Bitcoin, as the highest market value and most liquid cryptocurrency asset globally, has long had its DeFi potential underutilized. Stacks (STX) is rewriting this landscape with its revolutionary sBTC solution. By adopting a 100% Bitcoin-backed reserve solution, it not only releases Bitcoin's on-chain liquidity but also pioneers a Bitcoin-based yield system and a new paradigm for smart contracts. This report deeply analyzes how Stacks is leading the Bitcoin financial (BTCFi) revolution, facilitating Bitcoin's leap from a value storage tool to a financial infrastructure. These applications include, but are not limited to, trading, lending, staking, and any other yield-generating activities.

Stacks - The Underlying Engine of Bitcoin Finance: Since its establishment in 2017, Stacks has been a pioneer in Bitcoin financial innovation, being the first to implement on-chain Bitcoin smart contracts, lending protocols, and asset tokenization. Through the groundbreaking "Nakamoto upgrade," Stacks launched sBTC, which is 1:1 backed by Bitcoin reserves. Its first three rounds of deposit caps (1,000 BTC, 2,000 BTC, and 2,000 BTC) were reached in 72 hours, 24 hours, and 3 hours respectively, setting records for institutional capital inflow speed. The market cap of Stacks' stablecoin grew sevenfold by 2025, with the amount of Bitcoin crossing into its ecosystem increasing from 1,240 to 5,015, expected to reach 21,000 by the end of 2025.

BTCFi - Trillion-Dollar Market Opportunity: The wave of Bitcoin tokenization will unleash trillions of dollars in liquidity while adding financial functions such as staking, lending, and smart contracts, all while maintaining the underlying security of Bitcoin. The total value locked (TVL) in sBTC has surpassed $549 million. Core protocols like Zest, Velar, and Bitflow have built a complete DeFi matrix, with related trading pairs offering annual yields of up to 40%, continuously attracting institutional capital.

Institutional Layout and Global Strategy: Top institutions like Jump and SNZ Capital are heavily invested, while professional custodians like Bitgo provide compliance support. Product offerings include the Grayscale Stacks Trust and 21Shares Staking ETP, bridging traditional financial channels. In terms of regional expansion, the Stacks Asia Foundation has officially launched, focusing on strategic markets such as South Korea, Hong Kong, Singapore, and the UAE, building a global ecological landscape.

Future Growth Engine: sBTC has initiated a multi-chain deployment plan, achieving interoperability with public chains like Solana, Aptos, and Sui, injecting Bitcoin liquidity into the entire Web3 ecosystem. Additionally, Stacks is investing in the development of BitVM, which is expected to achieve breakthroughs in off-chain computation and trusted verification mechanisms.

Development Path: More than 75 Bitcoin Layer 2 projects emerging in 2024 have mostly faltered; however, Stacks continues to maintain its leading position in the field. Stacks' roadmap is ambitious, accelerating the development of its ecosystem, including core protocol technology upgrades, sBTC, and Stacks DeFi growth plans. With the increase in sBTC adoption and institutional recognition, we predict the price of the STX token could reach $3.81 by the third quarter of 2025.

BTCFi - Trillion-Dollar Market Opportunity

As the most liquid and largest market capitalization cryptocurrency economy globally, Bitcoin's price trend has fully entered a demand-driven phase after 94% of its circulation has been released. With the maturity of assets, Bitcoin's volatility continues to narrow, leading many investors to include it in their long-term asset allocation. As more holders incorporate Bitcoin into their asset allocation, the demand for Bitcoin asset yield generation has become a core market focus.

Despite uncertainties in the macroeconomic landscape in 2025, Bitcoin's attributes as a national strategic reserve and a target for institutional and pension fund allocation continue to strengthen. BitcoinTreasuries data shows that 143 publicly listed companies globally hold a total of 1.09 million Bitcoins, accounting for 3.2% of the circulating supply. MicroStrategy predicts that as institutional adoption increases, Bitcoin's market capitalization will expand from $2 trillion to $28 trillion over the next 21 years. Under the Bitcoin block reward halving mechanism, the supply of new coins is structurally contracting. Against this backdrop, the demand for maximizing yield on existing assets has surged, directly giving rise to the paradigm revolution of Bitcoin DeFi (BTCFi).

