Original Title: "From 'Alternative' to 'Essential'? ⸺ How is the 'Asset Manifesto' of cryptocurrency written in the trio of regulation, institutions, and macro storms? | WTR 6.2"

Original Source: WTR Research Institute

This Week's Review

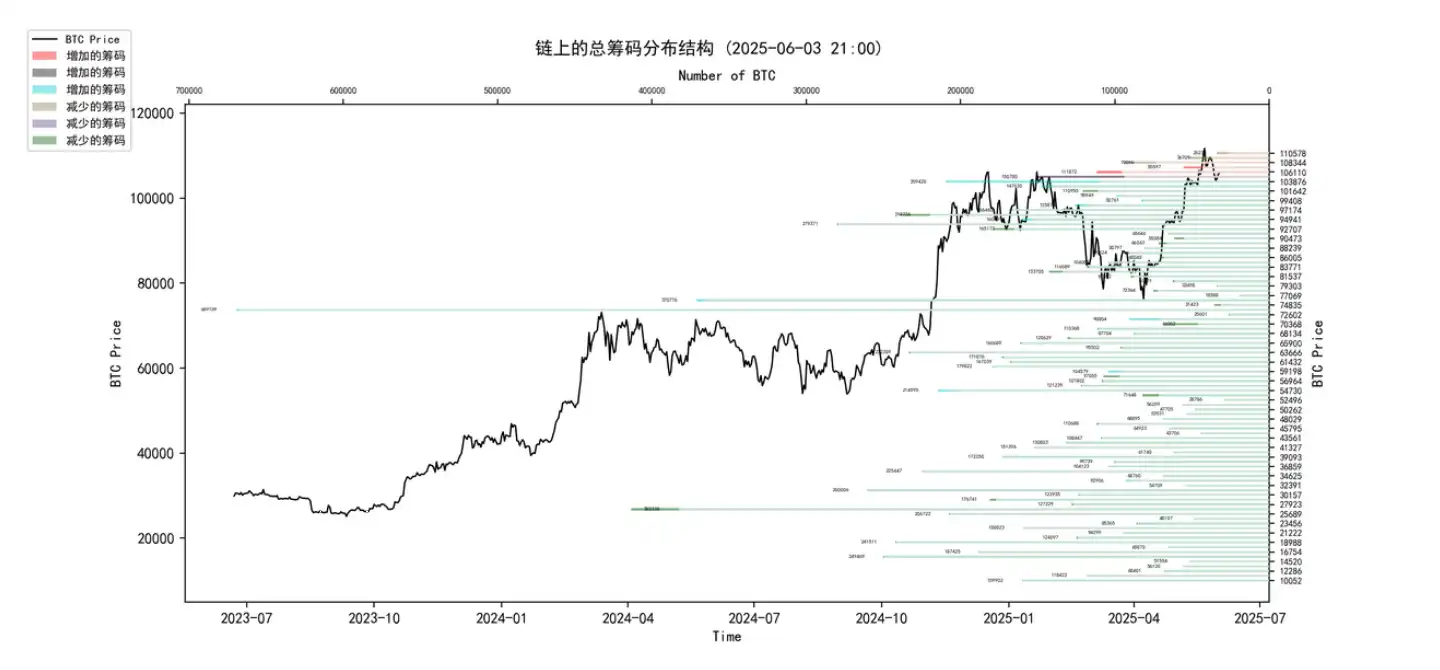

From May 26 to June 2, the highest price of the ice sugar orange was around $110,718, and the lowest was close to $103,068, with a fluctuation range of about 6.19%. Observing the chip distribution chart, there is a significant amount of chip transactions around 103,876, which will provide certain support or pressure.

• Analysis:

60,000-68,000 approximately 1.21 million coins;

76,000-89,000 approximately 1.28 million coins;

90,000-100,000 approximately 1.41 million coins;

• The probability of not breaking below 95,000~100,000 in the short term is 80%.

Important News

Economic News

On Monday, U.S. stock indices opened, with the Nasdaq up 0.11%, the S&P 500 down 0.1%, and the Dow Jones down 0.35%. Gold rose 2.6% to $3,376 per ounce.

South Korea will hold general election voting on Tuesday. Regardless of the election results, the cryptocurrency industry will benefit, as both popular candidates Lee Jae-myung and Kim Moon-soo have promised to ease regulations and expand access to digital assets. The Bank of Korea released data showing that by the end of last year, the total value of cryptocurrency held by South Koreans was approximately $74.5 billion.

Federal Reserve Governor Waller stated that the impact of tariffs on inflation may peak in the second half of 2025, and tariff measures will push up the U.S. unemployment rate, posing downside risks to the economy and job market, while inflation faces upside risks. The prospect of interest rate cuts depends on the slowdown of inflation and whether tariff measures remain at the lower end of the range. The "good news" is that there may still be a possibility of rate cuts later this year.

Derivatives market traders predict that the Federal Reserve will remain on hold until September, followed by "rapid and significant rate cuts."

Mellon Investment Chief Economist Vincent Reinhart stated that by June next year, the market expects the benchmark interest rate to drop sharply by 100 basis points to a range of 3.25%-3.5%. This view suggests that the Federal Reserve will urgently shift to prioritize growth despite inflation concerns.

U.S. banks warn that U.S. tariffs have a more significant negative impact on the U.S. economy and the dollar. Bank of America expects economic data to be weak. JPMorgan CEO Jamie Dimon warned that cracks will eventually appear in the U.S. bond market.

The one-year U.S. credit default swap (CDS) rose to 52 basis points, close to the highest level since 2023, as the debt ceiling crisis has never truly been resolved, increasing the risk of U.S. government default.

The dollar and U.S. bonds depreciated, gold received support to reach new highs, and cryptocurrency has also recently experienced new highs.

Cryptocurrency Ecosystem News

The U.S. Securities and Exchange Commission (SEC) Corporate Finance Division issued a statement on May 29, 2025, clarifying that three types of staking activities in proof-of-stake (PoS) networks do not constitute the issuance and sale of securities under the Securities Act of 1933 and the Securities Exchange Act of 1934. The three types of staking forms covered include self-staking by node operators, self-custody staking, and staking by custodial institutions on behalf of clients.

New York City Comptroller Brad Lander rejected the proposal for BTC-backed municipal bonds from Mayor Eric Adams. Brad Lander, who co-manages the bond issuance with the Mayor's Office of Management and Budget, stated that New York City will not issue BTC-backed bonds during his tenure, as the stability of cryptocurrencies is insufficient to fund the city's infrastructure, affordable housing, or schools.

At the ETHGlobal Prague conference, ETH founder Vitalik stated that ETH will scale L1 by about 10 times within a year, and then "take a breather" before the next leap.

Japanese listed company Metaplanet CEO Simon Gerovich stated that he acquired 1,088 BTC for approximately $117.3 million, bringing his total holdings to 8,888 BTC.

Salvador has increased its holdings by 8 BTC in the past 7 days, currently holding 6,194.18 BTC.

SharpLink Gaming submitted Form S-3 ASR to the U.S. Securities and Exchange Commission and has signed an ATM sales agreement with A.G.P., under which it can issue and sell up to $1 billion in common stock, most of which will be used to acquire ETH.

Analyst Rachael Lucas stated that BTC prices are at a critical psychological and technical point, which may determine the success or failure of the bull market. Indicators such as RSI and MACD show that strong bullish momentum has at least temporarily weakened, but the long-term outlook remains optimistic, possibly in the early stages of a new super cycle. BTC's connection to traditional financial markets is becoming increasingly close, making it more sensitive to economic data, comments from central banks in the U.S. and Europe, and geopolitical risks.

Bloomberg reported that South Korea will hold general election voting on Tuesday. Regardless of the election results, the cryptocurrency industry will benefit, as both popular candidates Lee Jae-myung and Kim Moon-soo have promised to ease regulations and expand access to digital assets. The Bank of Korea released data showing that by the end of last year, the total value of cryptocurrency held by South Koreans was approximately $74.5 billion.

Cointelegraph stated that investors are striving to cope with the changing macroeconomic environment, and cryptocurrency investors are closely monitoring U.S. tariff negotiations, looking for any signs of a potential lasting trade agreement. Analysts predict that if an agreement is reached, it will provide upward opportunities for altcoins and BTC.

Coinshares weekly report data shows that net inflows into digital asset investment products reached $286 million last week, totaling $10.9 billion over seven weeks. Last week, ETH inflows surged, reaching $321 million.

As of May 31, U.S. BTC spot ETFs held a total of 1,205,600 BTC, with BlackRock's IBIT holding 660,800 BTC in first place, followed by Fidelity's FBTC and Grayscale's GBTC with 198,000 and 186,600 BTC, respectively.

Strategy increased its holdings by 705 BTC last week. Strategy founder Michael Saylor stated that there is no upper limit to their BTC accumulation plan. As prices continue to rise, the difficulty of accumulating BTC in the future will increase exponentially, but Strategy will accumulate BTC with greater efficiency.

