Original Title: "The Wealth Code of BNB Chain You Must Know Beyond Binance Alpha"

Original Author: Viee, Core Contributor of Biteye

Recent data from May shows that BNB Chain has demonstrated strong growth momentum in its ecosystem, with DEX trading volume consistently ranking first among global public chains, and the number of successful on-chain transactions increasing by 122% month-on-month. Meanwhile, the number of monthly active users of stablecoins has surpassed 15.3 million, achieving nearly 40% monthly growth. At the same time, the Meme coins within the BSC ecosystem have sparked a surge, with many popular tokens like Ghibli and BOB doubling or even more in daily gains, becoming the focus of the market. Behind this series of impressive data is a clear manifestation of a new round of wealth effect in the BNB Chain ecosystem. What popular projects in the BNB Chain ecosystem are attracting capital inflows? How can retail investors leverage the liquidity advantages created by USD1 and Binance Alpha to seize market opportunities? This article will delve into the wealth code of BNB Chain, guiding you to discover the next wave of potential investment opportunities.

1. Decoding BNB Chain Hotspots: Data Surface and Deep "Wealth Code"

The recent explosion of the BNB Chain ecosystem makes it crucial to understand the logic behind the data and the core driving forces of project popularity to capture "Alpha."

1.1 Overview of Popular BNB Chain Projects

The table below showcases popular projects in the current BNB Chain ecosystem across different categories, along with several core characteristics:

First, among the recently active trading projects, we can see several mainstream narratives. The Meme sector's $B and $KOGE occupy high trading volumes, indicating that Meme remains an important entry point for traffic and capital in the current market phase. The AI sector's $SKYAI, $PORT3, and AI game $ELDE reflect that the potential of AI x Crypto is being actively priced by the market. Additionally, $SOPH representing ZK technology and $RWA representing real-world assets on-chain also hold a place, showcasing the diversification and forward-looking nature of the BNB Chain ecosystem narrative.

