Crypto Qingshui is a senior trader with a dual background in traditional finance and the cryptocurrency market. He previously worked in research at top financial institutions and officially entered the cryptocurrency field in 2018, serving as a market maker for one of the world's top ten exchanges, giving him a deep understanding of market operation mechanisms.

Currently, while working at a leading securities firm, Qingshui also operates the "Qingshui Community," focusing on sharing trading strategies for Bitcoin and altcoins. His real-time trading following on Binance and OKEx has reached $300,000, with his Binance following account consistently ranking in the top 50. He primarily shares market insights with investors through platforms like Binance Square, Twitter, and Xiaohongshu.

1: Methods for Accurately Judging Key Market Levels

When asked how to determine Bitcoin's key support and resistance levels, Qingshui shared his "three axes": trend line analysis, chip distribution assessment, and estimated liquidation data. He emphasized that all three tools can be found in the AiCoin PRO version, particularly the chip distribution feature, which, although commonly used in the stock market, also shows remarkable accuracy in the cryptocurrency market.

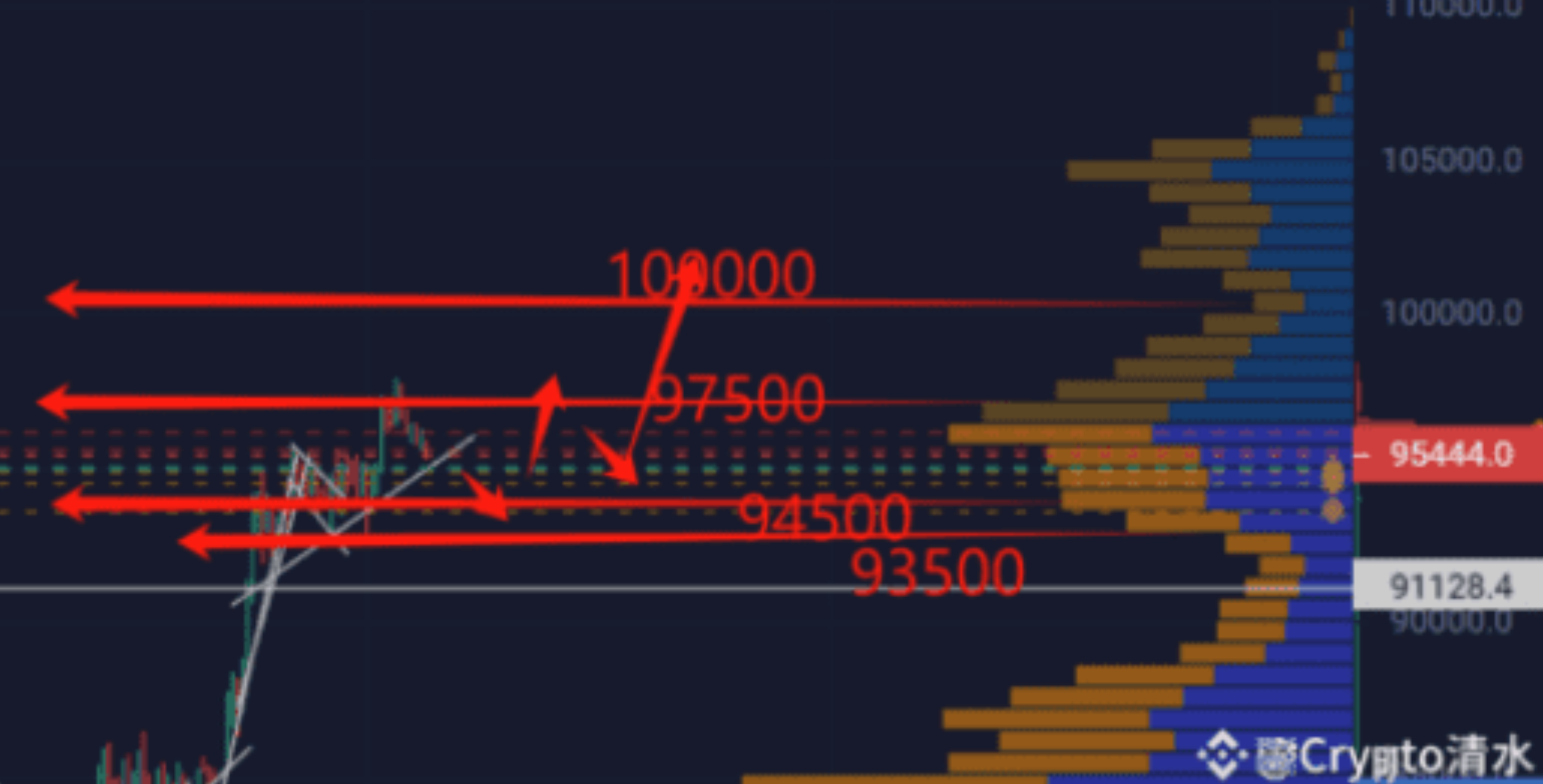

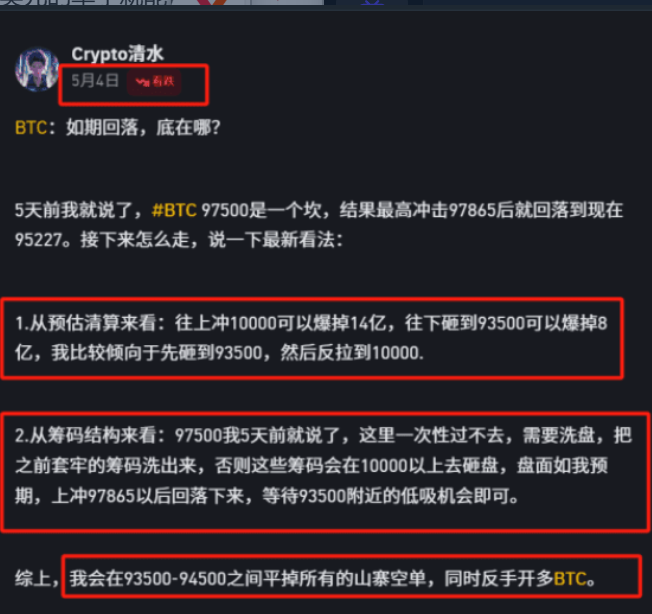

Qingshui illustrated this with a practical case from May 4. At that time, he accurately identified the pressure level at $97,500 and the support level at $93,500 through chip distribution analysis. Combining this with estimated liquidation data, when the price dropped to a low of $93,327, he decisively led community members to buy the dip, successfully capturing a significant upward trend. These analysis processes and trading records can be verified on his Binance Square and Twitter accounts.

2: Secrets to Identifying False Breakouts

Regarding how to judge the validity of Bitcoin's breakout after recently surpassing $100,000, Qingshui revealed his analysis method. He first observes whether the key chip distribution area is effectively stabilized, then verifies whether the trading volume aligns with healthy price increase characteristics, and finally confirms that the trend line remains intact.

