I. Introduction

On May 19, the U.S. Senate passed the procedural vote for the "GENIUS Act" with a high majority, marking the imminent arrival of the first nationwide unified regulatory framework for stablecoins in the United States, attempting to legally define and regulate the operational mechanism of the "digital dollar." This will not only reshape the power structure of the U.S. stablecoin market but may also trigger profound policy, economic, and geopolitical monetary chain reactions globally, reshaping the future landscape of financial markets.

The GENIUS Act represents a redefinition of U.S. financial sovereignty: embedding stablecoins within the structure of government bonds, incorporating on-chain assets into the dollar system, and evolving the "dollar peg" from price anchoring to liquidity and value anchoring. By legislating to guide global demand for stablecoins, it ultimately transforms into demand for U.S. government bonds, consolidating the dollar's anchoring position in the new round of financial system restructuring. Stablecoins will no longer just be the "dollar shadow" of the crypto world but will become the sovereign currency's "extended arm" linking the crypto market and traditional finance. Once this regulation is smoothly implemented, it will open a new cycle dominated by the dollar, potentially accelerating the large-scale adoption of stablecoins and providing institutional support for the next phase of RWA and digital government bonds.

This article will analyze the legislative content and institutional design of the "GENIUS Act," systematically sorting out its core provisions regarding regulatory definitions, licensing mechanisms, reserve requirements, and legal status, while also dissecting the current version's limitations in political maneuvering, applicability, and execution challenges. Based on this, the article will focus on assessing the direct and indirect impacts of the bill's passage on the U.S. government bond market, the crypto stablecoin market, and the RWA sector, aiming to comprehensively present the financial logic and far-reaching real-world implications hidden behind this "Genius Act."

II. Overview of the GENIUS Act

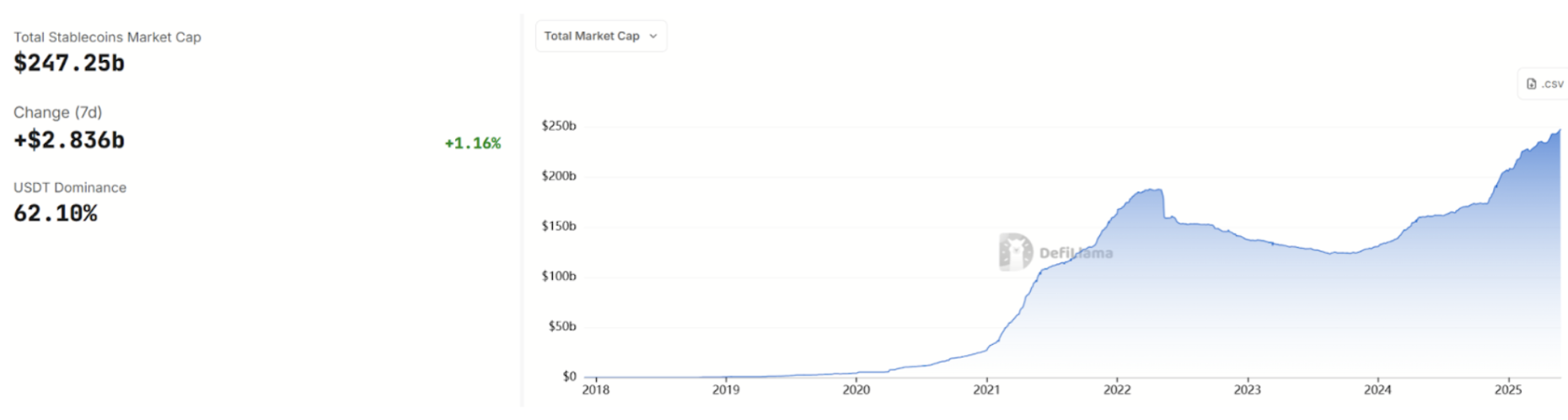

The emergence of stablecoins has exceeded a decade; since the birth of Bitcoin, they have evolved globally from speculative mediums to payment tools, liquidity bridges, and even store-of-value assets, characterized by "pegging to fiat currency and redeemable at any time." As of May 29, 2025, the market capitalization of stablecoins has approached $250 billion. However, stablecoin assets have long been in a regulatory blind spot, lacking clear standards in legal definitions, risk isolation, and reserve disclosure.

