BTC breaks 110,000, what about the altcoin season?

➤ Does the altcoin season mean a decline in BTC's market share?

❚ The altcoin season at least requires BTC to stabilize

When discussing the altcoin season, most people intuitively feel that BTC's market share is declining.

As the industry's barometer, the cryptocurrency market has rarely seen a scenario where BTC declines while altcoins soar.

At the very least, BTC needs to stabilize for an altcoin season to occur.

❚ Historically, the altcoin season starts with BTC rising + BTC's market share declining

Let's take a look back at history. I removed the market values of USDC and USDT and then calculated BTC's market share.

At the end of 2017 and the end of 2021, the comparison of BTC's market value and market share shows the same state.

The blue line represents BTC's market share, and the orange line represents BTC's market value.

At the end of 2017 and the end of 2021, the blue line, which is BTC's market share, reached its peak first. Then the orange line, which is BTC's market value, reached its peak.

This means that between these two peaks, the orange line was still rising, indicating that BTC was still increasing. However, the blue line was declining, meaning BTC's market share was decreasing.

This is when the altcoin season started! It was accompanied by BTC's rise and a decline in BTC's market share.

Historically, the altcoin season begins with BTC rising + BTC's market share declining.

❚ The small bull market has no altcoin season

Looking at mid-2019, the situation was exactly the opposite. BTC's market value reached its peak first, and then BTC's market share reached its peak.

Between these two peaks, BTC was declining while BTC's market share was rising. The only difference was that altcoins were declining more slowly; it was not a case of BTC declining while altcoins were rising.

The small bull market had no altcoin season.

➤ What is the difference between a big bull market and a small bull market?

The differences between a big bull market and a small bull market may be twofold:

❚ Different emotional cycles

◆ In 2019, after experiencing the major bear market of 2018, there was an emotional rebound. ◆ In contrast, 2017 and 2021 saw a big bull market triggered by BTC's halving a year prior, which ignited emotions due to BTC's scarcity.

❚ Different macro environments

◆ In the first half of 2018-2019, the Federal Reserve was in a tightening monetary policy phase. At the end of 2018, the Fed announced it would stop balance sheet reduction in mid-2019, which sparked small bull market emotions. However, the first half of 2019 lacked sufficient liquidity.

◆ In 2017, the market was in the early stages of interest rate hikes, where policies often have a certain lag. During the initial phase of rate hikes, market liquidity was still relatively abundant. Just like now in 2025, we are in the early stages of rate cuts (having cut rates in 2024), and market liquidity is still relatively tight.

In contrast, 2021 was a period of significant monetary easing.

➤ Conditions for the altcoin season

By comparing, we can understand the two conditions for the altcoin season and a big bull market:

One is the emotional and cyclical state within the industry, which is currently satisfied. The second is the macro environment that creates sufficient liquidity, which is still not satisfied.

Additionally, in the previous charts, we also see that the historical altcoin season starts with BTC rising + BTC's market share declining. This state indicates that BTC is rising while altcoins are rising even more. This situation clearly requires the market to have sufficient liquidity for both BTC and altcoins to surge simultaneously.

Therefore, industry factors and macro factors are two necessary but insufficient conditions for the altcoin season.

➤ Will there be an altcoin season soon?

