The future financial world will not only be defined by stablecoins but by the ecosystems formed around them.

Written by: Will 阿望

Whether stablecoins can reshape the global financial landscape is no longer a YES / NO question, but rather a question of "how" they will reshape it.

In the early days, the growth of stablecoins was measured by total supply, with the key challenge being the trust behind them: which issuers are credible, compliant, and capable of scaling. With the introduction of the U.S. Genius Act, this issue is expected to be resolved soon.

As issuance becomes standardized, the stablecoin market is entering the next phase—from issuance to distribution.

The days when issuers earned astonishing profits are numbered—distributors are beginning to realize their leverage and obtain their rightful share of value. This has been well articulated in Circle's prospectus.

Given this shift, it is increasingly important to understand which applications, protocols, and platforms are achieving real growth, especially for those on-chain stablecoin scenarios that are already relatively mature in the crypto market.

Last week, we compiled Artemis: A Frontline Data Report on Stablecoin Payment Adoption, starting from the off-chain payment stablecoin scenario to explore the potential and pathways for stablecoins to connect with traditional finance.

Today, we continue to delve into Artemis, The Future of Stablecoins, Usage, Revenue, and the Shift from Issuers to Distribution, focusing on stablecoin use cases related to on-chain activities, as each use case has its unique context and practices, while also allowing us to observe trends in value capture amid dynamic market changes.

Key Points

Despite the stablecoin market cap reaching $240 billion and annual trading volume soaring to $3.1 trillion, there are many misconceptions about its adoption among the public. On one hand, issuers are willing to pay high fees to distributors to expand their market, as Circle paid over $900 million to distributors like Coinbase in 2023, accounting for more than half of its revenue, to attract users to use USDC.

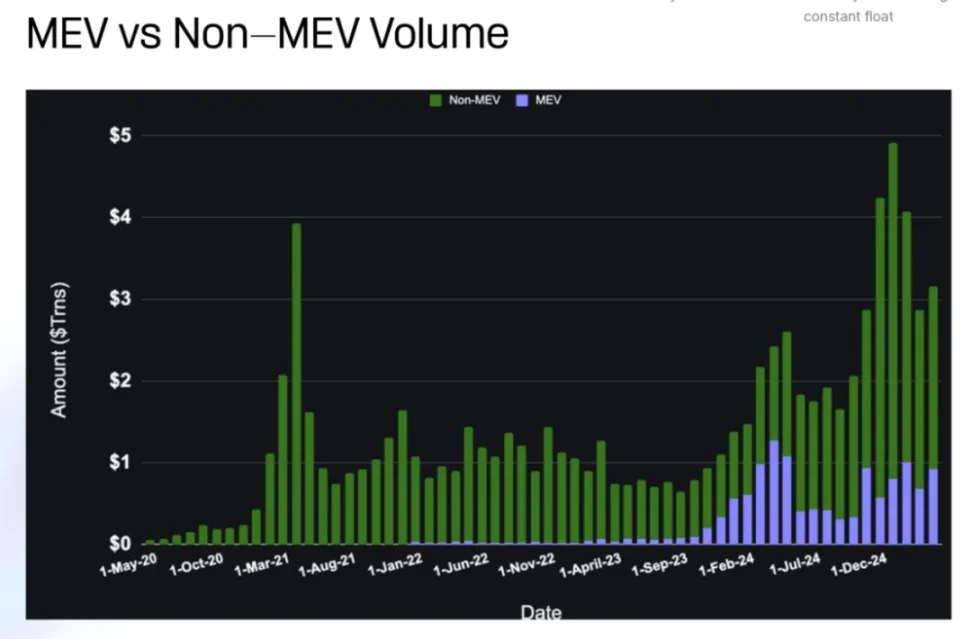

On the other hand, the so-called $3.1 trillion annual trading volume is highly misleading, with 31% stemming from MEV bots contributing through thousands of daily loop operations, repeatedly using the same funds, while the actual trading volume involving human participation is far lower than what the surface data suggests.

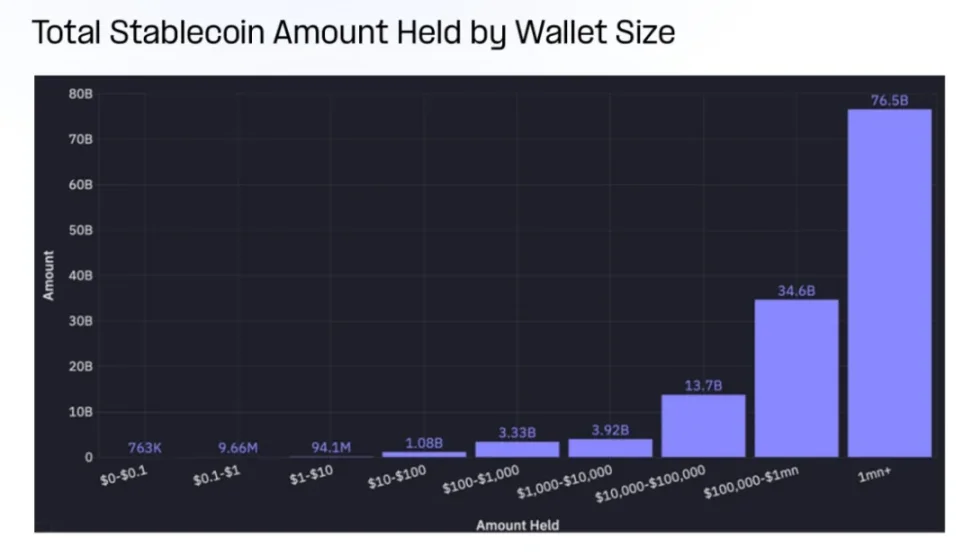

Additionally, there is a phenomenon of wealth concentration and obscurity in the stablecoin space. Currently, there are 150 million stablecoin wallets, but 99% of them have balances of less than $10,000, while just 20,000 mysterious wallets control $76 billion, accounting for 32% of the total supply. These wallets are neither exchanges nor DeFi protocols and are reported to fall into a "gray area," with unclear implications behind them.