Source: https://defillama.com/stablecoins

The passage of the GENIUS Act will set a complete definition, entry thresholds, operational boundaries, and reserve management rules for stablecoins, formally "naming" this core product of global financial innovation in institutional form. The GENIUS Act (full name: "Guiding and Establishing National Innovation for U.S. Stablecoins Act") is the Senate version, proposed by bipartisan senators including Bill Hagerty, aiming to establish the first federal regulatory framework for payment stablecoins. The House of Representatives is advancing the STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy Act of 2025), proposed by Republican Congressman Bryan Steil, which is similar in content to the GENIUS Act, both aiming to establish a comprehensive regulatory mechanism for stablecoin issuance.

1. Core Regulatory Content

The GENIUS Act requires that any payment stablecoin issued in the U.S. must obtain a federal or state-level license, and unlicensed entities are prohibited from issuing stablecoins. The bill defines "payment stablecoins" as digital assets pegged to a fixed fiat currency (such as the dollar) that can be redeemed at a fixed value (such as $1), and clarifies that such stablecoins are not supported by federal deposit insurance. Issuers must hold 100% of the equivalent high-quality reserve assets, requiring at least $1 in compliant reserves for every $1 stablecoin issued.

Permissible reserve assets are limited to: cash and coins, demand deposits at banks and credit unions, short-term U.S. government bonds (<=93 days), repurchase/reverse repurchase agreements collateralized by government bonds, government money market funds, central bank reserves, and other low-risk assets similar to government bonds approved by regulatory agencies. The bill strictly prohibits the diversion of reserve assets for other uses or rehypothecation, allowing reserves to be used only in limited circumstances, such as for stablecoin redemptions or as collateral for repurchase agreements. These provisions ensure that stablecoins are 1:1 pegged with solid asset backing and eliminate risks from reserve diversion.

2. Information Disclosure and Auditing

To enhance transparency, the bill requires issuers to publish reports on the circulation and reserve composition of stablecoins at least monthly, detailing the current number of issued stablecoins and the corresponding asset structure of reserves. Reports must be certified by the issuer's CEO and CFO and regularly audited by registered accounting firms. Issuers with a market capitalization exceeding $50 billion must also submit annual audited financial statements.

Additionally, issuers must establish a clear redemption mechanism to ensure that holders can quickly redeem stablecoins at face value. These frequent information disclosures and external audit requirements will shift stablecoin operations from the past "opaque black box" to transparency, aiming to dispel users' doubts about the sufficiency of stablecoin reserves.

3. Licensing System and Tiered Regulation

The GENIUS Act establishes a "dual-track" regulatory system of federal and state licenses. Both bank and non-bank entities can apply to become stablecoin issuers but must register for a license with the appropriate regulatory authority. The bill allows state regulatory agencies to oversee issuers that meet federal standards, provided that the state regulatory framework is "substantially equivalent" to federal standards.

For issuers choosing federal licenses, federal regulatory agencies will oversee them based on the nature of the institution: if the issuer is a non-bank, it will be overseen by the Office of the Comptroller of the Currency (OCC); if the issuer is a bank or its subsidiary, it will be overseen by the corresponding federal banking regulatory agency (OCC, Federal Reserve, or FDIC).

Issuers choosing state licenses will primarily be regulated by state authorities, but states may choose to enter into cooperation agreements with federal agencies (such as the Federal Reserve) for joint supervision. For interstate operations, licensed stablecoin issuers will gain mutual recognition across U.S. states, no longer limited by a single state-issued money transfer license, which helps form a nationwide unified market.

