Original Title: "Revealing 'Alpha Gold Digger': The Public Chain Keeta Network Invested by Former Google CEO Eric Schmidt: Integrating Traditional Finance, RWA…"

Original Author: DaFi Weaver, BlockTempo

Keeta Network Introduction

· Overview of Technical Highlights:

High-performance transaction processing

Anchor - High interoperability

Built-in compliance

Native tokenization

Digital identity

Private sub-network (Sub Network)

· Token Economics

· Team and Funding

· Conclusion: Is the Ripple Killer Here?

Since this week, altcoins have generally rebounded, with most tokens on foundational chains strongly bouncing back from their lows, and trading volumes surging, particularly for AI-related tokens. However, Keeta Network stands out not as an AI token but as a brand new L1 public chain, gaining attention even before its testnet launch due to investments from former Google CEO Eric Schmidt, with the token $KTA showing impressive trading volume and price increase.

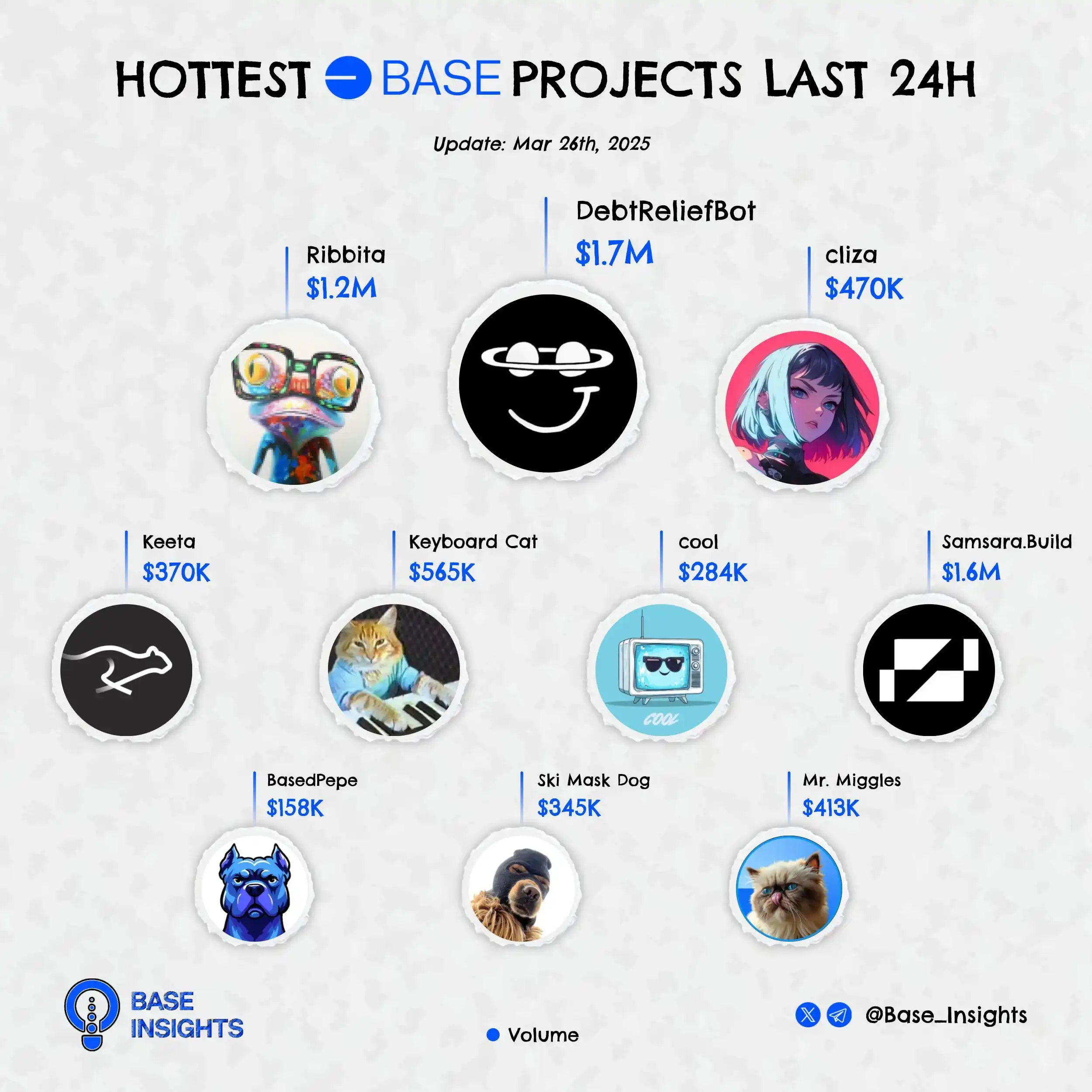

The token with the highest trading volume on the Base chain in the past 24 hours. Source: @ Base_Insights