It is noteworthy that the real explosive growth of stablecoins occurred in the past six months. Since summer, DeFi stablecoin trading volume has surged from $100 billion to $600 billion, while meme coin trading alone generated $500 billion in stablecoin flow, accounting for 12% of the annual trading volume.

However, the criteria we use to measure the success of stablecoins are misguided. A decline in total locked value (TVL) may not indicate a decrease in usage but rather a reflection of technological advancement and efficiency improvements, while an increase in trading volume may merely signify a rise in bot activity. All the metrics we use to track adoption rates have fundamental issues.

While people are still debating the market share of USDC and USDT, real transformation is quietly happening at the distribution level. This could lead to a complete reshaping of the entire stablecoin ecosystem's value chain.

1. The Next Phase of Stablecoins

In just a few years, stablecoins have evolved from experimental products to indispensable financial tools, with their product-market fit being undeniable. However, we have now entered a new era where mere issuance and liquidity are insufficient for sustained growth. The next phase of stablecoin applications will involve new factors, including sharing economic benefits with partners, the convenience of on-chain and off-chain integration, and the degree of utilization of programmable features.

—Jelena Djuric, Co-founder and CEO of Noble

1.1 Behind the $240 Billion Supply

Stablecoins have become one of the most widely used products in the crypto space, with a supply exceeding $240 billion and annual on-chain trading volume surpassing $7 trillion, rivaling traditional payment networks. However, many figures deserve deeper examination.

Supply reflects the existence of stablecoins, not their usage, flow, or purpose. Meanwhile, volume reflects a mix of on-chain human activity and bot programs but fails to capture off-chain data.

1.2 Usage as a New Signal

Not all stablecoins are in a state of efficient value circulation; some are dormant as node validators or in staking, while others are key drivers of cross-platform, cross-user, and cross-regional economic activities.

As noted in "The State of Stablecoins 2025," we see significant differences in stablecoin usage across different ecosystems. Stablecoins on Ethereum are often used as DeFi collateral and trading liquidity, while those on Tron are more commonly used for remittances and payments in emerging markets. USDC holds a higher share in institutional fund flows, while USDT thrives due to its coverage and accessibility.

These usage patterns not only reflect value flows but also provide builders with opportunities to target underserved or high-growth niche markets.

Understanding the application scenarios and functional utility of stablecoins is currently the clearest signal for assessing stablecoins, indicating where stablecoins are truly adopted and where the next wave of innovation will emerge.

2. From Institutional Issuance to Market Distribution

Stablecoins will continue to grow, and regulatory clarity is opening doors for institutional investors. The next phase of stablecoins is not just about who has scale but also about the business models of all participants in the stablecoin supply chain, including issuers, distributors, and holders. In the next 12-24 months, we will undoubtedly see changes and challenges in the value chain and value capture.

—Martin Carrica, Vice President of Stablecoins at Anchorage Digital

2.1 Historical Value of Issuers

In the early days of stablecoins, value capture was primarily concentrated among issuers. Maintaining a 1:1 peg at a massive scale is a challenge, and few issuers have managed to do this well.

Tether and Circle dominate not only because they are pioneers but also because they are among the few capable of continuously managing large-scale issuance and redemption, managing reserves, integrating with banking partners, and withstanding market pressures.

Monetizing through reserve earnings (primarily short-term U.S. Treasury bills and cash equivalents) can translate even modest interest rates into substantial income. Meanwhile, early successes have compounded: exchanges, wallets, and DeFi protocols built around USDT and USDC have reinforced the network effects of issuance and liquidity.

2.2 Distributors as an Important Value Layer

Trustworthy custody, liquidity, and redemption are no longer differentiators but expectations. As more issuers with similar capabilities enter the market, the importance of the issuers themselves is gradually diminishing.

What matters is what users can do with stablecoins. Therefore, the dominance of stablecoins is shifting from issuers to distributors.

Distributors that integrate stablecoins into real use cases through wallets, exchanges, and applications now wield influence and hold leverage. They control user relationships, shape user experiences, and increasingly decide which stablecoins gain attention.

Moreover, they are monetizing this position. Circle's recent IPO filing shows that it paid nearly $900 million to partners like Coinbase for integrating and promoting USDC, exceeding half of its total revenue in 2023.

Note that the current situation is that issuers pay distributors, not the other way around.

(Circle S-1 Form)

Many distributors are further enhancing their platform architectures. PayPal has launched PYUSD; Telegram is collaborating with Ethena; Meta is exploring stablecoin channels again; and fintech platforms like Stripe, Robinhood, and Revolut are embedding stablecoins directly into payment, savings, and trading functionalities.

Issuers are not standing still either. Tether is building wallets and payment channels. Circle is achieving full-stack development through payment application interfaces (APIs), developer tools, and infrastructure acquisitions, while launching the Circle Payment Network to create network effects.

But the situation is clear: distribution has now become a strategic high ground.

We are in the midst of a structural transformation: a shift in perspective, where stablecoins are no longer seen as "cryptocurrencies" but as "global infrastructure"; a shift in utility, where financial institutions are fully leveraging these new rails to actively reshape their products; and a constantly changing competitive landscape.

—Ran Goldi, Senior Vice President of Payments and Networks at Fireblocks

2.3 Building Programmability and Precision

With the proliferation of stablecoins, new infrastructures are emerging—designed to achieve programmability, compliance, and value sharing. Issuance alone is no longer key. To remain competitive, stablecoins must adapt to the demands of platforms that drive usage.

Next-generation stablecoins include programmable features such as reconciliation capabilities, compliance rules, and conditional transfers. These features enable stablecoins to act as application-aware assets, automatically routing value to merchants, developers, liquidity providers (LPs), or affiliates without off-chain protocols.

Each use case has its unique context. Remittances prioritize speed and conversion, DeFi requires composability and collateral flexibility, while fintech integration necessitates compliance and auditability. The emerging infrastructure stack aims to meet these diverse needs, allowing the stablecoin layer to dynamically adapt to its environment rather than providing a one-size-fits-all solution.

