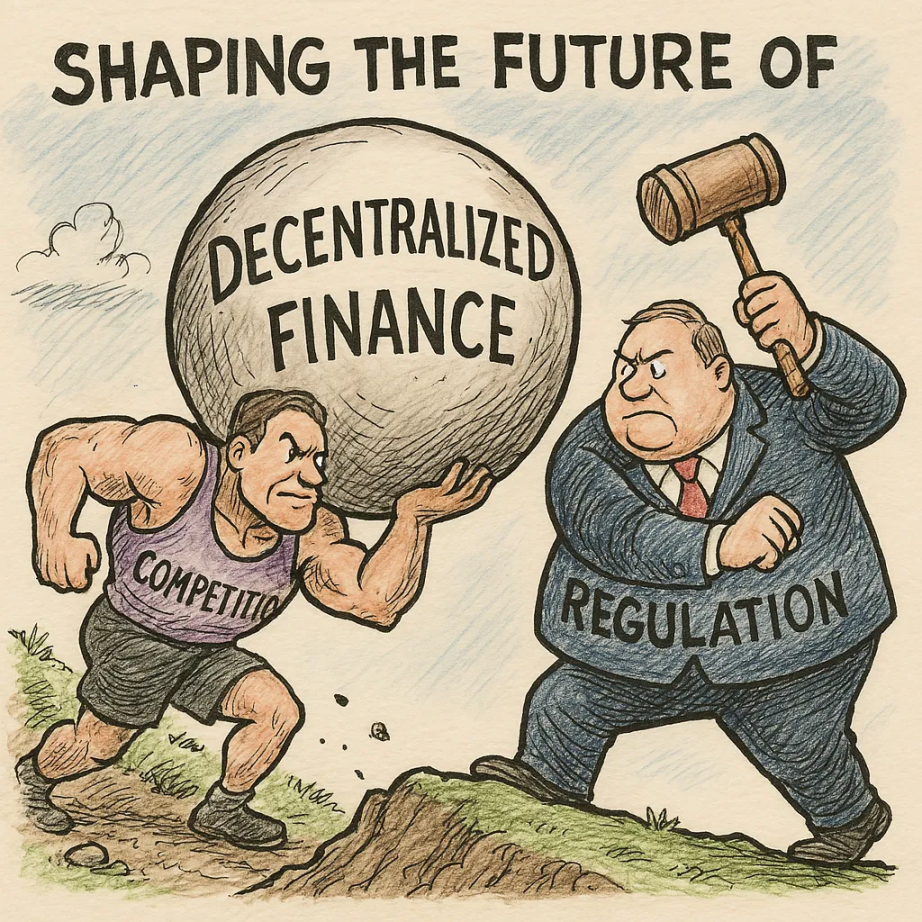

The dynamic tension between competition and regulatory oversight is not a hindrance, but rather a crucible forging a more resilient financial system.

Written by: Lorenzo Makoy

Translated by: Blockchain in Plain Language

The decentralized finance (DeFi) ecosystem is evolving at an astonishing pace. As innovation drives financial services beyond the realm of traditional intermediaries, both emerging and established market participants are fiercely competing for user attention, market share, and technological dominance. Meanwhile, global regulators are striving to understand, assess, and ultimately control these emerging systems while avoiding stifling their disruptive potential.

A Diverse and Dynamic Competitive Landscape

DeFi is not a singular domain but encompasses a variety of services, such as lending protocols, decentralized exchanges (DEX), yield farming platforms, asset tokenization projects, and insurance protocols. Each subfield attracts a unique group of innovators, and intense competition drives continuous improvements, featuring both incremental evolution and disruptive breakthroughs.

Key Areas Driving DeFi Innovation

- Lending Protocols: Platforms like Aave, MakerDAO, and Compound have laid the groundwork by offering over-collateralized loans and variable interest rate models. However, newcomers are exploring modular designs, zero-interest loans, and even AI-assisted credit scoring methods to enhance capital efficiency and risk management.

- Decentralized Exchanges and Automated Market Makers (AMM): The rise of DEXs like Uniswap and SushiSwap has fundamentally changed the way assets are traded. Their open, permissionless architecture encourages rapid experimentation and competition, prompting even established players to innovate liquidity and fee structures.

- Asset Tokenization and Real-World Integration: From real estate to artwork, asset tokenization is expanding the scope of DeFi. Integrating tangible assets with digital protocols compels existing participants to rethink liquidity mechanisms and market inclusivity.

- Emerging Innovations: New projects stand out with unique value propositions. For example, some projects integrate distributed physical infrastructure (like Grass Token), combining blockchain with the Internet of Things to create ecosystems that exceed traditional financial returns.

This fusion of technology, ideas, and business models not only sparks fierce competition but also fosters a spirit of collaboration. Many projects are beginning to achieve interoperability, allowing for "composability" between protocols, where multiple protocols work together to provide synergistic financial products.