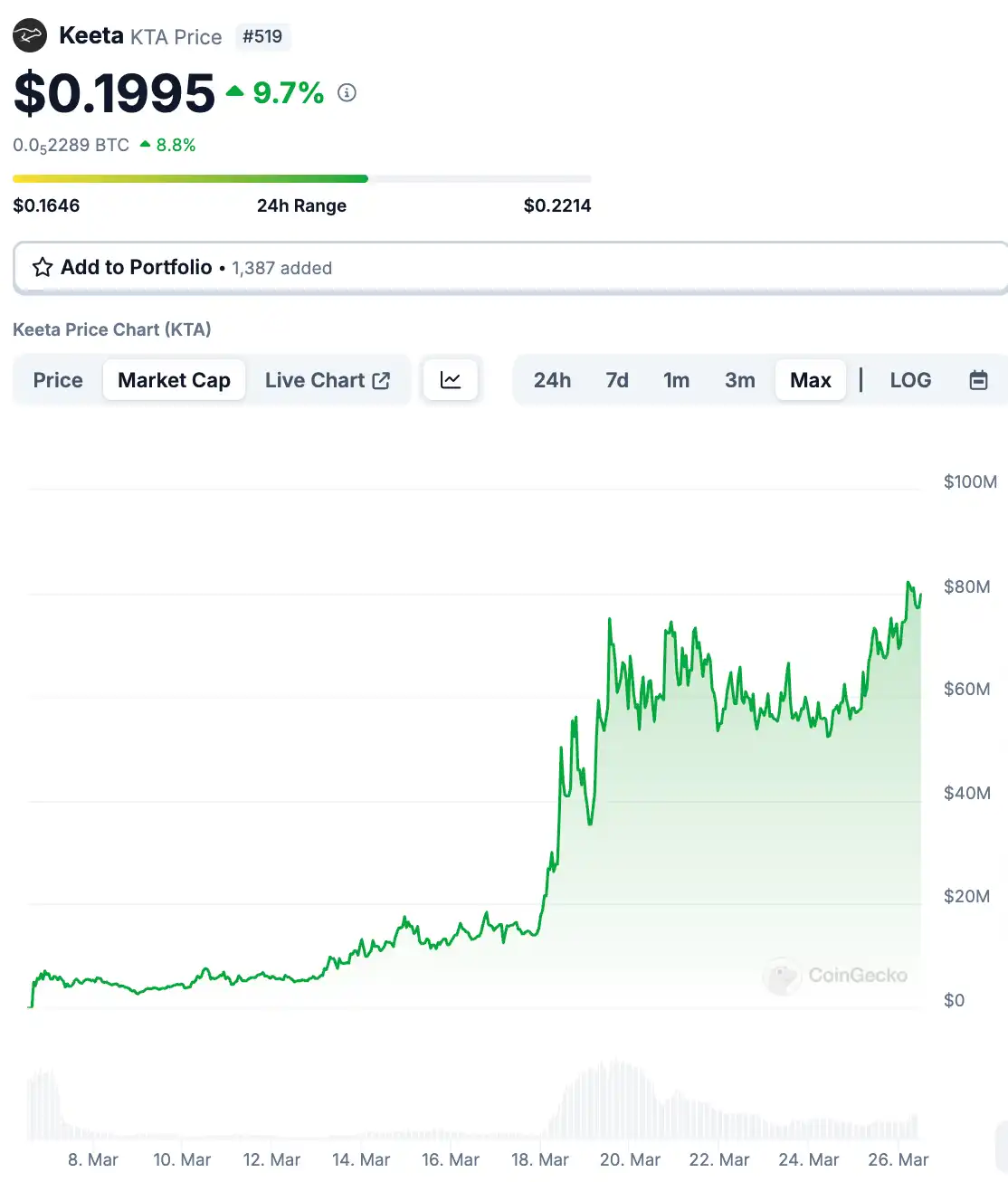

According to Coin Gecko data, $KTA has been on a continuous rise since its issuance on March 6, with a significant increase starting on the 18th, showing almost no severe corrections. Yesterday (25th), $KTA reached an all-time high of $0.2214, with a market cap exceeding $88.5 million, rising about 10% in the last 24 hours and over 13 times in the past two weeks. What makes this project so special that the market is so eager to chase it? Let’s take a deeper look at the core architecture and development blueprint of Keeta Network.

Keeta Network Introduction

Keeta Network is a high-performance Layer 1 blockchain dedicated to providing secure, efficient, and highly interoperable solutions for global payments and asset transfers. Its vision is to become the "common foundation for all asset transfers," supporting not only cross-chain transactions but also emphasizing seamless integration with traditional financial systems (TradFi).

The original intention behind Keeta's design is to address the pain points of traditional payment systems, such as high fees, slow settlement speeds, and lack of compliance support, aiming to achieve rapid transaction settlement and asset tokenization through its technical architecture. Founder and CEO Ty Schenk has pointed out that Keeta's goal is to "make international remittances as simple and fast as Venmo payments (for Taiwanese readers, comparable to LINE Pay), without worrying about the safety of funds."

Technical Highlights

1. High-performance transaction processing

Keeta claims to have a processing capacity of 10 million transactions per second, with a settlement time of only 400 milliseconds, significantly outperforming traditional public chains and payment systems.

This performance comes from the following four major designs:

1-1) DAG: Allows for parallel processing of transactions, thereby enhancing throughput and scalability.