Crucially, this transformation of infrastructure enables more precise value capture. Programmable liquidity means that value can be shared throughout the stack, rather than being hoarded solely by issuers. Stablecoins are becoming dynamic financial primitives, influenced by the incentive mechanisms and architectures of the ecosystems they inhabit.

3. On-Chain Stablecoin Use Cases

As the value capture of stablecoins shifts downstream, it is the distributors that define their actual use cases.

Wallets, exchanges, fintech applications, payment platforms, and DeFi protocols determine which stablecoins users can see, how they interact with these stablecoins, and where they create utility. These platforms shape the user experience and control the demand side of the stablecoin economy.

Analyzing the actual use cases of stablecoins in payments, savings, trading, DeFi, and remittances can reveal who is creating value, where the friction points are, and which distribution channels are effective. This report focuses on stablecoin use cases related to on-chain activities. By tracking the flow of stablecoins in wallets and platforms, we can gain insights into the infrastructure and incentive mechanisms that influence their adoption.

Among these known participants (also referred to as "tagged"), the current use of stablecoins is primarily concentrated in three main environments:

- Centralized Exchanges

- DeFi Protocols

- MEV

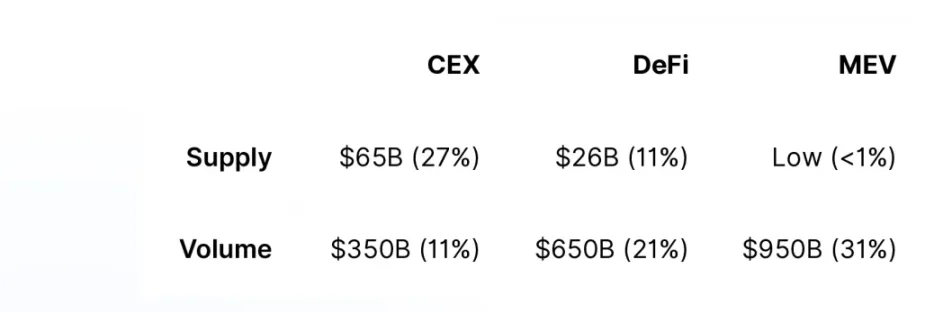

The table below shows the supply and trading volume proportions of each category as of April 2025:

These three categories of addresses account for 38% of the total supply of stablecoins and 63% of the total trading volume.

Unattributed addresses occupy the majority of the remaining supply and trading volume. These wallets are not directly associated with well-known institutions, exchanges, or smart contracts. We will explore the trends of unattributed addresses later in this report.

3.1 Overview of the Overall Stablecoin Market

- Total Supply of Stablecoins: $240 billion

- Total Trading Volume of Stablecoins in the Past 30 Days: $3.1 trillion

- Reserve Income: $10 billion

A. Supply

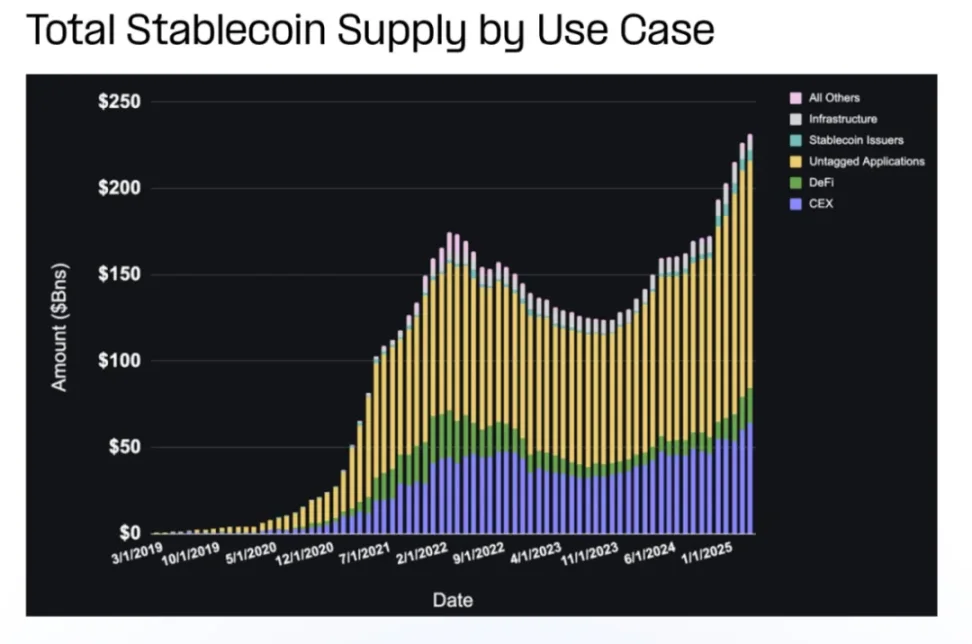

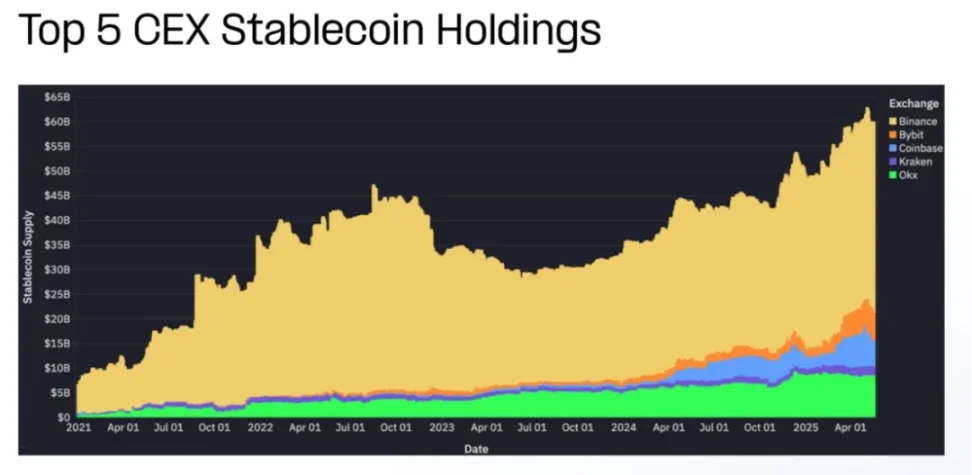

The distribution of stablecoin supply reveals which platforms and use cases are attractive enough to attract and retain circulation. Since the summer of 2023, the total supply of stablecoins has steadily climbed, reaching an all-time high this year, with significant growth in the supply from centralized exchanges (CEX), DeFi, and unattributed wallets.

