Taking profits allows you to go further.

Author: 2898

If you have tens of thousands of U to buy coins, you can just go all in, but what if you have 400 million dollars?

How should you buy?

If you don't know how to manage your assets, the operations of the funds under Yilihua may provide you with some reference.

Outline of this article:

🧨 The amazing operation of bottom fishing at the most FUD moment

🛒 Bottom fishing should mean buying more as prices drop, in small amounts multiple times

🤔 Can you guess what their holding cost is?

💼 Taking profits allows you to go further

🧾 How to learn the bottom fishing strategy from on-chain whales

⚠️ Note

Addresses: Mainly analyzing four addresses under Yilihua

Cost: Backtracking to early 2025, a large amount of ETH was deposited into Aave, which can be considered long-term holding, so it can only be estimated based on the market price at that time

Purpose: To see how the big players are bottom fishing

1. The amazing operation of bottom fishing at the most FUD moment 🧨

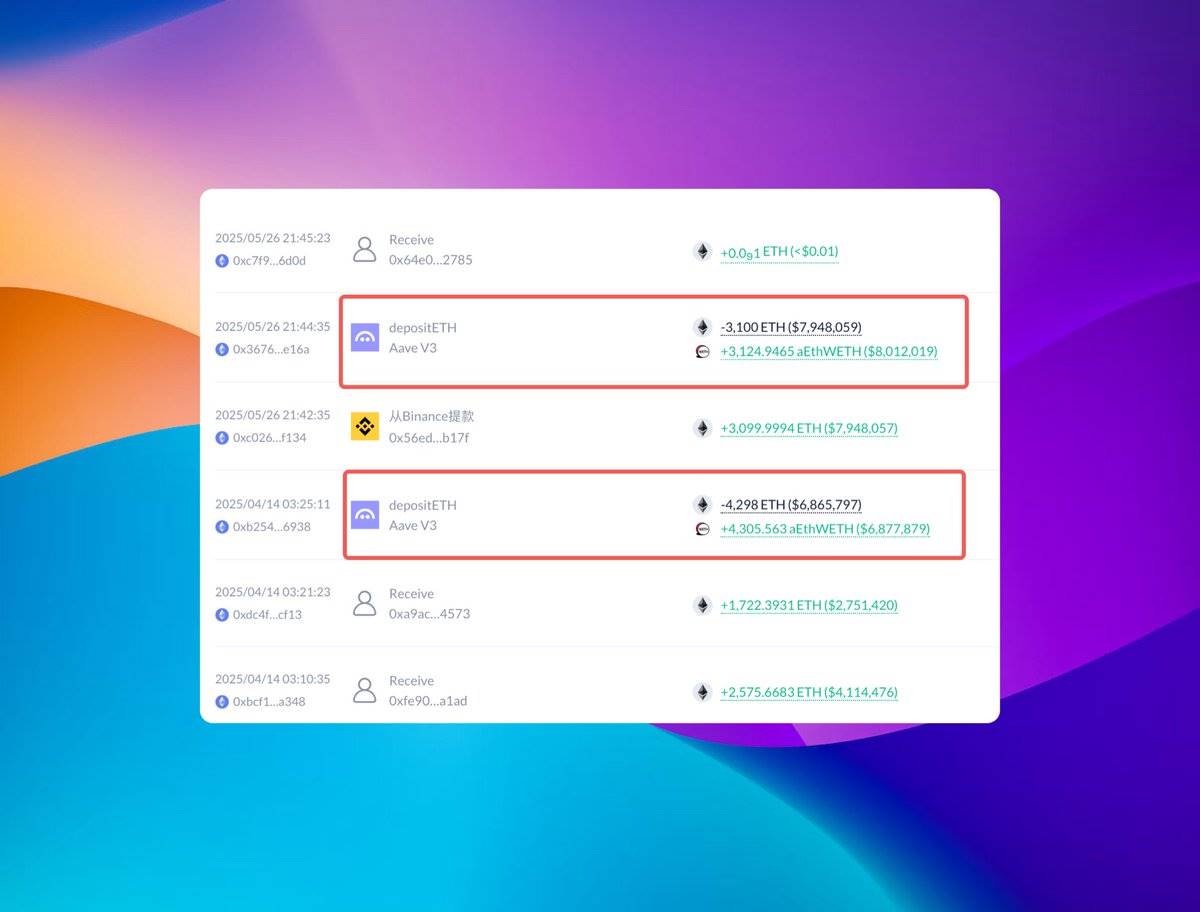

Address One:

0x8b0e4a56b3bc5ecbbaff8c64b06967c25af1f319

May 26, 9:44 PM: Spent 8 million dollars to purchase 3100 ETH, deposited into Aave (funds borrowed from Aave)

May 26, 9:30 PM: Borrowed 8 million dollars from Aave

April 14, 3:26 AM: Borrowed 3.8 million dollars from Aave, transferred out

April 14, 3:25 AM: Spent 6.87 million dollars to purchase 4298 ETH, deposited into Aave

March 27, 12:14 AM: Deposited 366 ETH into Aave

March 25, 3:27 PM: Spent 750,000 dollars to purchase 366 ETH

Total:

Principal: 7.62 million dollars

Current value: 366 + 4298 + 3100 = 7764 (approximately 21 million dollars)

Profit: 13 million 💰

Everyone should bottom fish in stages

First stage: April 14, the most FUD moment

Second extreme: May 26, when the situation became clear, leveraged with the same amount of funds as when bottom fishing

🤔 Insights

1️⃣ Do big funds still prefer Binance? After all, safety comes first

2️⃣ This address bought a large amount of NEIRO, which is probably the reason for the previous research report's recommendation

The research report released on April 24, buying continuously from May 11 to May 21, shows real confidence

3️⃣ The most frequent transactions in the address are phishing transactions; if you have large amounts of funds, be sure to pay attention to security, be cautious and prudent

2. Bottom fishing should mean buying more as prices drop, in small amounts multiple times 🛒

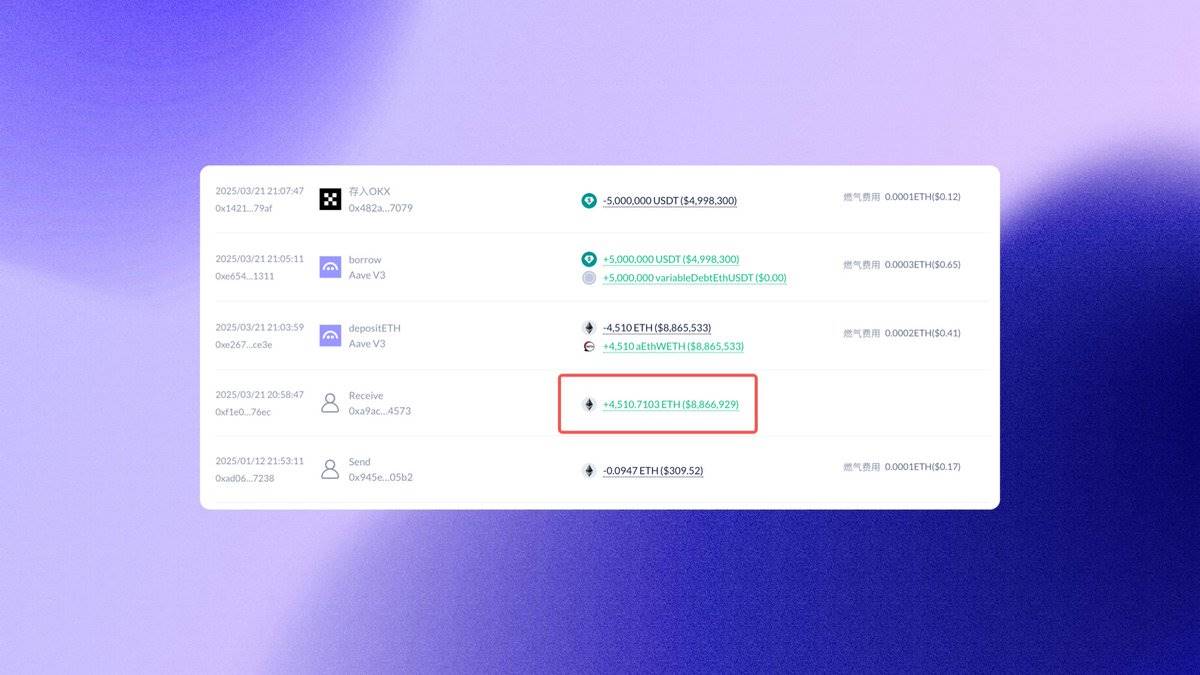

Address Two:

0x74ba54e959bbdd45be1e2f48c8032c776d78376c

May 26, 9:48 PM: Spent 5.1 million dollars to purchase 1964 ETH, deposited into Aave (certain opportunity to buy ETH)

May 26, 9:30 PM: Borrowed 5 million dollars from Aave

April 14, 3:31 AM: Borrowed 900,000 dollars from Aave, transferred out

March 31, 12:45 AM: Withdrew 1.18 million dollars from Binance, deposited into Aave

March 24, 4:26 PM: Spent 2 million dollars to purchase 965 ETH, deposited into Aave (ETH price 2081 dollars)

March 24, 4:03 PM: Borrowed 2 million dollars from Aave and deposited into Binance

March 21, 9:38 PM: Spent 5 million dollars to purchase 2560 ETH, deposited into Aave (ETH price 1953 dollars)

March 21, 9:05 PM: Borrowed 5 million dollars from Aave and deposited into OKX

March 21, 9:03 PM: Withdrew 4510 ETH from Binance, deposited into Aave

August 7, 2024: Borrowed 5 million dollars from Aave and deposited into OKX

Total:

Principal: 8.86 million dollars

Current value: 4510 + 2560 + 965 + 1964 = 10,000 (approximately 27.2 million dollars)

Profit: 18.34 million dollars 💰

This is an old address that has been in use for a long time; tracing back further goes to 2024, so we won't consider that

It's also impossible to calculate when and at what cost the initial 4510 ETH were purchased

🤔 Insights

Compared to the previous address's super bottom fishing operation, this address's operation is more like that of an experienced trader

I think you undervalue me, so I will slowly bottom fish

Each bottom fishing only uses a small amount of money: around 5 million dollars

Continuous bottom fishing, do not go all in, always keep liquidity funds available

