TL;DR

In May 2025, the U.S. macroeconomy entered a critical turning point: inflation continued to decline, employment remained resilient, the Federal Reserve shifted to a wait-and-see policy, and fiscal "quasi-QE" operations lowered interest rates. Combined with trade policy disruptions and the restoration of U.S.-China relations, this collectively boosted market risk appetite, potentially initiating a new round of structural capital repricing cycles.

The crypto market saw a significant rebound in capital activity in May, with daily trading volume increasing by nearly 16%, and total market capitalization rising to $3.56 trillion, showing a structural recovery trend. BTC and ETH led the gains, while USD1 ecosystem narrative projects continued to attract attention.

The easing of macro policies in May boosted market sentiment, with BTC and ETH spot ETFs recording net inflows of $5.77 billion and $317 million, respectively. The total circulation of stablecoins increased by approximately $7.28 billion, with continued capital inflows supporting the rise of crypto assets.

In late May, Bitcoin maintained above key resistance levels, rising for seven consecutive weeks and attracting significant institutional capital inflows. If it breaks through $111,980, it is expected to challenge $130,000. Ethereum and Solana also showed strong buying interest, with short-term targets of $3,000 and $220, respectively, as the overall market continued its structurally bullish trend.

In May, USD1 gained traction due to multiple narratives such as "presidential endorsement + RWA + stablecoin bill expectations," with the stablecoin market cap surpassing $2.1 billion. Ecosystem project tokens like Lista and StakeStone also surged, with the market highly focused on their potential policy dividends. Meanwhile, the Believe platform rapidly gained popularity in the MEME market due to its social token mechanism and Launchcoin surge, but its ecosystem is highly dependent on the performance of the platform token, raising community concerns about its long-term sustainability.

The rapid advancement of the "GENIUS Act" marks a bipartisan consensus in the U.S. on stablecoin regulation, establishing strict issuance qualifications, reserves, and compliance requirements aimed at strengthening the global dominance of dollar-pegged stablecoins while limiting participation from overseas issuers and large tech companies. Meanwhile, the approval of Ethereum ETF staking in the U.S. is still delayed due to regulatory disputes, but Hong Kong has already allowed staking services, with the market generally expecting the U.S. to follow suit, which would benefit ETH and staking-related assets.

1. Macroeconomic Perspective

In May 2025, the U.S. macroeconomy is at a critical turning point. Inflation continues to decline, the labor market shows resilience, monetary policy enters a wait-and-see phase, trade policies introduce new uncertainties, and fiscal measures impact market expectations through quasi-QE operations and debt rating adjustments. Against this backdrop, the crypto market demonstrates strong resilience, and the global risk asset structure may be entering a new round of revaluation.

1. Inflation Trends

The unadjusted CPI year-on-year rate for April fell to 2.3%, below the market expectation of 2.4%, marking a new low since February 2021, indicating that price pressures are easing. The seasonally adjusted CPI month-on-month rate recorded 0.2%, also slightly below expectations, suggesting insufficient momentum for a short-term inflation rebound. Meanwhile, the U.S. Treasury initiated a $40 billion Treasury bond repurchase operation, widely viewed as a "quasi-QE" measure aimed at releasing liquidity through the repurchase of issued Treasury bonds and refinancing at low interest rates. This operation has become a significant force supporting the prices of risk assets.

2. Labor Market

In April 2025, non-farm payrolls added 177,000 jobs, far exceeding the market expectation of 138,000, reflecting the resilience of the job market. This data provides a basis for the Federal Reserve to maintain a wait-and-see policy. The Fed closely monitors employment data as a basis for policy adjustments. Strong employment not only alleviates market concerns about recession but also diminishes the likelihood of multiple unexpected rate cuts within the year.

3. Monetary Policy Dynamics

Federal Reserve Chairman Powell stated that the current monetary policy framework would be reassessed, and the "average inflation targeting" mechanism might be abandoned. He noted that frequent supply-side shocks (such as tariffs, geopolitical issues, and energy transitions) are changing the traditional policy environment, prompting the Fed to focus more on structural inflation risks. In the future, the Fed may extend the period of high interest rates and even increase its holdings of medium- to long-term Treasury bonds to control long-term interest rate rises. The policy tone will be more flexible, with no urgency for preemptive rate cuts in the short term, emphasizing that decisions on June's policy direction will be based on data such as PCE, CPI, and tariff impacts.