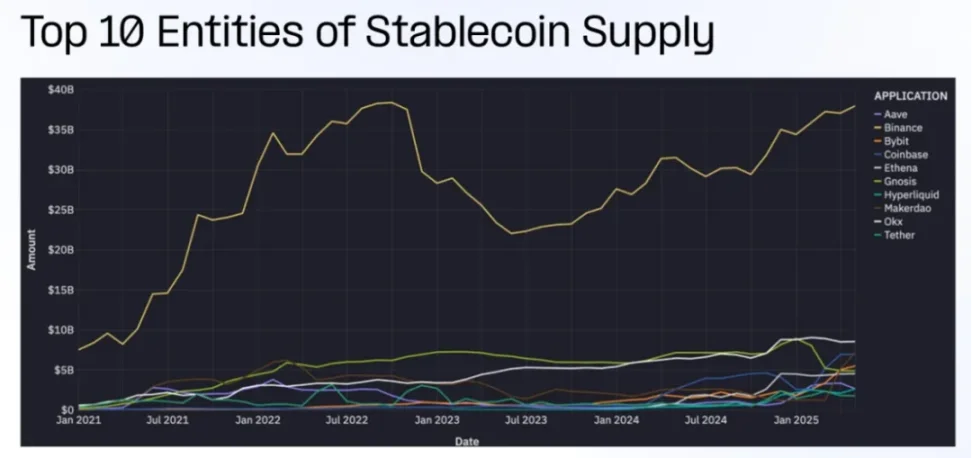

Most of the stablecoin supply is concentrated in centralized exchanges, with Binance holding a significant lead. DeFi protocols and issuers also hold substantial shares.

B. Volume

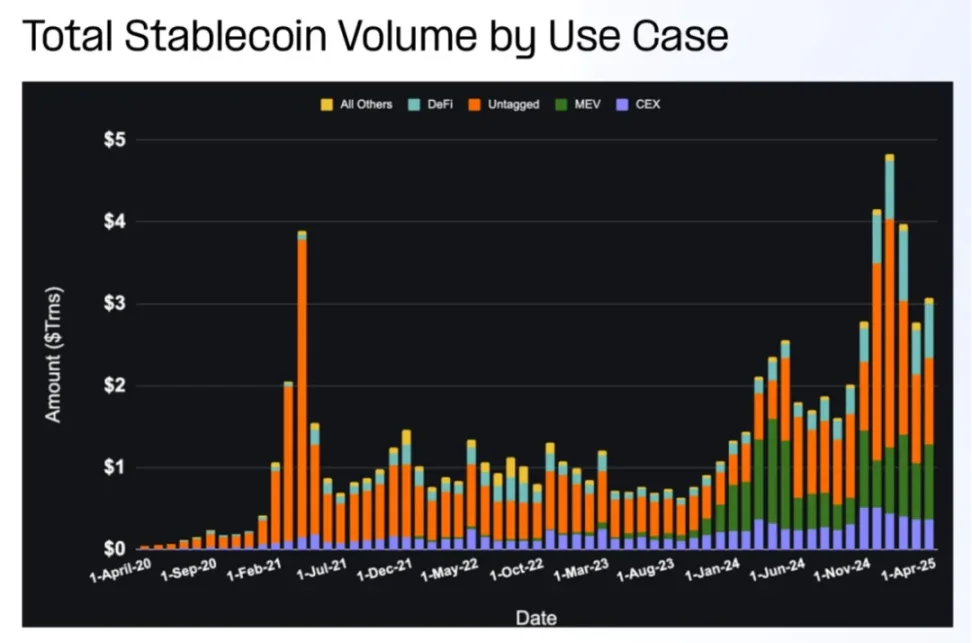

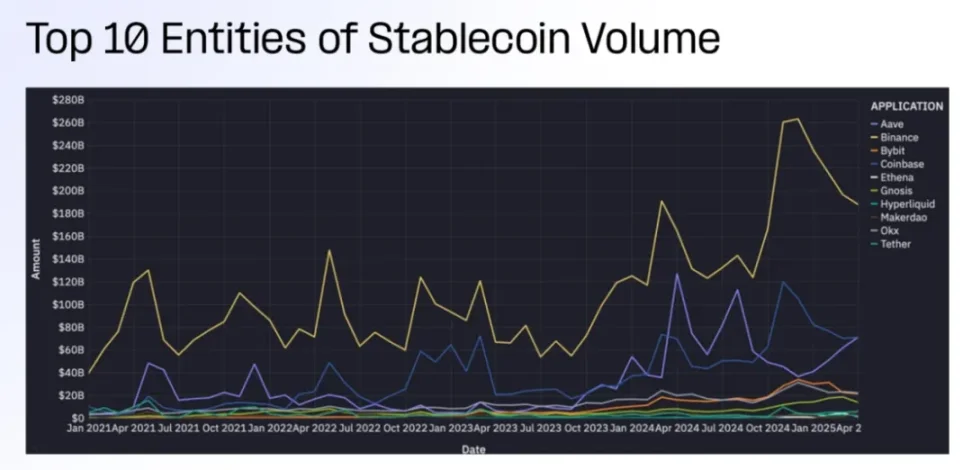

Since the summer of 2023, the total trading volume of stablecoins has steadily increased, with occasional spikes during periods of high market activity. DeFi has seen the highest increase in trading volume, while MEV and unattributed wallets have high but volatile trading volumes.