The Role of Regulation in DeFi

Innovation is at the core of DeFi, while regulation is becoming a key balancing force. The regulatory framework for decentralized platforms remains fragmented, with many jurisdictions still in the early stages of regulation. This duality presents both challenges and opportunities.

Challenges Posed by Regulatory Uncertainty

- Fragmented Global Standards: Unlike the relatively standardized regulatory frameworks of traditional finance, DeFi operates in a borderless digital ecosystem. This disparity leaves projects uncertain about their legal obligations and may expose them to enforcement risks due to a lack of clear guidance.

- Risk of Overregulation: Overly stringent regulation may inadvertently stifle innovation. If regulators apply measures designed for traditional financial institutions directly to decentralized protocols without considering their unique characteristics, potential projects may fail to achieve their disruptive goals.

- Balancing Consumer Protection and Innovation: Regulators need to create an environment conducive to technological advancement while protecting consumers from fraud, operational failures, and systemic risks. Many DeFi projects lack transparent KYC (Know Your Customer) and AML (Anti-Money Laundering) frameworks, further complicating this balance.

Opportunities for Regulatory Integration

- Embedded Regulation: Emerging concepts suggest that smart design can integrate regulatory checks directly into blockchain architecture. "Embedded regulation" envisions the execution of rules through smart contracts, achieving decentralization of finance and its regulation.

- Regulatory Clarity Promotes Growth: A clear regulatory framework can lend legitimacy to the DeFi industry. When investors (especially institutional investors) see a clear framework, confidence will increase, potentially attracting more capital into the ecosystem.

- Collaborative Approaches: The future of DeFi may depend on close cooperation between innovators and regulators. By establishing industry standards and self-regulatory agreements, DeFi projects can proactively set benchmarks and address regulatory issues in advance. This not only protects user interests but also paves the way for sustainable growth.

The Intersection of Competition and Regulation

Intense competition and an evolving regulatory landscape are redefining the strategic focus of DeFi projects. On one hand, competition drives developers to innovate at an astonishing pace, creating complex systems that challenge the boundaries of traditional finance. On the other hand, compliance demands require higher levels of transparency, security, and accountability, which may slow the pace of disruption but also protect users from market volatility and potential fraud.

The Balancing Act for DeFi Platforms

- Innovation and Compliance: Projects must ensure that regulatory measures are seamlessly integrated into operations while maintaining their innovative edge. This balance is crucial—being too rigid may stifle innovation, while being too lenient may invite legal scrutiny and undermine consumer confidence.

- Market Differentiation: In an increasingly crowded market, unique technological integrations (such as using AI for risk assessment) or novel business models (like hybrid models connecting DeFi with traditional finance) will become distinguishing factors for successful platforms.

- Risk Management Strategies: Adaptive and scalable robust risk control protocols will be key. As platforms strive to balance innovation and compliance, strategies such as real-time data monitoring, regular audits, and community-driven governance models may become increasingly important.

This dynamic tension between competition and regulatory oversight is not a hindrance, but rather a crucible forging a more resilient financial system.

Looking Ahead: The Future Blueprint of DeFi

The future of decentralized finance hinges on its ability to establish a comprehensive and adaptive regulatory framework while responding to competitive pressures. As the market becomes more crowded and innovative platforms continue to emerge, and as regulators gradually catch up with technological realities, the following trends are expected to shape future developments:

- A More Coordinated Regulatory Environment: Efforts for global regulatory coordination may reduce uncertainty and promote cross-border cooperation and investment. This evolution could attract retail enthusiasts and institutional giants, driving mainstream integration of DeFi.

- The Rise of Next-Generation Platforms: Successful platforms will be those that innovate without compromising compliance. We may see "embedded regulation" become the norm in next-generation models, achieving automated compliance and enhanced user protection.

- Enhanced Interoperability and Collaboration: The competitive spirit of DeFi is expected to drive greater interoperability between protocols. By combining strengths and forming alliances, platforms can mitigate risks and create a more comprehensive financial services ecosystem.

As the industry matures, the interplay between market competition and regulatory adaptation will not only determine the viability of individual projects but also shape the overall trajectory of decentralized finance. The symphony of ideas, technological prowess, and legislative foresight is laying the groundwork for a new financial paradigm—one that promises transparency, inclusivity, and resilience.

Where Do We Go From Here?

In this unfolding narrative, every participant—from developers to regulators, from early adopters to seasoned investors—plays a crucial role in shaping the future of finance. This path may be fraught with challenges and risks, but for those who can find balance between innovative disruption and regulatory caution, it is also filled with opportunities.

As you contemplate the next chapter of this exciting evolution, consider how the changes in competition and regulation might impact the projects you follow or invest in. Will embedded regulation become a game changer? What collaborative measures might become industry standards? These critical questions will guide DeFi into its next era—where every token, every smart contract, and every regulatory adjustment could redefine the boundaries of the essence of finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。