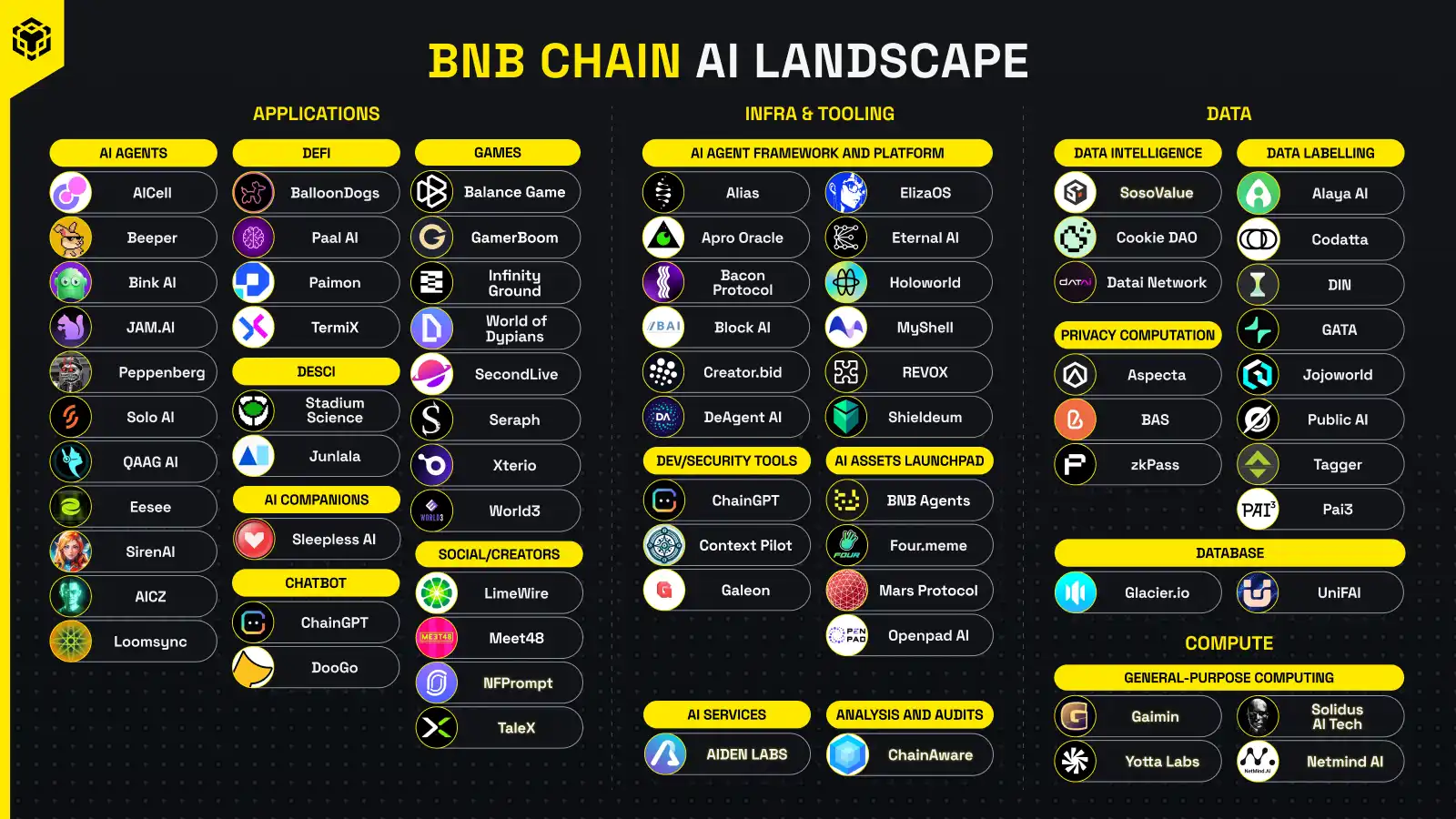

Second, the list of projects supported by the BNB Chain $100M fund (sorted by trading volume) reveals the foundation's preferences. Among these five high-volume projects, three ($AIOT, $SIREN, $CGPT) clearly belong to the AI field, covering popular directions such as AI combined with IoT/DePIN/gaming, AI Agents, and AI infrastructure. Many of the previously mentioned active trading projects have also received support from the BNB Foundation, clearly signaling that the BNB Chain official is strongly backing AI sectors with long-term growth potential and technological innovation, hoping they can contribute considerable on-chain activity.

Finally, DeFi, as a traditional strength of BNB Chain, remains solid. In the DEX field, PancakeSwap demonstrated its unshakeable leading position with a staggering monthly trading volume of 71.6 billion in May. The rise of platforms like MYX Finance, Aster, and KiloEx in the perpetual contract sector shows BNB Chain's competitiveness in the derivatives field, with trading volumes also being quite substantial.

In summary, the above popular projects showcase a panorama of the BNB Chain ecosystem led by mainstream narratives, emerging sector explosions, and the foundational strength of DeFi, representing the hot directions chosen by the market with real capital. For users, how can they find opportunities among these popular projects?

1.2 Interpretation of the "Wealth Code" Behind Popular Projects

Strategy One: "Narrative + Liquidity" Dual Leaders. Consider looking for projects that can both align with the strongest current market narratives (such as Meme, AI) and connect to powerful liquidity solutions, as they often possess the potential for a "Davis Double." For example, focus on projects that have a strong correlation with USD1 trading competitions, Binance Alpha, and other core liquidity sources.

Strategy Two: Value Analysis of AI Projects. The AI project categories on BNB Chain are diverse, and conducting layered research can help determine their position in the value chain. Additionally, attention should be paid to their technological barriers, team backgrounds, partners, and actual implementation progress. We use several popular projects as examples:

· Infrastructure Layer: Projects like $SKYAI (data bridging) and $REX (modular AI Infra) provide foundational support for AI applications and are expected to benefit first when AI applications explode. Therefore, it is worth paying attention to such projects, as there may be opportunities for value reassessment as technology is gradually validated and ecosystems expand.

· Application Layer: Projects like $ELDE (AI games) and $CA (AI life engine) directly target users, with the main consideration being whether the project can create killer applications and sustainable business models.

· Data Layer: Projects like $PORT3 and $AGT are dedicated to building decentralized AI data networks, with data being the fuel for AI, making its value self-evident. Attention should be paid to their data acquisition, governance, and commercialization capabilities, as well as whether they can build strong data network effects.