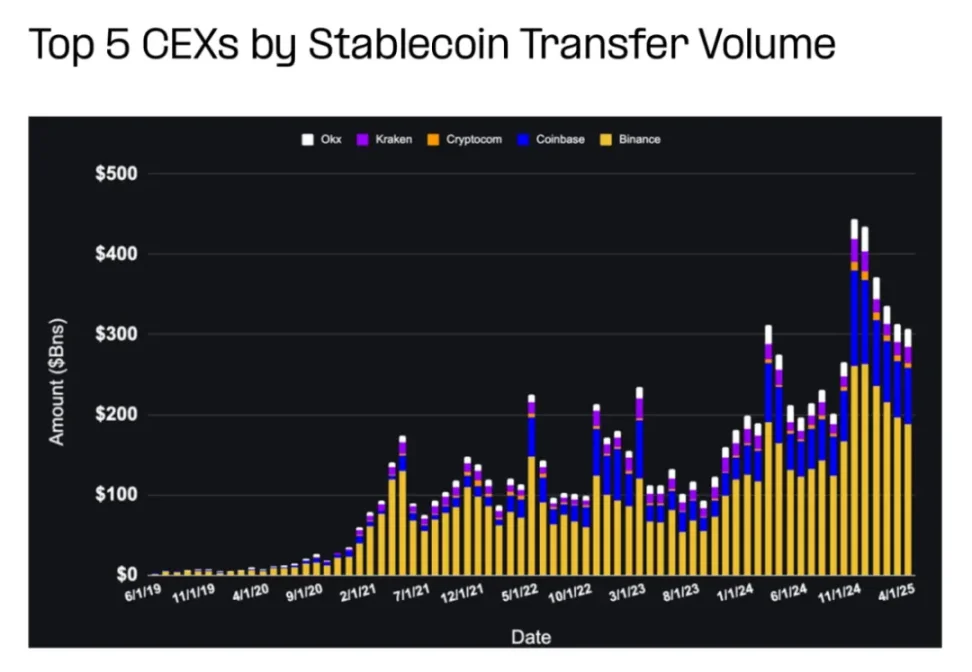

The entities with the highest stablecoin trading volumes are often centralized exchanges, followed by DeFi and issuing institutions. CEX trading volume does not reflect trades on CEX platforms, as most transactions occur off-chain. Instead, it reflects user deposits, withdrawals, inter-exchange transfers, and internal operational activities.

3.2 Centralized Exchanges (CEX)

The supply of stablecoins anchored by centralized exchanges occupies a significant portion of circulation in the ecosystem. In terms of trading volume, DeFi protocols and MEV-driven participants are currently the most active, highlighting the growing role of on-chain applications and composable infrastructure.

- Percentage of Total Stablecoin Supply: 27%

- Percentage of Total Stablecoin Trading Volume in the Past 30 Days: 11%

- Reserve Income: $3 billion

Since a local low in 2023, the supply of top centralized exchanges (CEX) has nearly doubled. The supply from Coinbase, Binance, and Bybit often fluctuates with market conditions, while Kraken and OKX have seen more stable growth.

Due to most activities occurring off-chain (centralized ledgers), it is challenging to obtain specific data on how centralized exchanges (CEX) use stablecoins. Funds are often pooled together, with little disclosure on specific uses. This opacity makes it very difficult to comprehensively assess stablecoin usage within centralized exchanges (CEX).

The trading volume attributed to centralized exchanges (CEX) reflects on-chain activities related to deposits, withdrawals, inter-exchange transfers, and liquidity operations, rather than internal trading, margin collateral, or fee settlements. Therefore, it is best viewed as an indicator of user interaction with exchanges rather than a measure of total trading activity.

