Original Author: Thejaswini M A

Original Translation: Block unicorn

Introduction

In the past five years, the United Arab Emirates (UAE) has built an impressive digital empire: processing $30 billion in cryptocurrency transactions annually, hosting over 700 blockchain companies, and attracting the world's largest cryptocurrency exchanges to establish their headquarters in Dubai.

The empire is built on resources, and the resource that the UAE's digital empire relies on is more valuable than oil: the tax obligations of others.

Changpeng Zhao, the founder of Binance, worth $33 billion, resides in Dubai.

So do executives from dozens of other large cryptocurrency companies, who have found a significant advantage in operating multi-billion dollar digital asset businesses in the UAE: they can retain more wealth.

The story of the UAE's digital transformation is a model of economic strategy.

While other countries are still debating cryptocurrency regulation, the UAE has already begun building infrastructure.

While competitors impose restrictions, Dubai offers clear rules.

While traditional powers hesitate, Abu Dhabi has invested billions of dollars.

Behind the narrative of innovation lies a simpler truth: the UAE has created the most sophisticated tax haven in the cryptocurrency space, cloaked in the guise of regulatory legitimacy, and has the world calling it "digital leadership."

What does this mean for the future of global finance?

Grand Entrance

Imagine this: in 2020, most governments were still debating whether cryptocurrency was a scam.

The UAE looked at its oil reserves, then at Bitcoin, and thought, "Why not have both?"

Fast forward to 2025, the UAE has executed the most successful national cryptocurrency strategy in history.

They have transformed from an oil-dependent economy to a powerhouse of digital assets.

By 2024, 30% of the population holds cryptocurrency

Annual cryptocurrency transaction volume exceeds $30 billion

Dubai alone has over 700 blockchain companies

Ranks among the top 40 globally by on-chain transaction value

The third largest cryptocurrency economy in the Middle East and North Africa

This is not just a retail market frenzy.

The UAE's sovereign wealth funds have invested billions of dollars.

Mubadala: $408.5 million invested in Bitcoin ETF

MGX Fund: $2 billion invested in Binance (using Trump's stablecoin, which is a bit odd for 2025)

A $30 billion AI infrastructure fund established in partnership with Blackstone and Microsoft

When your government buys Bitcoin ETFs and your sovereign wealth fund heavily invests in the world's largest cryptocurrency exchange, you know some fundamental changes are happening.

Let's Analyze

Regulatory Innovation: In March 2022, Dubai launched the Virtual Assets Regulatory Authority (VARA) — the world's first independent regulatory body specifically designed for virtual assets.

Not a committee, not a working group, and not a bunch of suited individuals learning on the job, but a truly authoritative dedicated cryptocurrency regulatory body.

Achievements of VARA in just three years:

Issued licenses to major global exchanges like Binance, Bybit, OKX, Crypto.com, and Bitpanda

Created an activity-based regulatory framework (rather than a "one-size-fits-all" rule)

Established clear guidelines for everything from staking to tokenization

Set compliance deadlines that companies actually adhere to (e.g., the deadline for updating rules is June 19, 2025)

Meanwhile, Abu Dhabi has created its own complementary framework through the Abu Dhabi Global Market (ADGM), focusing on institutional-level digital assets.

What’s the result? A dual-emirate model covering both retail and institutional markets.

Infrastructure Investment: The UAE has not only changed regulation — they have also built actual infrastructure:

Dubai AI and Web3 Park: a physical ecosystem for blockchain innovation

Sigma Capital established a $100 million blockchain startup fund

According to Tracxn, the park hosts 977 blockchain companies

The largest AI park outside the U.S. (located in Abu Dhabi)

Banking Integration: Zand Bank became the first digital-only bank to obtain a VARA custody license, now serving nearly all VARA-licensed virtual asset service providers.

They are the bridge between traditional banking and digital assets.

Meanwhile, the central bank approved Coin AE — the first stablecoin backed by the UAE Dirham — demonstrating their serious commitment to digital currency at the national level.

Practical Applications

Real Estate Tokenization: Dubai has just launched the first licensed tokenized real estate project in the Middle East and North Africa. For just 2,000 Dirhams ($545), anyone can purchase partial ownership of a Dubai property. The Dubai Land Department has even initiated a project to provide RWA tokenization for real estate registration.

Government Cryptocurrency Payments: Dubai announced a partnership with Crypto.com to accept cryptocurrency payments for government services. Parking fees, utility bills, license renewals — all fees can be paid with cryptocurrency and automatically converted to Dirhams.

Cross-Border Payments: In May 2025, Ripple launched a cross-border blockchain payment service in the UAE through partnerships with Zand Bank and Mamo.

AI Integration: Bold Technologies in Abu Dhabi has just announced a $2.5 billion AI-driven smart city platform called Aion Sentia Cognitive City.

The Mathematics of Escape

The UAE's appeal begins with an undeniable mathematical principle.