4. Tiered Regulation Based on Scale

To address different scales of issuers, the bill introduces a "$10 billion threshold" tiered requirement:

The Senate version (GENIUS Act) stipulates that if a state-regulated issuer's stablecoin circulation market capitalization reaches $10 billion, it must convert to federal regulation; otherwise, it cannot continue to expand issuance. Once this scale threshold is crossed, non-bank issuers will be regulated by the federal OCC, while bank issuers will be jointly regulated by federal banking regulatory agencies and states.

The House version (STABLE Act) differs in this regard, allowing state-regulated issuers to continue under state regulation regardless of scale, with no mandatory federal conversion requirement. This difference reflects the two chambers' divergence in weighing "federal vs. state" regulatory authority, which needs to be resolved during the final legislative coordination.

5. Legal Status and Consumer Protection

The bill clarifies the legal attributes of stablecoins: compliant payment stablecoins are excluded from the categories of securities and commodities, thus not considered securities or commodity contracts, exempting them from SEC and CFTC regulation. At the same time, stablecoins are not regarded as bank deposits (and therefore do not enjoy FDIC deposit insurance). U.S. bankruptcy law will also be amended accordingly to prioritize the rights of stablecoin holders: in the event of the issuer's bankruptcy liquidation, the claims of stablecoin holders on reserve assets will take precedence over other general creditors. This bankruptcy priority ensures that even if the issuing institution collapses, users' rights to redeem for sufficient reserve assets are legally protected, serving as an important consumer protection measure.

Additionally, the bill prohibits individuals with a history of financial crimes from serving as executives of issuers and requires stablecoin issuers to fully comply with U.S. anti-money laundering laws (AML) and sanctions compliance: issuers recognized as financial institutions under the Bank Secrecy Act must implement KYC identity verification, record transactions, and report suspicious activities. The Financial Crimes Enforcement Network (FinCEN) will develop specific anti-money laundering rules for digital assets and require issuers to have the technical capability to freeze, destroy, or prevent specific stablecoin transfers upon receiving lawful orders from courts or regulatory agencies.

6. Other Important Provisions

The GENIUS Act also includes several provisions aimed at the long-term development of the market:

Custody and Payment Integration: Allows banks to provide custody services for stablecoins and their reserve assets for clients, using blockchain for settlement and issuing their own tokenized deposits. In other words, traditional banks can legally issue and circulate customer deposits in token form, allowing bank deposits to be transferred on-chain like stablecoins. This opens the door for banks to participate in the blockchain space and helps promote RWA on-chain innovation.

Prohibition of Fund Mixing: For institutions providing stablecoin custody or reserve custody, the bill requires them to be regulated financial institutions and prohibits mixing customer stablecoin reserves with their own funds, except in specific exceptional circumstances. Custodians must treat the stablecoin assets held by customers as client property and protect them, preventing claims from other creditors in the event of the custodian's bankruptcy.

Prohibition on Paying Interest to Holders: Both the GENIUS Act and the STABLE Act explicitly prohibit stablecoin issuers from paying any form of interest or returns to holders. Stablecoins cannot provide interest returns to users like bank deposits or money market funds. This aims to avoid direct interest competition between stablecoins and bank savings and is one of the more controversial provisions.

Transition Period Arrangements: Considering the realities of the existing market, the bill sets a maximum 18-month adjustment buffer period for current stablecoin issuers. For example, existing major stablecoin issuers like USDT and USDC need to apply for licenses within a specified period after the bill takes effect or adjust their organizational structure to comply with regulations; otherwise, they will not be allowed to provide stablecoin services to U.S. users after the grace period ends. This "reconciliation" clause ensures a smooth market transition, allowing currently operating stablecoins to integrate into the new regulatory framework.