3.3 Decentralized Finance (DeFi)

- Percentage of Total Stablecoin Supply: 11%

- Percentage of Total Stablecoin Trading Volume in the Past 30 Days: 21%

- Reserve Income: $1.1 billion

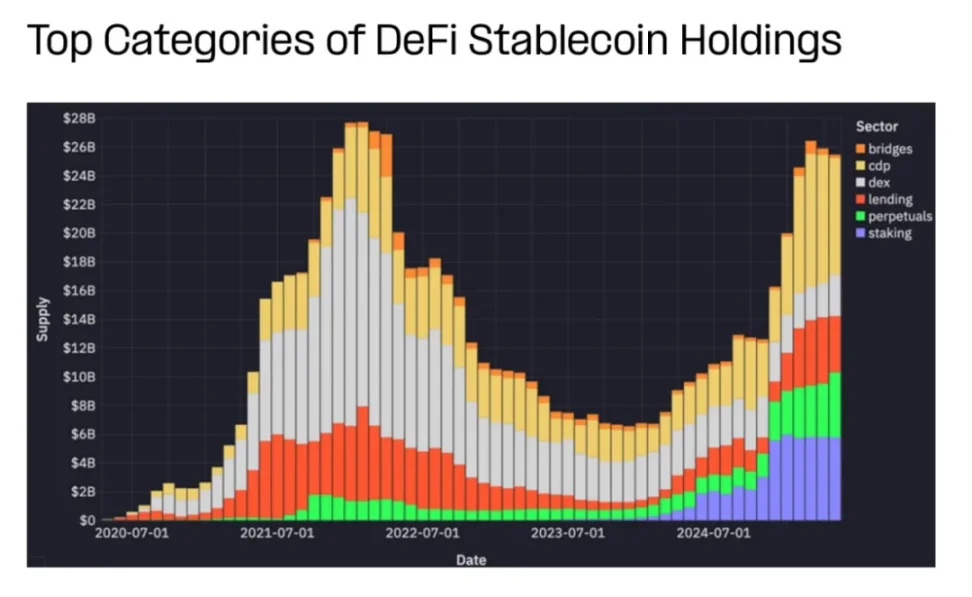

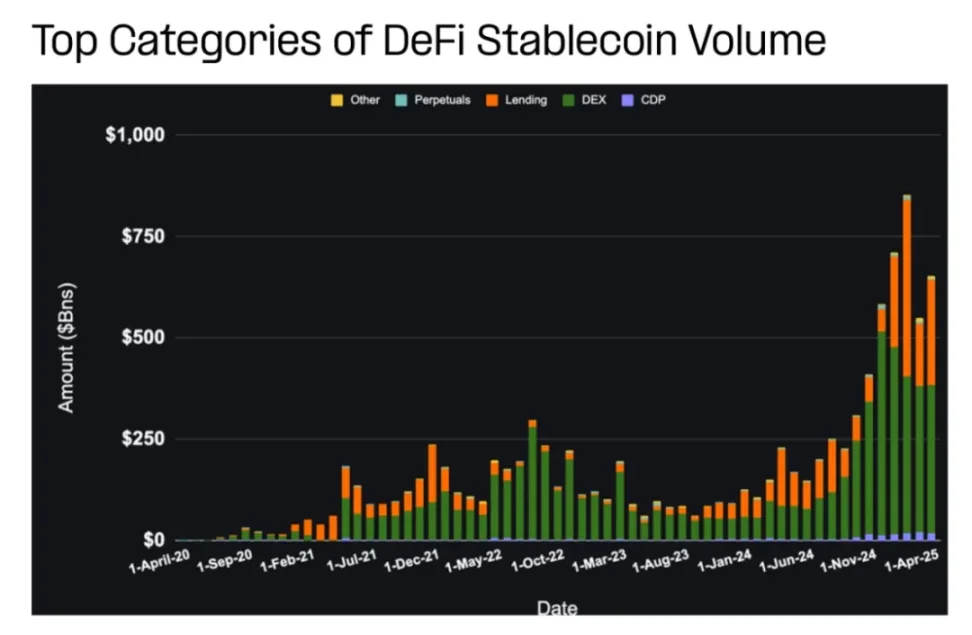

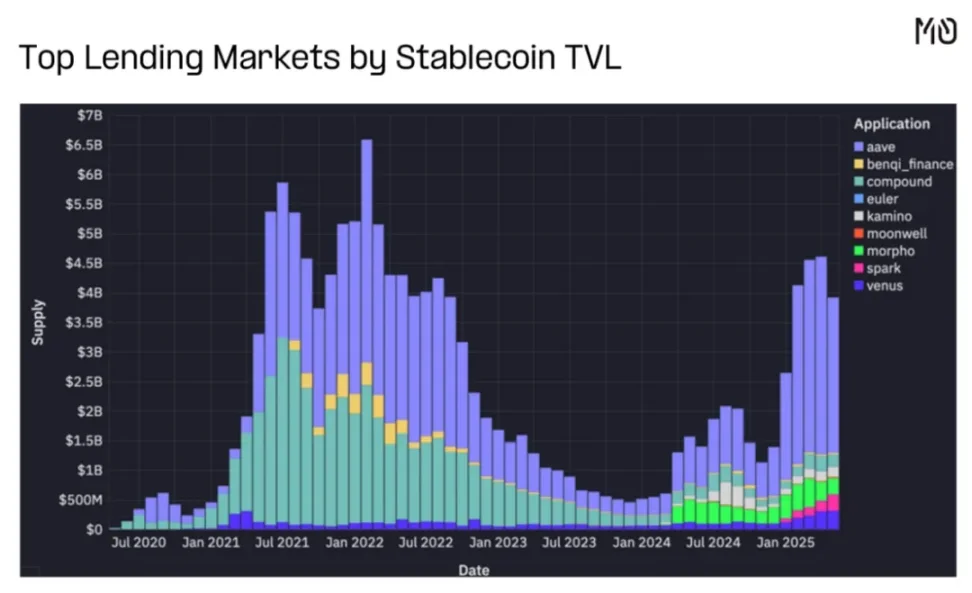

The supply of DeFi stablecoins comes from collateral, liquidity provider (LP) assets, and the settlement layers of lending markets, decentralized exchanges (DEX), and derivatives protocols. In the past six months, the supply from CDPs, lending, perpetual contracts, and staking has nearly doubled.