4. Trade Policy and Global Economic Outlook

At the beginning of May, Trump announced a 50% tariff on EU goods starting June 1, which was later postponed to July 9, but the threat of high tariffs has already impacted market sentiment. Given the previous frequent changes in trade policy by the Trump administration, market uncertainty regarding future policy paths has significantly increased. On the U.S.-China front, the People's Bank of China implemented a "reserve requirement ratio cut + interest rate cut" policy in May, releasing 1 trillion yuan in liquidity and lowering the policy interest rate to 1.4%. This move is seen as the start of a new round of easing, with market expectations for improved U.S.-China relations rising, thereby enhancing risk appetite.

Summary

In May 2025, the U.S. economy entered a critical turning point:

Inflation continues to decline, and easing expectations are rising;

Strong employment supports a wait-and-see monetary policy;

Fiscal "quasi-QE" operations, combined with a softer tone from the Fed, collectively lower market interest rates;

Global trade frictions have resurfaced, but the restoration of U.S.-China relations enhances market risk appetite;

In the crypto market, as the marginal improvement in macro funds and continued ETF inflows occur, Bitcoin's price broke the historical high of $111,959. The resonance of current macro policies and global financial trends may be helping the crypto market to initiate a new cycle based on structural capital repricing.

2. Overview of the Crypto Market

Cryptocurrency Data Analysis

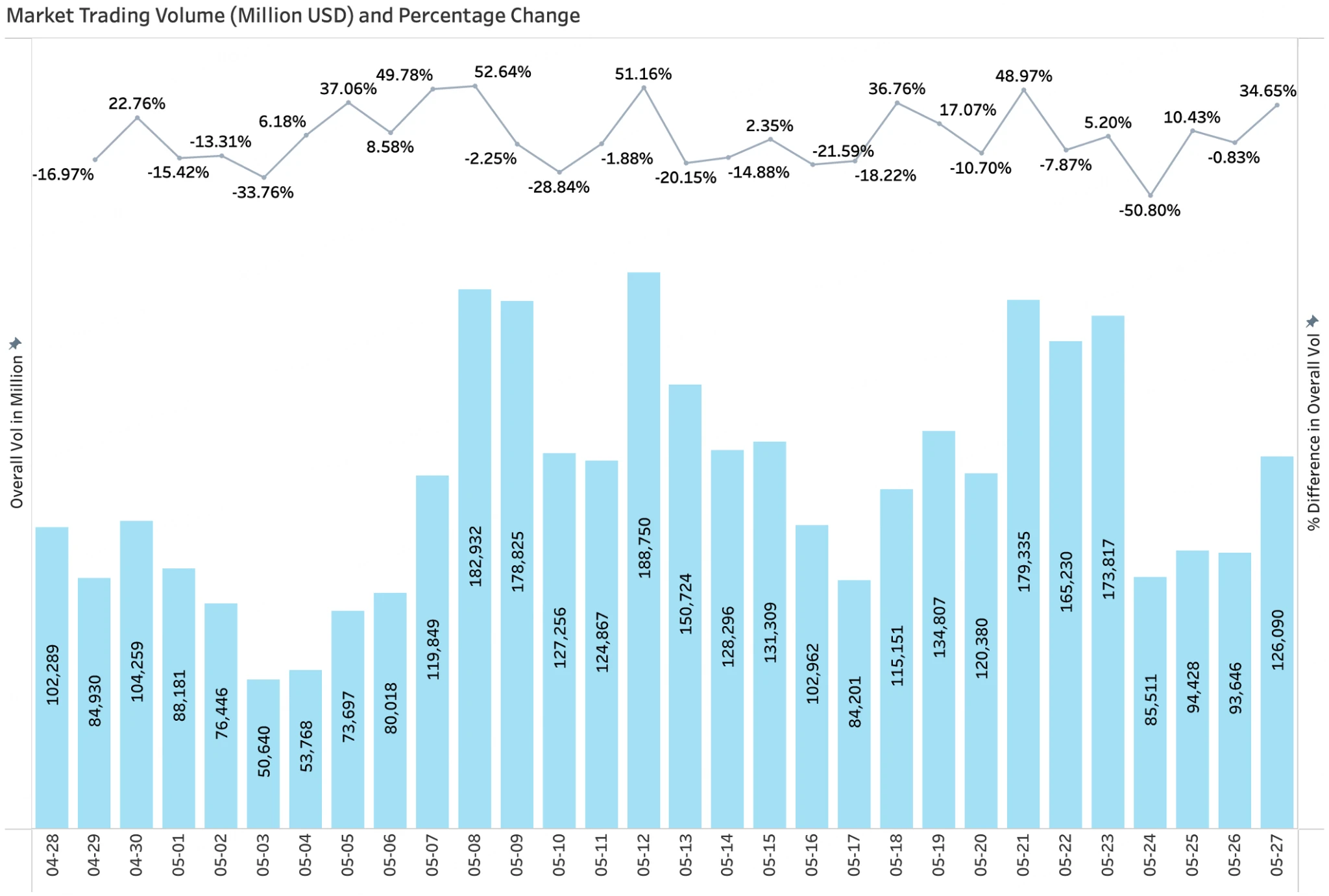

Trading Volume & Daily Growth Rate

According to CoinGecko data, as of May 27, the market's average daily trading volume was $117.4 billion, up 15.8% from the previous period, indicating a continued rebound in capital activity, with the overall market exhibiting high volatility. During this period, there were multiple instances of daily trading volume exceeding a 50% increase. In the phases from May 6 to May 12 and from May 21 to 22, trading volume surged significantly, with daily trading volume once exceeding $180 billion. During this time, BTC prices broke through $100,000 and $110,000, with market bullish sentiment significantly heating up, leading to a concentrated release of trading momentum in the short term.

