Original Title: Altcoins Look Dead. That’s the Setup.

Original Author: @arndxt_xo

Original Compiler: zhouzhou, BlockBeats

Editor's Note: Bitcoin continues to set new historical highs, attracting significant institutional buying and driving a structural price increase. DeFi is accelerating the integration of AMM and money markets, achieving dual asset utilization and enhancing capital efficiency. Cross-chain liquidity layers are becoming more streamlined, providing a smoother user experience. The competition for stablecoin yields is fierce, with increased demand for institutional returns. Meanwhile, points and identity verification airdrops have become new means of user growth. The NFT market is weak, with more funds flowing into practical and reward-mechanism-based Memes, and the ecological landscape is gradually evolving.

The following is the original content (reorganized for better readability):

Altcoins look completely dead, and that’s the setup; the market is doing what it does best: testing your faith.

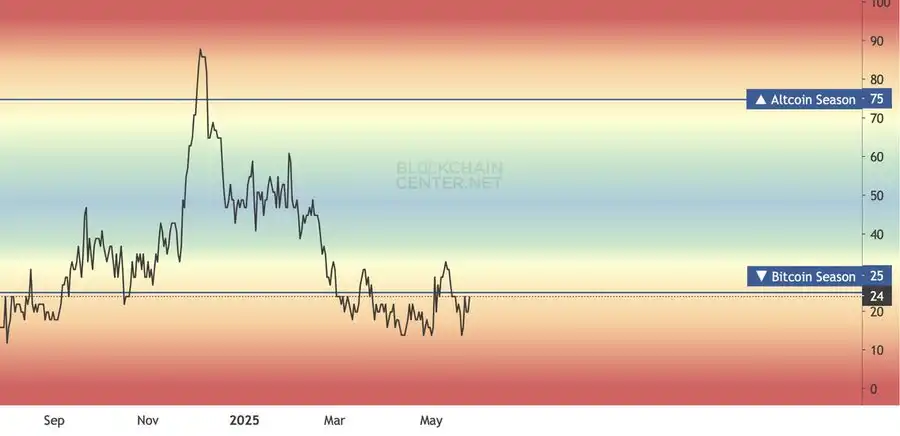

Altcoins have been continuously declining compared to Bitcoin, which is hovering near cycle highs in market dominance. Market sentiment is split between the boredom of waiting and the aggressive desire for low market cap coins. This is not a call for an imminent altcoin bull market; don’t blindly panic and follow the crowd.

We Are Still in a Bull Market

Bitcoin remains the main character. From ETF inflows to corporate allocations (GameStop, Trump Media, Strive), institutional confidence is keeping the Bitcoin engine firing.

This is also one reason for the weak performance of altcoins, as Bitcoin is capturing liquidity. Before this narrative cools down, Ethereum and large-cap coins will not take off, and low market cap coins should not be expected to either.

