Original Title: "Will Hong Kong's RWA Route Fail?"

Original Source: Ye Kai (WeChat/Twitter: YekaiMeta)

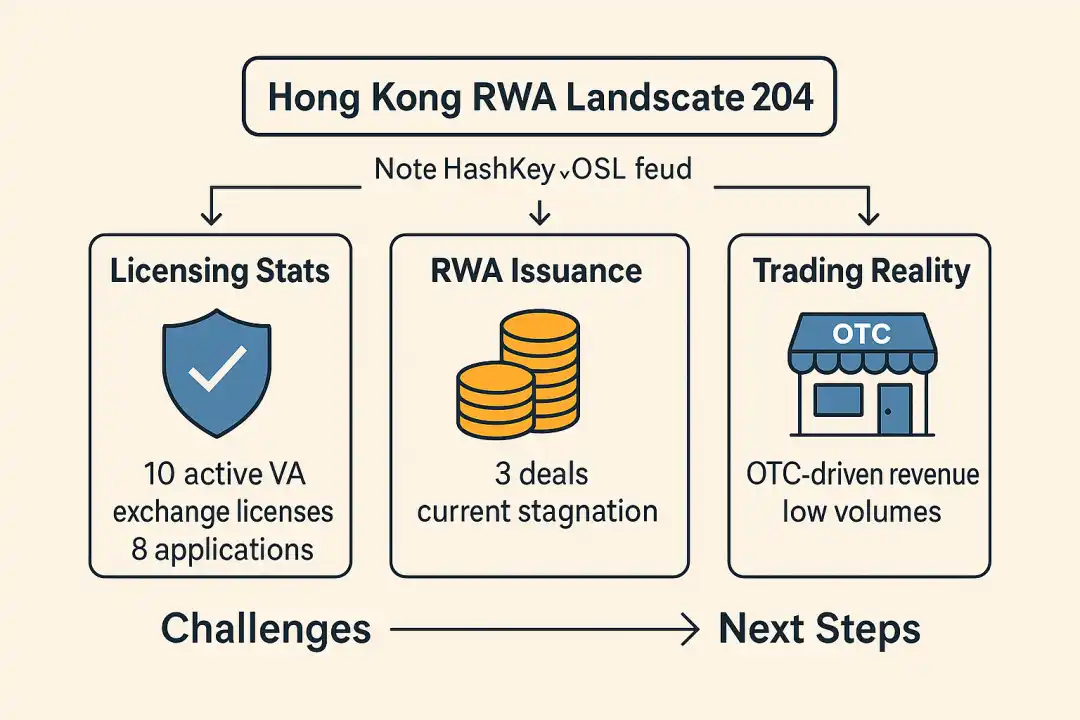

In the past few days, the media confrontation between HashKey and OSL has once again brought Hong Kong's virtual asset ecosystem into the spotlight: 10 licensed trading platforms have been issued licenses, and 8 are still in the queue, yet there are few that have truly generated traffic and depth. Even more embarrassingly, the highly anticipated RWA (Real World Assets) tokenization has stagnated after completing three trial transactions; most licensed platforms can only rely on OTC business to survive, with income barely making ends meet.

With the licensing benefits yet to be realized and product innovation struggling, Hong Kong's RWA route is facing a collective questioning of "where to go from here." Could this be a failed new financial pilot?

(ChatGPT generated image)

Core Conclusion First: The current RWA experiment in Hong Kong will not "fail," but if it continues to remain in the single-line thinking of "issuing bonds = financing," it will inevitably be squeezed by the standardization wave from Wall Street and the multi-layered capital networks of Southeast Asia. The only way out is to return to infrastructure, deepen the institutional market, amplify offshore advantages, and shape an Asia-Pacific on-chain asset hub.