GameStop CEO Ryan Cohen views BTC as a hedge against dollar depreciation and stated that if BTC ultimately becomes a hedge against dollar depreciation, it still has more room for growth.

In the past 12 years of BTC's June performance, there have been 6 instances of price increases and 6 instances of declines. The largest increase occurred in June 2016, with a monthly increase of 27.14%; the largest decline occurred in June 2022, with a monthly decrease of 37.28%.

Cointelegraph stated that investors are striving to cope with the changing macroeconomic environment, and cryptocurrency investors are closely monitoring U.S. tariff negotiations, looking for any signs of a potential lasting trade agreement. Analysts predict that if an agreement is reached, it will provide upward opportunities for altcoins and BTC.

Long-term Insights: Used to observe our long-term situation; Bull market/Bear market/Structural changes/Neutral state

Medium-term Exploration: Used to analyze what stage we are currently in, how long this stage will last, and what situations we will face

Short-term Observation: Used to analyze short-term market conditions; and the likelihood of certain events occurring in a certain direction under certain premises

Long-term Insights

• Non-liquid long-term whales

• Long-term participants' holding structure across different durations

• Total selling pressure on-chain

• Large inflows and outflows on trading platforms

• Cryptocurrency's U.S. ETF

• Cost lines for long and short-term holders

- Supply-side structural analysis: Continuous tightening of certainty

On-chain data shows that Bitcoin's supply side continues to exhibit a structurally tightening trend, which is the most significant and stable fundamental characteristic of the current market.

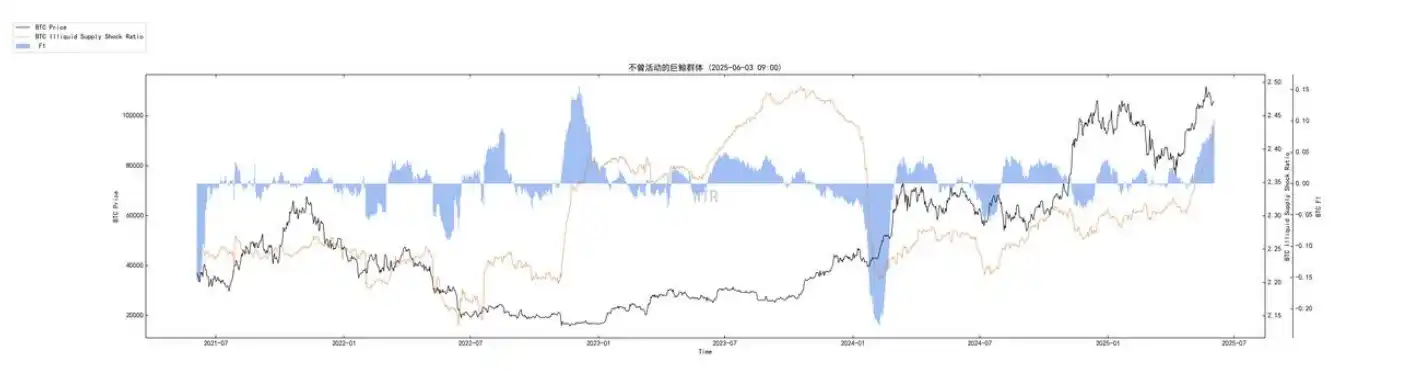

Strong growth of non-liquid supply:

(Below is the non-liquid long-term whale chart)

The non-liquid BTC supply controlled by long-term holders or whales continues to maintain a strong growth momentum, and its growth slope has not shown significant decay recently. This indicates that BTC is continuously transferring from high liquidity trading markets to low liquidity long-term storage addresses, effectively reducing the immediate sell pressure in the market.

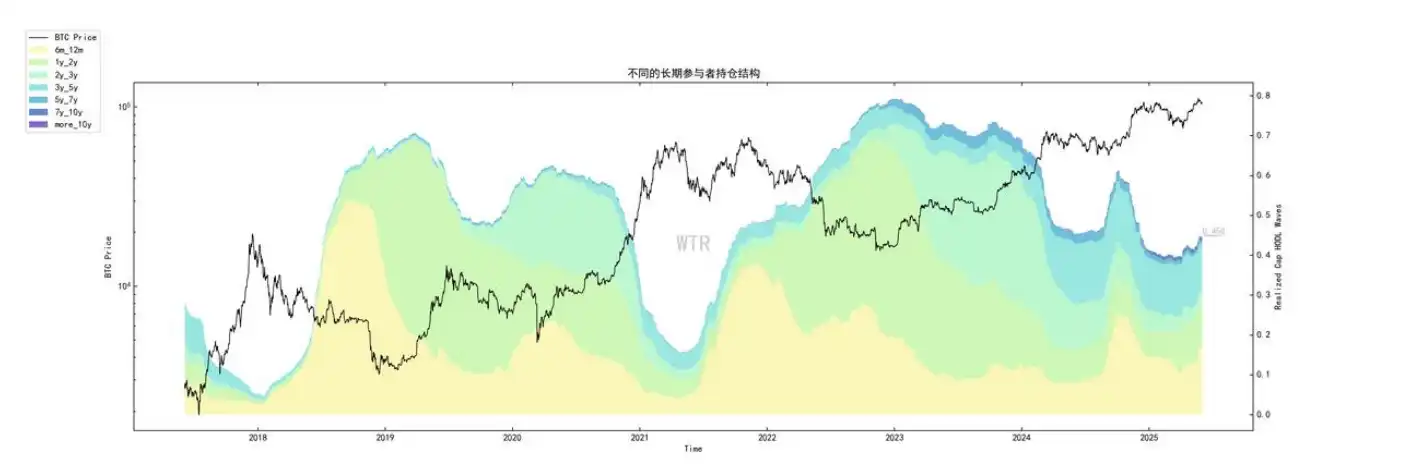

1.2 Steady increase in the proportion of long-term holders:

(Below is the holding structure of long-term participants across different durations)

The "realized market value" proportion of holders with more than six months of long-term holding has slightly increased to 0.450. This means that nearly half of the Bitcoin supply is held by steadfast long-term investors with lower trading frequency, forming the market's "ballast stone."

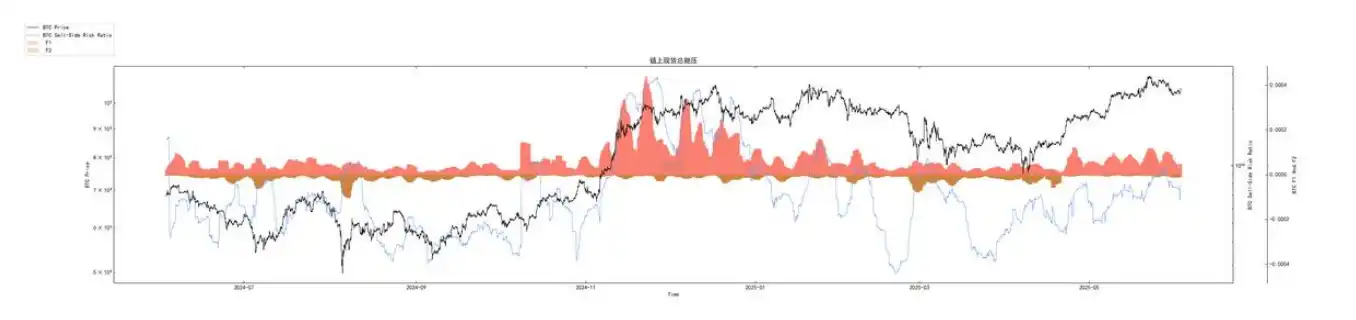

1.3 Confirmation of significant net outflows from trading platforms:

(Below is the total selling pressure on-chain)

Recent data shows a small amount of BTC has transferred to trading platforms, which may reflect an increase in short-term trading activity or some liquidity demand.