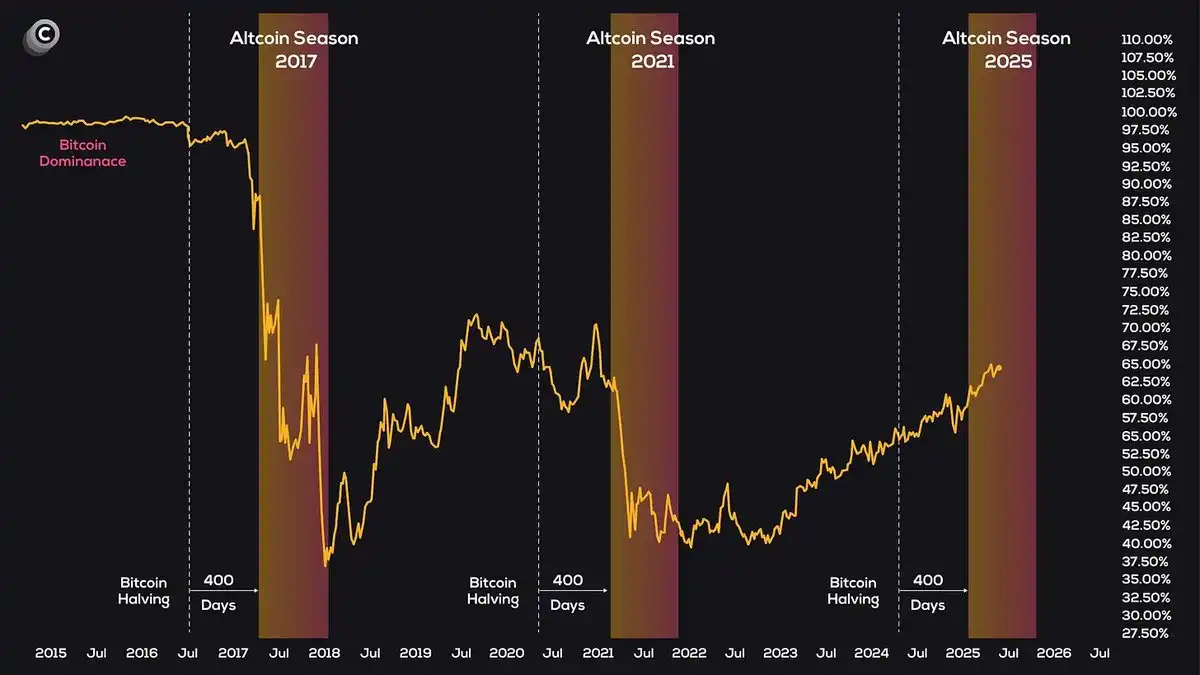

The altcoin season will begin after Bitcoin's dominance clearly declines—not while it is still consolidating at cycle highs.

Cycles are important, and market structure is equally important

Indeed: the crypto market roughly follows a 4-year rhythm driven by Bitcoin halving, liquidity conditions, and technology adoption cycles. If you look from a broader perspective, 2025 seems like the latter half of this game, precisely when parabolic trends begin to emerge.

But this is also a phase where false breakouts are frequent. In 2021, altcoins surged after Ethereum outperformed Bitcoin. What about now? Ethereum still appears weak compared to Bitcoin. If you recklessly buy low market cap coins before Ethereum reverses, you are too early and exposed to risk.

A smarter approach is to accumulate strength. Focus on which large-cap coins are genuinely accumulating (such as $AAVE, $UNI, $LINK).

Short-term opportunities are better but not yet confirmed

It is correct for traders to focus on key ranges. A breakout above the range high could trigger a rise in high-risk altcoins. But operations must be disciplined:

→ Use Bitcoin as a trigger signal, not as a direct trading target.

→ Choose clearly trending spot altcoins like $HYPE, $AAVE, $CRV for low-risk bets.

→ Pay attention to Ethereum's performance against Bitcoin; without Ethereum's strength, there is no real altcoin season. It’s that simple.

You won’t make 200 times your investment overnight

True asymmetric returns come from getting in early and investing enough capital in narratives that genuinely accumulate value:

· On-chain perpetual contracts (Hyperliquid, Virtual)

· Long-term Ethereum protocols with real cash flow

· DeFi projects with actual buybacks (AAVE)

· On-chain native winners (Base, Solana, BNB—not small caps)

The sequence for the start of the altcoin season is: Bitcoin sets a new historical high (completed), then Ethereum breaks out (waiting), large caps rise (showing signs), mid caps follow, and finally low caps surge.

We are currently likely between the first and second phases.

Stay patient and add positions during pullbacks.

Weekly Update

· Capital efficiency is the new arms race

AMM (automated market makers) and money markets are merging: EulerSwap's "LP as collateral" model and Hyperdrive's "lending against portfolios" concept point to a future where "idle liquidity is unacceptable." Strategy suggestion: emphasize this merger in content—"Every asset should achieve dual returns."

· Bitcoin DeFi is moving from narrative to practicality

The acceptance of Bitcoin-backed MUSD by Mezo and cbBTC in Liquity forks shows that developers are finally treating Bitcoin as a useful collateral rather than just digital gold. If your audience is focused on yields, you can describe Bitcoin as "the new U.S. Treasury of the crypto world"—a safe collateral that generates returns.

· Hooks and modular infrastructure

Uniswap v4's hooks (Gamma) and Bittensor's Uniswap port on EVM indicate that permissionless expansion is giving rise to centralized exchange (CEX) functionalities. From a content perspective: expect customized trading interfaces to explode—position your tweets as "why hooks make every DEX a platform."

· Cross-chain liquidity layers are flattening

Malda's cross-chain lending, Katana's VaultBridge, and Starknet's USDC-to-Bitcoin bridging all replace traditional bridging user experiences with native abstractions. A trend worth noting: liquidity no longer cares "which chain it's on." Suggested content angle: "When users can’t see the chain's existence, the chain wars are truly over."