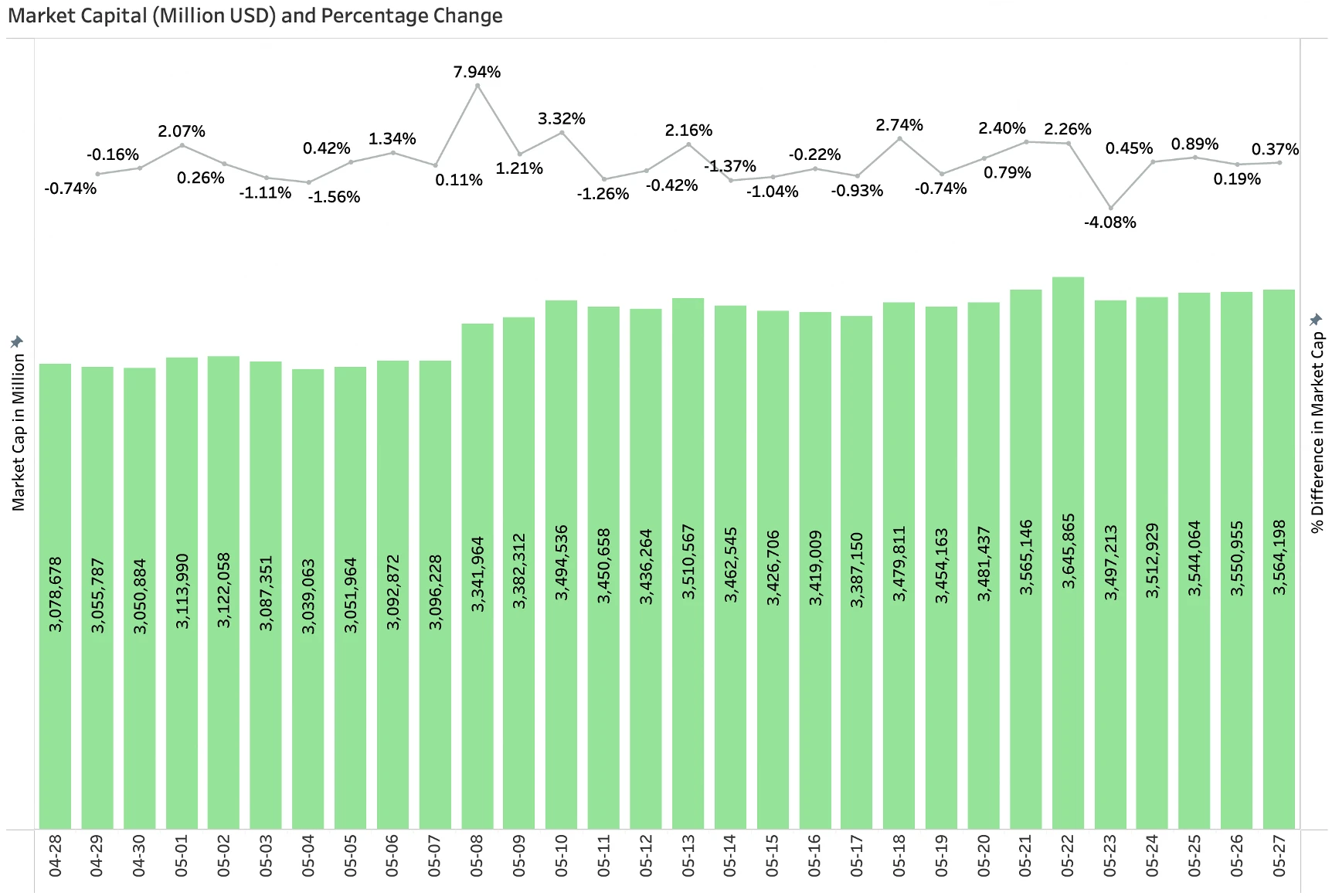

Total Market Capitalization & Daily Growth Amount

According to CoinGecko data, as of May 27, the total market capitalization of cryptocurrencies rebounded to $3.56 trillion, up 17.0% from the previous month, with a significant increase in total market capitalization. BTC's market share was 62.6%, and ETH's market share was 9.6%, with the latter increasing by 29.7% from the previous period, indicating a continued preference for ETH in this round of capital allocation. Since May 8, the total market capitalization has risen above $3.3 trillion and has been steadily climbing, showing a clear trend of structural recovery in the market.