Strategy Three: "Official List" as an Alpha Signal. The $100M fund support list from BNB Chain can be seen as a pool of projects filtered by the official. Although not all funded projects will skyrocket, it at least indicates the official recognition of these projects' narratives, technologies, teams, or sector prospects. Analyzing the reasons these projects received support, what problems they solve, and assessing their long-term growth potential is essential.

In conclusion, formulating reasonable strategies, avoiding the temptation of short-term hype while not missing out on long-term growth, is crucial. For short-term hotspots with strong speculative flavor, small positions can be taken for quick entry and exit, taking profits when available; for mid-term sectors that are promising, positions can be built in batches and tracked long-term, adjusting based on fundamental changes. It is advisable to diversify investments when laying out hot sectors rather than concentrating bets on a single project to reduce potential risks.

2. BNB Chain Ecosystem Foundation and Activity Overview

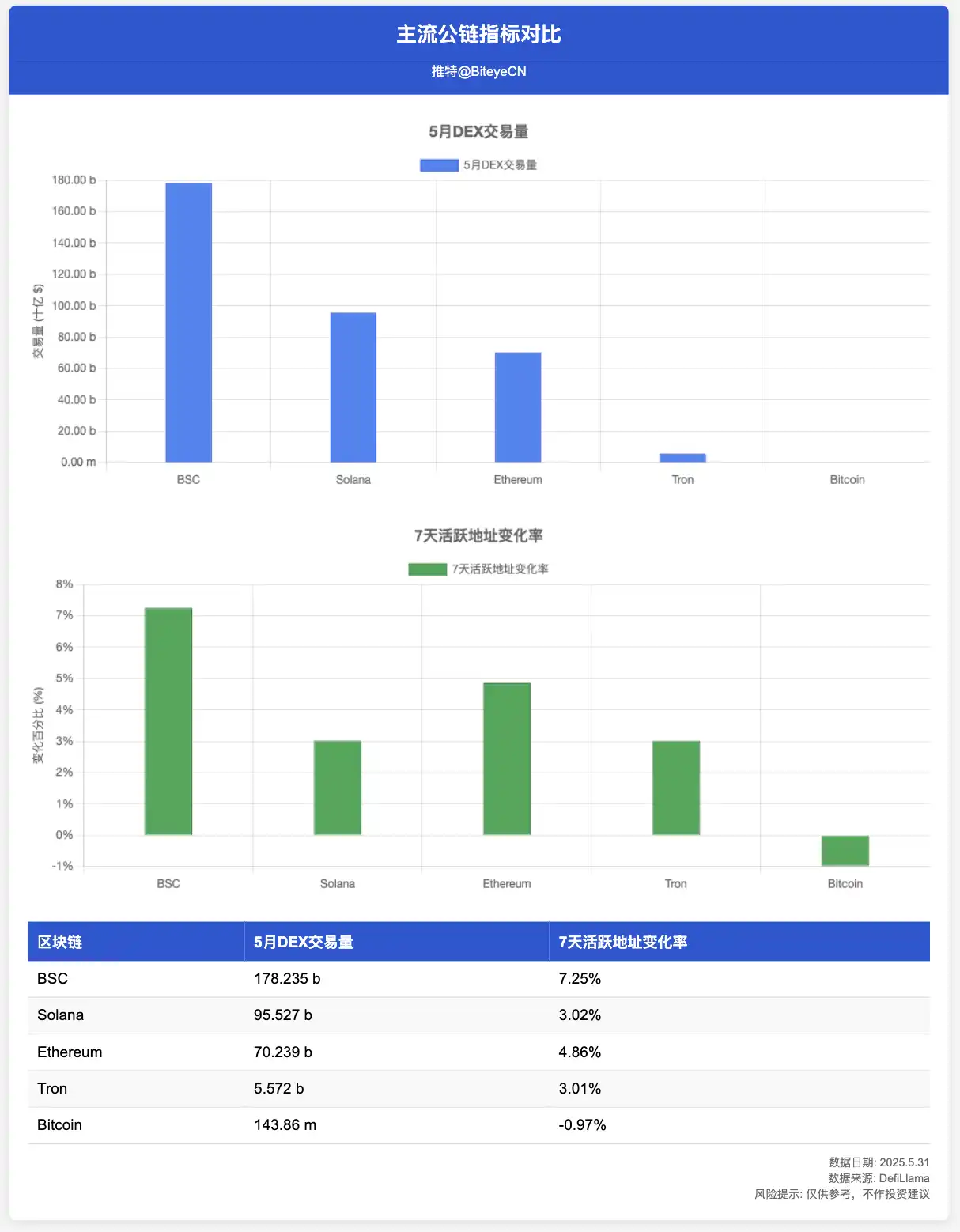

Having understood the wealth narratives and Alpha opportunities emerging on BNB Chain, we will now focus on the core data of the BNB Chain ecosystem, revealing the hard strength behind its popularity. The table below summarizes the comparison of BNB Chain with other public chains on key indicators.

As shown in the figure, based on data from May 31, the total DEX trading volume across all chains in May reached $474.135 billion, with BNB Chain DEX achieving a trading volume of $178.228 billion that month, ranking first and setting a historical high, stimulated by Alpha airdrops and trading competitions; the largest DEX on BNB Chain reached a trading volume of $165.35 billion that month, also achieving a historical peak. This "disruptive" lead proves that BNB Chain has become one of the preferred platforms for on-chain user trading. The massive trading volume not only represents extremely high liquidity depth but also means more effective price discovery and richer trading opportunities, attracting continuous inflows from traders and market makers.

Trading volume relies on the user base, and the "7-day active address growth rate" is a key indicator for measuring user growth. BNB Chain significantly leads this metric with a growth rate of 7.25%, compared to Ethereum (4.86%), Solana (3.02%), and Tron (3.01%), demonstrating strong ecological appeal.

