Bitcoin resumed its upward trend on Tuesday, climbing as high as $106,813.58 as stocks and the broader crypto market posted similar gains. Tech stocks led the rally for the S&P 500 and positive news about a slight jump in job openings also appears to have buoyed markets.

The Bureau of Labor Statistics reported that there were 7.4 million job openings in April, up by 191,000 compared to March. The data was reported in the Bureau’s Job Openings and Labor Turnover Survey, with arts, entertainment, mining, and logging industries leading the charge in terms of increased opportunities.

Crypto markets were up 1.94% reaching a market capitalization of $3.34 trillion, according to Coinmarketcap. The S&P 500, Nasdaq, and Dow, all rose 0.69%, 1.04%, and 0.52% respectively at the time of writing, according to CNBC. Interestingly, Newhedge shows that bitcoin’s correlation with the S&P 500 is around 54%, down from roughly 80% just a few months ago.

“Stocks up and so are long-dated treasuries, which takes out two FUD narratives at once,” said Bloomberg ETF analyst Eric Balchunas in a post on X. (“FUD” refers to “fear, uncertainty, and doubt.”) Indeed, the yield on the U.S. 30-year Treasury is down ever so slightly by 0.002% according to CNBC, but the 10-year Treasury yield is up by 0.01% (bond prices move opposite to yields).

This means sentiment on the attractiveness of U.S. government debt is mixed, but certainly not as bearish as it was just a couple of weeks ago when worries of excessive debt pushed long-term bond yields higher, bond prices lower, and triggered a record-breaking bitcoin rally.

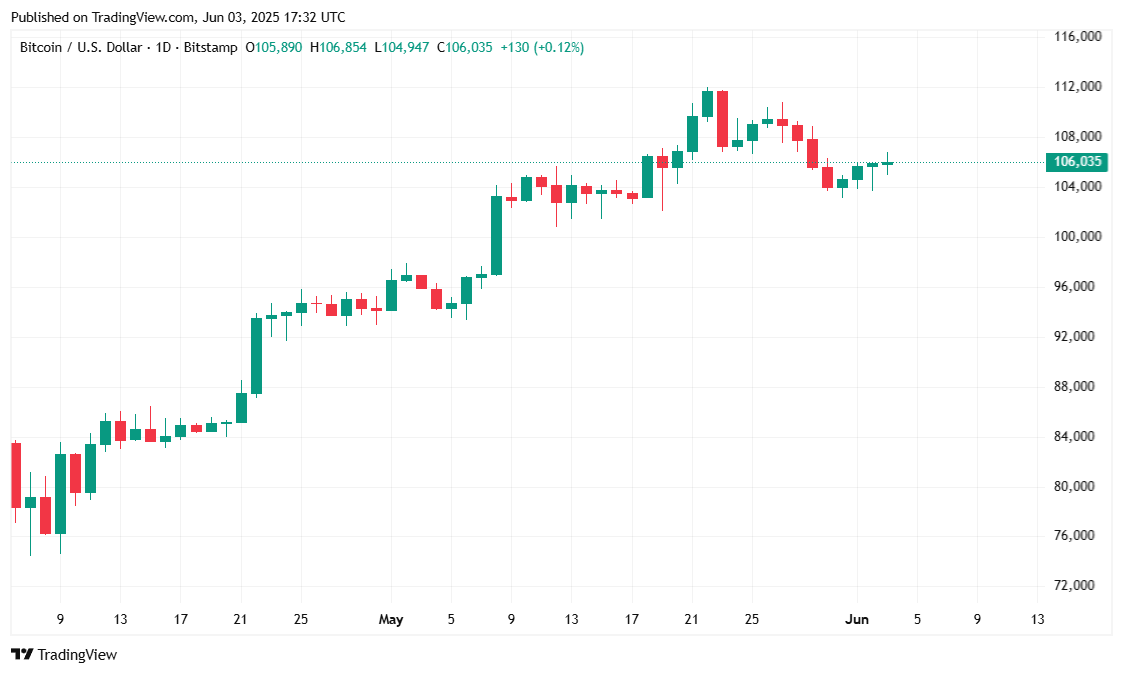

Bitcoin’s current price at the time of reporting is $106,015.42, a modest rebound of 1.47% over the past 24 hours. However, the weekly trend remains in the red, with prices still down 3.77% over the past seven days. The asset traded between $104,100.01 and $106,813.58, reflecting a relatively narrow range and cautious optimism in the market.

( BTC price / Trading View)

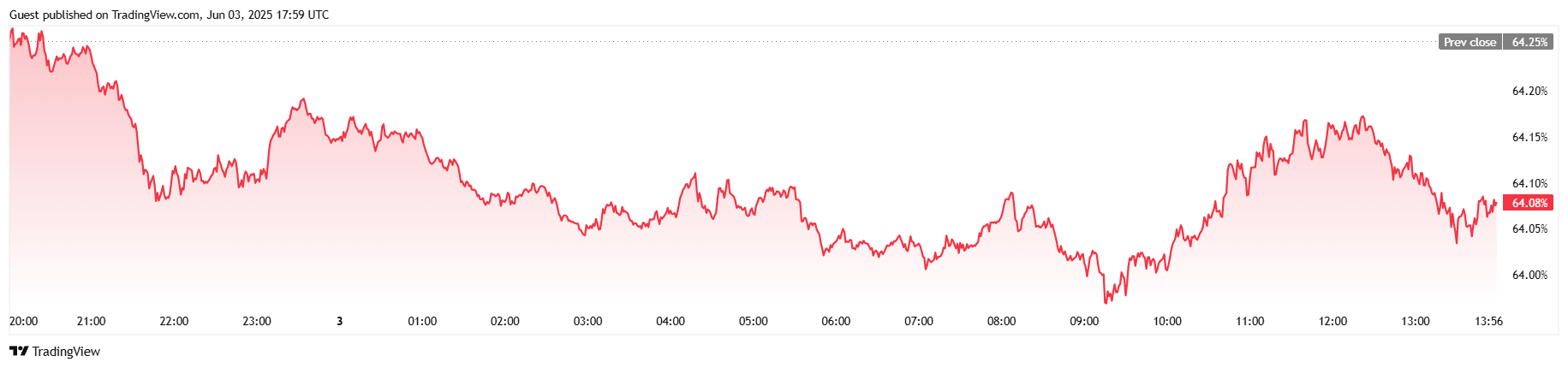

Trading activity ticked higher, with 24-hour volume rising 6.47% to $47.35 billion, as traders positioned for a potential breakout. Bitcoin’s market capitalization increased by 1.50% to $2.1 trillion, while its dominance dropped slightly by 0.26% to 64.06%.

( BTC dominance / Trading View)

The number of open BTC derivatives contracts dropped 0.19% to $72.01 billion over the past 24 hours according to Coinglass. Liquidations rose to 2.47 million with almost all of that being attributable to bulls who went long. Short liquidations were a negligible $4,350.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。