This decentralized derivatives exchange, after facing a "sniping" incident, is re-entering the spotlight of the crypto world from a new perspective.

Author: Frank, PANews

Recently, as whales stirred up "turbulence" on Hyperliquid, this decentralized derivatives exchange is re-entering the spotlight of the crypto world from a new angle after experiencing a "sniping" incident. Once a challenger, it is now truly shaking the traditional territory of centralized exchanges with a series of impressive data performances and rapid ecosystem expansion.

This article by PANews delves into Hyperliquid's recent data, aiming to comprehensively showcase the true picture of Hyperliquid's development.

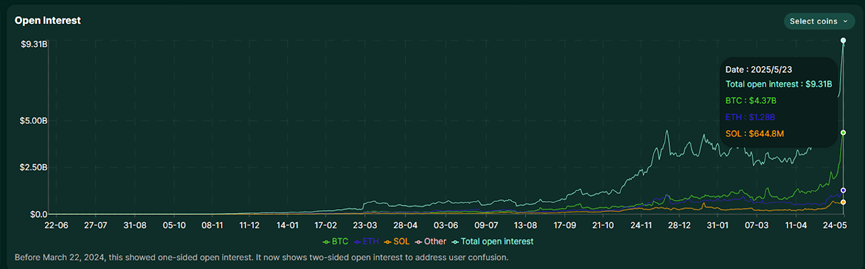

Contract Open Interest Hits New Highs, Approaching OKX

On May 23, Hyperliquid's open contract volume reached $9.31 billion, continuously setting new historical highs. This figure is more than double the $4.4 billion peak created in December last year. Among this, BTC and ETH contributed about half of the contract open interest.

In comparison with some mainstream CEX data, Hyperliquid's contract open interest is now similar to that of OKX. In terms of Bitcoin's contract open interest, it ranks between 5th to 7th place alongside exchanges like OKX, Bitget, and HTX. On May 23, Hyperliquid's DEX trading volume reached $714 million, a threefold increase compared to $200 million at the beginning of the month.

With the increase in trading activity, Hyperliquid's revenue situation has also seen a significant improvement, generating fees of $62 million in the past 30 days, making it the 8th ranked protocol in terms of revenue, just behind Jito and Pump.fun, and even surpassing Tron and Solana.

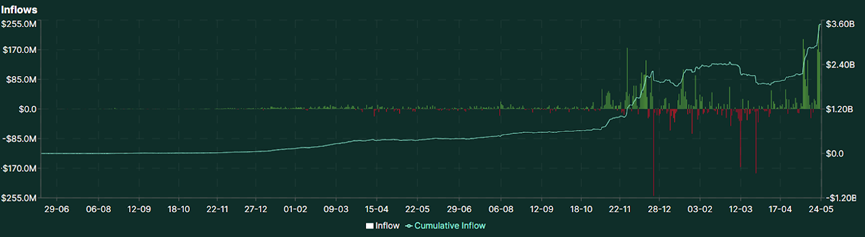

In March, Hyperliquid frequently encountered incidents where traders profited massively through order book loopholes (Related reading: Hyperliquid Faces Flash Sniping Again, A Life-and-Death Drama in 2 Hours, No Winners in the Hunt by Top Exchanges). From that period, it can be seen that Hyperliquid's capital inflow experienced a significant decline, dropping from $2.47 billion on March 1 to $1.85 billion on April 7, a decrease of about 25%. However, as whales returned and frequently placed large contract orders, attracting market attention, Hyperliquid's capital inflow began to reverse. As of May 26, Hyperliquid's net capital inflow had grown to about $3.5 billion. This figure not only recovered the previous losses but also set a new high. Especially after entering May, this inflow change became more pronounced, with the highest single-day net inflow reaching $240 million and an average daily net inflow of $53 million.

These capital inflows are closely related to the large orders placed by whales like James Wynn. After entering May, several whales, including James Wynn and "50x Brother," frequently placed contract orders worth tens of millions or even hundreds of millions on Hyperliquid. Under the real-time observation of on-chain analysts, these whales' operations became a market focus. At the same time, this also served as an advertisement for Hyperliquid. Interestingly, this transparent on-chain operation created a follow-on effect, becoming a unique advantage for Hyperliquid as a decentralized exchange, which traditional CEXs find hard to replicate.

Token Market Cap Surpasses SUI, Multiple New Protocols in Ecosystem Have Airdrop Expectations

Under the premise of comprehensive positive data, Hyperliquid's governance token HYPE began to surge after hitting a low of $9.3 in April, reaching a maximum price of $39.9 as of May 27, with a maximum increase of about 329%. The market cap of HYPE also peaked at $12.9 billion, surpassing SUI to become the 13th ranked token by market cap.