01 First, Look at the Curve: The U.S. Steadily Climbs, Hong Kong Passively Ripens

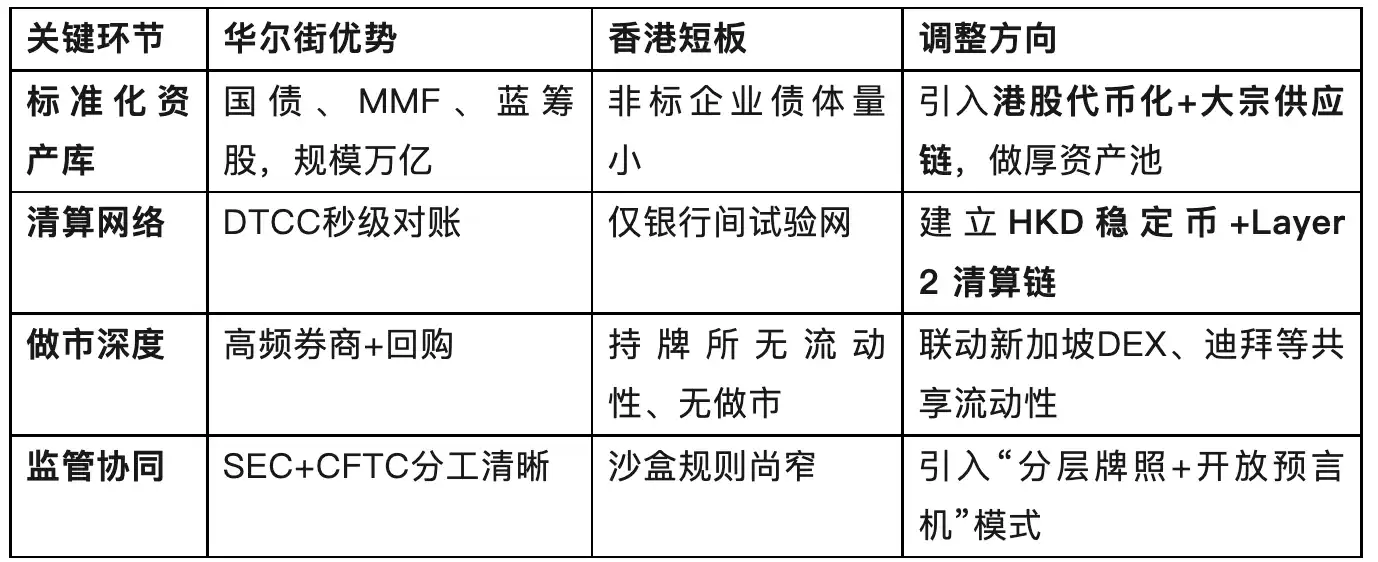

1. Wall Street (T-RWA Path): From Bitcoin spot ETF → U.S. Treasury tokenization → bank deposit tokenization → MMF tokenization → stablecoins → U.S. stock tokenization. All revolve around "reducing costs and increasing efficiency + not touching the existing stock," almost avoiding incremental financing and non-standard products.

2. Hong Kong Curve: Skipped the standardization phase and directly issued three non-standard corporate bonds in the sandbox, pushed to the forefront by tech companies and brokerages. The ripened RWA market currently lacks secondary liquidity, with new issuances stalled, having slid to the peak of expectation inflation.

Pain Points:

· Narrow Asset Side — Only accommodates quasi-new energy bonds, ignoring cash flow assets like logistics warehousing, AI computing centers, and precious metal mines;

· Expensive Funding Side — Dollar costs over 10%, project initiation at $30 million, deterring small and medium enterprises;

· Lack of Infrastructure — Public chains, custody, and Oracles rely solely on a single alliance chain;

· Market Education Deficiency — The asset side and funding side have yet to complete market education, third-party institutions like brokerages, auditing, and market makers are not yet systematic, while the RWA business of licensed trading platforms has not yet taken off, essentially relying on OTC to survive.

02 Why Can't "Copying Wall Street" Be Replicated?

Although Hong Kong is closely following Wall Street's lead, the data for ETFs shows that during a recent slump in BTC prices, U.S. ETFs saw a net inflow of $260 million; meanwhile, Hong Kong's ETF subscriptions and redemptions were zero during the same period.

Solutions (Three Steps)

1. Assets: Shift from single bonds to a diversified pool of "bonds + stocks + commodities + carbon credits."

2. Funding: Establish an offshore RWA mother fund, with HKD stablecoins/Crypto + HKD + USD running in parallel;

3. Infrastructure: Public chain Layer2 (HashKeyChain or WeBank) + HKD stablecoin + compliant custody, forming a 7×24 settlement network.

03 Offshore Financial Structure: Mainland Assets × Hong Kong Primary × Overseas Secondary × DeFi Subordinate

Do not be confused and polluted by various information channels; the path for high-quality mainland assets can only follow this offshore financial structure:

1. Asset Confirmation — Mainland SPVs package assets (precious metals, manufacturing, agriculture, AI computing data centers, logistics warehousing, etc.);

2. Primary Issuance — Hong Kong licensed brokerages + auditing pricing, private RWA Fund;

3. Secondary Liquidity — Singapore/Dubai secondary markets or ATS market making, speeding up USDT/USDC pools;

4. Subordinate/DeFi — On-chain AMM, staking collateral, opening up retail traffic.

This multi-layered capital market structure avoids single-point regulatory bottlenecks, allowing funds and assets to arbitrage across domains, which in turn feeds back into Hong Kong's primary market, forming a positive cycle.

04 Hong Kong Institutional Market: Debt is Just "Retirement Management," Don't Treat it as "Fundraising"

RWA is not just about bond financing, nor is it preemptive financing; good asset packages do not lack suitable funding sides.

The essence of debt is to serve long-term institutional holdings; if the asset pool is not broad enough, the secondary market will inevitably be barren.