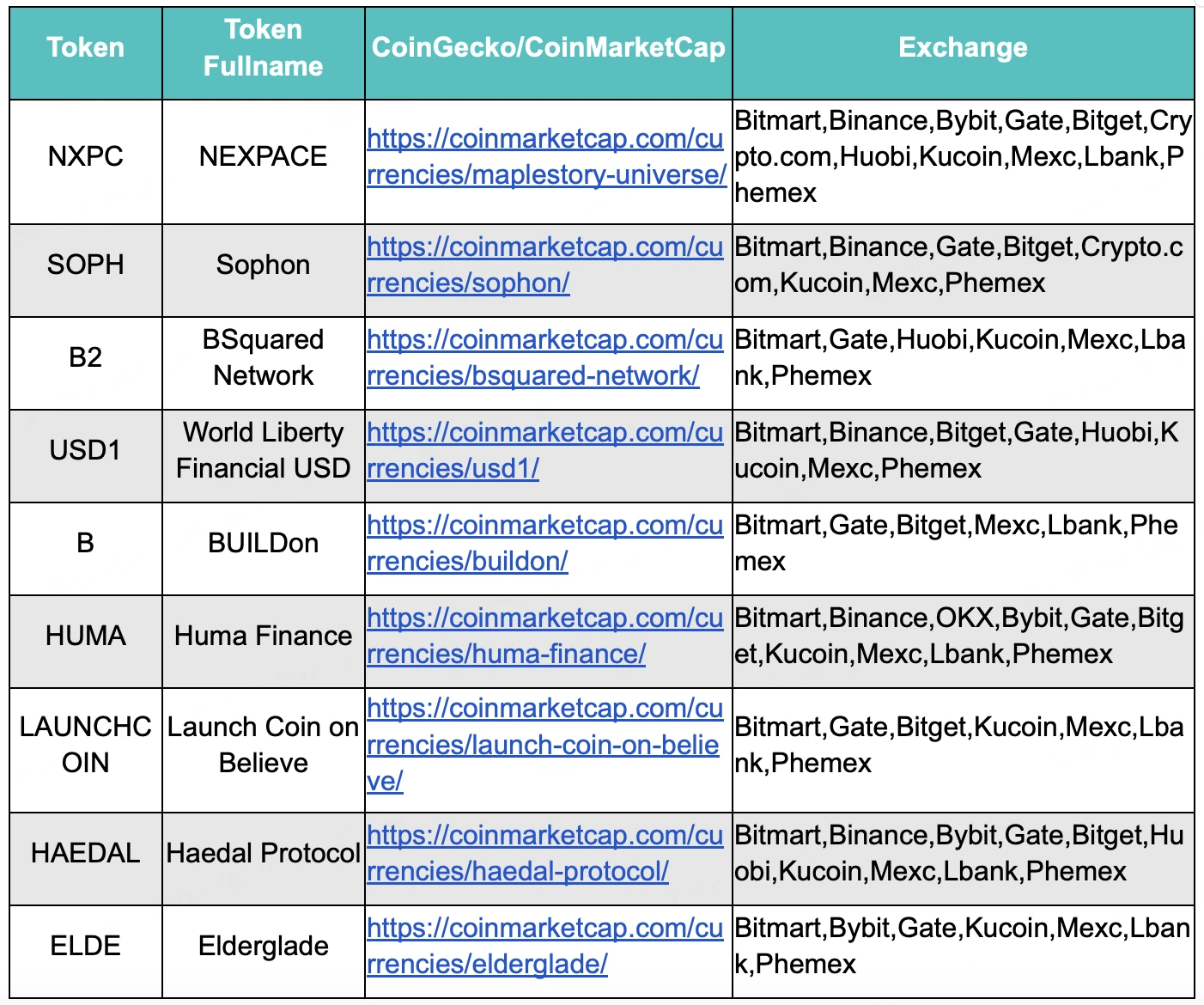

New Popular Tokens Launched in May

Among the popular tokens launched in May, VC-backed projects still dominate, including Layer 2 projects like SOPH and B2. Additionally, USD1 emerged as one of the popular narratives in May, with the stablecoin USD1 and its associated projects like B, Lista, and Staketone also receiving widespread market attention.

3. On-Chain Data Analysis

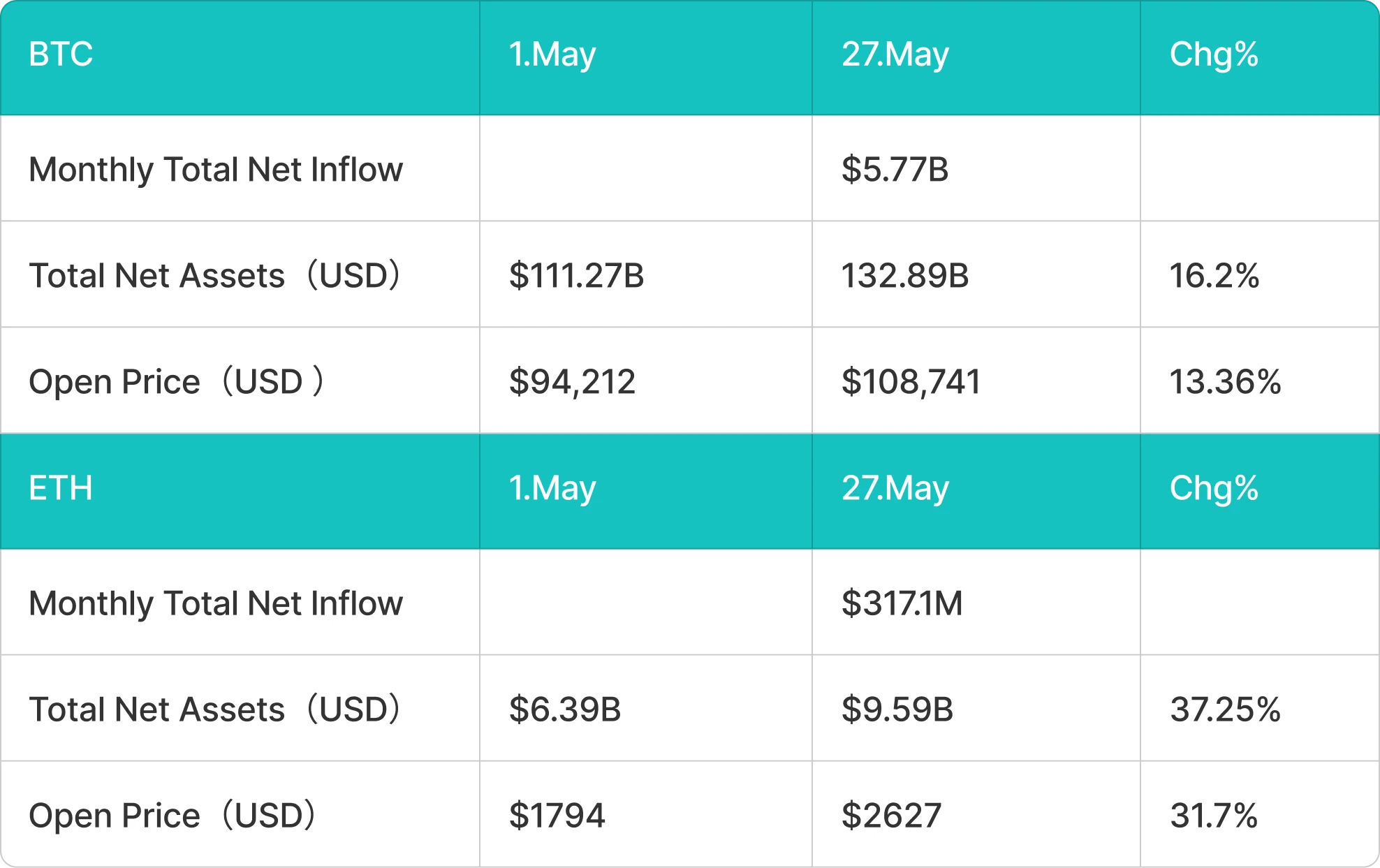

3.1 Analysis of BTC and ETH ETF Inflows and Outflows

May BTC ETF Inflow of $5.77 Billion

In May, as the U.S. reached a phased suspension agreement on tariff policies with multiple countries, market sentiment significantly improved, driving Bitcoin's price to rebound strongly and reach a historical high of $111,959. As of May 28, Bitcoin's price rose from $94,212 to $108,969 within the month, an increase of approximately 13.5%. Meanwhile, Bitcoin spot ETF funds showed a net inflow trend, with a cumulative inflow of about $5.77 billion in May.