This has led to the emergence of several Layer 2 solutions with Bitcoin smart contract functionalities, allowing users to earn Bitcoin by participating in L2. Stacks, which began in 2017 as the first Bitcoin Layer 2 project to introduce programmability, launched its mainnet in 2021 and has navigated market cycles through continuous innovation. In 2024, it launched the Nakamoto upgrade, achieving faster transaction speeds and a smoother user experience. Subsequently, it introduced sBTC, aiming to unlock over $1 trillion in potential Bitcoin assets.

According to DeFillama, the current total locked value in the Bitcoin financial ecosystem has surpassed $6.6 billion, with decentralized exchanges, staking protocols, and lending protocols forming the three pillars. Although the market is still in its early stages, Stacks remains at the top of Layer 2, with over 608 million STX locked in staking, and DeFi TVL reaching $121 million, while sBTC TVL has reached $549 million. Data from Electric Capital shows that Stacks ranks 7th in overall developer growth. Institutions remain optimistic about the BTCFi market, with VanEck predicting that the total locked value in Bitcoin Layer 2 will exceed 100,000 BTC by 2025, tripling from 2024. Aspen Digital's 2025 annual report predicts that the overall TVL of Bitcoin finance will cross the $20 billion threshold, with growth primarily coming from significant increases in the DeFi space of key players like Stacks.

Security: The Core Cornerstone of Tokenization Solutions

Centralized tokenization BTC solutions have previously raised security concerns:

The Ren protocol's renBTC was shut down due to the FTX collapse: The Ren Network, which issued $1.17 billion worth of renBTC, ceased operations due to the bankruptcy of its parent company, Alameda Research. Although renBTC claimed to use a multi-signature wallet maintained by a decentralized node network, it was later revealed that the Ren team actually controlled the majority of the nodes, raising market concerns about a single point of failure.

Controversy over wBTC's association with Tron: In August 2024, Bitgo transitioned the custody of wBTC to a multi-jurisdictional arrangement through a joint venture with Tron founder Justin Sun's BiT Global. Although wBTC plays a crucial role in DAI stablecoin collateral and yield streams, the major lending protocol MakerDAO has paused accepting wBTC as new loan collateral due to centralization concerns.

sBTC Leads the New Wave of Bitcoin Asset Tokenization

sBTC, as an ideal solution, features Bitcoin-denominated yields, a truly decentralized architecture, and a native-level user experience. sBTC is a token pegged 1:1 to Bitcoin, allowing users to connect Bitcoin across chains into DeFi applications, participate in yield farming, on-chain lending, and decentralized exchange trading.

Through the Nakamoto upgrade, sBTC inherits Bitcoin's security. It employs an improved Proof of Transfer (PoX) consensus mechanism, deeply binding the history of the Stacks blockchain with the Bitcoin chain. Each time a new Bitcoin block is generated, the state of the Stacks network is synchronously recorded, ensuring that its block history has the same immutability as the Bitcoin chain.

Each sBTC token is linked to an equivalent amount of Bitcoin in a wallet, managed by a decentralized network of signers responsible for handling user deposits and withdrawals. Signers earn Bitcoin rewards by processing sBTC transactions.

sBTC stands out among various Bitcoin tokenized assets

Why choose sBTC?

Compared to mainstream tokenized Bitcoin assets (such as wBTC and Coinbase BTC), sBTC has the following significant advantages:

1 Top-tier Security Protection: sBTC is the only tokenized solution that inherits Bitcoin's native security, requiring approval from 70% of the decentralized signer network for transactions. Additionally, Stacks employs a multi-layer security protection system: it has collaborated with top security experts like Asymmetric Research and ImmuneFi to conduct vulnerability assessments and bounty programs, and has engaged independent auditing firms to evaluate the security of sBTC.

2 Higher Economic Efficiency: Compared to wBTC, sBTC provides a fast programmable channel for Bitcoin and supports multi-chain expansion. With no packaging/unpacking fees, sBTC offers better economic value.

3 Decentralized Characteristics: Unlike wBTC and cbBTC, sBTC users do not need to complete KYC verification and do not rely on centralized institutions when transferring Bitcoin assets across chains.