Companies do not pay capital gains tax, cryptocurrency gains are exempt from personal income tax, and businesses with annual income over $102,000 only pay 9% corporate tax. Cryptocurrency transactions are completely exempt from VAT.

In contrast, in the U.S., cryptocurrency gains are subject to capital gains tax of up to 37%, companies must pay 21% federal tax plus state tax, and regulatory uncertainty increases compliance costs, potentially amounting to millions of dollars annually for large exchanges.

For example: if Coinbase moved to Dubai tomorrow, based on its projected net income of $1.3 billion in 2024, it could theoretically save over $250 million annually just in taxes.

But the mathematical principle only works if one can actually operate in Dubai.

This is where the relevance of the UAE's regulatory strategy lies — not because it is particularly innovative, but because it provides legal certainty that other jurisdictions lack.

Dubai's Virtual Assets Regulatory Authority (VARA) has issued licenses to Binance, Bybit, OKX, Crypto.com, and Bitpanda. These companies can operate legally under clear rules, which is surprisingly rare in the cryptocurrency industry.

Regulatory Arbitrage

VARA represents a different approach to cryptocurrency regulation: cooperation rather than confrontation. Instead of viewing cryptocurrency companies as potential criminals, VARA collaborates with them to establish a compliance framework.

This stands in stark contrast to the U.S., where regulatory agencies often communicate through enforcement actions rather than guidance. The Securities and Exchange Commission (SEC) has been embroiled in litigation for years over whether certain crypto assets qualify as securities, while VARA simply defines categories and licensing requirements.

What’s the practical outcome? Large cryptocurrency companies can obtain legal certainty in Dubai, while their competitors grapple with regulatory uncertainty in larger markets.

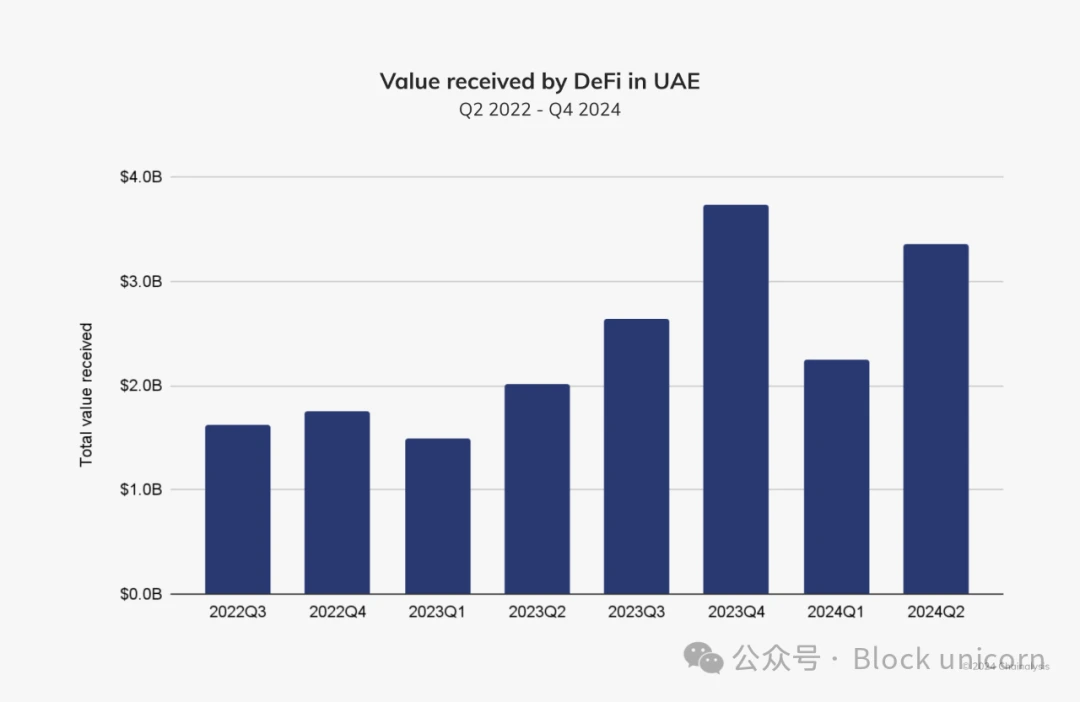

As of 2024, Dubai has over 700 blockchain companies. The UAE ranks third in cryptocurrency trading volume in the Middle East and North Africa, with decentralized finance (DeFi) activity growing by 74%.