Another major factor for ecological activity is the competitive advantage of trading costs. Many mainstream DEX protocols on BNB Chain offer trading fees as low as 0.01% for numerous trading pairs, making the trading cost for a typical transaction on BNB Chain only a fraction of that on Ethereum. This is a significant advantage, especially in the high-frequency trading scenarios of Memecoins.

In addition to outstanding performance in basic on-chain data, BNB Chain has further solidified its ecological foundation through various developer incentive measures. Recently, the MVB (Most Valuable Builder) program, continuously promoted by BNB Chain, provides funding support, technical guidance, and ecological resource connections for new projects and development teams.

Based on the above comprehensive considerations, BNB Chain has significantly outpaced most mainstream public chains and possesses strong momentum for sustained development, becoming one of the most active and promising public chains today.

3. Dual Engine Drive: USD1 and Binance Alpha Build BNB Chain Growth Momentum

The strong market appeal recently exhibited by BNB Chain has a solid foundation behind it. The deep liquidity brought by the USD1 stablecoin and the efficient traffic channels built by Binance Alpha act as two core engines, jointly driving the current value narrative of BNB Chain.

3.1 USD1: Building the Liquidity Foundation of BNB Chain

The rise of USD1 holds significance for BNB Chain that goes beyond an ordinary dollar-pegged stablecoin. First, over 99% of USD1 is deployed on BNB Chain. This stablecoin is issued by World Liberty Financial (WLFI) and is custodied by BitGo. Recently, the Abu Dhabi investment firm MGX completed a $2 billion investment in Binance through USD1, further highlighting its potential.

Behind this high concentration, the "zero Gas fee" incentive mechanism tailored for USD1 by BNB Chain plays a crucial role, significantly reducing users' trading costs. This has allowed USD1 to quickly become one of the favored stablecoins among on-chain users, especially high-frequency traders and Meme players, paving the way for its large-scale application.

The influence of USD1 is not limited to the Meme sector; it is expanding comprehensively. In mainstream DeFi protocols like PancakeSwap and Venus, trading volumes for pairs such as USD1/USDT and USD1/BNB continue to rise. Additionally, USD1 has landed on Ethereum (ETH) and plans to connect with Tron (TRON). This cross-chain and cross-platform layout, through the transmission of liquidity, further feeds back into the ecological value of BNB Chain.