Initial Achievements and Development Roadmap of sBTC

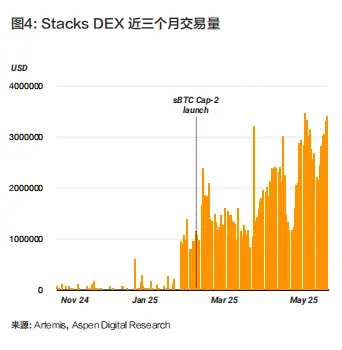

• Phase One - Bitcoin Deposit: sBTC officially launched in December 2024, with the team setting an initial cap (1,000 Bitcoins) and a second cap (2,000 Bitcoins), allowing Bitcoin to flow into the Stacks ecosystem. The second cap was reached within 24 hours of its launch, leading to explosive growth in Stacks DEX trading volume. On May 22, the third cap (2,000 Bitcoins) was reached in just 3 hours.

• Phase Two - Bitcoin Redemption: This will support users in seamlessly exchanging sBTC for BTC, with this feature planned to be officially enabled by the end of April.

• Phase Three - Opening Signer Nodes: The sBTC signer nodes will gradually expand from the initial 15 community-elected nodes, marking a key step towards full decentralization of the protocol.

sBTC Reward Program for BTC Earnings

The sBTC reward program provides Bitcoin holders with the simplest and safest way to earn yields. This program allows sBTC holders to earn an annual yield of 3-5% while maintaining full liquidity of their assets, and supports flexible asset allocation within the Stacks DeFi ecosystem. Its yield comes from the Bitcoin rewards generated by the underlying consensus mechanism of the Stacks Proof of Transfer protocol, with initial incentive funds provided by early supporters. Users can enjoy basic yields without needing to stake or lock sBTC, and rewards are automatically distributed to their non-custodial wallets every two weeks.

Since all sBTC transactions are settled 100% directly to the Bitcoin network, this yield program has become the only native Bitcoin yield mechanism that achieves a "Bitcoin in, Bitcoin out" closed loop.

Before the launch of sBTC, the STX token primarily served two core functions:

Payment medium for transaction and gas fees: As ecosystem activity increases, the demand for STX tokens for gas fees continues to grow (currently, 100% of fuel fee revenue is allocated to miners).

Staking: A unique mechanism on Stacks. Stakers lock their STX to earn Bitcoin. Miners must bid to obtain the right to package Stacks blocks to earn STX token rewards. The higher the ecosystem activity, the more valuable the blocks become, which in turn raises the Bitcoin bidding price for miners, ultimately driving the actual earnings of STX token stakers to increase (currently, the total annualized yield for each staking cycle exceeds 7%).

Staking slot scarcity mechanism: Miners gather all Bitcoins committed for Proof of Transfer (PoX) in each cycle and distribute them evenly among 4,000 reward slots. To obtain a slot, approximately 149,600 STX is currently required. As Stacks activity increases, blocks become more valuable, driving up BTC bids and increasing the actual earnings of STX stakers. Due to the limited number of slots, higher rewards make each slot more valuable, thus increasing the minimum STX required for each slot. This means that more activity on Stacks not only brings greater returns to stakers but also reduces the circulating supply of STX, as more STX needs to be staked to earn yields.

The introduction of sBTC further strengthens this economic model: as the scale of sBTC expands, the gas demand on the Stacks network will significantly increase, and higher gas consumption means increased Bitcoin earnings for stakers, making STX more valuable.

As indicated in the latest roadmap, the Stacks team is exploring more ways to enhance the value of STX, including coordinating a dual staking mechanism for BTC and STX incentives, sBTC yield mechanisms, and simplifying the user experience for capturing STX value.

Comprehensive Development of Stacks BTCFi

In 2025, the Stacks Bitcoin financial ecosystem is expected to experience explosive growth: the total locked value of sBTC reaches $549 million, the market cap of stablecoins on Stacks grows sevenfold, and the number of native Bitcoins crossing chains surges from 1,240 to 5,015 (expected to reach 21,000 by the end of 2025). Meanwhile, the total amount of STX staked reaches a historical high of 608 million.

As of May 2025, the following mainstream BTCFi protocols in the Stacks ecosystem can be highlighted:

- Zest Protocol: The leading lending protocol on Stacks, with a TVL exceeding $77 million.

- Velar: The premier perpetual contract trading platform in the Stacks ecosystem, currently supporting over 90 trading pairs, with a TVL surpassing $5 million in 2024 and over 100,000 community members.