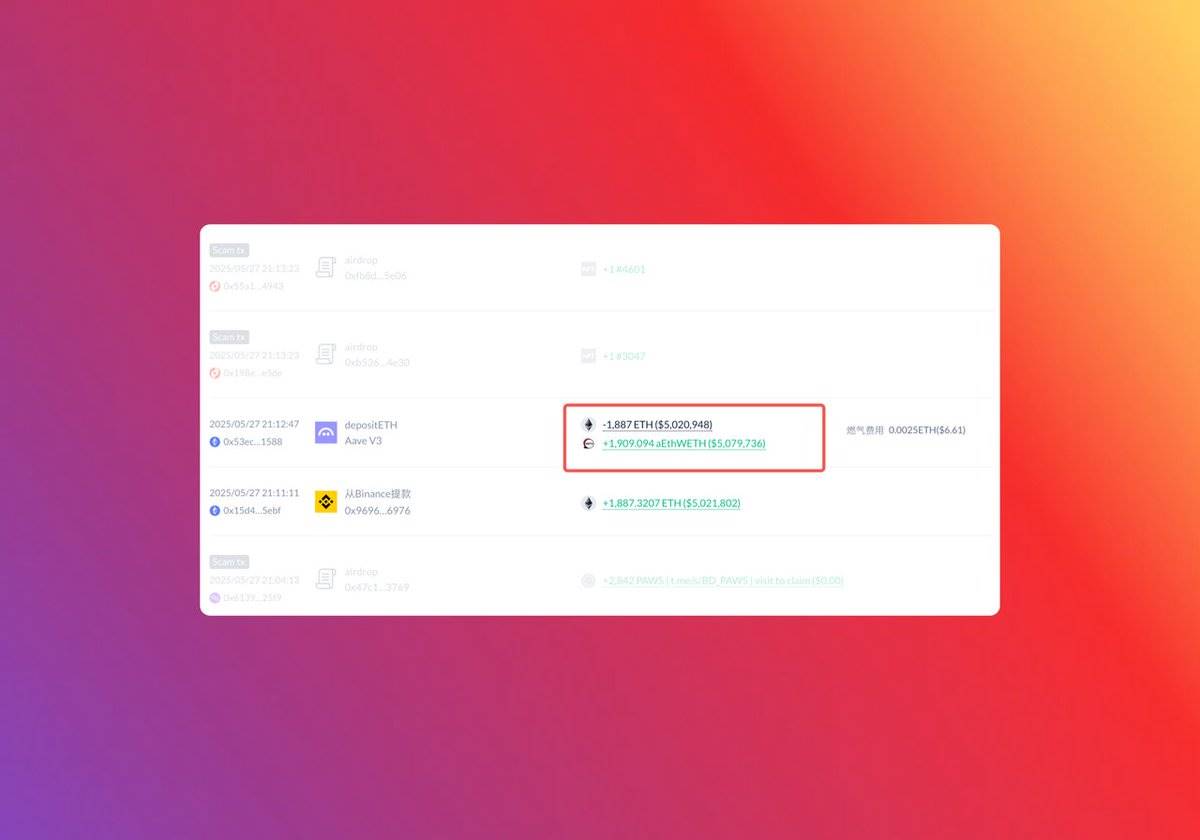

3. Can you guess what their holding cost is? 🤔

Address:

0xd9cf5e2a699c19a33b4ba7831d9525471e262931

May 27, 9:12 PM: Spent 5.07 million dollars to purchase 1887 ETH, deposited into Aave (certain opportunity to buy ETH)

May 27, 8:51 PM: Borrowed 5 million dollars from Aave (one day later than the previous address, also DCA)

April 14, 2:53 AM: Borrowed 1.3 million dollars from Aave, transferred out

March 24, 4:26 PM: Borrowed 1.4 million dollars from Aave, purchased 674 ETH, deposited into Aave (ETH price 2077 dollars)

March 19, 7:10 PM: Spent 3.11 million dollars to purchase 1513 ETH (ETH price 2055 dollars), deposited into Aave

March 19, 6:23 PM: Deposited 4058 ETH into Aave (worth 8.33 million)

Total:

Principal: 8.33 million dollars

Current value: 4058 + 1513 + 674 + 1887 = 8132 (approximately 22 million dollars)

Profit: 13.67 million dollars 💰

This is also an old address that has been trading meme coins 😂

It's also impossible to calculate when and at what cost the initial 4058 ETH were purchased

🤔 Insights

It can be seen that their target bottom fishing point is 2000 dollars; everyone is not too far from that

I also started bottom fishing from 2500, then 2000, 1800, 1400, so everyone's cost line is not 1400; this is something everyone must remember

4. Taking profits allows you to go further 💼

Address:

0xf2500b6014dfe916b8e7706434e21b5fb2191a15

7 hours 58 minutes ago: Transferred out 400,000 dollars

7 hours 59 minutes ago: Transferred out 700,000 dollars to Bybit, buying altcoins?