3.2 Binance Alpha: CEX Empowered Traffic Amplifier

As a project discovery platform launched by Binance, Binance Alpha has become a "wealth amplifier" for directing traffic to BNB Chain. Platform data shows that over 70% of the projects launched in the Alpha zone are tokens based on BNB Chain. Binance has even introduced incentives such as "double points for trading BNB Chain projects" to encourage users on the trading platform to trade assets on BNB Chain. This is a perfect embodiment of the synergistic effect of the Binance ecosystem—successfully combining the traffic and brand advantages of CEX with the on-chain ecological advantages of BNB Chain, forming a powerful growth flywheel.

In summary, the USD1 stablecoin, backed by strong capital, has built a liquidity foundation and institutional narrative for BNB Chain; while the Binance Alpha platform continuously delivers user traffic and market heat to BNB Chain. One solidifies the value anchor on-chain, while the other drives users and liquidity off-chain, both collaboratively pushing the wealth narrative of BNB Chain.

4. Main Paths for Retail Participation in BNB Chain

· "Point Accumulation" and Early Interaction: The Binance Alpha platform guides users to engage early with new projects on BNB Chain through tasks and incentives. Actively participating in these activities provides opportunities to gain early airdrop benefits.

· Alpha Earn Hub Liquidity Mining: Recently, the opening of the Binance Alpha Earn Hub has provided users with a direct value-added path. By providing liquidity for selected Binance Alpha tokens on PancakeSwap V3, users have the chance to earn annualized returns (APR) of up to 1000%, making it an excellent window to capture early high-yield opportunities (be cautious of impermanent loss and token depreciation risks when participating).

· Actively Participate in "New Token Offerings": Retail investors can participate in Binance wallet TGE, as well as PancakeSwap IFO (Initial Farm Offering) and Four.meme, which are also important channels for "new token offerings" on BNB Chain.

· Meme Coin Hotspot Tracking: Utilize tools like Four.meme, DexScreener, and DEXTools to track popular Meme trading pairs on BNB Chain in real-time, focusing on those with unique culture, strong communities, or that can ride on trending narratives. However, be aware that Meme coins are highly volatile and carry significant risks. If participating, treat it with small amounts and a "zero-sum" mindset, entering and exiting quickly, with strict profit-taking and stop-loss measures.

· Deepen Engagement with DeFi Protocols: Provide liquidity, engage in lending, or stake BNB in DeFi protocols like PancakeSwap, Venus, and Lista DAO to obtain relatively stable returns.

5. Information Channels Worth Noting for BNB Chain

Official Core Channels:

· Twitter: @BNBCHAIN (the preferred source for official announcements, ecosystem updates, and event information), @BNBCHAINZH, @fourmeme (BNB Chain token issuance platform), @BNBChainDevs (technical and developer updates)

· BNB Chain Blog: The official blog often features in-depth articles, technical interpretations, and roadmap updates.

· DappBay: The official DApp browser for BNB Chain, where you can discover and evaluate on-chain applications.

Research Institutions: @MessariCrypto, @Delphi_Digital, @Btieyecn, etc.

Data Analysis and Tool Platforms: On-chain data analysis tools like BscScan, DefiLlama, DexScreener, Dune Analytics, TokenTerminal, etc.

6. Future Outlook: The Next Wave of BNB Chain

BNB Chain is continuously building its ecological competitiveness through a dual drive of "technology + narrative." On the technical side, its 2025 roadmap clearly states the goal of "sub-second latency + gasless experience," having already achieved the plan to reduce block speed to 0.75 seconds at the beginning of the year, combined with high TPS, providing a smoother on-chain interaction experience for DApps and users. On the ecological level, the entry of institutional funds behind the USD1 stablecoin and its integration with global payment scenarios are accelerating BNB Chain's convergence with mainstream finance. Meanwhile, the "AI-First" strategy embeds AI technology into the underlying logic of the public chain, releasing the potential of AI applications through infrastructure support like opBNB and Greenfield. Various signals indicate that BNB Chain has already laid the groundwork for the next round of public chain explosion.

The so-called "wealth code" is not a one-time answer; it is more like a probabilistic opportunity window in specific market cycles and ecological stages. The current wave of enthusiasm for BNB Chain has undoubtedly created many such windows. Where will the tide flow next? The answer to this question may lie in BNB Chain's next technological breakthrough or the next blockbuster application.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。