Qingshui particularly pointed out that Bitcoin's recent trend exhibits typical "Wall Street-style" trading characteristics, where major funds prefer to create volatile markets to shake out weak hands. In light of this, he advises investors to continue using AiCoin's chip distribution and trend line tools for analysis to avoid being misled by short-term fluctuations.

In terms of trading philosophy, Qingshui proposed a simple yet profound viewpoint: Bitcoin will inevitably rise in the long term, while most altcoins will eventually go to zero. Based on this understanding, his core strategy is to buy Bitcoin on dips while shorting inferior altcoins at highs, using 1x leverage to achieve long-short hedging, thus controlling risk while ensuring returns.

3: Trading Strategies for High-Volatility Coins

For trading strategies involving high-volatility coins like SOL, Qingshui still adheres to the principle that "volume does not lie." He believes that traditional indicators like moving averages may produce false signals, but trading volume reflects real monetary transactions, and chip distribution is another intuitive representation of volume.

Using TRUMP coin as an example, he demonstrated how to apply this method. On April 18, when the TRUMP price fell to $7.4, he discovered signs of major players accumulating through chip distribution, so he publicly suggested buying the dip and accurately predicted subsequent key target levels of $8.05 and $9.3, ultimately leading the coin to a peak of $16.4, providing substantial returns for followers.

When discussing the current market, Qingshui shared his latest assessment: this round of Bitcoin's correction will last a maximum of three days, after which it will return to the $110,000 mark. This judgment is also based on in-depth analysis of chip distribution.

AiCoin Exclusive Benefits

At the end of the interview, Qingshui brought special benefits for readers: AiCoin PRO membership is currently on a limited-time promotional discount, and users who register on Binance through the exclusive link can also receive AiCoin PRO membership for free. These tools will help investors better implement the trading strategies shared by Qingshui.

(Registration link: https://www.binance.com/zh-CN/join?ref=aicoin668)

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice for anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。