participation threshold for retail investors.

Overall, the deep value of the "crypto-based perpetual options" paradigm shift lies in the fact that when users discover that any long-tail token in their wallets, even meme coins, can be directly converted into risk hedging tools, and when the time dimension is no longer the enemy of returns, on-chain derivatives may truly break through the niche market and build an ecological niche that can stand shoulder to shoulder with CEX.

From this perspective, the potential of the "crypto-based perpetual options" as a "new ticket" may be one of the important weights that could tilt the balance of the game between on-chain and CEX.

Will On-Chain Options Yield New Solutions Worth Watching?

However, the large-scale popularization and penetration of options, especially on-chain options, are still in the very early stages.

Visibly, since the second half of 2023, new players in on-chain derivatives have been exploring entirely new business directions: whether it is Hyperliquid's on-chain native leverage or "crypto-based perpetual options" like Fufuture, decentralized derivatives trading products are indeed brewing some seeds of significant change.

For these new-generation protocols, beyond achieving direct competition with CEX in terms of trading speed and cost, and releasing the capital efficiency of long-tail assets on the Crypto chain, the more critical aspect is that, based on the on-chain architecture, they can maximize the binding of interests among the community, trading users, and the protocol—liquidity providers, trading users, and the protocol itself can form a network of shared interests (taking Fufuture's protocol architecture as an example):

Liquidity providers earn risk-layered returns through a dual-pool mechanism (high returns from private pools + low risk from public pools);

Traders can participate in high-leverage strategies with any asset, with clear loss limits;

The protocol itself captures ecological value growth through governance tokens;

This fundamentally subverts the traditional "platform-user" exploitative relationship of CEX. When the long-tail tokens held in users' wallets can directly become trading tools without relying on CEX, and when trading fees and ecological value are distributed to ecological contributors through DAO, on-chain derivatives finally show the true form of DeFi—more than just a trading venue, but a value redistribution network.

This is actually the "DeepSeek moment" that the market has been longing for in on-chain derivatives for years—to allow decentralized derivatives to break through the constraints of trading experience, gradually introduce on-chain native leverage and maximize capital efficiency, no longer relying on CEX as a necessary link, thus potentially bringing about a larger leap in the market, fostering more boundaryless innovations, and ushering in a new "DeFi summer."

Historical experience tells us that every narrative explosion requires the resonance of "correct narrative + correct timing." Whoever can solve the most painful asset efficiency problem for users at the right moment will hold the scepter of on-chain derivatives.

In Conclusion

I personally believe that decentralized derivatives protocols are undoubtedly the "on-chain Holy Grail," and not a pseudo-proposition of narrative.

From multiple dimensions, decentralized derivatives still have the potential to become one of the most scalable and revenue-generating tracks in the DeFi ecosystem; however, they must truly step out of the shadow of "centralized alternatives" and leverage on-chain native structures and capital efficiency revolutions to achieve self-reform in product forms.

The key issue, however, is that for on-chain users, the value of decentralized derivatives lies not only in providing new trading tools but also in whether it can open a path of "frictionless asset flow—derivatives hedging—compound growth of returns."

From this perspective, when meme coin holders can directly use tokens to participate in trading long-tail crypto assets, and when multi-chain assets can serve as collateral without cross-chain transactions, the form of on-chain derivatives can be considered redefined. This is also the leap thinking of new-generation players like Hyperliquid and Fufuture.

Perhaps the ultimate goal of decentralized derivatives is not to replicate CEX but to create new demand using the native advantages of the chain (open, composable, permissionless), and the market may have already taken a crucial step.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。