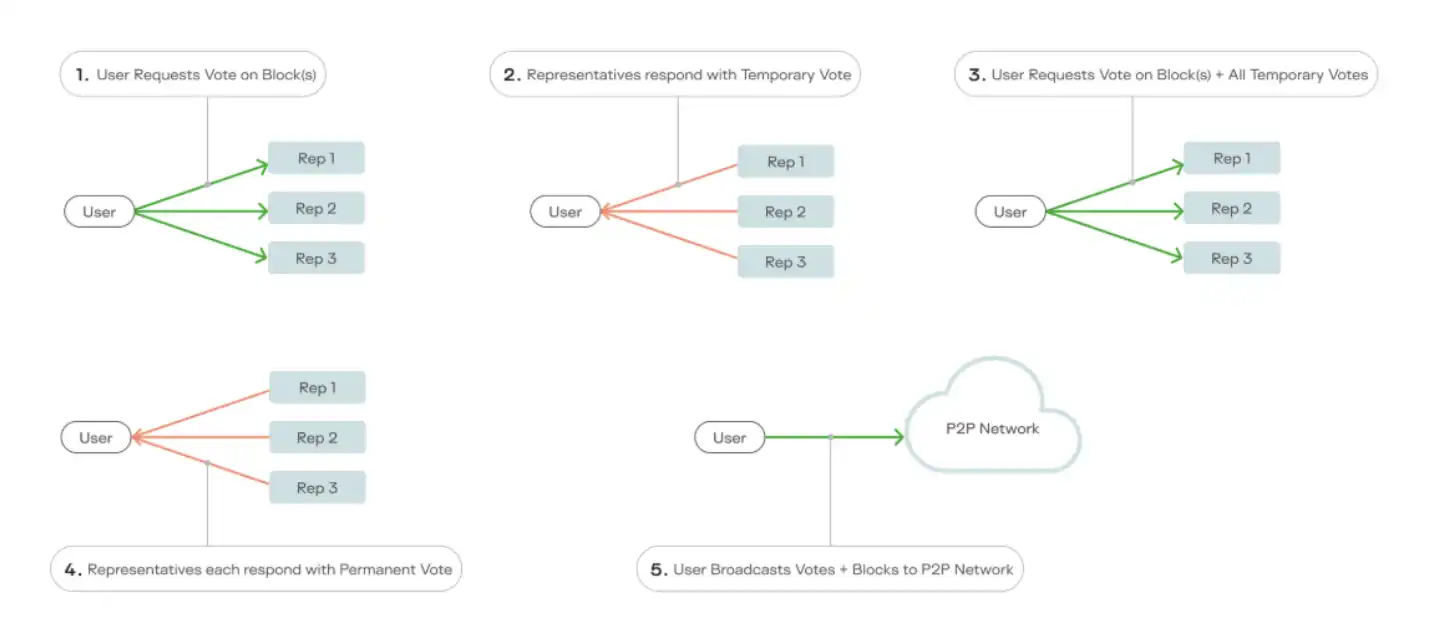

1-2) dPoS consensus mechanism: Keeta uses Delegated Proof of Stake (dPoS) as its consensus mechanism, allowing token holders to delegate their tokens to representatives who participate in governance and transaction validation, achieving a fast and decentralized block validation process through five steps: initiating a voting request -> temporary voting -> cross-validation -> final voting -> block broadcasting.

1-3) Separation of nodes and hardware: Nodes are not tied to specific servers, allowing multiple servers to support a single node. This design allows for vertical and horizontal scaling without interrupting service, maintaining stable transaction processing speeds even under high loads.

1-4) Elimination of the mempool mechanism: In traditional blockchains, the mempool is a waiting area for transactions before they are added to a block. However, this design can lead to delays and higher transaction fees during periods of high network activity. Keeta Network eliminates the mempool, allowing for faster transaction processing and lower costs.

2. Anchor - High interoperability

Any blockchain can connect to the Keeta network through Keeta's anchor point feature, enabling users to transfer assets between different blockchains. More groundbreaking is that Anchor also supports integration with traditional payment systems, such as SWIFT and ACH, achieving seamless exchanges between fiat and digital assets, creating a global payment interoperability network.

Through the Anchor feature, any blockchain can connect to the Keeta network, supporting cross-chain asset transfers. More importantly, Anchor can also interface with traditional payment systems like SWIFT and ACH, enabling seamless exchanges between fiat and digital assets, thus creating a global payment interconnected network. For example, a U.S. bank can use SEPA Anchor to transfer funds to a European bank account, even if the recipient is not on the Keeta network, ensuring successful receipt.

3. Built-in compliance