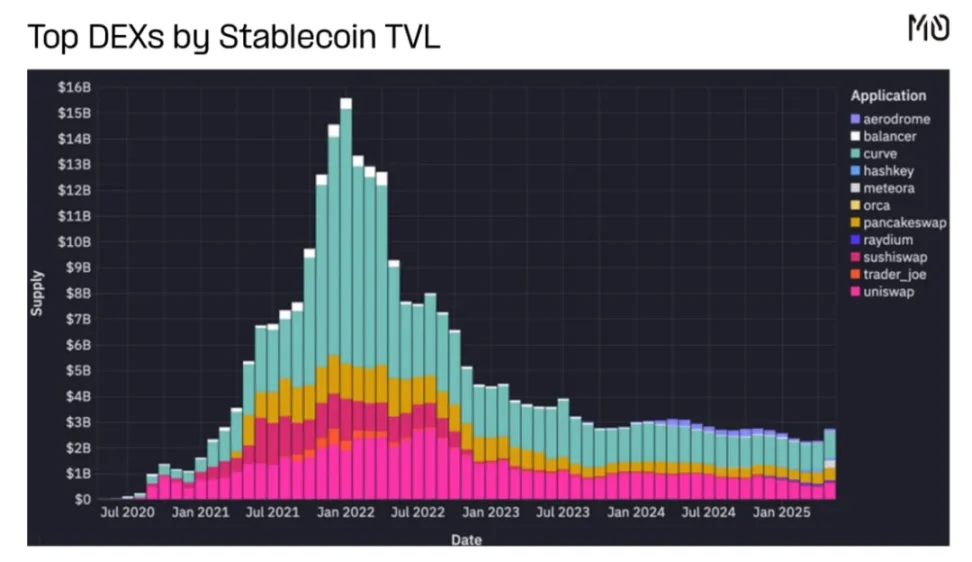

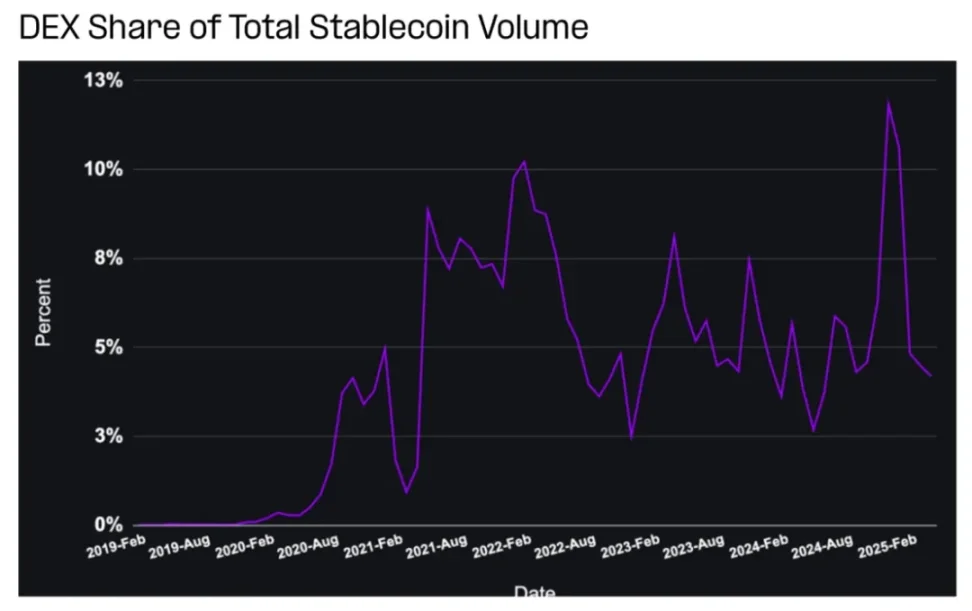

The supply share from DEXs has significantly decreased, not due to a decline in DEX usage, but because DEXs have become more capital efficient. With the rising popularity of Hyperliquid, the supply locked in perpetual contracts has recently increased significantly.

In the past six months, the monthly trading volume of DeFi stablecoins has grown from about $100 billion to over $600 billion, primarily due to significant growth in decentralized exchanges (DEX), lending markets, and collateralized debt positions (CDP).

In the DeFi space, stablecoin applications are prominent in the following key areas:

- DEX liquidity pools

- Lending markets

- Asset collateralized debt positions

- Others (including perpetual contracts, cross-chain, and staking)

Each area has different ways of using stablecoins—whether as liquidity, collateral, or payment methods—which affects user behavior and the economic benefits at the protocol level.

A. DEX

Concentrated liquidity, stablecoin-centric DEXs, and cross-protocol composability have reduced the need for DEXs to maintain high stablecoin volatility.

The majority of stablecoin trading volume in DeFi comes from DEXs. The share of DEXs in total trading volume fluctuates with market sentiment and trading trends, with recent memecoin trading volumes surging to over $500 billion, accounting for 12% of total trading volume.

B. Lending Markets

Although lending activity has retreated from its peak, Aave has shown strong recovery momentum, while new protocols like Morpho, Spark, and Euler have also gained attention.

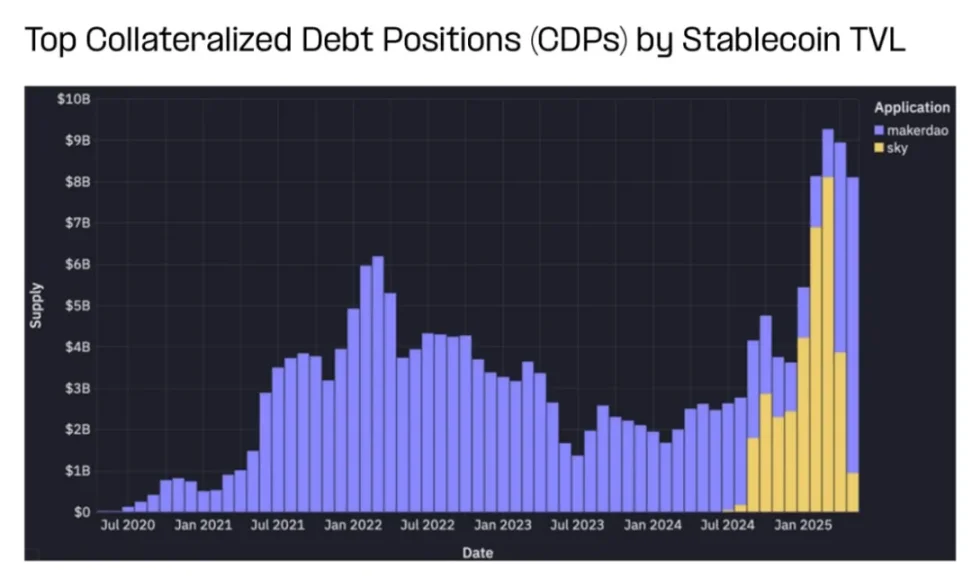

C. Collateralized Debt Positions

MakerDAO continues to manage one of the largest stablecoin pools in DeFi, with the adoption of DAI steadily increasing due to high savings rates. They hold billions of dollars in stablecoins, playing a key role in maintaining the peg of DAI to the U.S. dollar.

D. Others

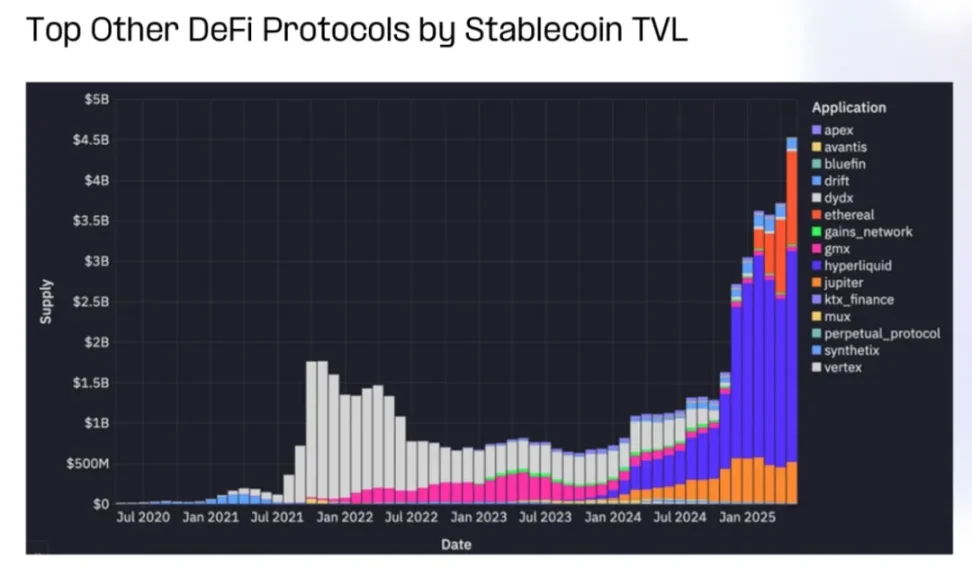

Stablecoins also play a critical role in supporting DeFi derivatives, synthetic assets, perpetual contracts, and trading protocols.