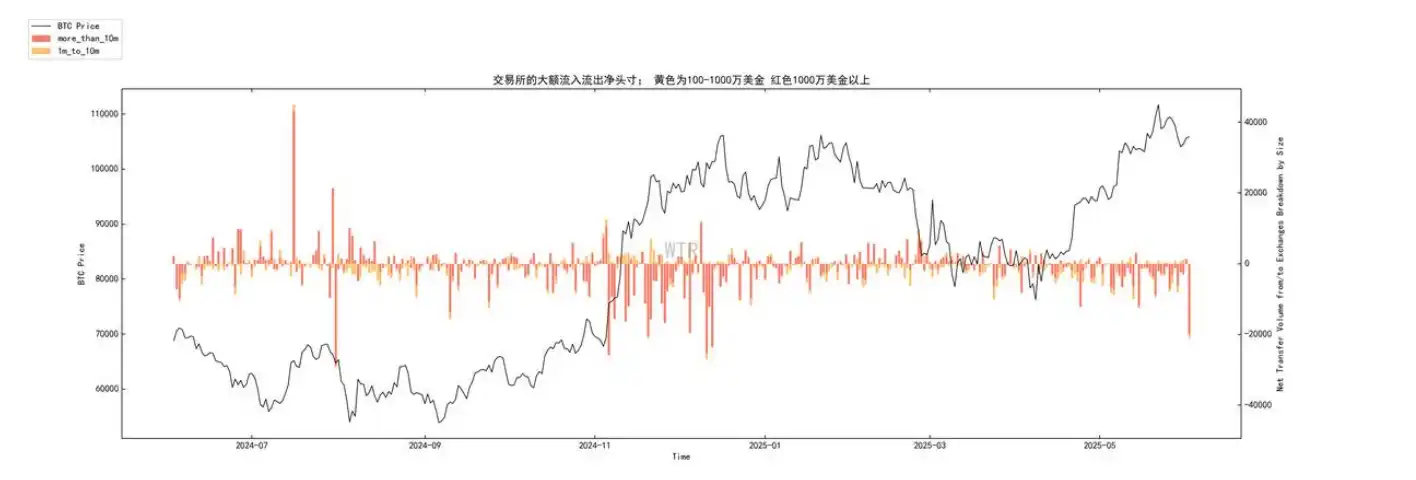

(Below is the net inflow and outflow on trading platforms)

Trading platforms have again experienced significant net outflows. This indicates that even with short-term bidirectional flows, the ultimate direction of large funds is still out of trading platforms, further reinforcing the judgment of tightening supply.

- Demand-side dynamic analysis: Total resilience and marginal sensitivity game

In contrast to the certainty tightening on the supply side, the demand side presents more complex and dynamic characteristics, showing that structural demand for long-term allocation still exists, but is easily disturbed by price, macro signals, and market sentiment in the short term.

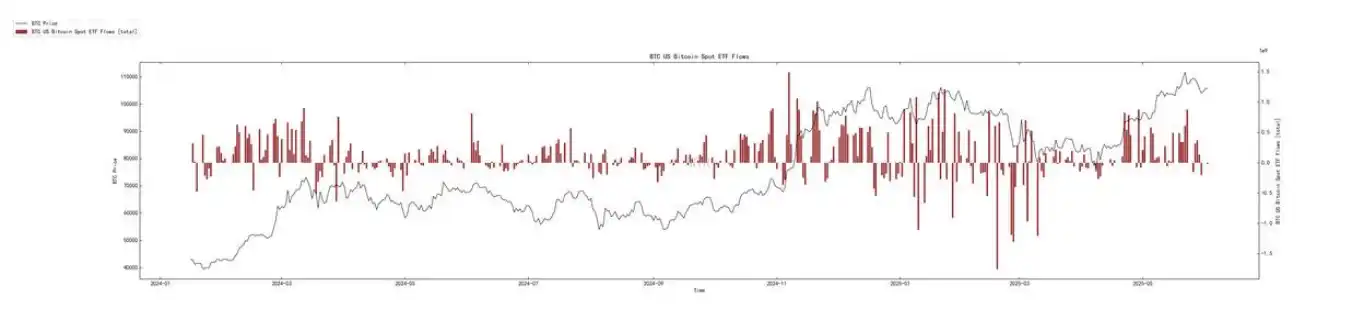

2.1 Observation of the "gear shift" in ETF fund flows:

(Below is the U.S. ETF for BTC)

It shows that after experiencing explosive growth in the early stages, the inflow rate of Bitcoin spot ETFs has significantly slowed down recently, approaching the zero axis. Although the latest day's data has slightly turned positive, the magnitude is small and insufficient to determine a trend reversal. Of course, news data (such as monthly inflows and total scale of IBIT) indicate that leading ETF products still demonstrate strong capital attraction, implying that institutional demand for long-term allocation in BTC has a certain resilience. The current ETF flow may be in a "gear shift" period transitioning from "FOMO-style influx" to "normal, value-driven allocation."

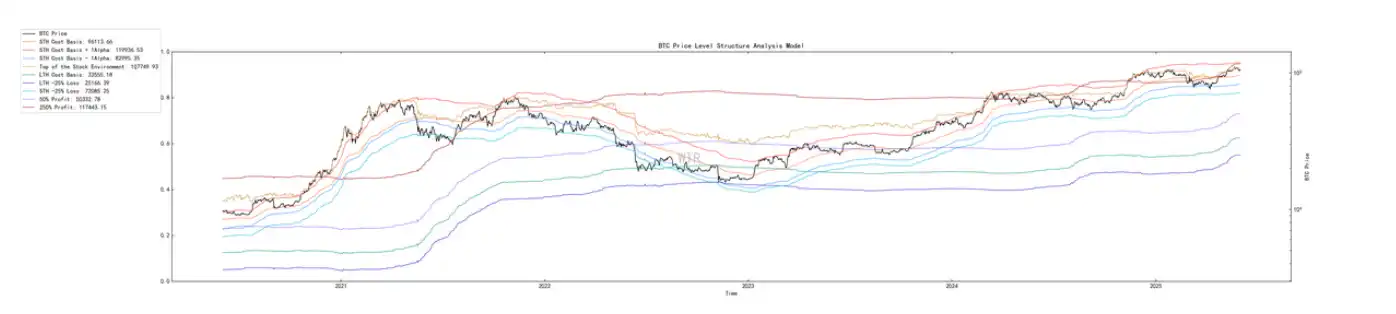

2.2 Support Effect of Short-term Holder Cost Line

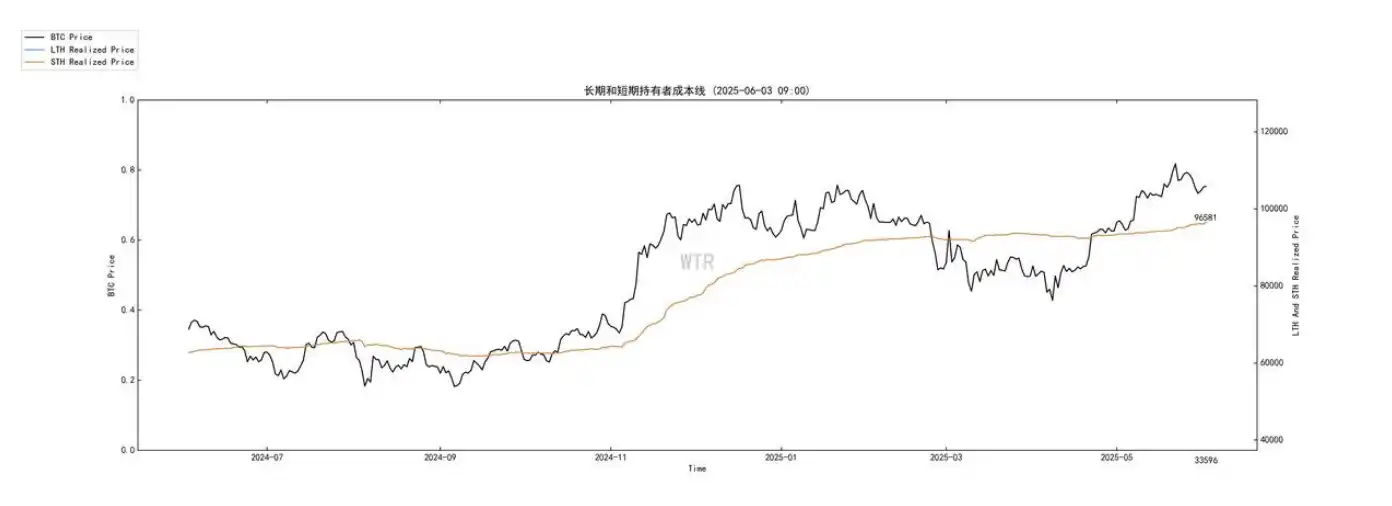

(Below is the cost line of short and long-term holders)

The average holding cost of short-term holders has steadily risen to $96,581. The current BTC price is still operating above this cost line, meaning that most short-term participants are in a profitable state, which to some extent reduces the risk of large-scale sell-offs triggered by panic or liquidation. This cost line constitutes an important dynamic psychological and technical support level in the current market.

2.3 Potential Catalysts for Macroeconomic Expectations and Hedging Demand: In terms of news analysis, the improvement in PCE data reinforces the Federal Reserve's expectations for interest rate cuts, which constitutes potential liquidity support for risk assets like BTC. At the same time, concerns about the global economy (especially risks in the U.S. bond market and expectations of dollar depreciation) may also enhance BTC's attractiveness as a store of value and risk hedging tool (as expressed by GameStop CEO). The degree and pace of realization of these macro-level demand drivers will have a significant impact on BTC demand.

- Market Equilibrium State Assessment: Demand Rebalancing and Expectation Game under Strong Supply Constraints

Comprehensive analysis of supply and demand indicates that the current short- to medium-term equilibrium state of the Bitcoin market can be defined as a "demand rebalancing and expectation game under strong supply constraints."

