On May 22, we continued to track the movements of major players through market data to see where large funds are positioning themselves. No guessing, just analyzing the concrete trading data of the main players—without further ado, let's get straight to the point.

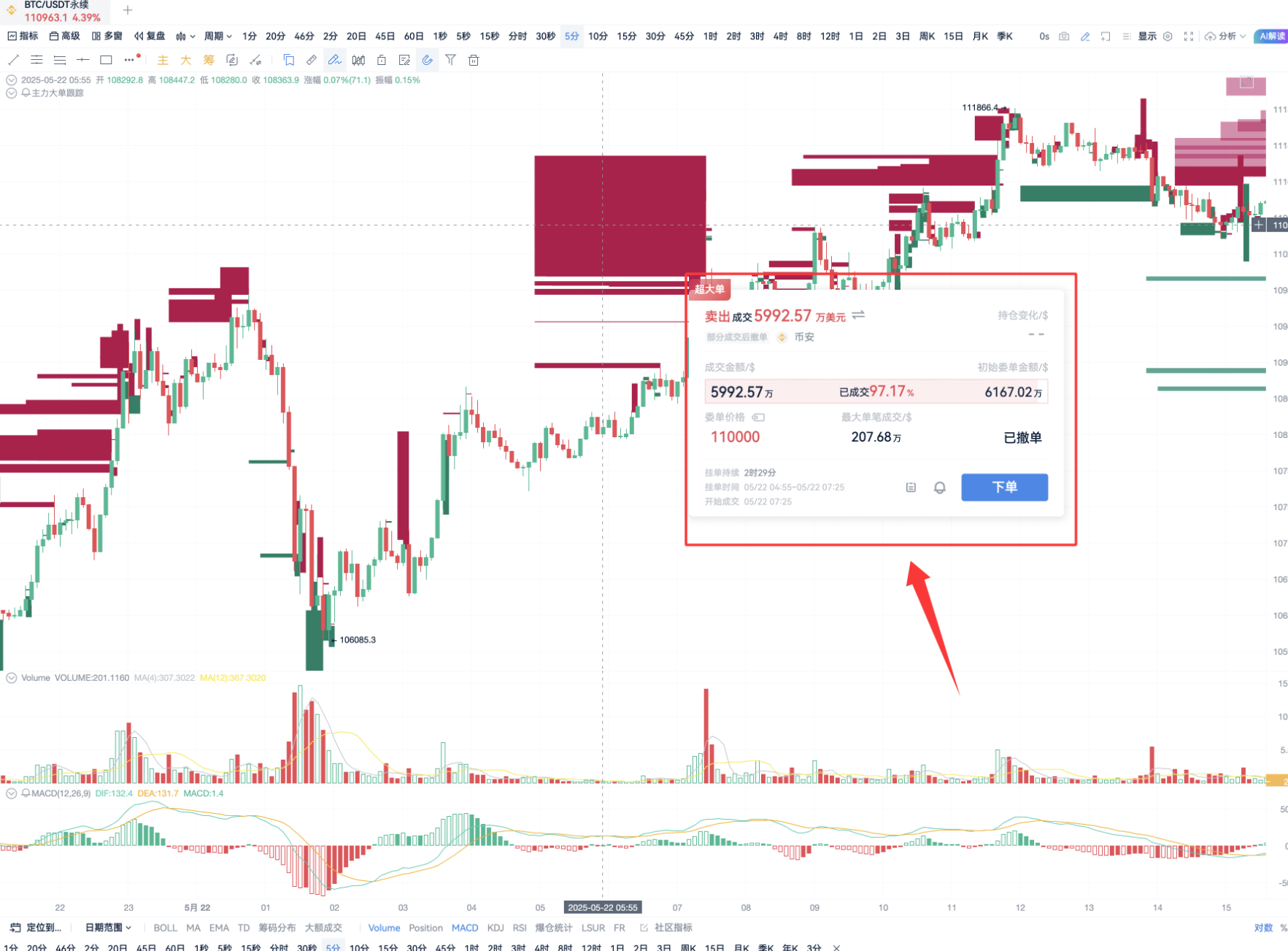

The market for Bitcoin (BTC) today was intense. When it approached the $110,000 mark, it faced a large number of sell orders, but the bullish momentum was strong, ultimately leading to a successful breakthrough. From the market data, it appears that some major funds may have already broken even at this position.

Key market movements recap:

In the early morning, major players quickly closed short positions for profit.

An hour later, the major players flipped and sold $50 million in short positions!

An hour later, the major players flipped and sold $50 million in short positions!

In less than 30 minutes, the same major player flipped again and opened long positions!

In less than 30 minutes, the same major player flipped again and opened long positions!

Subsequently, they completed the turnover!

From the funding flow in the past 24 hours, major players are still active in the market, and current positions are primarily long.

There is a wall of sell orders above, but major players still have the momentum to push higher.

Another favorable signal for the bulls is that although there are some dense sell walls above the current price, the amounts of these orders are generally not large, likely representing profit-taking orders from smaller institutions. If major players choose to continue pushing up, they may very well eat through these sell orders, further driving up the price.

Recently, the frequency of large orders on the market has been extremely high, often in the tens of millions of dollars. Compared to three months ago, a $7 million order could be seen as a major player action, whereas now, a $15 million order is merely considered "normal operation," with true large funds entering often exceeding $30 million per transaction. Clearly, larger institutional funds are entering the market.

According to the major player trading method and major player attraction method, market prices often gravitate towards the key positions set by major players. However, there is a key point: the target price set by major players will not be too far from the current price, otherwise the cost will be too high and it will be easy to be targeted by other large funds.

Disclaimer: This article only represents the author's personal views and does not reflect the stance or views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and column writers are unrelated to this platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。