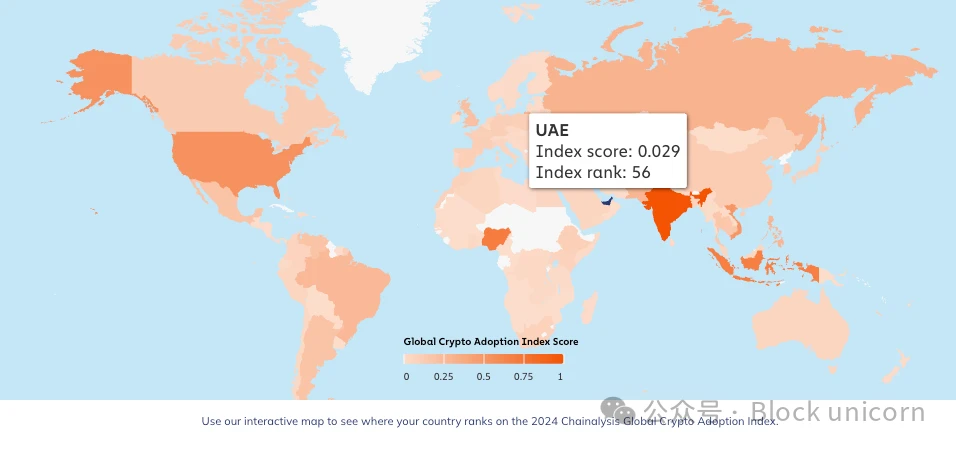

However, according to Chainalysis's 2024 report, the UAE ranks only 56th in global cryptocurrency adoption, while the U.S. ranks 4th.

The U.S. processes $1.3 trillion in cryptocurrency transactions annually — over 40 times the volume of the UAE.

U.S. companies dominate cryptocurrency development, with 19% of global cryptocurrency developers based in the U.S., while the UAE's share is negligible.

Wealth concentration reflects a similar story.

The total wealth of the 17 cryptocurrency billionaires globally is $93 billion, most of whom are in the U.S., including Chris Larsen (Ripple), Brian Armstrong (Coinbase), and Michael Saylor (MicroStrategy).

The UAE's contribution mainly comes from Changpeng Zhao.

The UAE has built impressive infrastructure for cryptocurrency businesses, but core innovation still occurs elsewhere?

Stablecoin Sovereignty Experiment

The UAE's stablecoin strategy showcases both opportunities in its development approach and inherent contradictions. The UAE Central Bank approved the first stablecoin backed by the UAE Dirham (AED), AE Coin, thereby bridging the gap between UAE currency and the global cryptocurrency market.

More controversially, Abu Dhabi's MGX Fund used Donald Trump's USD1 stablecoin for its $2 billion investment in Binance. This choice highlights the UAE's strategy: maintaining neutrality through collaboration with those in power.

This pragmatic approach raises questions about the UAE's long-term positioning. Building financial infrastructure around politically connected assets may yield short-term advantages but could also lead to long-term dependency.

The UAE's so-called dominance in the cryptocurrency space stems from its successful hosting of industry events. Dubai's Token2049, various blockchain summits, and regular cryptocurrency conferences create the impression of a thriving local event scene.

These events attract global participants and generate positive coverage, but they do not necessarily reflect underlying economic activity.

The UAE has become very skilled in cryptocurrency marketing, but this should not be confused with cryptocurrency development.

Our Perspective

The success story of the UAE in the cryptocurrency field essentially lies in arbitrage — regulation, taxation, and geography. They have identified inefficiencies in how other countries handle digital assets and established corresponding systems to seize the opportunities that arise. However, this approach has its limitations. As the market matures and inefficiencies are corrected, arbitrage opportunities will eventually disappear.

The UAE's advantages depend on other countries maintaining suboptimal policies, which may not last forever. What will happen if tax advantages disappear, or if the regulatory clarity of other jurisdictions becomes comparable?

The model heavily relies on attracting foreign companies and talent rather than developing domestic capabilities. If global tax coordination efforts succeed, or if major economies like the U.S. achieve regulatory clarity, the UAE's competitive edge may quickly vanish.

That said, in the broader global geopolitical landscape, 25 years of political stability is undoubtedly significant.

The UAE also demonstrates something valuable: how quickly a jurisdiction can adapt to new technologies when it chooses to act decisively. While other countries have spent years debating cryptocurrency policy, the UAE simply implemented a framework and learned from experience.

They have built real infrastructure and expertise, providing some protection against this scenario. VARA's regulatory framework, the concentration of cryptocurrency businesses, and the growing developer community create network effects that go beyond tax advantages.

The regulatory clarity and tax advantages driving the UAE's cryptocurrency growth are not sustainable forever. Ultimately, major economies will offer similar benefits to retain their own cryptocurrency businesses. When this happens, the UAE will need to compete based on innovation and infrastructure rather than arbitrage.

The test of the UAE's cryptocurrency strategy is not whether it can attract companies fleeing unfavorable regulatory environments, but whether it can retain those companies when those regulatory disadvantages disappear.

Currently, large-scale relocations are still ongoing. Cryptocurrency executives are packing their bags for Dubai, drawn by clear rules and favorable taxes.

Whether they are building the future of finance or merely optimizing their tax bills largely depends on what they do once they arrive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。