3.1 Dynamic Evolution of Supply-Demand Imbalance: The continuous structural tightening on the supply side, combined with short-term fluctuations in marginal momentum on the demand side, constitutes the main shield of the current market. Against the backdrop of increasingly scarce supply, any positive signals from the demand side (such as sustained recovery in ETF flows or favorable macroeconomic developments) may be amplified, pushing prices upward. Conversely, if demand continues to weaken, prices may seek to find a new equilibrium point through sideways fluctuations or moderate corrections.

3.2 Interpretation of Internal Activities on Trading Platforms: The slight increase in transfer amounts to trading platforms, coexisting with significant net outflows, may reflect an increase in internal turnover rates and short-term trading activity in the market. This provides long-term buyers with opportunities to accumulate, but may also increase price volatility in the short term.

3.3 Identification of Key Turning Points:

Upward turning point signals: Continuous and significant net inflow recovery in ETF funds; further clarification or advancement of macro-level interest rate cut expectations (such as positive resolutions to tariff issues); unexpected favorable developments in the regulatory environment.

Downward turning point signals: Continuous net outflows from ETFs, or inflows falling far short of expectations; prices effectively breaking below the short-term holder cost line ($96,581) and triggering a chain reaction; severe negative shocks at the macro level (such as unexpected inflation rebounds or sharp deterioration in tariff issues).

- Conclusion and Outlook: Seeking Alpha Amid Certainty and Uncertainty

Based on the latest on-chain data and news analysis, the short- to medium-term outlook for the Bitcoin market presents the following characteristics:

· Strong Fundamental Support: The structural tightening on the supply side is the most important cornerstone of a long-term bull market, providing solid bottom support for prices.

· Demand Side Entering Observation Period: The long-term trend of institutional demand remains optimistic, but in the short term, the volatility of ETF flows and sensitivity to macro signals have increased, and the market is actively seeking new, sustainable demand drivers.

Short-term: The market is expected to maintain high-level fluctuations, with strong support from the short-term holder cost line ($96,581). Of course, given the marginal sensitivity of ETF flows and high dependence on macro signals (especially tariff progress and the actual interest rate cut path of the Federal Reserve), price fluctuations around this level may intensify.

• Upward Catalysts:

Continuous and significant net inflow recovery in ETF funds (averaging several hundred million dollars daily); macro-level interest rate cut expectations receiving unexpected confirmation (such as the Federal Reserve clearly shifting to a dovish stance before September); substantial favorable developments in the regulatory environment (such as key progress on the "Digital Asset Market Clarity Act").

• Downward Risk Points:

Continued weakness in ETF flows or a significant shift to net outflows; macro "black swan" events (such as sharp deterioration in tariff issues leading to a global increase in risk aversion, but funds not choosing BTC as a safe haven); prices effectively breaking below the short-term holder cost line and triggering a broader range of stop-losses.

• Risk Focus:

Macroeconomic uncertainty (especially regarding tariff issues) and the sustainability of ETF flows are the biggest risk points in the short term. For market participants, the current strategy should be to fully recognize the long-term benefits on the supply side while closely monitoring marginal changes on the demand side and the evolution of the macro environment. In this "demand rebalancing and expectation game under strong supply constraints," meticulous data tracking, rational expectation management, and keen capture of key turning point signals are crucial for achieving excess returns.

Medium-term Exploration

• Price Structure Analysis Models

• Liquidity Supply Volume

• Incremental Models

• USDC Purchasing Power Composite Score

(Below is the price structure analysis model)

Currently, the stock is capped around $108,000, and the market is generally in a profitable state. From a static structural perspective, this may currently be a good profit-taking area, even temporarily ignoring the results and processes of market dynamic games to reduce decision-making paths.

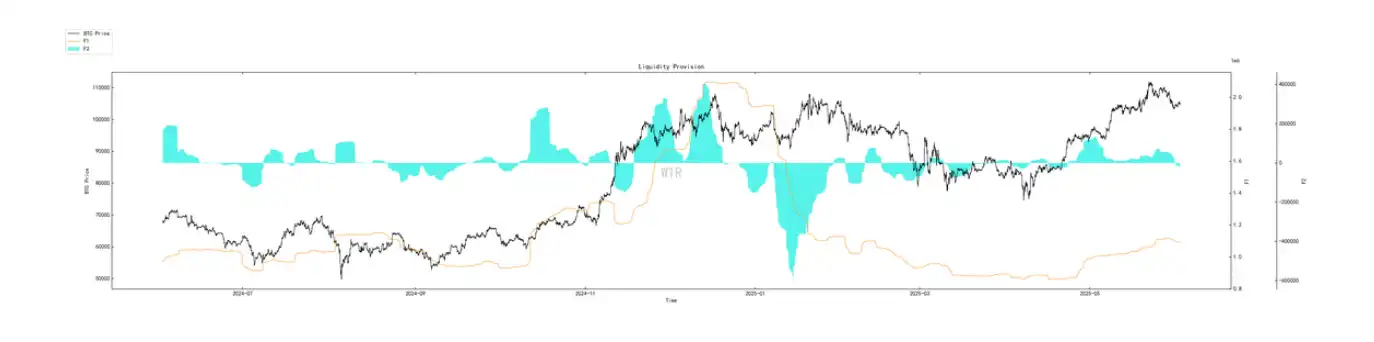

(Below is the liquidity supply volume)

The liquidity supply volume is currently in a gradually declining phase, indicating that the market may currently be in a state of weak liquidity. Following this, the overall sentiment may slow down. If the market declines from the current state, it may enter a brief consolidation and adjustment phase.

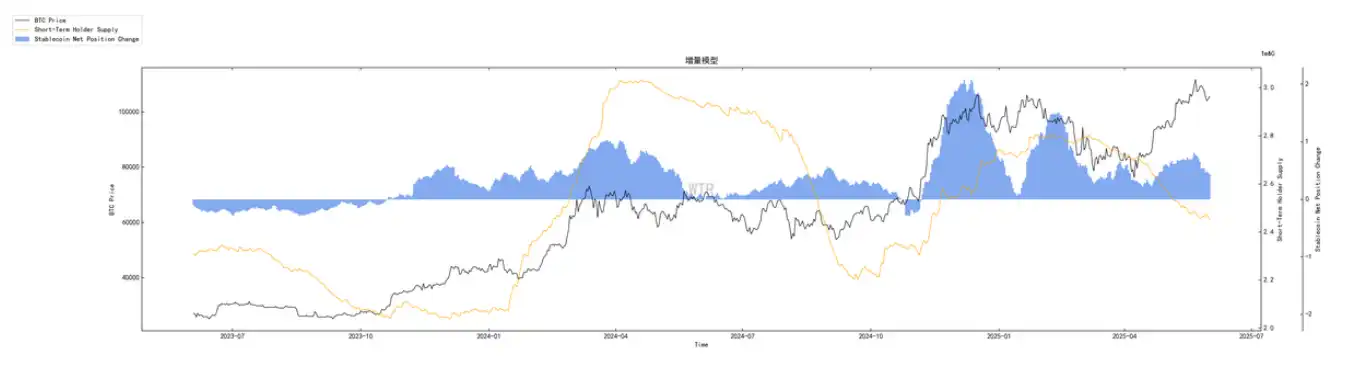

(Below is the incremental model)

The increment is currently in a phase of decline and contraction. When the market faces overall profit-taking pressure, a lack of incremental supply may reduce upward momentum and the sustainability of price increases.