In the ecosystem, Hyperliquid has also made some new progress recently. In April, external DeFi protocols like Morpho and Upshift began to deploy on Hyperliquid. Several exclusive protocols within the ecosystem, such as HyperLend, Felix, and HypurrFi, have seen their TVL exceed $100 million. As of May 27, Hyperliquid's TVL reached $1.46 billion, and the number of protocols increased to 27, of which 16 are exclusive to Hyperliquid. Many of these protocols, being in the early stages, have already launched point programs, indicating significant airdrop potential.

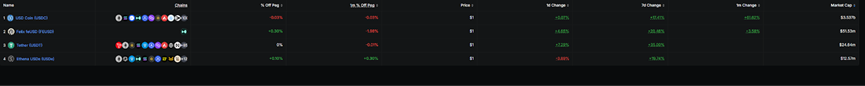

Additionally, the previous reliance on Arbitrum for capital flow has seen significant changes, with new cross-chain bridge tools like Hyperunit, HyperSwap, and HyBridge supporting direct capital flow of more on-chain assets. In terms of stablecoin issuance, Hyperliquid ranks sixth among all public chains with a stablecoin market cap of $3.6 billion, surpassing other longer-established public chains like Arbitrum, Aptos, Sui, and TON. The largest issued stablecoin, USDC, holds a market cap of $3.5 billion, accounting for 97% of the issuance, while Hyperliquid's unique feUSD currently has an issuance of only $51 million, still in the early stages. Moreover, the full-chain stablecoin USDT0 was launched on Hyperliquid in May. Although the current issuance is not high, it has provided a new important channel for capital flow on Hyperliquid.

Beneath the Spotlight, Shadows Remain: User Growth and Trust Face Challenges

Although most data appears positive, some changes are not as evident. For instance, the cumulative number of new users has not shown a significant increase recently, with only a few hundred new users daily, a stark contrast to the thousands of new users per day when Hyperliquid first launched. There seems to be a lack of momentum in attracting newcomers. Additionally, while the number of daily unique traders has seen some growth, peaking at over 30,000, this figure still lags significantly behind other centralized exchanges. Furthermore, in terms of trading categories, the market share of BTC, ETH, and SOL has long hovered around 50%, making it difficult for other types of token trading volumes to break through. This has also made it challenging for newly listed tokens on Hyperliquid to generate the "listing effect" seen in other leading exchanges. Recent token auctions have also been relatively quiet, with auction prices generally between $20,000 and $30,000.

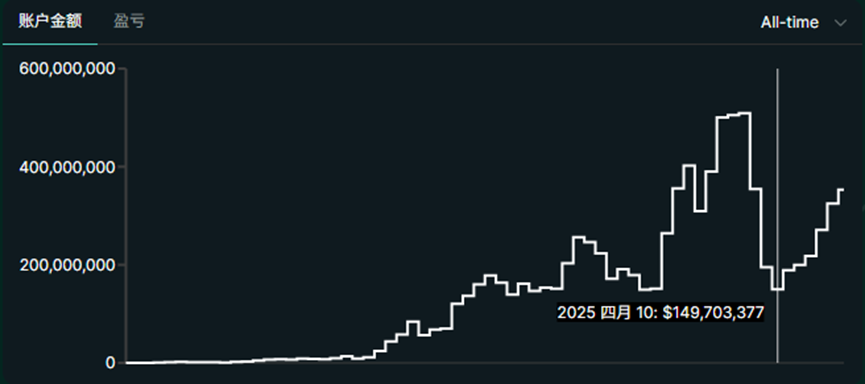

Moreover, in the previous flash sniping incident, Hyperliquid's biggest direct loss came from the revenue loss of the HLP treasury, which is a major source of liquidity. The treasury's revenue dropped from $63 million to $4 million at that time. However, recent data shows that the current HLP revenue has returned to $64.7 million, breaking a new high. From another perspective, this aftereffect has not been completely resolved; the treasury's deposit amount fell from $500 million to a low of $149 million in March, losing 60% of its deposits. Although this figure has recently rebounded to $350 million, it still lags about 30% behind the original high. This indicates that the flash sniping incident significantly impacted the trust of these large depositors in Hyperliquid, which has yet to fully recover.

Overall, Hyperliquid has undoubtedly delivered an impressive report card recently. Whether it is the exponential growth of core data such as contract open interest and trading volume, or the market performance of its native token HYPE, it demonstrates a strong upward momentum and high market attention. Especially the entry of whales and transparent on-chain operations have brought a new wave of free market promotion for Hyperliquid.

However, beneath the shine, there are concerns: the slowdown in new user growth and the complete restoration of trust among large depositors in the HLP treasury are issues that Hyperliquid must confront and resolve before moving to a higher level. But overall, Hyperliquid's performance still proves to the industry that this emerging platform is gradually becoming an undeniable force among trading platforms.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。