III. Limitations and Progress of the GENIUS Act

Under bipartisan negotiations, the bill text has undergone multiple revisions. Major concerns include insufficient consumer protection, regulatory loopholes for anti-money laundering and foreign stablecoins (such as USDT), and doubts about potential benefits to the Trump family's cryptocurrency business. Subsequently, intensive negotiations between the two parties led to several modifications to strengthen consumer protection. For example, provisions were added to reinforce the applicability of existing federal and state consumer protection laws, clarifying that stablecoin issuers remain subject to state laws regarding fraud and other financial consumer protections and will not be exempt from state law responsibilities due to federal licensing. Additionally, ethical provisions were added to ensure that government officials cannot participate in stablecoin issuance, responding to "conflict of interest" allegations.

1. Differences Between Bill Versions

The House's STABLE Act and the Senate's GENIUS Act are consistent in core spirit, but there are several differences in specific provisions:

Issuer Scale and Regulatory Restrictions: The Senate version stipulates that state-regulated issuers must convert to federal regulation if their issuance scale exceeds $10 billion; the House version does not have this requirement, allowing state regulatory models to continue indefinitely.

Licensing Geographic Restrictions for Issuers: The GENIUS Act only allows domestic U.S. institutions to become licensed issuers, prohibiting unlicensed foreign stablecoins from being sold to the public in the U.S. after a three-year transition period, unless the relevant foreign regulators reach an equivalence agreement with the U.S. This means that overseas issuers like Tether will be considered "non-compliant" stablecoins by the U.S. financial system if they do not establish a regulated entity in the U.S. In contrast, the House's STABLE Act is relatively open to foreign compliant stablecoins: it allows issuers from countries recognized by the U.S. Treasury as having "equivalent" regulation to circulate their stablecoins in the U.S. on the condition that they agree to U.S. regulatory inspections and reporting obligations.

2. Limitations of the GENIUS Act

Although the GENIUS Act is seen as an important milestone in U.S. crypto policy, it has several limitations and concerns:

Scope Limitations: The bill focuses on fiat-pegged payment stablecoins and does not address other types of crypto assets. For example, algorithmic stablecoins do not fall under the definition of "payment stablecoins" and will remain in a legal gray area. Decentralized stablecoins like DAI, which lack a centralized issuer, will find it nearly impossible to meet licensing application, AML compliance, and other requirements. Therefore, while the GENIUS Act encourages centralized compliant stablecoins, it objectively suppresses decentralized attempts.

Regulatory Enforcement Limitations: The bill requires foreign stablecoins to reach a regulatory equivalence agreement within three years to be sold in the U.S. However, in practice, if some foreign entities provide stablecoins to U.S. users through decentralized exchanges or peer-to-peer wallets, how regulatory agencies will monitor and enforce compliance remains a challenge. There are still many unlicensed trading venues and wallets globally, and the U.S. cannot eliminate their use.

Political Risks: The bill's introduction and passage are influenced by the political backdrop of the Trump administration, attempting to consolidate the dollar's position through stablecoins. Although ethical provisions were ultimately added to the bill, changes in party control could still affect its fate. If the Democratic Party regains power in 2028, there is a possibility of re-evaluating stablecoin policies. Therefore, the long-term stable implementation of the GENIUS Act depends on stablecoins proving their value and consolidating stakeholder support over the next few years.

International Coordination: Stablecoins are inherently cross-border, and U.S. legislation alone cannot solve all issues. The EU has already passed the MiCA regulation to manage crypto assets, including requirements for stablecoin issuance and reserves. The People's Bank of China strictly prohibits the issuance or trading of any stablecoins domestically. The U.S. GENIUS Act will become an international reference, but countries have differing attitudes, and multiple regulatory models may coexist or even conflict in the future.

3. Progress of the GENIUS Act

On May 19, several previously cautious "crypto-friendly" Democratic senators announced their acceptance of the revised proposal and expressed their willingness to vote in support of the bill. That evening, the Senate broke the impasse with a vote of 66 in favor and 32 against, successfully advancing the bill into the full chamber debate and voting process.