May ETH ETF Inflow of $317 Million

On the Ethereum side, benefiting from expectations of the Pectra upgrade and easing macro policies, the price increase was even more pronounced. As of May 28, ETH rose from $1,794 at the beginning of the month to $2,635, an increase of 31.9%. Ethereum spot ETFs also attracted capital inflows, with a net inflow of approximately $317 million in May.

3.2 Analysis of Stablecoin Inflows and Outflows

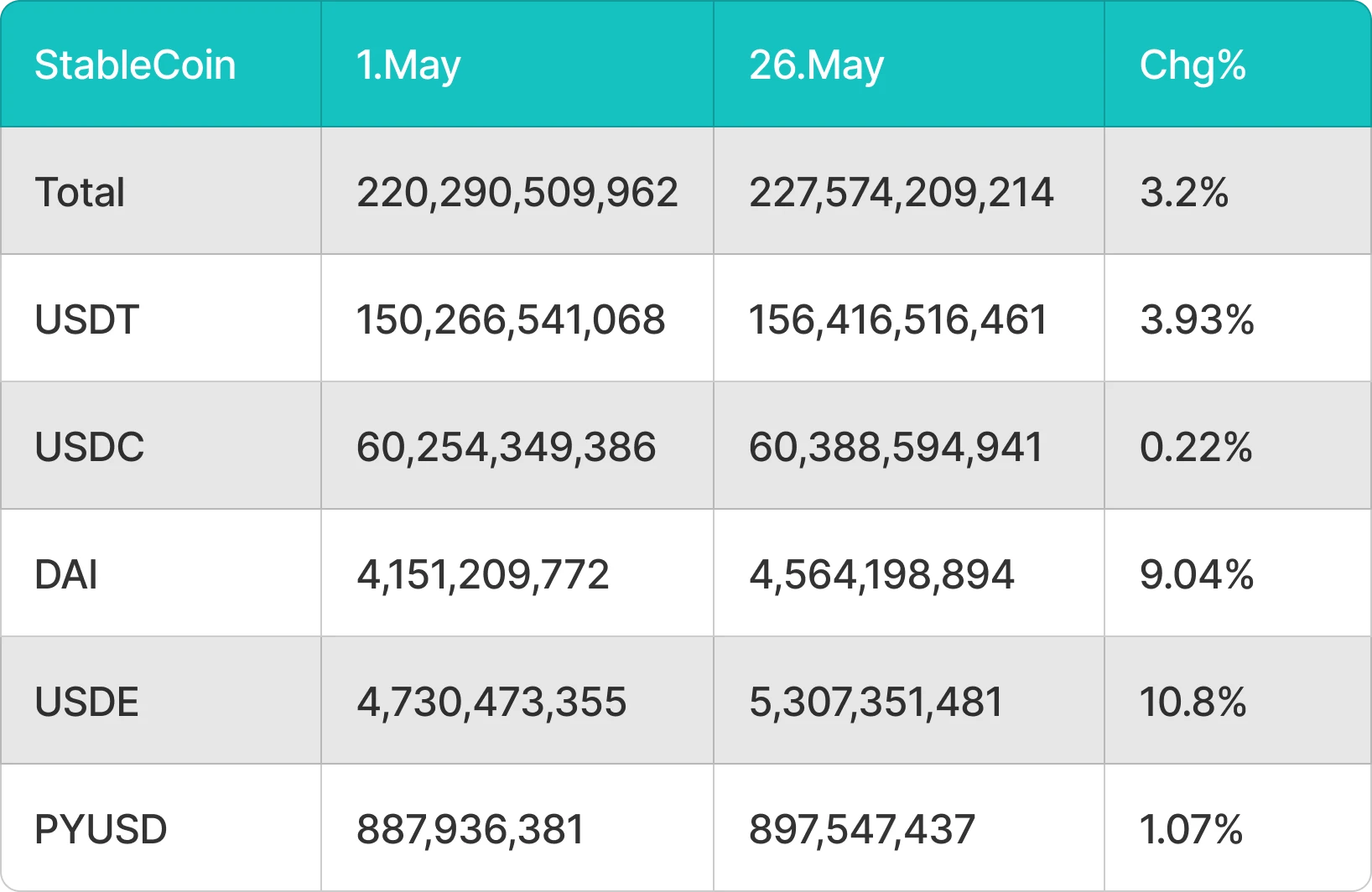

May Stablecoin Inflow of Approximately $7.28 Billion—Mainly from USDT and USDC

In May, as the U.S. suspended tariff policies, the easing of macro policies led to a significant pullback in the crypto market. The stablecoin market continued its strong growth momentum. Among them, USDT, USDE, and DAI became the main drivers of growth this month, with the total circulation of stablecoins increasing by approximately $7.28 billion.

4. Price Analysis of Major Currencies

4.1 BTC Price Change Analysis

Bitcoin is striving to maintain above $109,588, indicating that there is buying interest every time there is a slight pullback. Bitcoin has risen for seven consecutive weeks, and if buyers can extend this trend into the eighth week, it will pave the way for further increases. Institutional investors see long-term opportunities and continue to inject funds into Bitcoin exchange-traded products. CoinShares reported on May 26 that Bitcoin ETPs recorded inflows of $2.9 billion last week, accounting for a quarter of the total inflows for 2024.

Bitcoin bulls are striving to push and maintain the price above $109,588, indicating that every pullback is being bought. The rising moving average and the RSI approaching the overbought zone suggest that the easiest direction for resistance is upward. If buyers can push the price above $111,980, the BTC/USDT trading pair could soar to $130,000.

On the downside, the 20-day EMA ($104,886) is a key support level to watch. If the price falls below and closes under the 20-day EMA, it may entice short-term investors to take profits, leading to a drop in price to the psychological level of $100,000, where strong buying is expected to form solid support.

4.2 ETH Price Change Analysis

Ethereum rebounded from the 20-day EMA ($2,425) on May 25, showing strong demand at lower price levels. Bulls will again attempt to break through the resistance at $2,738. If successful, the ETH/USDT trading pair could surge to $3,000, although bears may try to halt the rise around $2,850.

If the price pulls back from the current level or encounters resistance and falls below the 20-day EMA, it indicates that the bulls' control is weakening. In this case, the price may drop to $2,323 and then further to $2,111.

