The financing for Strive Asset Management and Asset Entities Inc. (Nasdaq: ASST) includes a private investment in public equity (PIPE) priced at $1.35 per share—a 121% premium to Asset Entities’ pre-merger announcement stock price—with potential additional proceeds of $750 million if warrants are exercised, bringing total funding to $1.5 billion.

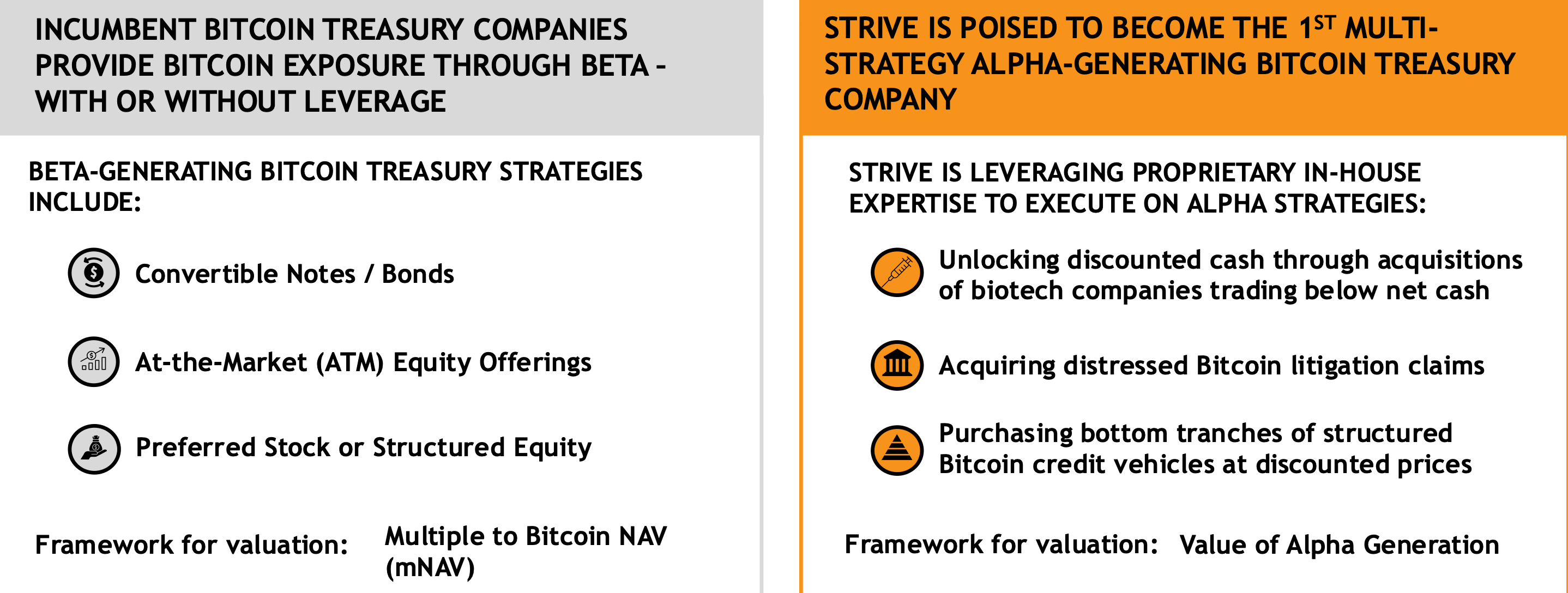

The merged entity will operate debt-free post-transaction, preserving future leverage capacity. Strive CEO Matt Cole outlined plans to deploy “alpha-generating strategies” to outperform bitcoin’s baseline returns, diverging from traditional beta approaches.

These include acquiring biotech firms trading below net cash value, purchasing distressed bitcoin claims like Mt Gox holdings at discounts, and investing in discounted tranches of structured bitcoin credit vehicles. Cole emphasized that Strive’s model requires a “new valuation framework,” arguing most competitors rely on bitcoin’s price multiples rather than active strategies.

The company has partnered with 117 Partners LLC to access an estimated 75,000 BTC in distressed claim opportunities. A group of institutional investors and Strive’s management team participated in the PIPE, which is set to close alongside the firms’ merger.

The announcement on Tuesday explained that shareholder approvals and customary conditions remain pending. The merger positions Strive to compete in a sector dominated by passive bitcoin treasury holdings, betting on active tactics to drive growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。