In early June, the Senate is expected to formally vote to pass the GENIUS Act, requiring only a simple majority to send it to the House for consideration. In the House, the Financial Services Committee has already passed the STABLE Act with bipartisan support in March and submitted it to the full chamber, awaiting scheduling for a vote. As the two versions need to be harmonized, congressional members plan to complete the merged bill and send it to President Trump for signing before the summer recess. President Trump has publicly supported stablecoin legislation multiple times, claiming that "crypto will expand the global dominance of the dollar." It is anticipated that the GENIUS Act will officially become law around August 2025. This will be the first codified law in the U.S. specifically addressing stablecoins.

IV. Impact of the GENIUS Act on the U.S. Government Bond Market

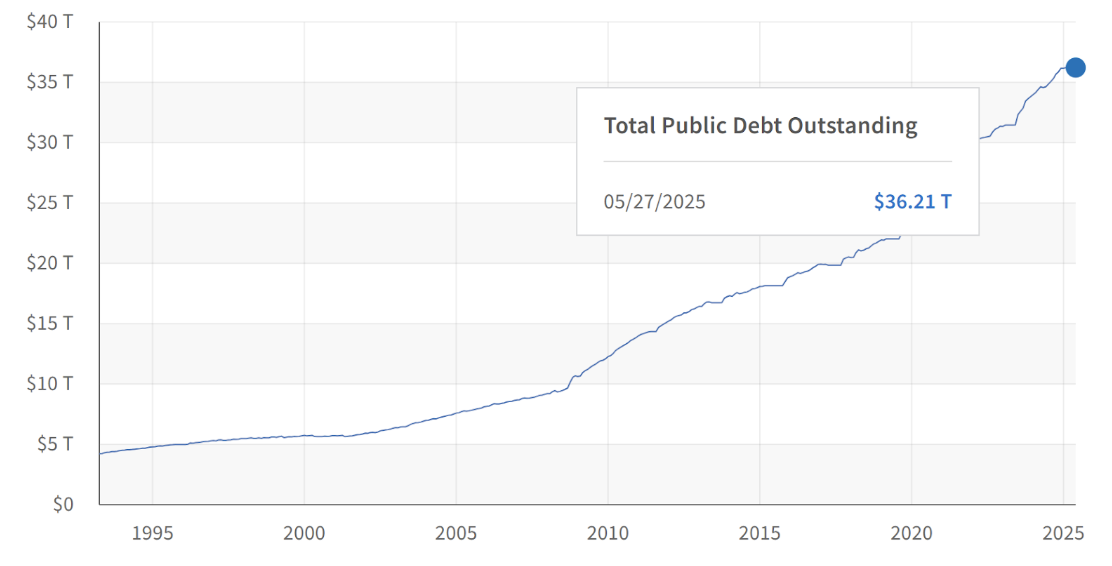

As of May 2025, the total federal government debt of the United States has exceeded $36 trillion, accounting for approximately 123% of GDP, with the debt scale reaching a historical high. The normalization of fiscal deficits and the surge in interest burdens have put the government bond market in a dual dilemma of continuous expansion and tight funding sources. The bill's requirement for stablecoin reserves to primarily invest in short-term U.S. government bonds and other highly liquid assets is expected to transform global demand for digital dollars into a rigid demand for U.S. government bonds, alleviating financing pressure and strengthening the dollar's dominant position in the crypto financial system.

Source: https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/

Enhanced Demand for Government Bonds: Currently, major dollar-pegged stablecoins (such as USDT and USDC) have already allocated a significant amount of U.S. government bonds as reserves. Once the regulation takes effect, it will direct a massive pool of crypto funds toward U.S. government bonds. For instance, as of the first quarter of 2025, Tether held $120 billion in U.S. government bonds as part of its reserves, making it the 19th largest holder of U.S. government bonds globally. The robust development of stablecoins will provide the U.S. Treasury with a new source of stable funding, becoming a strategic opportunity to strengthen dollar hegemony and reduce government financing costs, transforming global demand for digital dollars into real purchasing power for U.S. government bonds.