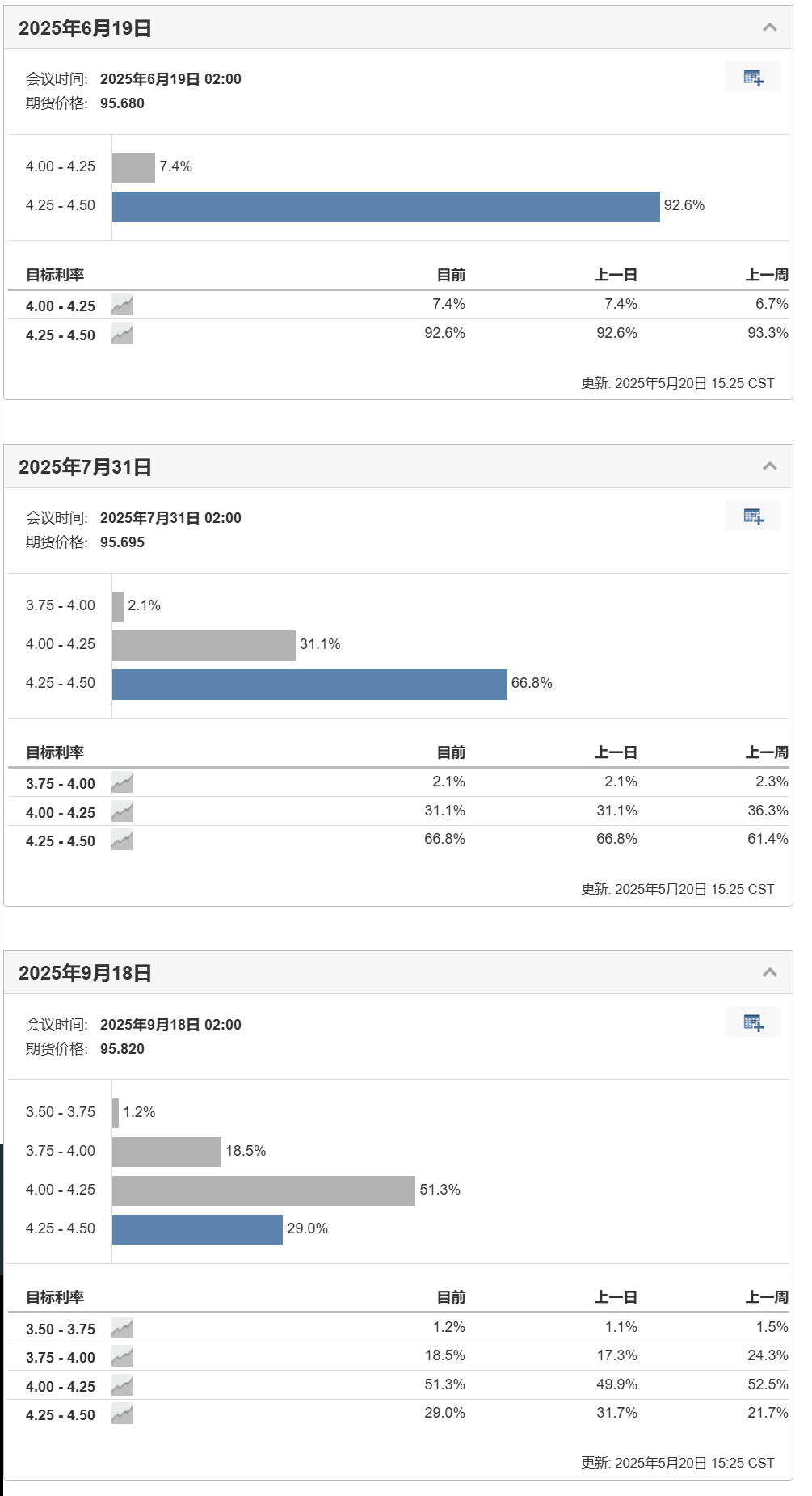

The market expects the first rate cut to occur in September. Even if there are cuts in June or July, it won't immediately lead to significant liquidity; it will take some time after the cuts.

Thus, the current conditions do not meet the requirements for an altcoin season.

➤ Will there be an altcoin season in this round?

Although many people are losing hope for an altcoin season, we still cannot rule out the possibility.

Note that, speaking generally, if BTC rises + BTC's market share declines, it can be considered an altcoin season.

My judgment is that the Federal Reserve may start cutting rates in Q4 or even Q3. As interest rates fall, liquidity will gradually increase. BTC should gradually start to rise, and the altcoin season may occur in the first half of 2026, primarily in Q1.

Because during this period, it aligns with the market's emotional cycle + macro environment.

I have mentioned before that in the first half of 2018, the mainnets of EOS and TRON went live, triggering a wave of public chain enthusiasm. Similarly, in the first half of 2022, the well-known project StepN emerged.

On one hand, as the demand side of the market, emotions will not suddenly shift from bullish to bearish; there will be continuity.

On the other hand, as the supply side of the market, some projects may face development difficulties and may take longer to launch.

More importantly, with the approval of ETFs and the entry of institutions, the influence of internal industry groups (mining pools, exchanges, etc.) is diminishing. Moreover, the amount of BTC left to mine is decreasing, and the impact of halving is naturally lessening. Conversely, the influence of macro factors is increasing, so macro liquidity easing will have a stronger decisive power over the altcoin season. This is why I still believe there will be an altcoin season.

➤ The altcoin season is unlikely to be a broad rally

Whether the altcoin season will be a broad rally, a rotating rally, or a localized rally depends on the size of liquidity.

◆ Large liquidity is more likely to lead to a broad rally;

◆ Moderate liquidity may result in a rotating rally;

◆ Limited liquidity may only lead to localized rallies.

However, it is generally difficult to see a broad rally because there are simply too many cryptocurrencies.

On the other hand, it also depends on the narratives within the Web3 industry. Strong narratives in certain sectors and projects will likely see optimistic timing and growth. Conversely, projects that lack innovation or are merely opportunistic may not attract market interest.

Currently, I personally see three promising narratives:

One is AI, which can integrate with many sectors, such as trading, gaming, etc.

Two is RAW / RWAFi / PayFi, which have a certain Web3 background and may not be overly constrained by bull and bear cycles.

Three is chain abstraction; there are simply too many Layer 1 and Layer 2 solutions. The market needs chain abstraction.

In addition, DePin also has certain opportunities, but comparatively, AI + DePin may have a stronger market presence.

➤ In conclusion

My views are:

First, there is no altcoin season in the near term.

Second, there is a high probability that there will still be an altcoin season in this round.

Third, before the rate cuts, I do not rule out the possibility of further declines. Trump may negotiate with countries that have paused tariff policies to moderately increase tariffs.

If there are no black swan events, the market may experience a consolidation phase. It will be somewhat similar to the period from March to September last year, where the market was waiting for reactions before the rate cuts. However, it won't be completely identical. Last year, BTC experienced a wide range of fluctuations, while altcoins trended downward; recently, there may be some strong altcoins, as it is a bull market cycle year.

However, whether the US stock market and BTC will crash depends on the occurrence of black swan events.

Japan's interest rate hikes may have some impact. Japan's current benchmark interest rate of 0.5% is the highest since 1996. The yen is internationally recognized as a safe-haven asset, and if it continues to raise rates, the market's reaction is difficult to predict. Japan's inflation rate is still somewhat high, which may lead to further rate hikes. However, I believe that Japan's rate hikes and traditional financial markets should have certain expectations, so it is not considered a major black swan. As for any unexpected impacts, I cannot predict.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。