What is truly lacking is not "people who can sell bonds," but rather the combination of brokerages + auditing that produces "diligent, transparent" high-quality asset packages.

Licensed trading platforms should transform into a market-making + research + community triad, rather than waiting for star projects to parachute in.

05 Agricultural RWA: From "Malu Grapes" to Rural Upgrading

The returns on high-value agricultural products are not low, and the policy regulatory tolerance is quite high.

Land confirmation difficulties → adopt equity SPV + agricultural REITs, avoiding touching the red line.

High-value crops (wild ginseng, traditional Chinese medicinal materials, agarwood, dried tangerine peel, etc.) + warehouse receipts/purchase long-term agreements → rights financing.

Rural cultural tourism + landmark brands on-chain → allowing global capital to buy "scenery + returns + ESG."

Agricultural RWA provides incremental stories, opening a new track of "green finance + rural revitalization" for Hong Kong.

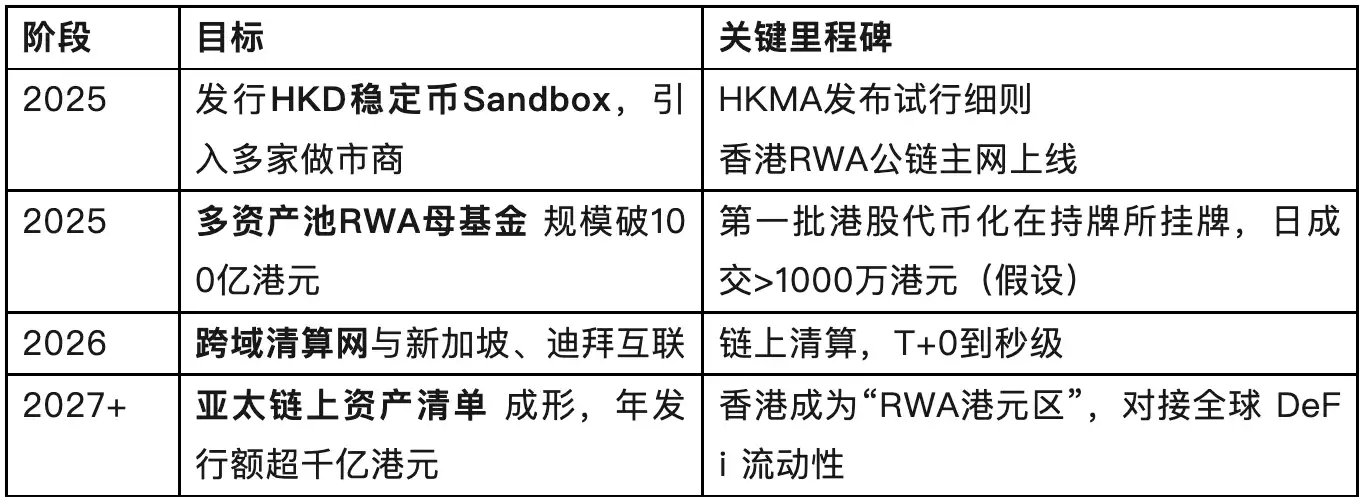

06 Infrastructure Strategy: Build an "Asia-Pacific On-Chain Asset List"

Use the thinking of Web3.0 infrastructure to build Web2.5's RWA infrastructure.

· HKD Stablecoin — Links to the internationalization of the RMB (reserve assets - offshore RMB), becoming the settlement anchor for HKD;

· Layer2 Public Chain — Carries Hong Kong stock tokenization and RWA infrastructure;

· Licensed Trading Platform Alliance DEX — Establish a liquidity alliance, share market-making depth, and connect Hong Kong stocks with crypto stocks;

· OTC & Custody — Connect offshore funds from institutional cold wallets, family offices, and financial institutions based in Hong Kong;

· DePIN + AI Agent — Abandon the erroneous path of "digitalization - on-chain - tokenization," and directly generate on-chain distributed assets based on infrastructure, forming a traceable distributed asset data network.

07 Future Roadmap: From "Copying Homework" to "Setting Exam Questions"

08 Conclusion: Hong Kong's RWA Will Not Fail, But the Path Needs Reconstruction

It is not the concept that fails, but the single-threaded "issuing bonds - financing logic." If Hong Kong wants to maintain its status as a new financial center in the RWA era, it needs to upgrade from "copying Wall Street" to a three-dimensional battlefield of "integrating mainland assets + offshore funds + on-chain infrastructure." When the HKD stablecoin, Layer2 settlement, and cross-domain ATS three-pronged approach take shape, Hong Kong will transform from a "follower" into an "Asia-Pacific on-chain asset hub," truly completing, deepening, and expanding the RWA story.

ARAW Always RWA Always Win!

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。