Ruslan Lienkha, Chief of Markets at Youhodler, views the recent net distribution by large holders as a correction within bitcoin’s established $90,000–$110,000 consolidation zone, not a reversal. “This area is saturated with market orders, suggesting strong trading interest and potential support,” he said.

Lienkha expects bitcoin to maintain a medium-term correlation with U.S. tech equities due to shared sensitivity to rates and liquidity, though this could weaken over time or during severe macro disruptions where bitcoin’s hedge attributes may strengthen. On Ethereum, he noted its strong fundamentals for growth but sees institutional adoption lagging bitcoin.

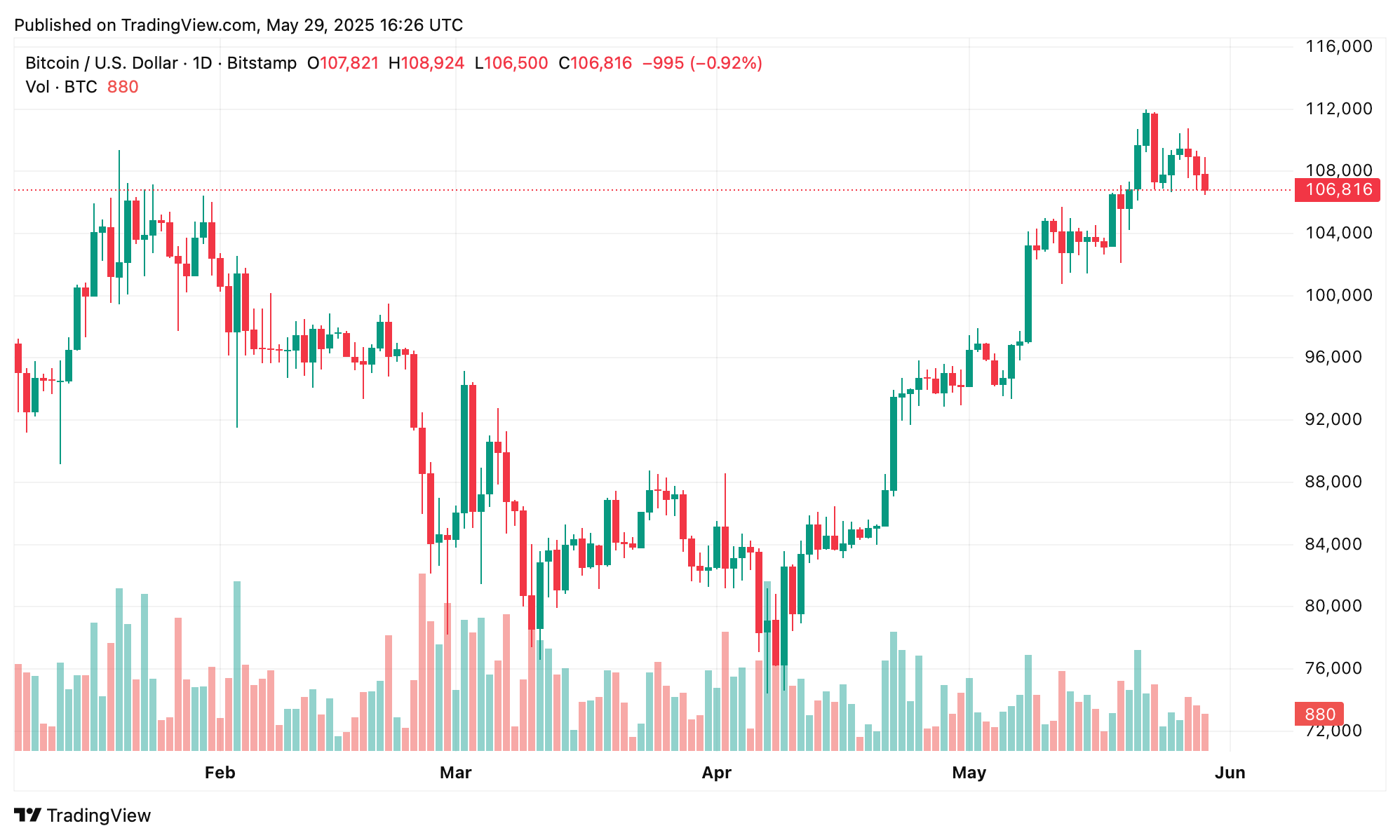

BTC/USD 1-day chart via Bitstamp on May 29, 2025.

Nic Puckrin, founder of Coin Bureau, observed bitcoin’s muted reaction to news of blocked Trump tariffs, underscoring its primary focus on Federal Reserve policy. “Bitcoin doesn’t care about tariffs – it cares about the Fed,” Puckrin stated. He highlighted diminished market expectations for 2024 rate cuts – now below 20% – following cautious FOMC minutes, suggesting bitcoin needs new catalysts for upward momentum.

“While Bitcoin isn’t surging, the U.S. market is set to open higher, judging by the S&P 500 futures. It’s likely that Bitcoin front-ran stocks over the last couple of weeks, fuelled by the sovereign risk fears. Now, crypto investors have turned their attention to monetary policy, and it’s not looking good,” Puckrin said in a note sent to Bitcoin.com News.

James Toledano, COO of Unity Wallet, said bitcoin’s rally already priced in bullish catalysts like institutional inflows and geopolitical uncertainty. “I see it as a stabilization and not a stall,” he noted, pointing to high open interest and neutral funding rates. He warned of potential volatility ahead of key economic releases, including PCE inflation data and jobless claims.

Toledano added that Nvidia’s record earnings could support bitcoin via tech-rally correlation, but cautioned that signs of slowing artificial intelligence (AI) demand might spook risk assets. “The combination of potentially soft inflation, a cooling labor market, and positive tech earnings… could create a supportive environment,” he said, though hotter-than-expected inflation could pressure prices.

Markets now await clearer signals from macroeconomic data and policy developments to determine bitcoin’s next significant move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。