Over time, the supply of stablecoins rotates among various perpetual contract protocols, currently concentrated on Hyperliquid, Jupiter, and Ethereal.

3.4 MEV Miners/Node Validators

- Percentage of Total Stablecoin Supply: 1%

- Percentage of Total Stablecoin Trading Volume in the Past 30 Days: 31%

- Reserve Income: /

MEV bots extract value by reordering transactions. Their high-frequency behavior leads to an excessive share of on-chain trading volume, often reusing the same funds.

The above chart distinguishes MEV-driven activities to differentiate between bot trading volume and human trading volume. MEV trading volume spikes during peak trading periods and fluctuates as blockchains and applications attempt to counter MEV strategies.

Predicting revenue for high trading volume, low volatility use cases like MEV is not as straightforward as predicting for high volatility use cases. Forecasting reserve yield is less applicable here, but these use cases can adopt various monetization strategies, such as trading fees, spread capture, embedded financial services, and monetization for specific applications.

3.5 Unattributed Wallets

- Percentage of Total Stablecoin Supply: 54%

- Percentage of Total Stablecoin Trading Volume in the Past 30 Days: 35%

- Reserve Income: $5.6 billion

The stablecoin activity in unattributed wallets is harder to explain, as the intent behind transactions must be inferred or confirmed through private data. Nevertheless, these wallets account for the vast majority of stablecoin supply and often represent a significant portion of trading volume.

The composition of unattributed wallets includes:

- Retail users

- Unidentified institutions

- Startups and small to medium-sized enterprises

- Dormant or passive holders

- Unclassified smart contracts

Although attribution models are not perfect, these "gray area" wallets are increasingly significant in real-world payments, savings, and operational processes, many of which do not fully align with traditional DeFi or trading frameworks.

Some of the most promising use cases are emerging, including:

- P2P remittances

- Treasury management for startups

- Dollar savings for individuals in inflationary economies

- Cross-border B2B payments

- E-commerce and merchant settlements

- In-game economies

As regulatory transparency increases and payment-centric infrastructure continues to attract capital, these emerging use cases are expected to expand rapidly, especially in regions underserved by traditional banking services.

Related content can be found: Artemis: First-line data from stablecoin payment adoption

Currently, we will focus on the following high-level trends:

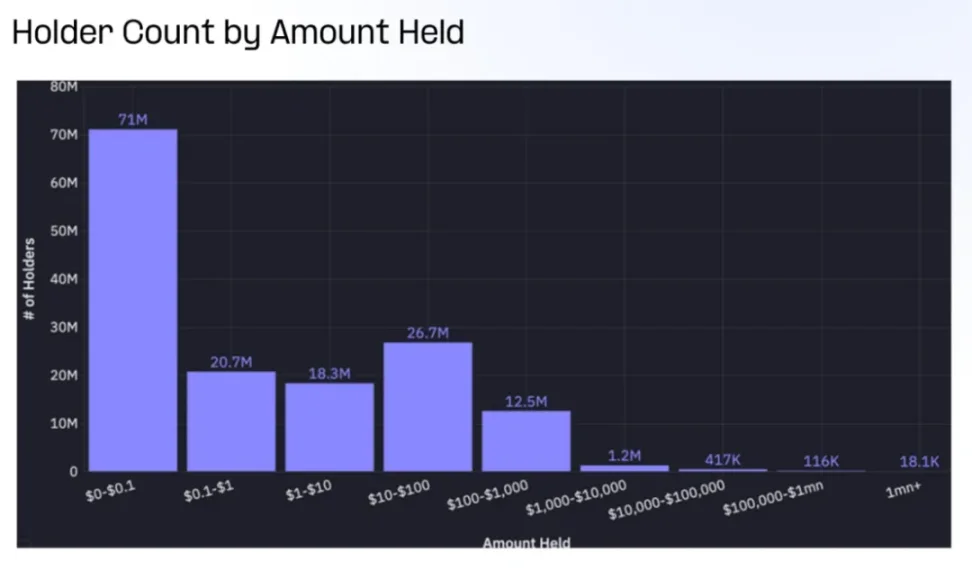

Despite the large number of unattributed wallets (over 150 million), the vast majority of wallets hold negligible balances. Over 60% of unattributed wallets hold less than $1 in stablecoin balances, while there are fewer than 20,000 wallets holding more than $1 million in stablecoin balances.

When we shift our focus to the balance of each wallet, the situation is completely reversed.

There are fewer than 20,000 unattributed wallets with balances exceeding $1 million, holding a total of over $76 billion, which accounts for 32% of the total stablecoin supply.

Meanwhile, wallets with balances below $10,000 (accounting for over 99% of unattributed wallets) hold a total of $9 billion, which is less than 4% of the total stablecoin supply.

Most wallets are small in scale, but the majority of unattributed stablecoins are held by a few high-value groups. This distribution reflects the dual nature of stablecoin usage: on one hand, there is a broad base of grassroots users, and on the other hand, there is a high concentration among institutional users or whales.

### Conclusion

The stablecoin ecosystem has entered a new phase, where value will increasingly flow to those building applications and infrastructure.

This marks a key maturation of the market, shifting the focus from the currency itself to the programmable systems that make the currency work. With the improvement of regulatory frameworks and the surge of user-friendly applications, stablecoins are poised for exponential growth. They combine the stability of fiat currencies with the programmability of blockchain, making them a cornerstone of future global finance.

The future of stablecoins belongs to those who create applications, infrastructure, and experiences that unlock their full potential. As this shift accelerates, we can expect more innovations in how value is created, distributed, and accessed throughout the ecosystem.

The future financial world will not only be defined by stablecoins but by the ecosystem that forms around them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。