Bitcoin ETFs Slide for Second Day As Blackrock’s IBIT Leads Withdrawals

After 10 days of bullish momentum, bitcoin ETFs appear to be facing a short-term correction. For the 2nd day in a row, the sector saw significant outflows, totaling $616.22 million.

Blackrock’s IBIT, the fund that has consistently led inflows in recent weeks was at the center of the exit with a massive $430.82 million withdrawal. Ark 21shares’ ARKB followed with $120.14 million in outflows.

Additional redemptions came from Bitwise’s BITB ($35.33 million), Grayscale’s Bitcoin Mini Trust ($16.22 million), and Fidelity’s FBTC ($13.71 million). No inflows were reported across the remaining seven ETFs. Trading volume remained high at $3.39 billion, while total net assets dipped to $126.15 billion.

Source: Sosovalue

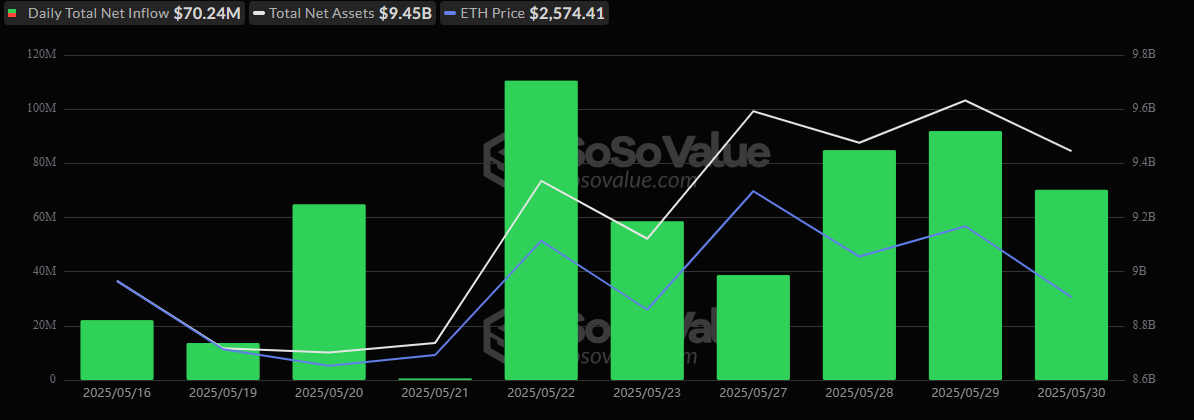

In contrast, ether ETFs continued their quiet winning streak, posting a tenth consecutive day of inflows. The entire $70.24 million influx came from Blackrock’s ETHA, underscoring the institutional preference for the fund. No other ETF saw action. The total value traded came in at $485.80 million, with net assets holding steady at $9.45 billion.

While bitcoin ETFs face some near-term selling pressure, ether’s growing momentum, especially backed by a single dominant fund, signals continued investor confidence ahead of key regulatory and macroeconomic catalysts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。