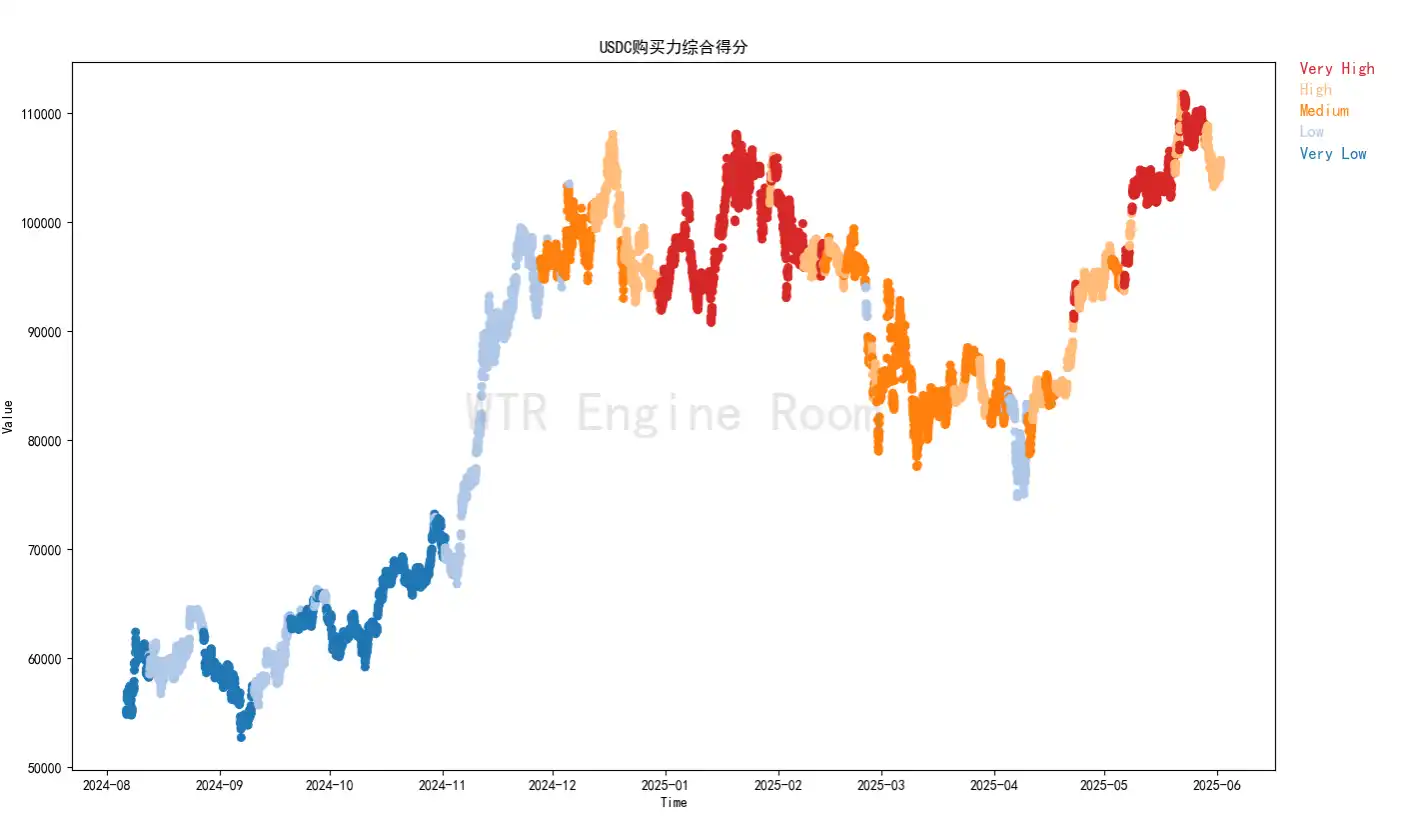

(Below is the USDC purchasing power composite score)

Compared to before, the USDC purchasing power score has dropped one rating, currently only at the "high" level. There may be a slight shift in the loss of purchasing power in the U.S. market, weakening momentum status.

Short-term Observation

• Derivatives Risk Coefficient

• Options Intent Transaction Ratio

• Derivatives Trading Volume

• Options Implied Volatility

• Profit and Loss Transfer Volume

• New Addresses and Active Addresses

• Ice Sugar Orange Trading Platform Net Position

• Pionex Trading Platform Net Position

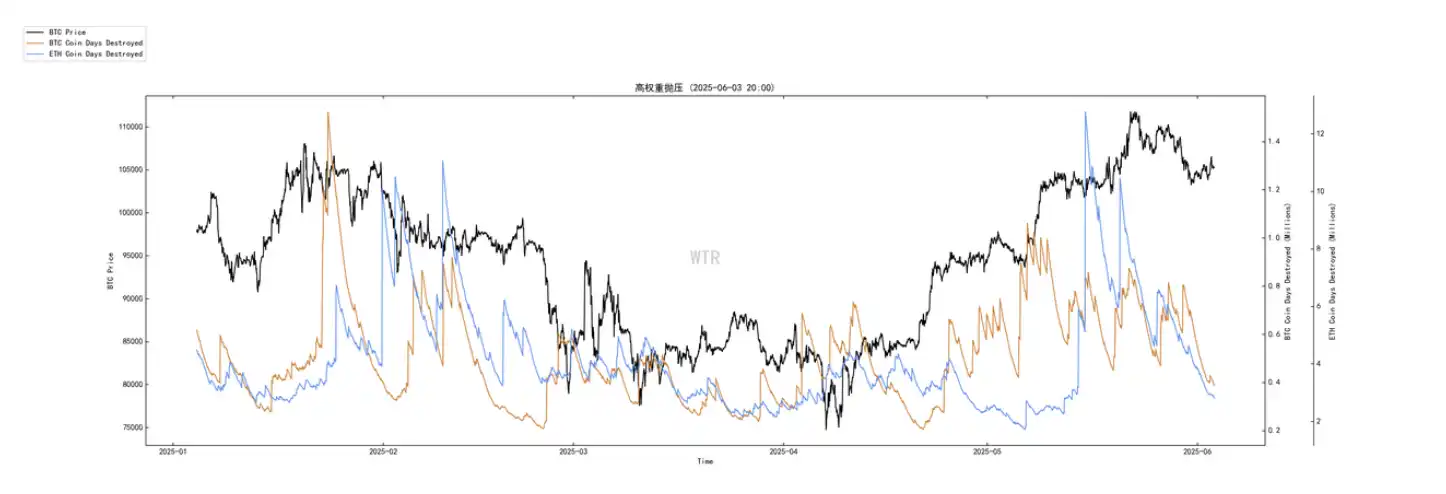

• High-weight Selling Pressure

• Global Purchasing Power Status

• Stablecoin Trading Platform Net Position

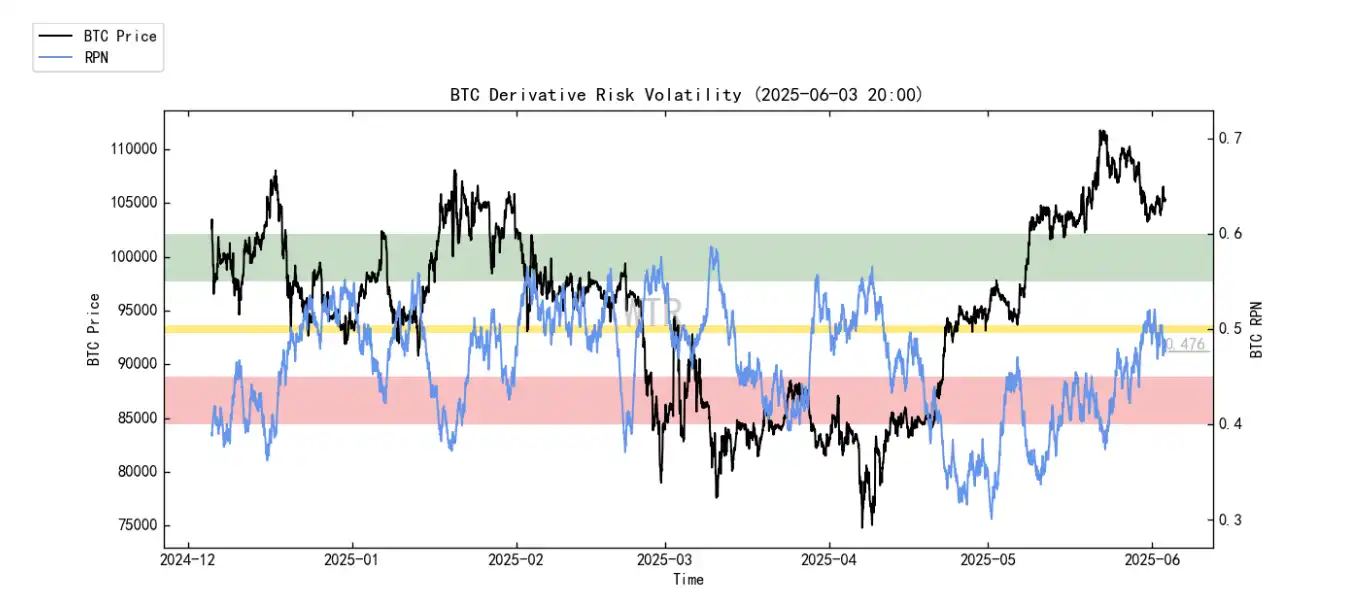

Derivatives Rating: The risk coefficient is in a neutral area, with moderate derivatives risk.

(Below is the derivatives risk coefficient)

The market has experienced a slight correction, and the derivatives risk coefficient has moved from the red zone to the neutral area. This week, there are no special expectations from the derivatives perspective.

