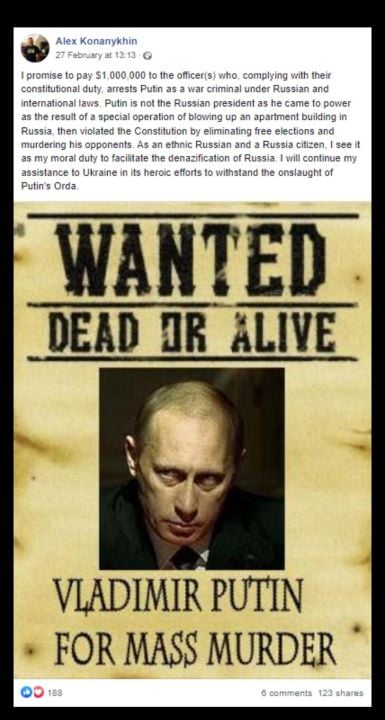

“Wanted dead or alive, Vladmir Putin, for mass murder,” the February 2022 Facebook post reads. Those are the words of Unicoin founder Alexandre Konanykhin, who could soon be in legal trouble, again, if courts find him guilty of securities fraud as alleged by the SEC on Tuesday.

The 58-year-old Russian is no stranger to run-ins with the law. Immigration woes have landed him in the slammer on at least two occasions, and now, a shady crypto operation he dubbed Unicoin, may see him back in front of a judge one more time.

(Alexandre Konanykhin put a $1M bounty on Vladmir Putin’s head on or around February 27, 2022 after Russia invaded Ukraine / Alexandre Konanykhin on Facebook )

Konanykhin created Unicoin around the same time he put out a $1 million bounty for Russian President Vladmir Putin. “I promise to pay $1,000,000 to the officer(s) who, complying with their constitutional duty, arrest(s) Putin as a war criminal under Russian and international laws,” Konanykhin wrote on or around February 27, 2022, just three days after Russia invaded Ukraine. The bounty is yet to be claimed, but Konanykhin may now have bigger fish to fry after the SEC filed a complaint with the U.S. District Court for the Southern District of New York (SDNY), accusing the Russian businessman of securities fraud and various other violations related to the sale of Unicoin tokens.

“We allege that Unicoin and its executives exploited thousands of investors with fictitious promises that its tokens, when issued, would be backed by real-world assets including an international portfolio of valuable real estate holdings,” said Mark Cave, associate director at the SEC in a press release. “But as we allege, the real estate assets were worth a mere fraction of what the company claimed.”

As a former KGB-era banking oligarch, Konanykhin knows a thing or two about money and fraud. He made a name for himself as a financial services wunderkind at only 25, amassing a $300 million fortune and landing himself a coveted spot in former Russian President Boris Yeltsin’s inner circle.

But in a turn of events, Konanykhin claims he was suddenly kidnapped by the KGB while on a business trip in Hungary. He managed to escape to the United States where he filed for asylum with his wife Elena Gratcheva in 1992.

“I was kidnapped in Hungary, in Budapest on my business trip by the KGB,” Konanykhin told CNN in a 2006 interview. “And simultaneously with the kidnapping in Hungary, they seized by force my banks, my brokerage network and all of my organizations in Moscow.”

After being jailed twice for violating U.S. immigration laws, Konanykhin finally won a hard-fought legal battle to remain in the country. He was forced to rebuild from scratch, and still managed to successfully launch multiple startups, including Transparent Business, a holding company that debuted a popular Shark Tank-style reality TV series titled Unicorn Hunters.

The show drew from the star power of names like Apple co-founder Steve Wozniak and even federal government old hands such as former U.S. Treasurer Rosa Rios and former Joe Biden Senior Policy Advisor, Moe Vela. These celebrities formed a “Circle of Money,” that would stress test featured startups and then invest in the most promising ones. The audience was also able to invest alongside the celebrity group.

(The Unicorn Hunters’ “Circle of Money,” which included Apple co-founder Steve Wozniak, former U.S. Treasurer Rosa Rios, and former Joe Biden Senior Policy Advisor Moe Vela. / unicornhunters.com)

It was against this backdrop that Unicoin was created. Konanykhin designed a cryptocurrency in 2022 that would own equity positions in the same companies featured on Unicorn Hunters. Unicoin would also own real estate and was designed to pay dividends to token holders.

“A company backed by real assets,” reads the Unicoin website. “This is your chance to enter early, before valuations rise and market momentum takes over. Get in before the market does.”

It wasn’t long before Unicoin was aggressively promoting its token by advertising on television, social media, taxi cabs, and even airports. The company claimed to have registered with the SEC, but the regulator has disputed it. After an extensive investigation, the SEC finally stepped in and filed a legal complaint against Konanykihn and his executive team: Silvina Moschini, former Unicoin president and chairwoman, and Alex Dominguez, former chief investment officer.

(A Tesla taxi cab wrapped in Unicoin promotional material / unicornhunters.com)

The SEC claims that Unicoin sold millions of dollars worth of tokens as “rights certificates” to more than 5,000 investors by convincing them that the tokens were backed by “billions of dollars of real estate and equity interests in pre-IPO companies,” when in fact, the value of the underlying assets in question was miniscule, according to Cave. Unicoin told investors it had raised $3 billion from its token sales, when in fact, the number was closer to $110 million, the regulator alleges.

“The SEC’s allegations are blatantly false. We intend to prove in court that they constitute yet another case of gross abuse of power,” said Konanykhin in an X post on Wednesday. “We will fight for our vision, for our community, and for the legacy of transparency we are building…We will not back down.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。