BUIDL, or the Blackrock USD Institutional Digital Liquidity Fund, is an asset manager’s first tokenized money market fund, created in partnership with Securitize. The fund brings traditional money market exposure—U.S. Treasury bills, cash, and repurchase agreements—onto public blockchains, allowing these assets to be represented and traded as tokens.

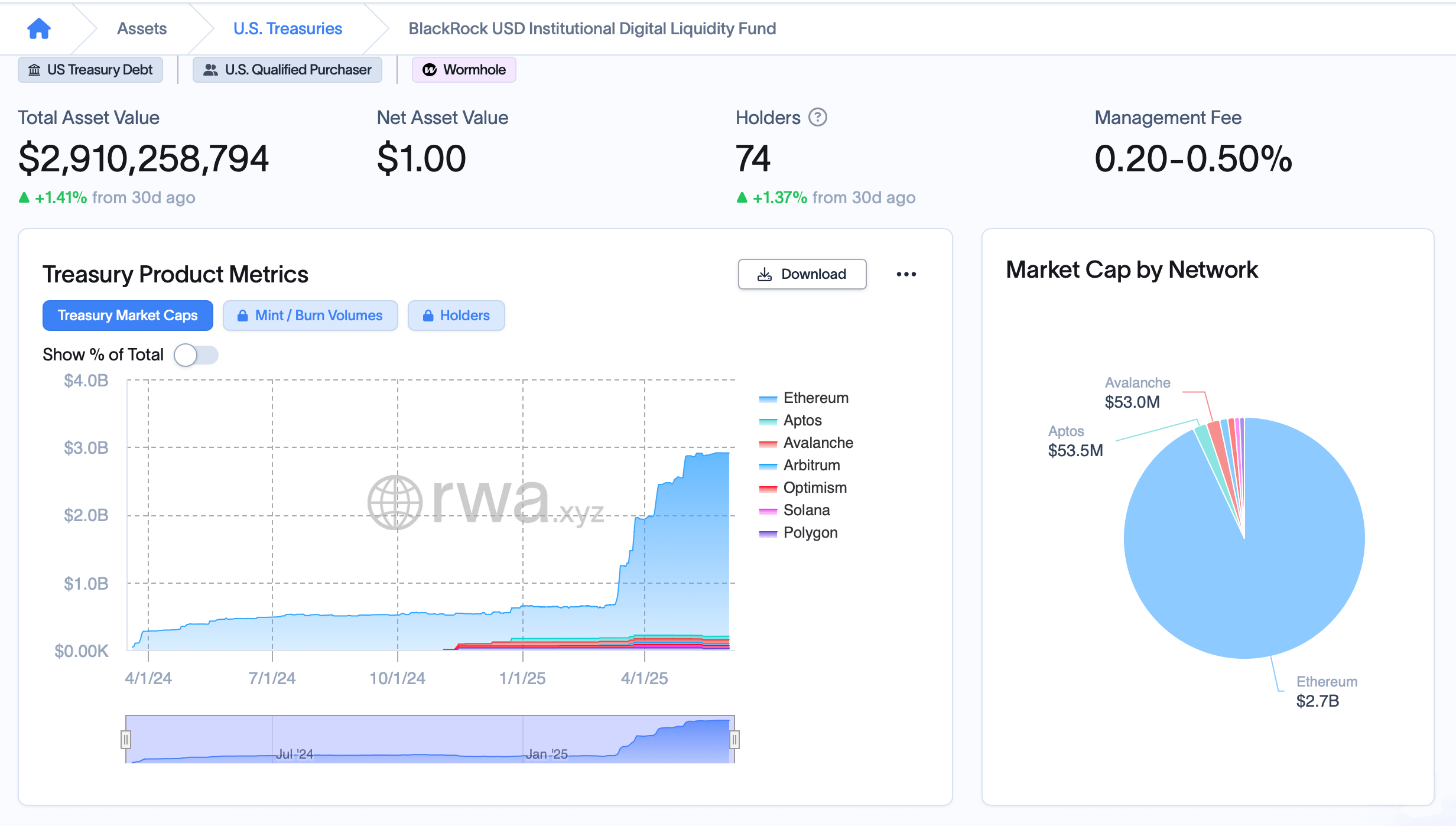

Source: BUIDL’s total asset value on June 3, 2025, via RWA.xyz.

The fund issues tokens with a whitelist mechanism to ensure regulatory compliance and operates on several blockchains including Ethereum, Solana, Polygon, Avalanche, Arbitrum, Optimism, and Aptos. Investors in BUIDL receive daily interest based on yields from the fund’s underlying assets.

Dividends are paid every day, enabling investors to redeploy capital immediately. The May total of more than $10 million is the first time a tokenized treasury fund has exceeded that threshold in a single month. Dividends for May were distributed across seven blockchains, with Ethereum accounting for $9,370,969 of the total.

Aptos generated $187,734, Avalanche $185,708, Polygon $104,889, Arbitrum $102,000, Optimism $85,339 and Solana $70,593. This chain-by-chain breakdown underscores Ethereum’s dominance, but other networks are seeing growing participation. Securitize serves as the tokenization platform and transfer agent for BUIDL, handling compliance, investor onboarding, and whitelist management.

Only qualified purchasers—accredited individuals and institutional investors who meet strict financial requirements—can invest, with minimums set at $5 million for individuals and $25 million for institutions. Investors transact in U.S. dollars and must pass KYC and AML checks before being whitelisted. Assets are custodied by Anchorage, Bitgo, Coinbase and Fireblocks, with BNY Mellon acting as asset custodian.

Since its launch, BUIDL has distributed more than $43.4 million in dividends, highlighting growing demand for institutional-grade, onchain yield products. Daily distributions and near real-time returns illustrate the benefits of tokenization for capital deployment. At press time, BUIDL reigns as the largest tokenized money market fund, sporting a $2.91 billion valuation.

While it’s the largest, BUIDL operates in a competitive arena of tokenized money market funds, sharing the field with Franklin Templeton’s BENJI, Superstate’s USTB, Ondo’s USDY and OUSG, as well as Circle’s USYC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。