Original Title: My Takes on the Value of Attention

Original Author: @Punk9277

Original Translation: zhouzhou, BlockBeats

Editor's Note: In the era of attention economy, attention itself has value, but its value depends on factors such as retention, consensus, and content quality. Kaito transforms attention into users, capital, and markets through products like Yaps, Earn, and Capital Launchpad. In the future, Kaito will break the information cocoon and build a fairer InfoFi network, achieving data sovereignty and monetization for all.

The following is the original content (reorganized for better readability):

My views on the "value of attention." Recently, I've seen many debates about whether "attention really has value," both in the crypto space and other industries.

Here are some of my perspectives, along with the role Kaito plays in this:

Does attention really bring value?

"First-time entrepreneurs are obsessed with the product, while repeat entrepreneurs focus on distribution channels." — @justinkan

For today's consumer products, "distribution" is often closely related to "attention"—whether it's screen time or share of voice.

The value of attention extends far beyond the crypto industry; it is crucial in broader fields as well.

Many times, a decent product may have few users, while an average product can achieve widespread adoption simply because its distribution is more effective.

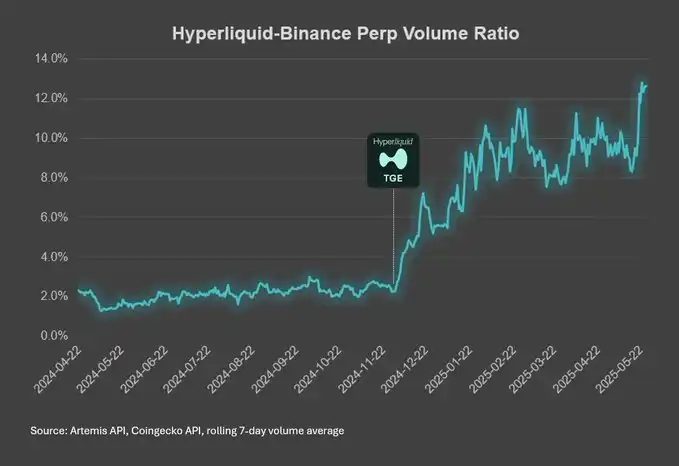

The same is true in the crypto space: even the best product can significantly accelerate growth with the support of attention—we have already seen examples of hyperliquid's market share skyrocketing since its TGE (Token Generation Event).

Since attention can bring value, can it also drive valuation?

1. For non-meme projects, my framework suggests an indirect relationship between attention and valuation through user growth and investor education:

· Attention → User growth → Stronger fundamental data → Potential token purchases

· Attention → Investor education → Potential token purchases

This is essentially a standard operating model for publicly listed companies in traditional financial markets:

· The marketing department is responsible for reaching the "top of the funnel" → User conversion

· The investor relations department is responsible for investor education

In the crypto space, the value of attention is even higher for two reasons:

· Users are often also token holders; converting users also converts investors

· Under speculative sentiment, attention itself carries a "premium"

2. However, for meme coins, this traditional funnel model does not hold.

So I prefer a simpler valuation model:

Attention × Narrative (= Fundamentals × Multiple)

· With the same attention, different narratives can lead to significant valuation differences

· Under the same narrative, whoever garners more attention can compete for a higher valuation

I won't comment on specific projects, but simply put: attention is very important, but not all "value" of attention is the same.

The role of attention building before and after TGE

- Before TGE (Token Generation Event):

Since TGE usually comes with a lot of incentive mechanisms, the unit value of attention is very high:

· Leverage brand recognition and user education to convert as many airdrop users into real users as possible

· Communicate the investment logic of the project to as many potential investors as possible

- After TGE:

· Building attention is especially important for new product launches and new investment narratives

· However, most brands will continue to operate attention, which is crucial for user acquisition/retention and capital markets—similar logic to traditional publicly listed companies

About the relationship between Kaito and the value of attention

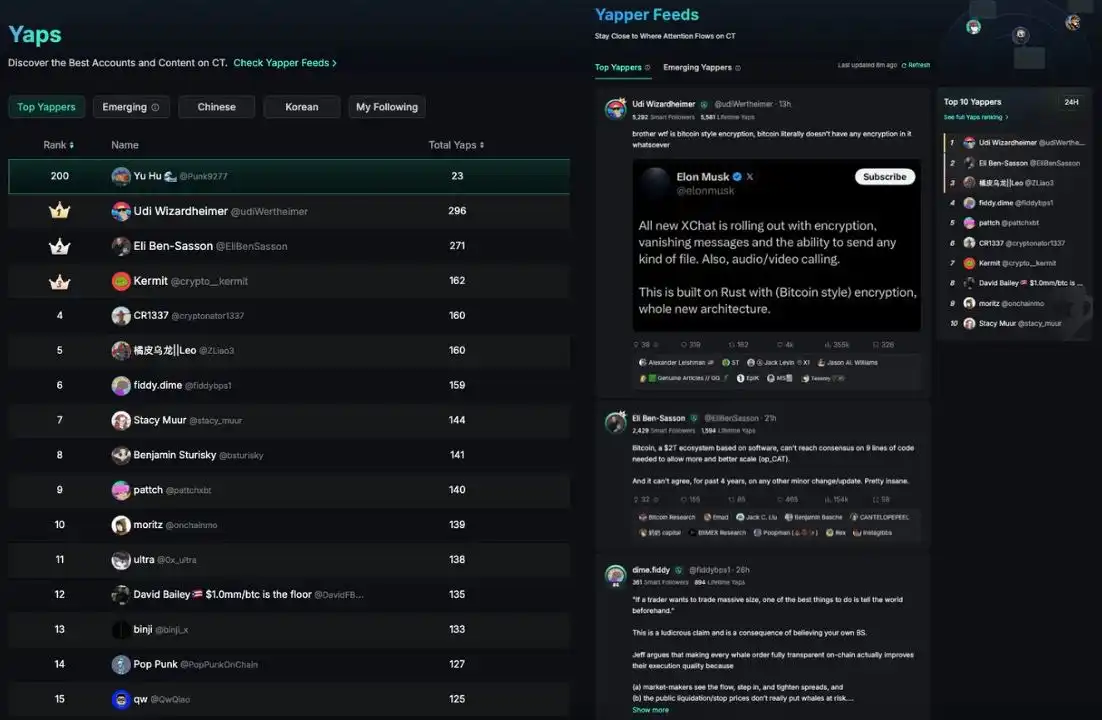

Some believe that Yaps (the discussion module launched by Kaito) may encourage "noise/low-quality" content.