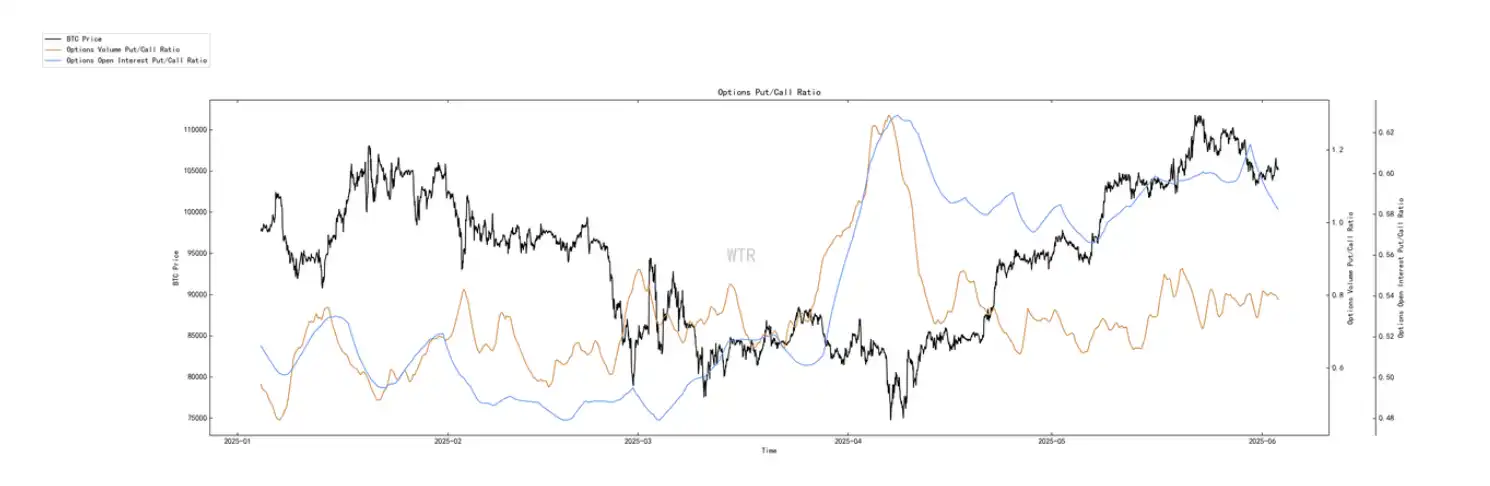

(Below is the options intent transaction ratio)

The put option ratio is at a high level, with trading volume at a medium level.

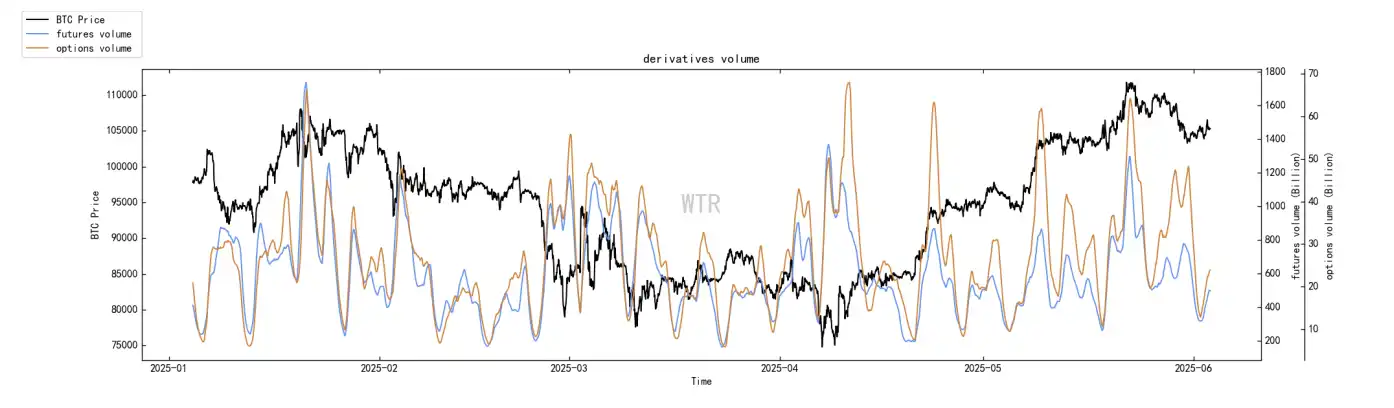

(Below is the derivatives trading volume)

Derivatives trading volume is at a medium level.

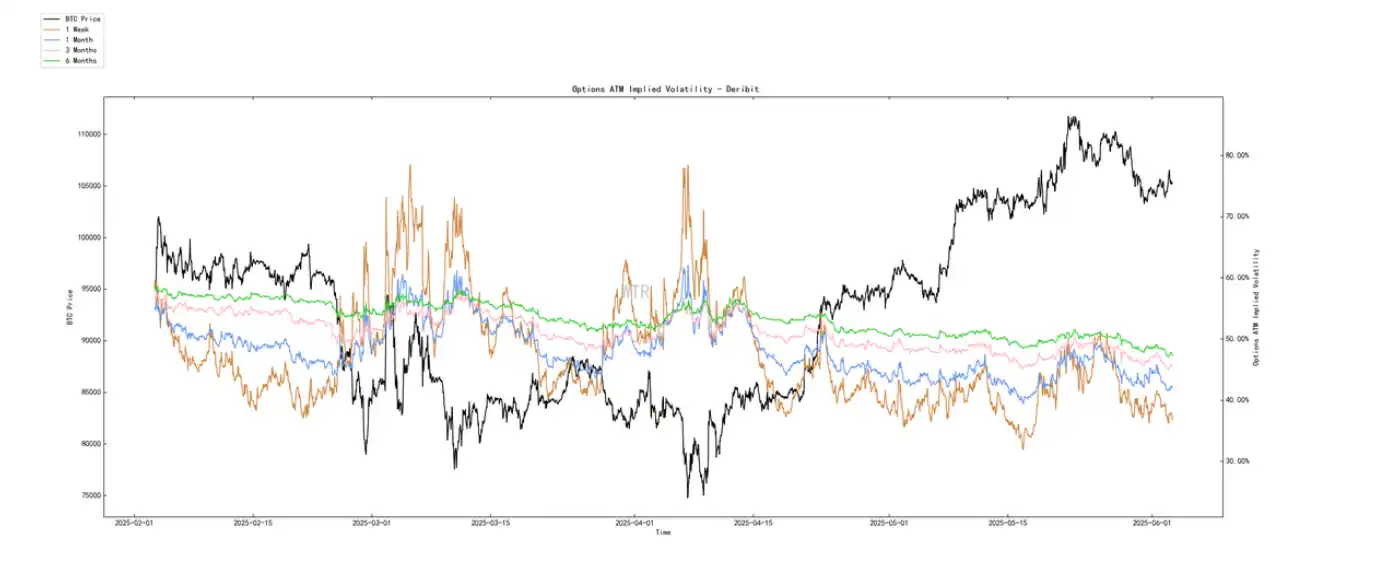

(Below is the options implied volatility)

Options implied volatility has only shown low amplitude fluctuations in the short term. Sentiment status rating: neutral.

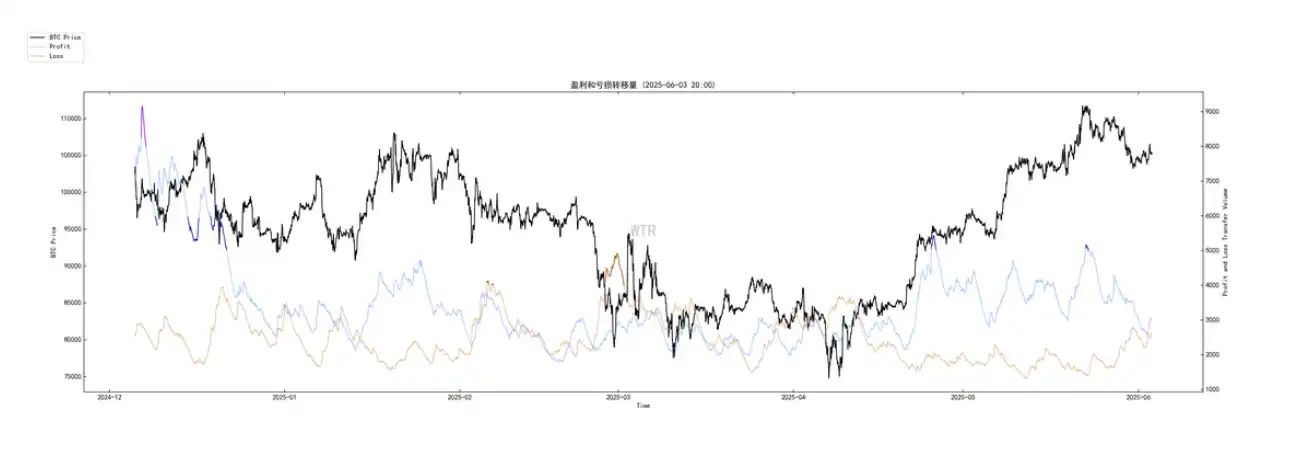

(Below is the profit and loss transfer volume)

The market's slight correction has only seen a small amount of panic chips being sold. Currently, both positive and panic sentiments in the market are at low levels.