Keeta has a native built-in compliance protocol, making it feasible for highly regulated entities such as central banks and commercial banks. This interoperability makes it an ideal intermediary platform connecting TradFi and DeFi.

4. Native tokenization

Keeta employs a native tokenization mechanism, allowing for the issuance and operation of tokens without relying on smart contracts, enhancing efficiency, flexibility, and reducing costs. Unlike platforms like Ethereum, Keeta's tokens are native assets of the network, allowing for the direct issuance of fungible and non-fungible tokens, and supporting diverse applications such as real-world asset (RWA) tokenization, with a built-in programmable rules engine that allows creators to design specific behaviors and conditions to flexibly meet different tokenization needs.

5. Digital identity

Keeta establishes a comprehensive digital identity profile for each user by integrating certificates issued by various credentialing agencies (verification authorities), covering multiple verifications from government, banking, industry, and academia. All information is tied to the user's public key, which can be selectively disclosed as needed, and verified information can be shared, reducing redundant verifications, thus achieving a highly efficient and privacy-focused cross-service identity verification mechanism.

6. Private sub-network (Sub Network)

Keeta supports the deployment of private versions in the form of "sub-networks" to meet specific privacy needs. The sub-network operates similarly to the main network, but transactions are not publicly visible on the main network and can be designed as centralized or decentralized as needed. Main network accounts can seamlessly switch to the sub-network using a "single universal key," and assets and transaction records can also be synchronized and updated when switching back to the main network.

With these features, Keeta's potential in the payment field is seen as a possible challenge to existing competitors, with some commentators even calling it the "Ripple killer."

