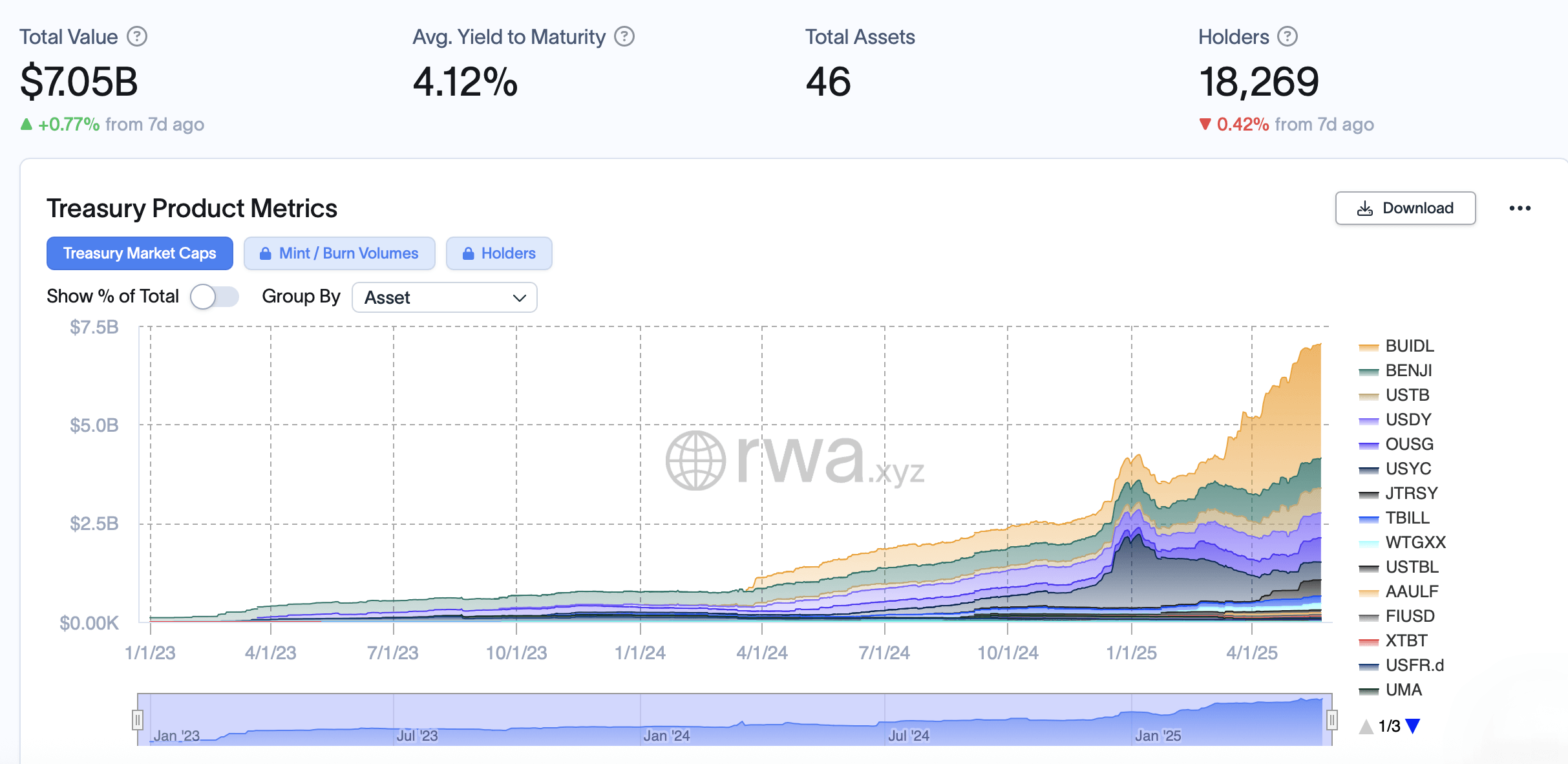

As of Friday, May 23, 2025, the cumulative value of all tokenized U.S. Treasury funds has reached $7.05 billion. Over the past month, this figure has expanded by $1.15 billion, with $54 million added during the most recent seven-day stretch. The top performer over the past month was the Centrifuge-powered Janus Henderson Anemoy Treasury Fund (JTRSY), which notched an 85% increase.

Metrics collected by the rwa.xyz analytics platform shows JTRSY holds $409 million in assets. Trailing closely behind, Wisdomtree’s Government Money Market Digital Fund (WTGXX) recorded a 48.89% gain over the same 30-day span, with its market capitalization currently hovering around $164 million. Following WTGXX, the Ondo U.S. Dollar Yield Fund (USDY) and the Ondo Short-Term US Government Bond Fund (OUSG) collectively advanced by 23.18% since April 23.

The leading fund this month is the Securitize-powered BUIDL, which climbed 15.17% and is closing in on the $3 billion milestone. At present, Blackrock’s BUIDL boasts a market capitalization of approximately $2.899 billion. Franklin Templeton’s Benji Investments—also known as the Franklin Onchain U.S. Government Money Fund (BENJI)—gained 7.69% over the past 30 days and trails just behind BUIDL at $758 million. Meanwhile, Spiko’s U.S. T-Bills Money Market Fund (USTBL) advanced about 3% and is currently valued at roughly $73.11 million.

Roughly $5.9 billion worth of tokenized Treasury assets have been issued on the Ethereum blockchain, while another $482 million resides on Stellar. The remainder is distributed across Solana, Arbitrum, Avalanche, and smaller networks such as Polygon, XRP Ledger, and SUI. Altogether, 46 distinct tokenized Treasury instruments are circulating across these platforms, held by approximately 18,269 unique addresses, according to statistics from rwa.xyz.

Certain tokenized Treasury assets are reserved exclusively for accredited investors, while others are open to the broader retail market. Holding coins from these funds—USDY, for instance—automatically accrues yield simply by keeping them in your wallet. However, gaining access to such tokenized offerings requires completing Know Your Customer (KYC) protocols, as no prominent institutional-grade issuer currently permits direct investment or redemption without satisfying KYC requirements.

Even so, these real-world asset (RWA)-backed tokens are experiencing a tremendous wave of demand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。