The rebound in digital assets since early April has been marked by a significant shift in activity, with Asian trading hours gaining market share in global bitcoin BTC, ether ETH and solana SOL spot trading volumes, while the U.S. steadily loses ground.

The U.S. trading hours' share of the spot volume in the three major tokens has dropped below 45% on a 30-day simple moving average basis, having peaked at an all-time high of over 55% at the beginning of 2025, according to data tracked by institutional crypto prime brokerage firm FalconX. The latest reading is the lowest since pro-crypto Donald Trump's victory in the November presidential election.

Meanwhile, Asian trading hours now account for nearly 30% of global activity, with Europe accounting for the remainder.

Slower activity during the U.S. represents a change in investor mix driving the price action, according to FalconX.

"It may point to increased influence from non-U.S. portfolio flows or suggest that U.S. investors are focusing more on markets beyond spot crypto," FalconX's Head of Research David Lawant said in a note shared with CoinDesk.

Bitcoin, the leading cryptocurrency by market value, has surged 40% to $105,000 since hitting lows under $75,000 in early April, according to CoinDesk data. Ether and solana have surged 87% and 68%, respectively, during the same period.

Low-volume BTC rally

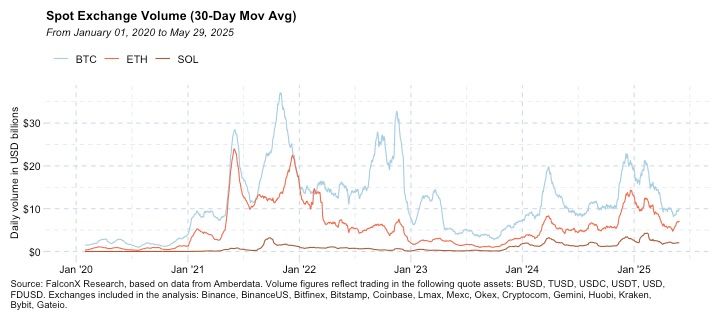

Although bitcoin's price has surged to new highs, global spot trading activity hasn't yet recovered to levels seen early this year.

According to FalconX, daily volume in BTC spot markets, which averaged over $15 billion on a 30-day rolling basis after the November election, declined during the April sell-off and has since held below $10 billion.

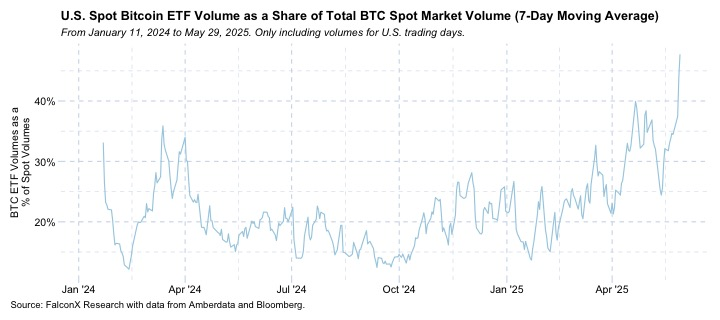

A low-volume rally is often viewed as a bear trap. However, that's not necessarily the case this time, as ETFs have recently gained popularity as investment vehicles.

According to FalconX, the cumulative volume in the 11 U.S.-listed spot bitcoin ETFs has surged from approximately 25% of the global spot BTC market volume to a record 45% in under two months.

The spike in ETF volume stems mainly from bold directional bets rather than non-directional arbitrage bets like the cash and carry trade, involving a long position in the ETF and a simultaneous short position in the CME BTC futures.

The 11 spot ETFs have amassed $44 billion in net inflows since inception in January 2024, according to data source Farside Investors. BlackRock's IBIT, the largest of them all, attracted $6.35 billion in May, the most since January 2025, indicating growing institutional demand for BTC amid trade tensions and bond market jitters.

"All of this points to room for growth and suggests that ETFs are likely to remain a major force behind demand in this rally," Lawant said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。