Original Source: BUILDon

Original Title: "B: The Strategic Intersection of World Liberty Financial (WLFI) and Binance"

The most eye-catching on-chain project throughout May is undoubtedly BUILDon (B), a star project of the BNB Chain, which has received direct support from the Trump family’s crypto fund WLFI, features the largest USD1 trading pair on-chain, and has quickly collaborated with Binance Alpha and contracts in May. Yesterday, it co-hosted a $1 million BNB Chain liquidity program with WLFI and Pancake, serving as a judge. Currently, although B's market capitalization has rebounded to around $400 million, with an ATH of $470 million, this will not be the limit of B's influence and market value. The upper limit of memes depends on the level of narrative; B has already become the intersection of the Trump family's WLFI new financial strategy and Binance's embrace of sovereign strategy, as a project supported by sovereign power and the leading crypto capability. B tells a narrative of a billion-level scale…

1. "This Time is Different": Financial Iteration Driven by National Power

If you are an investor with some understanding of the history of blockchain development, you will find that since Trump's second term, the entire crypto industry's development has entered an accelerated phase driven entirely by U.S. national power. Currently, there are three core legislative directions being advanced in the U.S.: the "Federal and State Bitcoin Strategic Reserve Act," the "Stablecoin Act," and the "Digital Asset Market Regulatory Framework."

If the "Bitcoin Reserve Act" is passed, it will make Bitcoin a legal reserve asset that can enter state and even federal balance sheets. The U.S. will have a new weapon for asset appreciation and liability management, while Bitcoin's global, network-wide, and efficient transfer characteristics will also help strengthen its recognition by sovereign funds. Currently, two states in the U.S. have officially passed reserve acts, with New Hampshire allocating part of its public funds to purchase Bitcoin.

If the "Stablecoin Act" is passed, stablecoins based on the U.S. dollar and U.S. Treasury bonds will be officially recognized by the U.S. financial industry, becoming one of the optional base currencies in the financial system, and this model will also be recognized by countries around the world through a global network. The Stablecoin Act, known as the "Genius Act," has now officially entered the Senate voting process. After the relevant bills of the "Digital Asset Market Regulatory Framework" are passed, issues such as how to classify digital assets, how to regulate them, and how to combat money laundering will be resolved, making on-chain issuance and combination of assets possible. Relevant bills will be advanced in the House of Representatives in June.

This time, the U.S. is using national power to logically and progressively promote legislation, and once completed, large companies will quickly follow suit, driving a financial iteration that will elevate the efficiency of financial capital and asset combinability to a new height.