Capital Flow and Impact on Banks: The large-scale adoption of stablecoins will also affect the flow of traditional bank deposits and money market funds. When users transfer funds from banks to stablecoins, stablecoin issuers will invest the corresponding funds in U.S. government bonds or deposit them in demand accounts at large banks. This could lead to deposit outflows from small and medium-sized banks, potentially triggering a chain of liquidity risks. In response, the GENIUS Act mitigates the direct competition of stablecoins with bank savings to some extent by prohibiting interest payments on stablecoins. At the same time, the bill grants regulatory agencies like the Federal Reserve the authority to intervene: when stablecoin issuance shows violations or anomalies, the Federal Reserve and OCC can take action in "exceptional emergency situations," including halting new coin issuance if necessary. This allows regulators to monitor large-scale capital flows of stablecoins and provide early warnings and interventions for systemic risks.

Potential Risks: Currently, the scale of short-term bonds held by stablecoins is relatively small compared to the total U.S. government debt of $36 trillion. However, if a major stablecoin collapses, the liquidation of short-term government bonds in its reserves could trigger a fire-sale effect, impacting the liquidity of the entire short-term bond market. The GENIUS Act aims to minimize the credit risk and spillover effects of stablecoins through requirements for 100% high-quality reserves and priority liquidation rights. Overall, the implementation of the bill will make stablecoins highly transparent and regulated funding pools, similar to money market funds, providing stable buying support for U.S. government bonds and more closely binding U.S. government interests with global demand for digital dollars.

V. Impact of the GENIUS Act on the Stablecoin Market

Currently, fiat-collateralized stablecoins dominate the total supply of stablecoins, with a supply of $115 billion, accounting for 90.5%; crypto-asset over-collateralized stablecoins supply $11.3 billion, accounting for 8.9%; and algorithmic stablecoins only account for 0.6%. Among them, dollar-pegged fiat stablecoins like USDT and USDC hold an overwhelming share. The GENIUS Act will reshape the competitive landscape and regulatory ecology of the current stablecoin market. The main impacts are reflected in the issuer structure, market confidence, and the compliance transformation of existing stablecoins.

Source: https://dune.com/KARTOD/stablecoins-overview

Issuers and Competitive Landscape: Under the new law, stablecoin issuance will transition from previous unregulated growth to a licensed competitive era. Non-bank entities can legally issue stablecoins by applying for licenses, no longer limited to banks for issuing digital dollars. It is foreseeable that after the regulation is implemented, large financial institutions and tech giants in the U.S. may accelerate their entry into the stablecoin space. Current dominant players like USDT and USDC will face challenges from new competitors on Wall Street, and various companies may offer more favorable rates and services to compete for users. For users, this means safer and more diverse stablecoin options, as well as potential cost reductions and service improvements.

Changes in the Existing Stablecoin Landscape: As the largest stablecoin by market capitalization globally, USDT is issued by the overseas-registered Tether company and has long operated outside U.S. regulation. After the GENIUS Act takes effect, unlicensed foreign stablecoins will gradually be marginalized in the U.S. market. During the approximately 18-month transition period set by the bill, if Tether wishes to continue serving U.S. users, it may need to establish a subsidiary in the U.S. and apply to become a licensed issuer, subjecting itself to U.S. regulation and meeting reserve, audit, and other requirements. Otherwise, after the three-year grace period, U.S. entities (including exchanges, brokers, etc.) will be prohibited from providing trading and turnover services for non-compliant foreign stablecoins. Some analysts believe that Tether's historically opaque operations and complex offshore structure, if forced to disclose reserve details and accept U.S. regulation, may expose hidden risks, thereby undermining market confidence in USDT. In contrast, Circle's USDC is almost certain to emerge as a compliance winner. Circle is already registered in the U.S., has regularly disclosed reserves and undergone audits, and strictly adheres to KYC/AML regulations in cooperation with companies like Coinbase, establishing itself as a "model stablecoin." Circle is expected to apply for a federal OCC issuer license or come under Federal Reserve regulation, making USDC one of the first officially recognized compliant stablecoins.