- Bitflow: Focused on providing exchange services for Bitcoin, stablecoins, and Bitcoin-native assets, with a cumulative trading volume exceeding $197 million, and has integrated with the Leather wallet.

- StackingDAO: A liquid staking solution, with its liquid staking token stSTX's TVL exceeding $55 million.

- Alex Labs: A DeFi ecosystem based on Stacks, its latest incentive program "Surge 4" has launched, distributing 1 million ALEX tokens to liquidity providers. In addition to earning up to 5% sBTC yield from Stacks, sBTC trading pairs can also earn additional rewards from the Surge 4 program.

- Hermetica: Provides Bitcoin-backed stablecoin USDh services on Stacks. With the expansion of sBTC Phase II, users can now borrow USDh by collateralizing sBTC for yield farming, achieving multiple asset appreciation. Currently, the TVL of USDh has surpassed $5.6 million.

Stacks Ecosystem: Future Growth Engine

In addition to the existing DeFi ecosystem, Stacks has announced its latest roadmap to accelerate ecosystem growth:

#1 Deep Integration of Stacks with Bitcoin Virtual Machine

BitVM (Bitcoin Virtual Machine) is an innovative architecture that supports off-chain computation, achieving verifiable off-chain operations through the deployment of fraud-proof mechanisms on the Bitcoin blockchain. BitVM reconstructs the trust system using a 1-of-n security model, requiring only one honest participant to ensure system security (originally requiring 30% honest signers), enhancing the security and trustlessness of the sBTC cross-chain bridge. Stacks has established a BitVM technical task force and will invest over $2 million in R&D budget over the next 12-18 months. Additionally, Stacks is adding WASM compatibility to the smart contract language Clarity to enhance the developer experience.

#2 Multi-Chain Expansion of sBTC

The Stacks ecosystem is promoting the expansion of sBTC to public chains such as Solana, Aptos, and Sui. Stacks is building a decentralized and secure BTC cross-chain bridge based on a fully programmable Stacks L2 architecture (breaking through Bitcoin script limitations), allowing a broader range of Web3 users to enjoy native Bitcoin yields, achieving real-time price data synchronization through Bitcoin oracles, and supporting cross-chain queries of the Bitcoin network's real-time status.

sBTC is expected to be included in the liquidity pools of leading DEXs on Solana, allowing users to exchange Solana assets for sBTC to earn native yields. For the Aptos ecosystem, sBTC has enabled the Aptos Foundation to join the signer set, allowing Bitcoin holders to directly participate in applications such as games, social interactions, and NFT markets within the Aptos ecosystem.

#3 Innovative Use Cases

The Stacks ecosystem is expanding into innovative use cases such as DEFAI (Decentralized Finance Artificial Intelligence) and re-staking. For example, Alex Labs integrates AI agents to enhance users' liquidity, asset exchange, and cross-chain operation capabilities.

Institutions Fully Bet on the Stacks Ecosystem

STX as the First Token Compliant with SEC Standards Takes the Lead

Stacks' STX is the first token approved by the SEC (July 2019), recognized as a non-security asset due to its sufficient network decentralization. Although the U.S. SEC has not clearly defined the token attributes of most Bitcoin ecosystem projects, STX's non-security status significantly reduces legal/regulatory risks for Stacks.

As the U.S. government shifts to support the crypto industry, Stacks' advantage as a "domestic token" becomes prominent. Institutions are seeking Bitcoin-denominated yields through Bitcoin ETFs and decentralized solutions like Stacks' sBTC. Despite Bitcoin ETFs seeing inflows of 26,700 BTC in May, institutions increasingly favor sBTC, which can provide native BTC rewards and additional DeFi yields. Notable institutions such as Jump Crypto, SNZ, Rootstock Labs, UTXO Management, and Asymmetric Research have all supported sBTC.

Institutions Compete to Lay Out STX Exposure to Capture Bitcoin Ecosystem Expansion Dividends

- Grayscale Stacks Trust: Allows investors to gain STX exposure in the form of securities without directly purchasing or storing tokens.

- 21Shares Staking ETP (ASTX): 100% physically backed, the product not only tracks STX price performance but also automatically reinvests staking rewards to enhance yields.