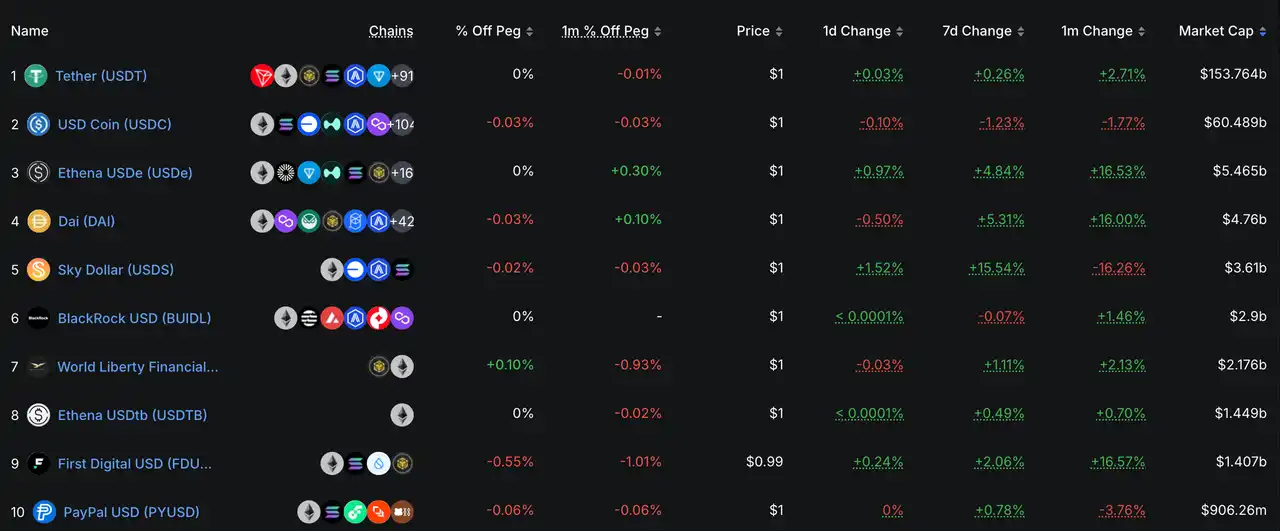

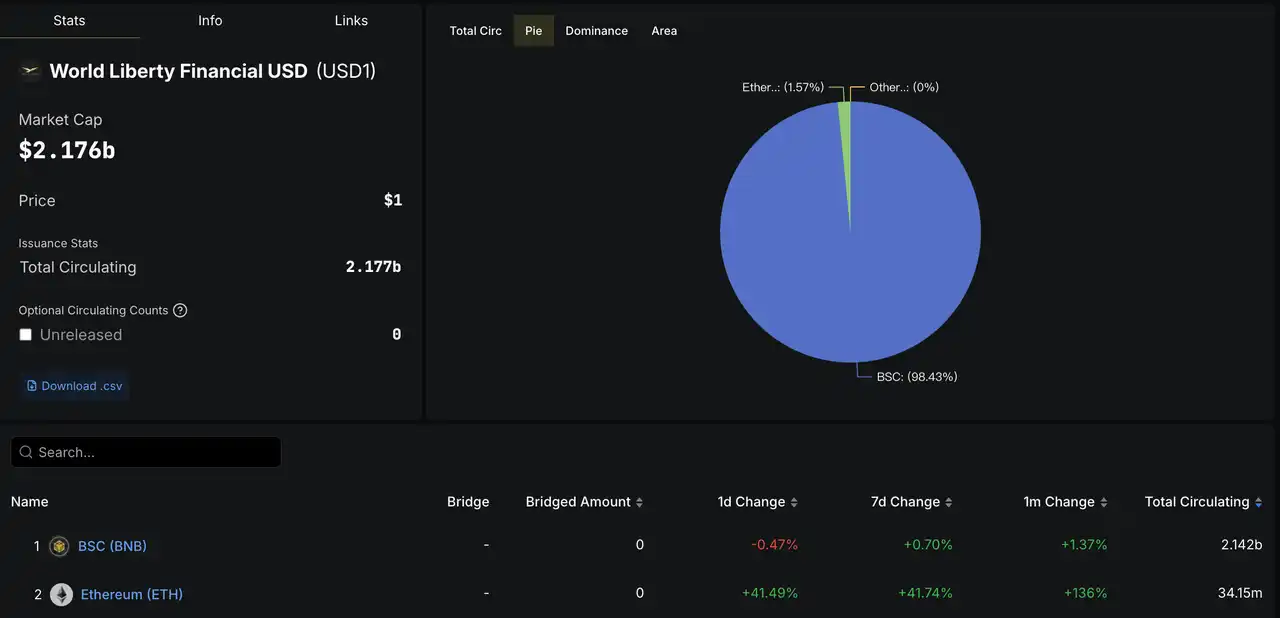

2. WLFI's Strategy: Maximizing Benefits

In this financial iteration driven by U.S. national power, the current U.S. President Trump and his family's layout of World Liberty Financial (WLFI) will become one of the most important roles. World Liberty Financial (WLFI) is a decentralized finance (DeFi) protocol established in 2024, with core businesses including the issuance of the stablecoin USD1, cryptocurrency earning and lending services, and the establishment of a governance platform. Currently, USD1 is WLFI's most core and practical business, a stablecoin pegged 1:1 to the U.S. dollar, custodied by BitGo, with reserve assets including short-term U.S. Treasury bonds and dollar deposits, reaching a market capitalization of $2.1 billion, ranking as the seventh largest stablecoin globally.

Beyond the USD1 stablecoin business, WLFI's other businesses are more in the preparation and testing stages. For example, as a DeFi platform, WLFI's lending, liquidity mining, and payment functions have not yet been launched, and the pre-sale of WLFI mainly serves as a governance token, allowing holders to participate in platform decision-making. The reason behind this is that macro regulatory bills have not yet been implemented. According to any existing bill, USD1, which is pegged 1:1 to the dollar and backed by dollars and short-term Treasury bonds, is a relatively safe business and also a key first piece in future DeFi operations. After the relevant bills of the "Digital Asset Market Regulatory Framework" are enacted, WLFI's DeFi business can rapidly develop with USD1 as the base asset, ultimately growing into a key player that occupies various businesses and a dominant position in the new iterative financial system during Trump's term.