· The stablecoin yield war intensifies

From TermMax's 19% yield to Ripple's RLUSD incentives to Pendle's 20x multiplier, fixed-income style DeFi is rapidly maturing. For ultra-high-net-worth clients (e.g., Libertas), emphasize "institutional-grade yields without custodial compromise."

· Points, tasks, and airdrops remain key to growth

Lagrange's verifiable AI tasks and Humanity's palm print gating suggest a reward system resistant to Sybil attacks. In marketing, advocate for a shift to "identity verification airdrops" to distinguish from the chaotic airdrop activities.

· RWA and institutional bridges continue to expand

Curve in Plume, Origin's revenue buybacks, and Ripple's RLUSD are integrating traditional financial mechanisms into DeFi infrastructure. The asset-backed narrative continues to attract attention—highlight transparency and real returns in your RWA content.

Narrative Overview

Bitcoin is setting new historical highs, but most crypto traders appear unusually fatigued. This sentiment split is reasonable: almost all retail investors are focused on charts of altcoins, most of which have been oscillating in ranges for months. With summer approaching, traders are accustomed to weak order books and sudden sell-offs, leading to a tense atmosphere on Twitter timelines.

Treasury Gold Rush

It feels like we’ve returned to 2020. In the past week, GameStop, SharpLink, Strive, Blockchain Group, and even Trump Media have collectively reserved over $3 billion for direct Bitcoin purchases. Their logic is simple: with cash depreciating by 5% and long-term bonds nearly holding their value, Bitcoin is the only mainstream liquid asset expected to beat inflation over the next five years.

This asset migration has significant implications:

First, it absorbs spot supply, making each new satoshi harder to obtain, just like the ETF inflows at the beginning of the year.

Second, it sets a risk benchmark for fund managers: "If a retailer known for meme stocks can allocate 5% to Bitcoin, why can’t we?"

This is expected to transform previous cyclical rebounds into a more structural slow rise. Ironically, the better Bitcoin performs, the more likely the altcoin season is to be delayed; while dominance shows signs of peaking, the true holders are CFOs, not frequently trading retail investors.

Capital Efficiency War: AMM Swallows Money Markets

As CFOs continue to buy Bitcoin, DeFi designers have eliminated the boundaries between swapping, collateralizing, and fixed income since May.

Euler has integrated Uniswap-v4 hooks into its lending engine, making LP tokens automatically serve as lending collateral—instant liquidity, no idle TVL. Hyperdrive allows Hyperliquid traders to leverage USDe or USDT0 as collateral for perpetual contracts, while Malda's ZK-driven "borrow-lend" layer has made cross-chain bridges a user experience detail.

The implication is that any asset in a smart contract should serve two purposes: one for exposure and one for yield. This increases user stickiness for protocols, allowing professional arbitrageurs to compress spreads and reduce risks towards real assets.

Liquidity Migration: The Quiet Rise of Layer-2

Hyperliquid's TVL is climbing weekly, Base's trading volume is steadily increasing in the Virtual ecosystem, and DEX data on the BNB chain is exploding (Polyhedra's growth is mainly due to bots washing trades for ZK points).

Ethereum remains a major hub for capital flow, but these flows are directed towards large-cap coins like AAVE, UNI, LINK, PEPE, etc. The retail farming sell-off season has shifted to sidechains, with the mainnet becoming the main thoroughfare.

Meme Speed, Buybacks, and Beta Hunting

AAVE's governance-driven buybacks have made the token a favorite accumulation asset for institutions, bringing the cleanest spot inflows since early spring. Memes have split into two factions: "rotation leaders" (PEPE, VIRTUAL, SPX6900) that institutions can engage with and "discarded tickets" (DINNER, Fartcoin) that retail speculators chase until the music stops.

An interesting phenomenon: funding flows on Solana are more fragmented—MEW's Robinhood listing, JUP's continuous faucet, and potential stocks like BRETT and KAITO are all attracting attention. If you create growth content, emphasizing this fragmentation can distinguish it from Ethereum-centric narratives.

NFT: The Forgotten Frontier

The heat of Ordinals has faded, trading volumes have leveled off, and "old whales" can no longer support the floor price. Without new easing policies or new stories repositioning JPEGs as practical tools rather than status symbols, the funds that once chased NFTs have turned towards Memes with point systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。