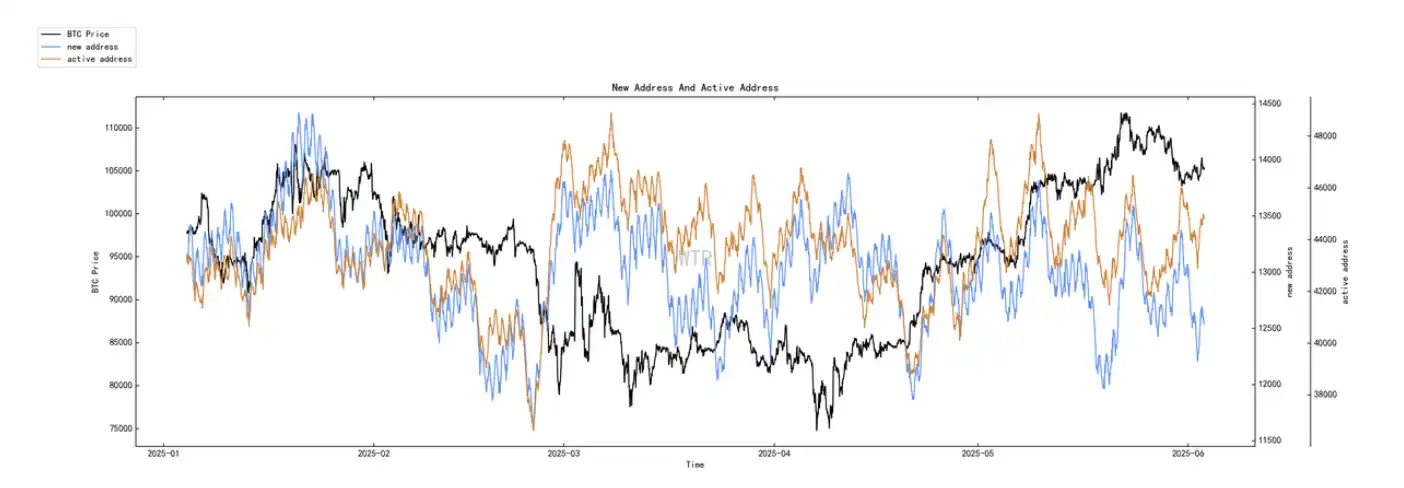

(Below is the new addresses and active addresses)

New active addresses are at a medium-low level.

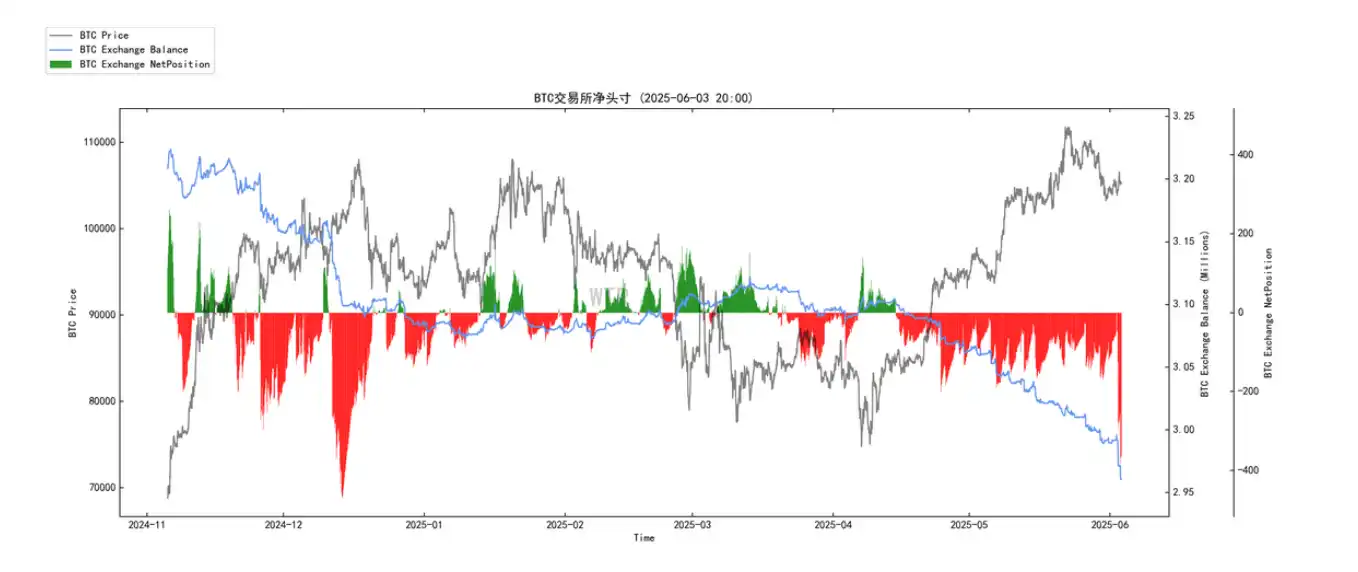

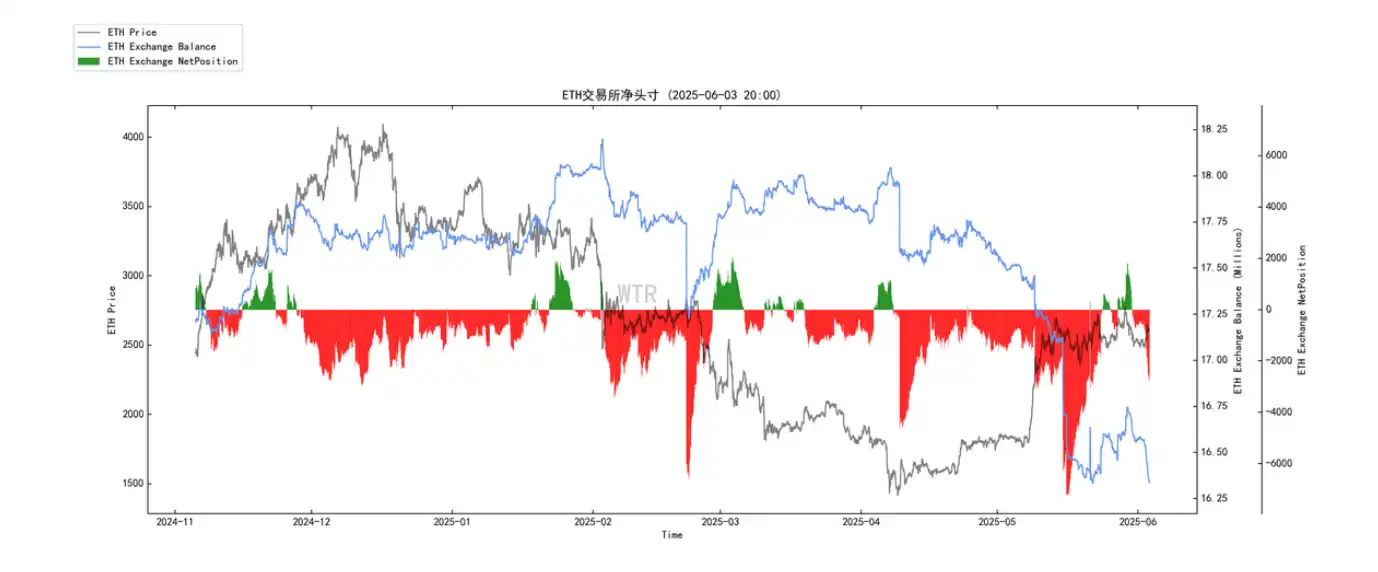

Spot and selling pressure structure rating: BTC and ETH are in a state of continuous large outflows.

(Below is the Ice Sugar Orange trading platform net position)

Currently, BTC is experiencing continuous large outflows.

(Below is the Pionex trading platform net position)

ETH is experiencing large outflows.

(Below is the high-weight selling pressure)

Currently, there is no high-weight selling pressure.