- Coinbase 50 Index: Tracks the top 50 cryptocurrencies by market capitalization, with STX consistently among the constituents.

- Bitgo and Hex Trust support: Allow institutions to invest sBTC into the DeFi ecosystem while ensuring Bitcoin security.

- Fordefi supports sBTC: The first operational wallet to fully support Bitcoin DeFi, compatible with all SIP-10 assets (including sBTC).

- Bitfinex Exchange lists STX: Opening up participation channels for institutions and retail investors.

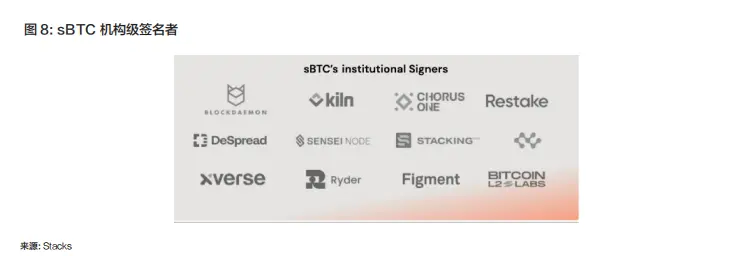

Institutional Nodes Build a Security Moat for Stacks

Signers are responsible for managing Bitcoin custody and processing sBTC deposits and withdrawals. Initial nodes are composed of well-known institutions such as Chorus One and Figment, and will gradually transition to a fully decentralized model in the future, further enhancing the network's risk resistance. Currently, the total asset scale managed by sBTC signer nodes has exceeded $10 billion, with more heavyweight institutions joining the Stacks network.

STX Price Prediction Model

We expect the target price range for Stacks over the next four months to be $0.85 to $3.81. This price prediction is based on the following indicators: i) expected market size of Bitcoin Layer 2, ii) Stacks FDV valuation, and iii) the ratio of Ethereum Layer 2 to Ethereum market capitalization as a reference. It is important to note that the current price prediction model does not fully incorporate the impact of the sBTC flywheel effect, making the price prediction conservative.

Hypothetical scenario: If Stacks maintains its position as the top Bitcoin L2 token by market capitalization and among the top three in DeFi TVL, referencing the valuation logic of Ethereum's leading L2 project Mantle: if STX only accounts for 0.11% of BTC FDV (equivalent to MNT's 15% share of ETH FDV), then the valuation of STX could reach $1.73.

Bull Market Scenario

Hypothetical scenario:

If Stacks maintains its position as the top Bitcoin L2 token by market capitalization and among the top three in DeFi TVL, referencing the valuation logic of Ethereum's leading L2 project Mantle: if STX only accounts for 0.11% of BTC FDV (equivalent to MNT's 15% share of ETH FDV), then the valuation of STX could reach $1.73.

Risk Warning

Hypothetical scenario: Given that Stacks occupies the largest market capitalization and TVL in the Bitcoin ecosystem, and that sBTC has become the dominant tokenized solution in BTCFi, combined with the expectation of institutional accumulation of STX and the rapid expansion of the decentralized signer network, we expect STX to reach $3.81 by the end of Q3. Core assumptions: 1) Bitcoin FDV will reach $2.6 trillion; 2) Stacks FDV will account for 15% of the total market cap of Bitcoin L2. Market risk: The current valuation model does not account for the impact of macroeconomic uncertainty on the crypto market, especially the risk of significant price volatility for Bitcoin in 2025.

DeFi market risk: The model does not assess the influence of sBTC in Bitcoin assetization solutions.

Conclusion

BTCFi, as an emerging market, holds immense potential to unlock trillions of dollars of idle capital in Bitcoin. Leveraging the advantages of leading projects in the Bitcoin L2 space, Stacks occupies a strategic high ground in the BTCFi market through sBTC—1:1 Bitcoin collateralized assets enable users to cross-chain BTC to DeFi applications for yield, engage in on-chain lending, and trade on decentralized exchanges. sBTC, inheriting Bitcoin's security genes and decentralized characteristics, has become the preferred asset for institutions entering the BTCFi space.

As of May 28, STX is priced at $0.88. Driven by strong network fundamentals, the increasing institutional adoption in the BTCFi space, and the future expansion momentum of the Bitcoin L2 market, this asset shows significant upside potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。