But from the real-time Yaps rankings, the actual situation is quite the opposite: high-quality discussions are always mainstream.

For example, in the past 24 hours, the top 3 Yaps by growth were:

· @udiWertheimer sparked widespread discussion about Musk's comments on crypto communication

· @EliBenSasson criticized Bitcoin's inability to achieve OP_CAT

· @fiddybps1 rebutted Jeff.hl's view that Hyperliquid's transparent trading mechanism favors large holders

This is different from the rankings of each yapper. The rankings are determined by the project team based on what type of discussions they reward, such as whether the content is insightful, emotional inclination, alignment with project direction, etc.

A key point to recognize about "attention" is—who it comes from and in what form is important.

For instance, some projects want to amplify their voice as much as possible, like Loudio, so their chosen algorithm leans towards "casting a wide net" rather than content quality or depth.

Conversely, some projects focus more on concentrated, in-depth discussions around a specific product, like Infinex.

Kaito's role is to customize support directions for different projects. In doing so, it also benefits users: whether it's project education or brand recognition—you can see the project's positioning from what they are willing to incentivize/recognize in terms of content.

Completing "Attention Transformation" through Kaito

Kaito is not just an "attention machine." In addition to Yaps, we also have:

· From attention → User conversion: Kaito Earn

· From attention → Capital conversion: Capital Launchpad

· From attention → Market formation: Coming soon, stay tuned

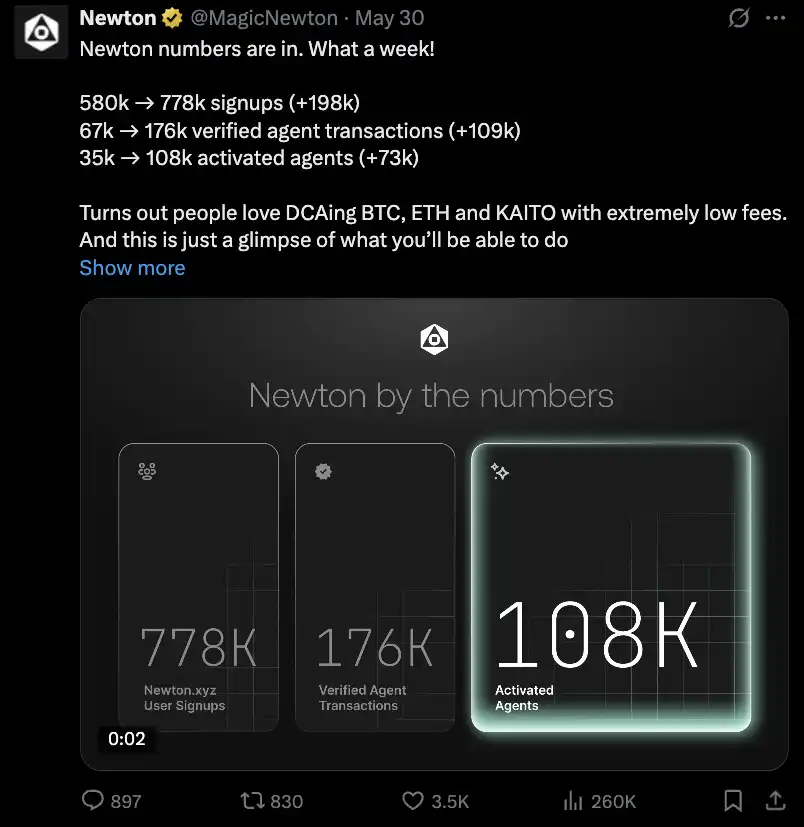

Since May, the launch of Kaito Earn has allowed us to start making deep efforts in user conversion, relying on our high-quality, highly engaged user base.

Last week we announced that Kaito has activated 33,699 smart agents, accounting for about one-third of Newton's activity. These agents have actually deployed funds, dollar-cost averaging into BTC, KAITO, and other tokens, and have generated real transaction fees.

We are also collaborating with Infinex and other projects in similar ways.

Soon, with the launch of Capital Launchpad, Kaito will bridge AI analysis and capital formation, optimizing long-term consistency, value contribution, and coverage.

Conclusion

In the "attention economy," attention itself is a form of value.

However, it is important to emphasize that the value of attention is layered; it depends on:

· Retention

· Consensus

· The content or product it is attached to

· Content quality

· And several other dimensions

The world is moving in a clear direction:

· Influencers who control attention will control monetization capabilities

· Tech platforms that control screen time will control distribution rights and user data

This is why today's brands (and entrepreneurs) need to have a social presence.

Rather than resisting this trend, it is better to leverage it—we in this industry actually have the ability to build a new network structure that is fairer and empowers more people.

This is my vision for InfoFi: empowering the public to monetize by unlocking three pillars:

· Data sovereignty and data monetization

· Market mechanisms as the closest force to the truth

· Information markets as the most decentralized and democratic way of expressing viewpoints

Let us continue to push boundaries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。