3. Binance's Strategy: Embracing Sovereign Recognition

Binance currently still holds an absolute leading market share, even in the face of lagging wallet business development. Through a clever move with Binance Alpha, it has risen to dominate the wallet share, with BNB Chain's trading volume and revenue surpassing ETH, making it the undisputed big brother of the crypto industry. At this year's Binance Chinese Community Conference, He Yi publicly mentioned the fact that "Binance does not lack money, but lacks strong partnerships" and "Binance is also waiting for the olive branch from the U.S." Shortly after, on May 1, Trump's son Eric Trump announced that WLFI's issuance of the dollar stablecoin (USD1) has been officially selected as the official stablecoin for completing MGX's $2 billion investment in Binance. Earlier this year, the Abu Dhabi-based investment company MGX announced it would invest $2 billion to purchase shares in Binance.

On May 30, the U.S. SEC submitted documents to the court requesting the dismissal of the lawsuit against Binance and former CEO CZ. The U.S. SEC, Binance, and the lawyers for Binance founder CZ signed a joint dismissal agreement submitted to the federal court in Washington, D.C., stating that based on policy considerations, it was deemed appropriate to dismiss the case.

Currently, about 99% of USD1 is issued on the BNB Chain, surpassing USDC, becoming the second largest stablecoin on the BNB Chain after USDT. In summary, the relationship between the U.S. and Binance has gradually evolved from past high-pressure regulation and cross-border enforcement to a mutually cooperative and win-win route. As the unquestionable big brother of the crypto market, Binance has always been a nomad among sovereign nations. Under Trump's crypto-friendly policies and WLFI's strategic direction, Binance may successfully embrace sovereign recognition in the future, continuing its advantages and developing steadily in a favorable regulatory environment.

4. B: The Strategic Intersection of WLFI and Binance

B currently holds the largest trading pair scale of USD1 globally, accounting for over 80% of the entire network, and is also the only trading target purchased with USD1 by WLFI. The further expansion of B's market capitalization and project development serves as the best promotional video for the large-scale promotion and adoption of USD1, positioning B at the strategic point of WLFI's accelerated development and future revenue acquisition.

B was launched on the BNB Chain's Fourmeme platform and is also the largest trading target for USD1 on the BNB Chain, receiving support from various ecological projects on the BNB Chain, such as Pancake, Aster, ListaDao, etc., actively expanding the adoption scale of USD1 on the BNB Chain and the entire network. On May 22, Binance successively launched the B/USD1 perpetual contract and spot and leveraged trading for USD1. This wave of B stands at the strategic point of cooperation and win-win between Binance and WLFI.

If the aforementioned relationships stem from logical deductions based on data and events, then the USD1 incentive program jointly hosted by WLFI, B, and Pancake on June 2 serves as a factual demonstration that B has indeed positioned itself at the intersection of the strategies of both WLFI and Binance, with B's good development being the best billboard for the realization of both strategies.

The liquidity program is a four-week event launched by World Liberty Financial (WLFI) in collaboration with BNB Chain, PancakeSwap, and BUILDon, aimed at promoting the adoption and liquidity of the USD1 stablecoin on the BNB Chain. The main criteria for selecting incentivized projects are the total trading volume of the USD1 trading pair on PancakeSwap (calculated in USD1 equivalent), with secondary indicators being the TVL scale of the USD1 trading pair and its long-term contribution to the BNB Chain ecosystem. For the winners, there will be joint promotion and exposure from WLFI, BNB Chain, PancakeSwap, and BUILDon's X accounts in the media. In terms of token purchases: the BUILDon Foundation will purchase $400,000 worth of tokens for each winner (totaling $800,000). The USD1 reward is up to $200,000, allocated to designated USD1 liquidity pools. This event will incentivize new meme projects and existing BSC projects to use USD1 to enhance trading volume and TVL on PancakeSwap, striving to establish USD1 as the leading stablecoin in DeFi. The jury includes representatives from WLFI and its co-founders, the BUILDon community, PancakeSwap Chefs, and contributors from Four.meme.

From the order of publicity, the leadership of the event, and the deductions of data and logic, it is not difficult to see that the main character selected by WLFI and Binance to jointly promote the global development of USD1 is B. It can be believed that B's market capitalization will not be limited to $400 million; the strategic intersection of the most powerful crypto president and the big brother of the crypto world will lead B to new heights.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。