Market Confidence and Application Scale: Stablecoin legislation will significantly enhance public and institutional trust and acceptance of stablecoins. A series of mandatory reserve and disclosure requirements will accelerate the mainstream adoption of stablecoins: consumers will feel more secure using stablecoins for payments and transactions, and businesses will be more willing to accept stablecoins as a payment method. It is expected that more online platforms and offline merchants will support stablecoin settlements. U.S. users are likely to pay with digital dollars in their mobile wallets at coffee shops and supermarkets, just as conveniently as using cash or credit cards. Furthermore, the launch of compliant stablecoins will facilitate the conversion between fiat and cryptocurrencies, reducing transaction friction and costs, and promoting innovation in the financial industry.

Impact of the Interest Payment Ban: The bill's prohibition forces stablecoins to abandon paying interest to users, making stablecoins more likely to be used for payment settlements and short-term value storage rather than long-term holding for interest rate differentials. This may make stablecoins resemble "digital cash" rather than "digital deposits." For funds seeking returns, they may prefer to remain in traditional banks or invest in money market funds (with annual returns around 5%). However, stablecoin issuers themselves will continue to profit from reserve assets, and to compete for users, they may indirectly offer incentives such as transaction fee discounts and airdrop rewards.

VI. Impact of the GENIUS Act on the RWA Market

With the implementation of the stablecoin bill, the U.S. financial system is quietly opening its doors to the tokenization of real-world assets (RWA). The GENIUS Act not only regulates stablecoins but also sends a clear signal: mainstream financial institutions can participate in blockchain activities within a regulated framework, including issuing on-chain financial products. This will drive the tokenization process of various real financial assets, bringing about institutional changes and new investment opportunities.

Tokenized Deposits and Bank Innovation: The bill explicitly allows regulated banks to use distributed ledger technology to issue tokens representing customer deposits, known as "tokenized deposits." This means banks can attempt to issue on-chain dollar deposits and engage in on-chain settlements, among other innovations. For the RWA market, active participation from banks will bring a wealth of real assets on-chain: banks can try to issue tokenized rights to loans, accounts receivable, real estate investment trusts, and other assets to qualified investors, providing products with higher liquidity and transparency. The on-chain transformation of traditional financial assets is expected to accelerate under regulatory support.

Improvement of the Stablecoin Ecosystem Benefits RWA: Stablecoins are referred to as the "bridge" connecting the crypto world and real assets. Other RWA tokens (such as on-chain bonds and notes) can leverage stablecoins as a value carrier during trading and settlement, eliminating the need for fiat currency settlement and significantly improving efficiency. For example, a tokenized government bond based on Ethereum can be instantly purchased and transferred using USDC, unrestricted by bank operating hours. This creates conditions for introducing 24/7 trading and instant settlement in the bond market.

