Bitcoin ETFs See Third Straight Day of Outflows as Ether ETFs Extend Green Run

The momentum that once fueled bitcoin exchange-traded funds (ETFs) seems to have hit a wall. With another $286 million in outflows, Monday, June 2, marked the third straight day of investor retreat from the asset class.

Leading the pullback was Blackrock’s IBIT, which saw $130.44 million exit the fund, followed by Ark 21Shares’ ARKB (-$73.91 million) and Fidelity’s FBTC (-$50.11 million). Even Grayscale’s GBTC wasn’t spared, shedding $16.47 million. Only Bitwise’s BITB posted a modest inflow of $3.41 million, not nearly enough to reverse the tide.

Total value traded across bitcoin ETFs remained strong at $2.33 billion, but net assets edged down to $125.47 billion, reflecting cautious investor sentiment.

Source: Sosovalue

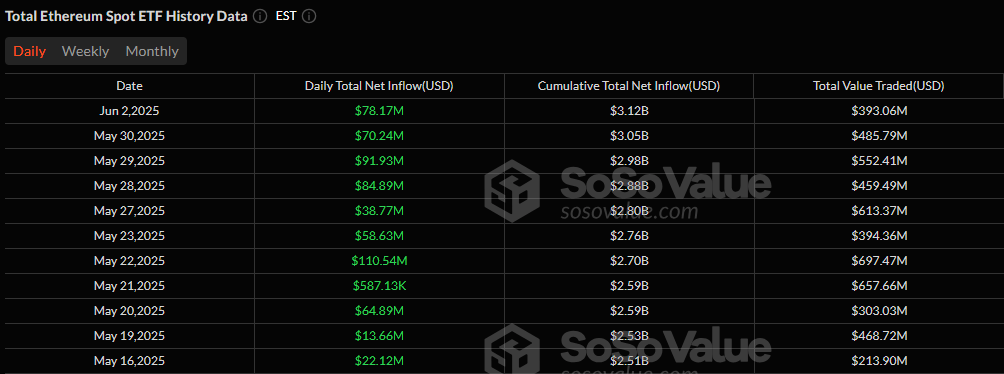

In stark contrast, ether ETFs continued their impressive rally, chalking up an 11th consecutive day of net inflows, this time totaling $78.17 million. Blackrock’s ETHA led the charge with $48.40 million, while Fidelity’s FETH followed with $29.78 million. There were no outflows reported across ether ETFs.

As ether continues to attract fresh capital and bitcoin shows signs of profit-taking or rebalancing, this divergence is catching the eye of institutional watchers, and the rotation narrative may be gaining traction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。