Bitcoin ETFs Defy Holiday Lull With $385 Million Inflow, Ether Funds Extend Streak

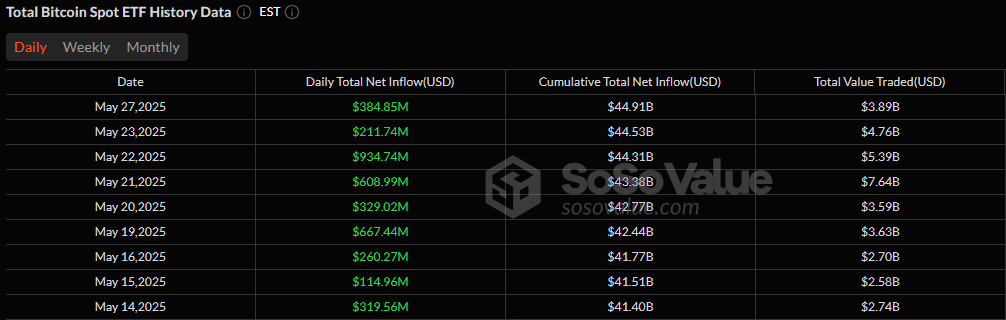

Not even Memorial Day could dampen the bullish momentum behind crypto exchange-traded funds (ETFs), as bitcoin ETFs notched their ninth consecutive day of inflows, hauling in $384.85 million.

Despite notable outflows from heavyweights like Ark 21Shares’ ARKB and Grayscale’s GBTC, Blackrock’s IBIT once again stole the spotlight, pulling in $409.26 million, reinforcing its dominance as the go-to ETF for institutional flows.

Source: Sosovalue

Supporting the rally were Grayscale’s Bitcoin Mini Trust with $36.03 million, Vaneck’s HODL with $7.77 million, and Bitwise’s BITB with $1.79 million. Even with ARKB’s $38.34 million, GBTC’s $26.87 million, and Fidelity’s $4.79 million in outflows, the bulls had the upper hand. Total value traded hit a strong $3.90 billion, and total net assets climbed to $132.89 billion.

Meanwhile, ether ETFs kept their hot streak alive, marking the sixth straight day of inflows with a $38.77 million boost. Blackrock’s ETHA contributed the lion’s share at $32.48 million, followed by Fidelity’s FETH with $3.35 million and Vaneck’s ETHV with $2.95 million. With daily volume topping $613 million, ether ETF net assets closed at $9.59 billion.

The takeaway? Markets are embracing crypto ETFs with conviction, holiday or not.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。