Token Economics

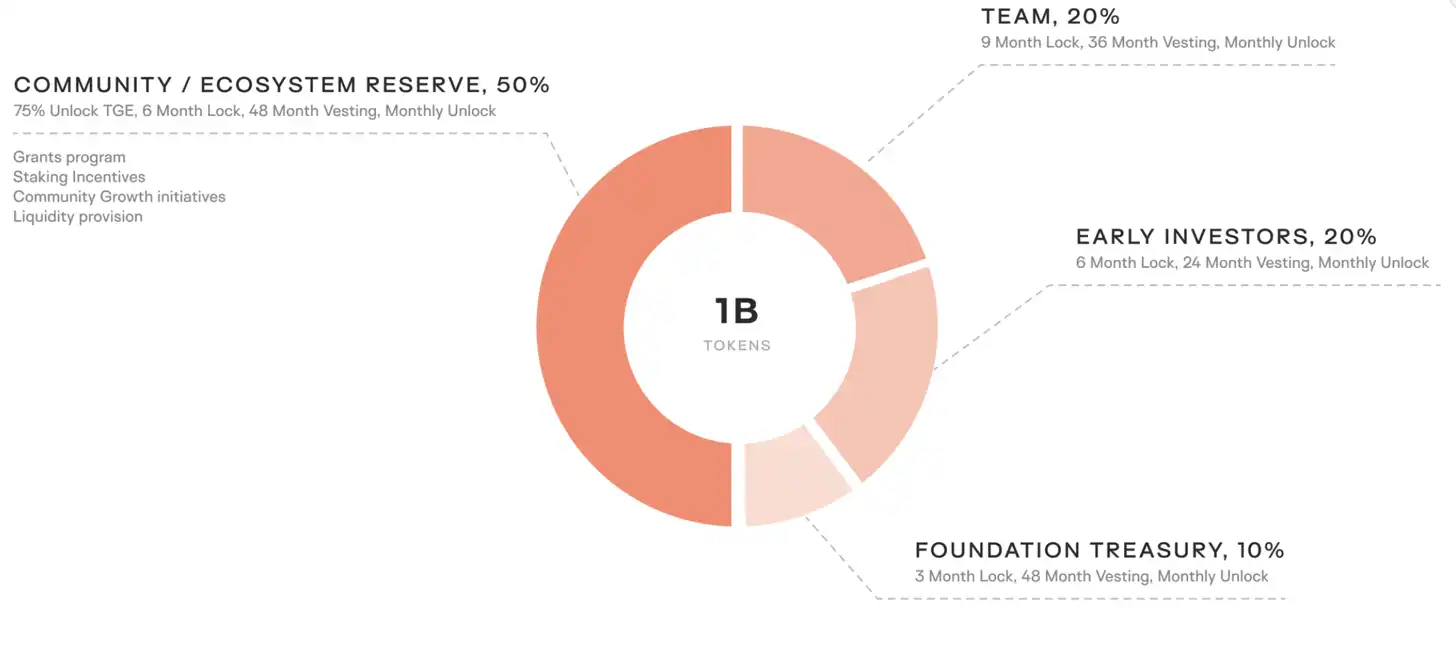

Keeta's native token is $KTA, with a total supply of 1 billion tokens, distributed as follows:

· Community and ecosystem reserve (50%): 75% unlocked at TGE, the remaining portion locked for 6 months, with a linear release over 48 months. Uses: grant programs, staking rewards, ecosystem growth promotion, liquidity provision.

· Team (20%): 9 months lock-up, linear release over 36 months.

· Early investors (20%): 6 months lock-up, linear release over 24 months.

· Foundation (10%): 3 months lock-up, linear release over 48 months.

Team and Funding

· Founder: Ty Schenk (@SchenkTy), CEO of Keeta.

· CTO: Roy Keene (@your pal), former chief developer of Nano (which once had a market cap of $4 billion).

According to an official statement in 2023, Keeta has received $17 million in funding from investors including former Google CEO Eric Schmidt and Steel Perlot Management, with a valuation of $75 million.

Conclusion: Is the Ripple Killer Here?

Keeta Network is highly sought after by the community due to its strong team (backed by a former Google CEO and the former chief developer of Nano) and technical highlights (10M TPS, RWA support). Its permissioned system designed for traditional financial regulation and digital identity features address blockchain privacy and compliance issues. After the mainnet launch, international payments will be a key focus, and subsequent applications are worth looking forward to.

However, the official testnet has not yet launched (announced to be coming on March 23), and actual performance remains to be validated. Additionally, the top 10 holders of $KTA account for as much as 67%, indicating a high concentration of tokens that needs attention. Future monitoring of the testnet and mainnet progress, bank adoption rates, and changes in token distribution will be essential to avoid blindly chasing prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。