4.3 SOL Price Change Analysis

Solana found support at the 20-day EMA ($169) on May 25, indicating that market sentiment remains positive, with traders buying on slight pullbacks. Bulls will again attempt to break through the resistance at $188. If successful, the SOL/USDT trading pair could soar to $210 and possibly reach $220.

However, sellers need to push the price below the 20-day EMA to prevent further increases. If the price breaks below this support level, it may test the 50-day SMA ($151), which could serve as strong support. A rebound from the 50-day SMA may lead to price consolidation between $153 and $188 for some time.

5. Hot Events This Month

USD1 Ecosystem

In mid-May, as BTC's price broke historical highs and the launch of USD1 on Binance led to a surge in its popularity, the USD1 ecosystem collaboration projects also gained market attention. As of May 28, 2025, the market capitalization of the USD1 stablecoin has surpassed $2.1 billion, making it the seventh-largest stablecoin. Although USD1 does not significantly differ in mechanism design from other mainstream stablecoins like USDT and USDC, its core advantage lies in being issued by WLFI, led by the Trump family, making it the first stablecoin project with presidential endorsement.

The current narrative surrounding USD1 revolves around "presidential endorsement + RWA track + expectations of stablecoin legislation," with WLFI positioning USD1 primarily for institutional users, suggesting that retail investors have better opportunities to benefit from participating in USD1 ecosystem projects. Recently, several USD1 partner tokens, such as Buildon, Lista DAO, StakeStone, Haedal, and Cookie, have seen significant price increases, driving high market enthusiasm for the "WLFI + USD1" concept. If the U.S. stablecoin legislation is successfully passed in the future, USD1, as a stablecoin project personally endorsed by the president, along with its deeply integrated projects, is expected to occupy a more important position in the future crypto ecosystem.

Believe Rises as a New MEME Platform Star

As of May 28, the core token of the Believe platform, Launchcoin, rose from $0.014 at the beginning of the month to a peak of $0.36, with a market capitalization nearing $310 million, making it one of the largest gainers among MEME coins recently. The platform, created by Ben Pasternak, focuses on the concept of "social assetization," allowing users to automatically trigger token issuance by tweeting with $TICKER and @launchcoin on the X platform.