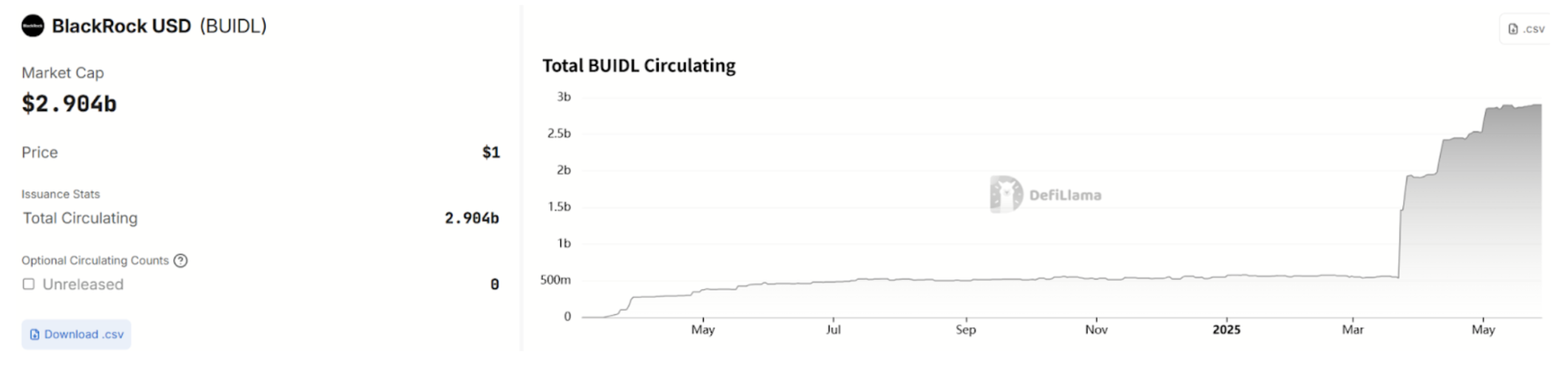

Growth and Opportunities in the RWA Market: Over the past two years, the concept of RWA has begun to emerge in the crypto space, with many protocols attempting to introduce assets such as U.S. Treasury bonds, corporate bonds, and mortgages in tokenized form into DeFi. Although the scale is still small, growth has been rapid. The world's largest asset management company, BlackRock, launched a tokenized money market fund called BUIDL on the Avalanche chain in March 2024, and as of May 29, its asset scale has exceeded $2.9 billion. MakerDAO plans to invest up to $1 billion in tokenized U.S. Treasury bonds, and on-chain real assets are attracting capital from various sources. Major institutions have begun to lay out plans in this emerging field: Goldman Sachs is developing a digital bond platform, JPMorgan is expanding its Onyx on-chain clearing network, and SWIFT is testing blockchain for cross-border asset transfers, indicating that the RWA market may experience exponential growth in the coming years.

Source: https://defillama.com/stablecoin/blackrock-usd

- Risks and Challenges: Compliance costs will be a significant bottleneck for RWA tokenization: the auditing, reporting, and other requirements mandated by the new stablecoin regulations will incur substantial expenses, which may be burdensome for small innovators attempting RWA. Overly stringent rules may stifle some creative ideas. Additionally, RWA tokens involve technical and legal challenges such as cross-chain governance and legal ownership proof, which are still being explored. If regulators lack flexibility in formulating specific rules, it may limit the adaptability of RWA models.

It is expected that in the future, we will see more regulatory sandbox projects allowing financial institutions to experiment with issuing more types of on-chain assets. After the success of stablecoins, the next legislative focus may shift to the formulation of rules for security tokens, decentralized finance (DeFi), and other areas, further improving the regulatory framework for digital assets.

VII. Conclusion: Digital Expansion of Dollar Sovereignty

The passage of the GENIUS Act not only establishes a stablecoin regulatory mechanism for the first time in the U.S. through federal law but also represents a rare strategic alignment between national will and market innovation. It signifies that the U.S. officially views stablecoins as an important component of financial infrastructure, bridging the gap between cryptocurrencies and traditional finance. From the refinancing logic of the U.S. Treasury market to the reshaping of the stablecoin competitive landscape, and to the policy incentives for RWA tokenization, the signals released by the GENIUS Act are clear: the dollar aims to dominate not only the settlement system of the real world but also the flow of value on-chain. Stablecoins are becoming a new "value extension tool" for the dollar, and their reserve allocation rights are becoming a new bargaining chip in U.S. financial policy.

This "Genius Act" is not without its flaws. It still faces controversies and uncertainties regarding decentralized stablecoins, cross-border issuance regulation, and political neutrality. The flexibility of enforcement after regulation, market feedback, and international coordination will determine whether it becomes a true global standard or a "stablecoin special zone" in the U.S.

However, regardless of the outcome, this "Genius Act" has already legitimized stablecoins and taken a crucial step in U.S. digital financial regulation, accelerating the advancement of broader digital asset legislation, including DeFi, crypto securities, and CBDCs. The ultimate goal of this process is not just to "regulate stablecoins," but to create a "stable regulatory environment for the crypto world," which will continue to profoundly change the structure of global financial markets and the landscape of the digital economy.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and 24/7 market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selection" and daily news updates of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。