Meta Platforms Inc. declined a shareholder-backed initiative to explore adding bitcoin to its corporate treasury during its annual meeting on May 28. Shareholders voted on fourteen proposals, all of which were detailed in a prior filing with the U.S. Securities and Exchange Commission (SEC) dated April 17. Participation was substantial, with 92.61% of the combined voting power of Class A and Class B shares represented, ensuring a quorum for the proceedings.

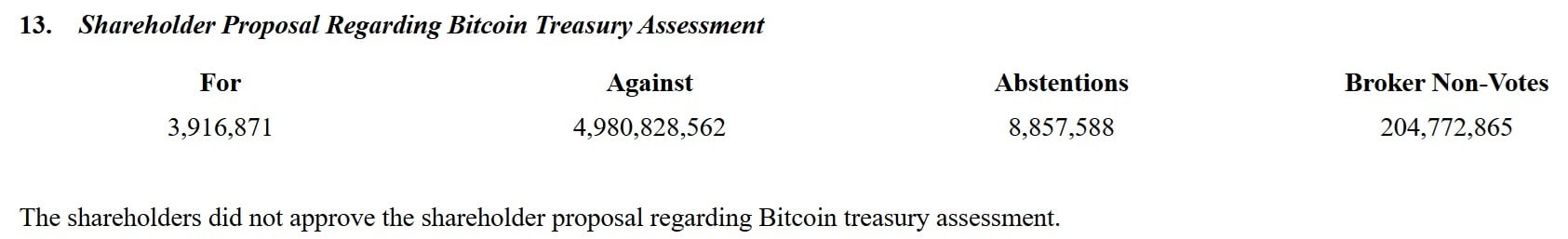

The bitcoin-related proposal drew notable attention, as it mirrored similar efforts presented at other major tech firms. Despite increasing discourse on cryptocurrency in corporate finance, Meta shareholders decisively rejected the idea. Less than 0.1% voted in favor, with 95% voting against and approximately 8.9 million shares abstaining. Vaneck’s head of digital assets research, Matthew Sigel, commented on Meta’s vote on social media platform X:

Meta joins Microsoft and Amazon in rejecting calls to add bitcoin to the balance sheet.

Meta’s SEC filing. Source: SEC.

An increasing number of corporations are embracing bitcoin as part of their financial strategy, adding the cryptocurrency to their balance sheets as a hedge against inflation and a store of value—an approach notably championed by Michael Saylor and his firm, Strategy (Nasdaq: MSTR). This trend underscores a growing institutional interest in digital assets, particularly as economic uncertainty and fiat currency concerns persist.

However, major players like Microsoft and Amazon have recently opted not to follow suit. Both companies have faced shareholder proposals urging them to allocate a portion of their reserves to bitcoin, but they firmly rejected the idea, citing the cryptocurrency’s volatility and the need for stability in their financial operations. Though Meta shareholders opted not to move forward with such a measure, ongoing developments in digital asset regulation and market infrastructure may keep the door open for similar proposals in the future as institutional attitudes evolve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。