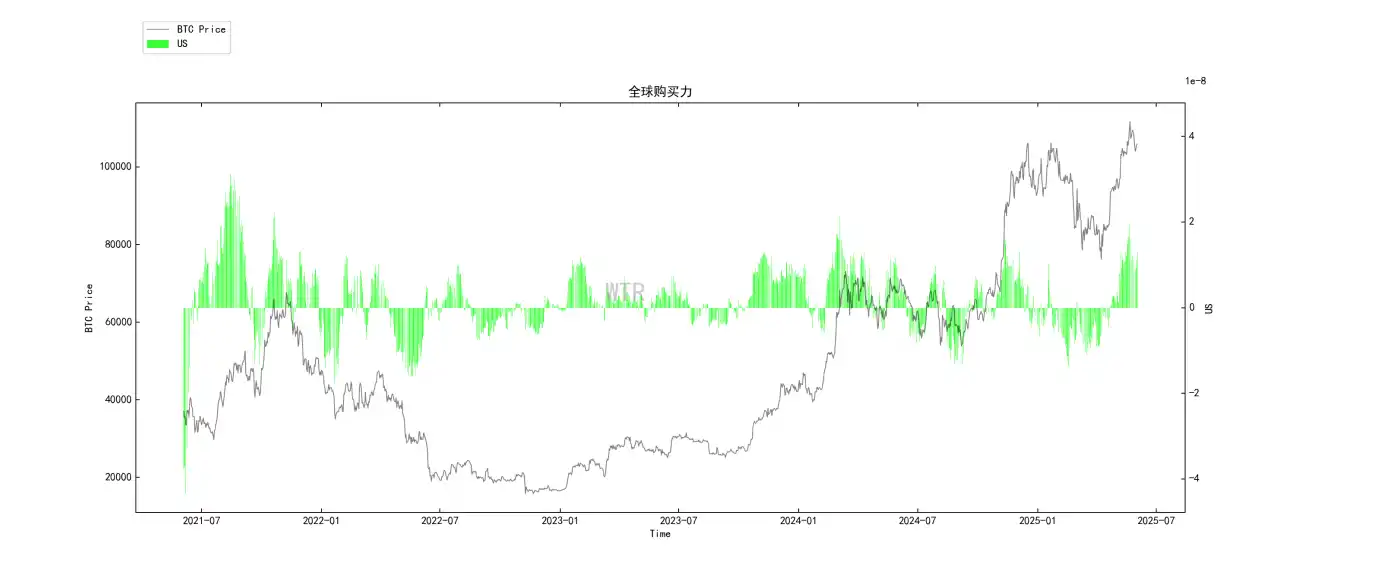

Purchasing power rating: Global purchasing power and stablecoin purchasing power remain unchanged compared to last week.

(Below is the global purchasing power status)

Global purchasing power remains unchanged compared to last week.

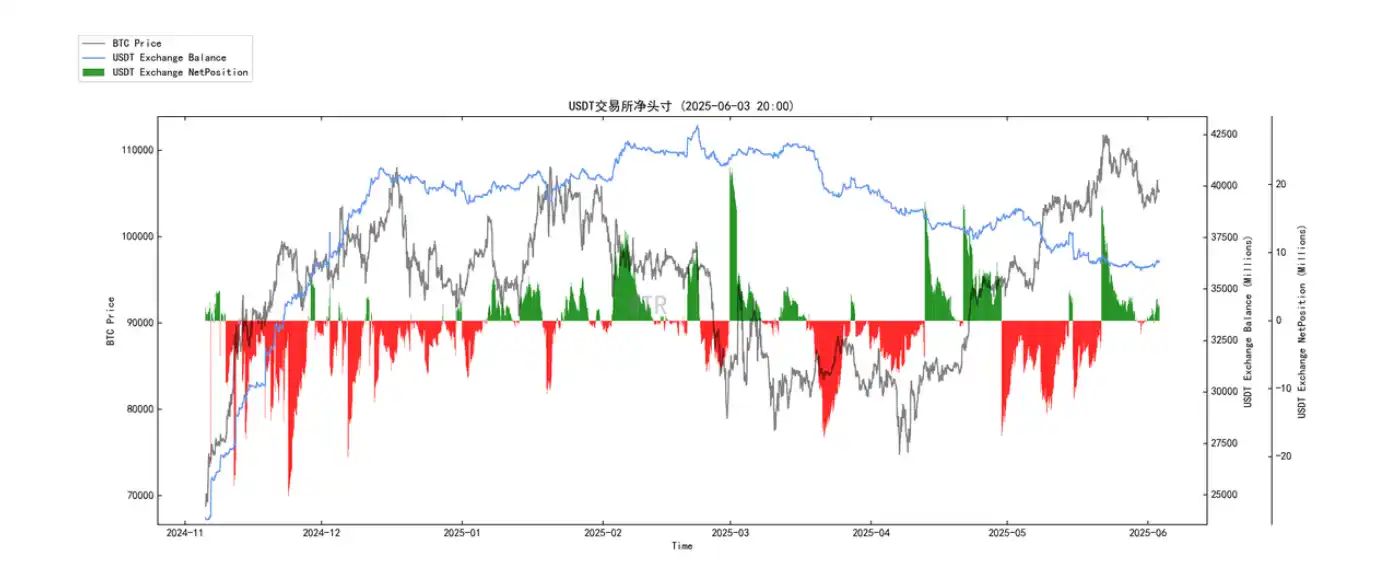

(Below is the net position of USDT trading platform)

Stablecoin purchasing power remains unchanged compared to last week.

This Week's Summary:

News Summary:

The latest market news depicts a scenario where crypto assets are making difficult choices amid the "double-edged sword" of macroeconomic factors (interest rate cut expectations vs. tariff risks) and the "dawn" of the internal regulatory environment. The SEC's favorable clarification on PoS has injected critical certainty into industry development, and the deep participation of institutions and strategic adoption by enterprises are reshaping the fundamental supply and demand of the market. Of course, the Federal Reserve's ultimate policy path remains constrained by complex macro games, and short-term market sentiment is inevitably disturbed by external noise.

• Short-term: The market may continue to exhibit a fluctuating pattern, being highly sensitive to macro signals (especially progress in tariff negotiations and statements from the Federal Reserve's monetary policy meetings). If tariff risks are effectively controlled and interest rate cut expectations are further solidified, it is expected to bring new upward momentum for BTC and ETH. Conversely, one should be cautious of the risk of technical corrections.

• Medium-term: As the positive effects of the SEC's clarification on PoS gradually manifest and institutional allocations continue to deepen, the ETH ecosystem is expected to welcome development opportunities (due to suppression over the past year, changes may not be significant). BTC, as a store of value and macro hedging tool, will continue to attract attention against the backdrop of global economic uncertainty. Further clarification of the regulatory framework (such as policies from the new South Korean government) will be an important catalyst.

• Long-term: Whether the "new super cycle" of the crypto market can truly take shape depends on its ability to achieve a fundamental shift from speculation-driven to value-driven on a path of increasingly refined regulation, and to successfully respond to competition and integration from the traditional financial system, as well as challenges from other emerging technologies (attention positioning). If Vitalik's grand plan for ETH L1 scaling can be successfully realized, it will greatly enhance its application value and network effects, potentially laying a solid foundation for long-term growth. For market participants, the core strategy at this stage should be to maintain a deep understanding of the coexistence of "structural optimism" and "cyclical caution." Stay steady, flexibly respond to short-term fluctuations, and continuously pay attention to long-term signals that can fundamentally change industry development (such as key regulatory breakthroughs, disruptive ecosystem innovations, and strategic adoptions by different countries).

On-chain Long-term Insights:

The structural tightening on the supply side remains the most important cornerstone of a long-term bull market, providing solid bottom support for prices;

The long-term trend of institutional demand remains optimistic, but the volatility of ETF flows and sensitivity to macro signals have increased in the short term;

The market is actively seeking new, sustainable demand drivers.

It is expected that the short-term may maintain a high-level fluctuation pattern, with prices oscillating between the short-term holder cost line ($96,581) and previous highs.

Directional breakthroughs require clearer catalysts.

Risk focus: Macroeconomic uncertainty (especially regarding tariff issues) and the sustainability of ETF flows are the biggest risk points in the short term.

• Market Tone:

The current strategy should be to fully recognize the long-term benefits on the supply side while closely monitoring marginal changes on the demand side and the evolution of the macro environment.

The overall state is currently one of "demand rebalancing and expectation game under strong supply constraints."

On-chain Medium-term Exploration:

The market is generally profitable, with around $108,000 as the stock ceiling, which can simplify decision-making paths.

Liquidity supply is declining, and market liquidity is weak, with sentiment slowing down or entering a consolidation phase.

The incremental contraction phase, with a lack of supply weakening upward momentum and price sustainability.

The USDC purchasing power score has dropped to "high," with slight capital outflow and weakened momentum status.

• Market Tone:

Cautious, wait-and-see.

The market is profitable, but liquidity is declining, incremental contraction is occurring, and USDC purchasing power is weakening, with momentum diminishing. The market may currently be in a consolidation and adjustment phase.

On-chain Short-term Observations:

The risk coefficient is in a neutral area, with moderate derivatives risk.

New active addresses are at a medium-low level.

Market sentiment status rating: neutral.

The net positions of BTC and ETH on trading platforms are in a state of continuous large outflows.

Global purchasing power and stablecoin purchasing power remain unchanged compared to last week.

In the short term, the probability of not breaking below $95,000 to $100,000 is 80%.

• Market Tone: Currently, there are few chips choosing to take profits at this price level, and purchasing power is sufficient to provide support. This week, the market is expected to be influenced by derivatives while leaning towards fluctuations, with a low probability of a direct large retracement.

Risk Reminder: The above is all market discussion and exploration, and does not constitute directional opinions for investment; please approach with caution and guard against market black swan risks.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。