With its innovative token issuance mechanism and the surge of Launchcoin, the activity on the Believe platform has rapidly increased, with tokens like Dupe and Goonc following suit. The number of new tokens issued on the platform has jumped to third among MEME platforms. However, the over-supported token $YAPPER by Believe's official team plummeted over 66% after its launch, triggering community FUD and causing a sharp decline in ecosystem enthusiasm. As of May 28, Believe has issued over 27,000 tokens, with a total market capitalization of approximately $290 million, of which Launchcoin contributes nearly 63%, and its trading volume accounts for nearly 72% of the ecosystem total. It is evident that the popularity of the platform token heavily relies on the market performance of LAUNCHCOIN. However, this platform token has been criticized for lacking dividends and practical application scenarios, raising significant doubts in the community about its long-term sustainability. If market enthusiasm cannot be maintained, investor confidence may quickly decline, posing a risk of a stampede.

Overall, the current MEME market platforms are highly homogeneous. Although Believe simplifies the process of issuing tokens through X, it does not change the logic of MEME issuance. Whether it can maintain its popularity in the future will depend on its ability to continue innovating or create truly wealth-generating projects.

6. Outlook for Next Month

Progress on Stablecoin Legislation

This month, the stablecoin "GENIUS Act" passed the debate motion with 69 votes in favor and 31 against, entering the revision process. With the rapid advancement of stablecoin legislation in both the House and Senate, a rare bipartisan consensus on the regulation of crypto assets has been reached, and the bill is expected to complete the legislative process by Q4 2024.

The core of the "GENIUS Act" includes key contents such as issuance qualification restrictions, reserve requirements, compliance obligations, user protection, and international applicability. The bill stipulates that only specific financial institutions can issue payment stablecoins, and all stablecoins must be 100% backed by highly liquid assets, with strict segregation of customer assets. Issuers must disclose reserve status monthly, undergo audits by registered accountants, and senior management will bear legal responsibility for the authenticity of the information. Additionally, issuers must establish a complete anti-money laundering and sanctions compliance system and record and monitor transaction activities. The bill also imposes restrictions on overseas issuers and large tech companies, requiring them to adhere to U.S. regulatory standards to prevent systemic risks and market monopolies. In terms of consumer protection, holders have priority repayment rights in the event of the issuer's bankruptcy, and officials are prohibited from participating in stablecoin business during their terms. Furthermore, the bill clarifies that payment stablecoins do not fall under the categories of securities or commodities, eliminating regulatory overlap between the SEC and CFTC.

The "GENIUS Act" is not only a regulatory framework for stablecoins but also a strategic measure for the U.S. to strengthen the international dominance of the digital dollar by promoting the compliant issuance of dollar-pegged stablecoins, attracting global capital to U.S. Treasury bonds, and limiting foreign issuers. Currently, Hong Kong has passed the "Stablecoin Issuer Ordinance Draft," establishing the first complete regulatory framework for the stablecoin market in Hong Kong. Based on previous experiences with Bitcoin spot ETF approvals, it is highly likely that the U.S. will soon follow with related legislation. In this context, compliant stablecoin projects are expected to gain greater market recognition in the future.

Progress on Ethereum ETF Staking Approval

On April 14, the SEC postponed its decision on the Grayscale Ethereum Trust ETF and Grayscale Ethereum Mini Trust ETF to June 1, with the final decision deadline set for the end of October. The delay is related to regulatory issues concerning staking and physical subscription/redemption mechanisms. In contrast, the progress of Ethereum ETF staking in Hong Kong has been relatively swift. On April 11, Bosera Fund announced that its Bosera Hashkey Virtual Asset Ethereum ETF received regulatory approval, allowing up to 30% of Ethereum holdings to be staked starting from April 25, 2025. On April 18, Huaxia Fund is set to launch staking services for its Ethereum spot ETF, becoming the second fund in Hong Kong to offer such services.

Based on previous experiences with Bitcoin and Ethereum ETF approvals, Hong Kong typically leads the U.S. Therefore, after Hong Kong's early approval of staking, the market generally expects U.S. regulators to soon reach a regulatory framework regarding related mechanisms, advancing the final approval of the Ethereum spot ETF. Once this occurs, it will not only promote the institutionalization of Ethereum as an asset class but also potentially bring a new wave of market enthusiasm for Ethereum and Ethereum staking-related assets like Lido and Eigen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。