Ethereum ETF Approval: Price Impact and Retail Participation Strategies

Impact of ETF Approval on ETH Price

The approval of the Ethereum ETF has had a significant impact on the price of ETH. Firstly, although the ETF has only been approved recently, the market has reacted in advance, with ETH recently breaking through $2,700, reaching a new high in nearly two months.

Secondly, once the S-1 filing officially takes effect, the launch of the ETF may further impact the ETH spot market. The market currently expects this filing to be approved by mid-year, but the official timeline has not been confirmed.

Current Market Situation

The current cryptocurrency market is under close scrutiny due to the progress of the Ethereum (ETH) spot ETF approval. Unlike the previous surge caused by expectations of ETF approval, the market is currently in a state of stable fluctuation, with investors generally adopting a wait-and-see attitude. Last year, the Bitcoin spot ETF was approved, so when the Ethereum spot ETF appears, it is inevitable that comparisons will be made to that situation.

On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) expedited the approval of 11 Bitcoin spot ETFs, completing the approval of the S-1 registration statement and the 19b-4 rule change documents. However, this process was not smooth. Previously, the approval of the 19b-4 document was hindered by concerns over market manipulation, leading to significant fluctuations in Bitcoin prices. After the final approval, market sentiment turned highly bullish, with enthusiasm from both institutions and retail investors driving Bitcoin prices significantly higher. In contrast, the approval of the Ethereum spot ETF is still ongoing. On May 23, 2024, the SEC approved the 19b-4 documents for multiple Ethereum spot ETFs, marking a key development. However, the S-1 registration statement is still under review, leading the market into a wait-and-see period.

However, comparing the market performance after the approval of the Bitcoin ETF, once the Ethereum ETF completes the S-1 approval, it is likely to become a catalyst for price increases.

Participation Opportunities

For ordinary investors, how to participate in this wave of market activity has become crucial. The following will focus on retail participation strategies.

In the current phase where Ethereum prices are stable but may rise due to ETF approval, DCA (Dollar-Cost Averaging) allows retail investors to gradually build positions and lower their average holding costs. If you want to participate in the upward trend while seizing opportunities and controlling risks, "follow the main trend and respond flexibly" is a pragmatic approach. "Long Contract DCA (Investment Strategy)" can help you find a balance between aggressiveness and flexibility, easily capturing upward trends.

For example:

Assuming you expect ETH to rise to $4,500 next month, you could try the following DCA strategy:

- Initial entry price: $3,900;

- Add a position for every $100 drop;

- Take profit at +12% for each trade;

- Total investment controlled at $3,000.

In this way, you can not only "buy low and sell high," but also make your trading more disciplined, easily coping with market fluctuations and gradually accumulating profits. Why is this strategy particularly suitable for retail investors now?

- The market may fluctuate before and after the ETF approval, and DCA helps you average your costs through phased entry, reducing the risk of chasing highs.

- Contract leverage can amplify returns, allowing you to participate in the market more efficiently even with limited funds.

- The automatic position addition and profit-taking rules of DCA keep you away from emotional trading, making it both worry-free and labor-saving.

In summary, using long contract DCA is like having a smart little assistant, helping you steadily "buy low and sell high" in an upward market, allowing you to seize opportunities without fear of market jitters!

How to Quickly Start a Contract DCA?

The first step is to choose the cryptocurrency you want to trade (e.g., ETH/USDT), and then click to enter the "Contract DCA" function to create it.

If you are an experienced trader, you can create a DCA strategy on your own, offering high flexibility.

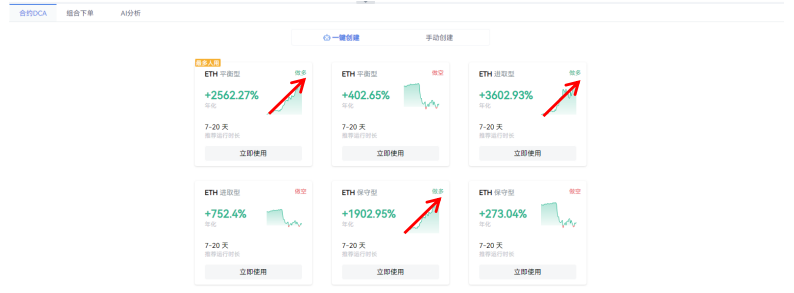

Of course, if you want a hassle-free operation, you can also try ready-made DCA strategy templates!

Step 1. Determine the current market direction (for example, if the Ethereum ETF has positive expectations, you can lean towards going long);

Step 2. Choose your risk preference type: conservative, balanced, aggressive; different contract DCA can be selected based on different risk preferences;

Step 3. Set the total amount of funds you plan to invest;

The remaining operations can be left to the contract DCA to execute automatically!

You can also refer to the automatic backtesting return rate charts provided by the system to assist in judging the effectiveness of the strategy. From historical data, the three types of long contract DCA have shown strong return capabilities and risk control performance under different market conditions, making them a good choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。