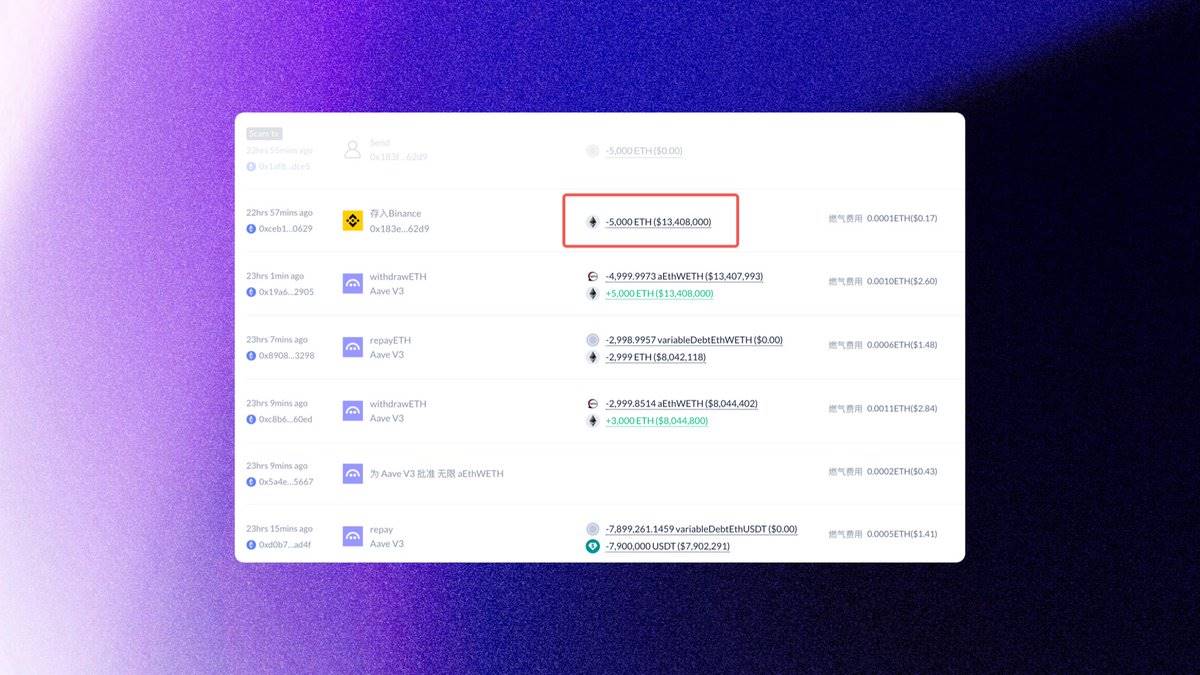

22 hours ago: Withdrew 13 million dollars from Binance, gave 10 million dollars to Aave

22 hours 30 minutes ago: Received 956 ETH

22 hours 52 minutes ago: Withdrew 5000 ETH from Aave and sold it on Binance (13.4 million dollars, combined with the later withdrawal, means it was all sold)

23 hours ago: Borrowed 3000 ETH from Aave and sold it on Binance (8 million dollars, repaid after selling on Aave)

May 28, 9:12 PM: Borrowed 5.09 million dollars to purchase 1900 ETH, deposited into Aave (certain opportunity to buy ETH)

May 27, 6:52 PM: Borrowed 5.04 million dollars to purchase 1894 ETH, deposited into Aave (certain opportunity to buy ETH)

March 24, 5:08 PM: Borrowed 1.99 million dollars to purchase 957 ETH, deposited into Aave (ETH price 2079)

March 19, 10:37 PM: Borrowed 5.07 million dollars to purchase 2467 ETH, deposited into Aave (ETH price 2055)

February 26: Deposited 6922 ETH into Aave (worth 14.23 million)

Total:

Principal: 14.23 million dollars

Current value: 6922 + 2467 + 957 + 1894 + 1900 = 14,140 (approximately 38.46 million dollars)

Profit: 38.45 million dollars

🤔 Insights

This address is one that operates frequently; observing this can reveal its subsequent actions

Due to the frequent operations of this address, it has been targeted by phishing, with several pages filled with phishing transactions; safety must be a priority

5. How to learn the bottom fishing strategy from on-chain whales 🧾

From the four addresses, the overall strategy of the "Yilihua" team demonstrates strong capital mobilization and risk control capabilities. Their bottom fishing methods have the following core characteristics:

Firmly hold ETH: These four addresses have never sold ETH, only continuously adding to their positions and leveraging. It can be judged that this is their core asset allocation.

Batch building and clear DCA strategy: Whether during the most severe FUD period or after the market reversal, the whales insist on "buying more as prices drop, in small amounts multiple times," with the principal mainly concentrated in the $2000–$2100 range for bottom fishing.

Leveraging to amplify returns: A large amount of ETH is deposited into Aave, then borrowed to obtain USDC to buy ETH again, and after confirming the market rebound, they close positions in a timely manner, completing the capital cycle.

Diverse operating styles:

Some addresses focus on "single-point explosions," precisely timing large purchases;

Others adopt an "experienced trader style," slowly building positions in batches;

Some frequently enter and exit, demonstrating strong short-term judgment.

Strong risk control awareness: Each investment amount is relatively conservative compared to the account size, mostly concentrated in the 5–8 million dollar range; multiple addresses have been disturbed by phishing transactions, reminding us: safety first, the blockchain is always a hunting ground.

Behind the bullish calls is a long-term layout: Although bullish calls are made at $1400, on-chain data shows they began laying out at $2000; the separation of public opinion and operations is a common tactic among large players.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。