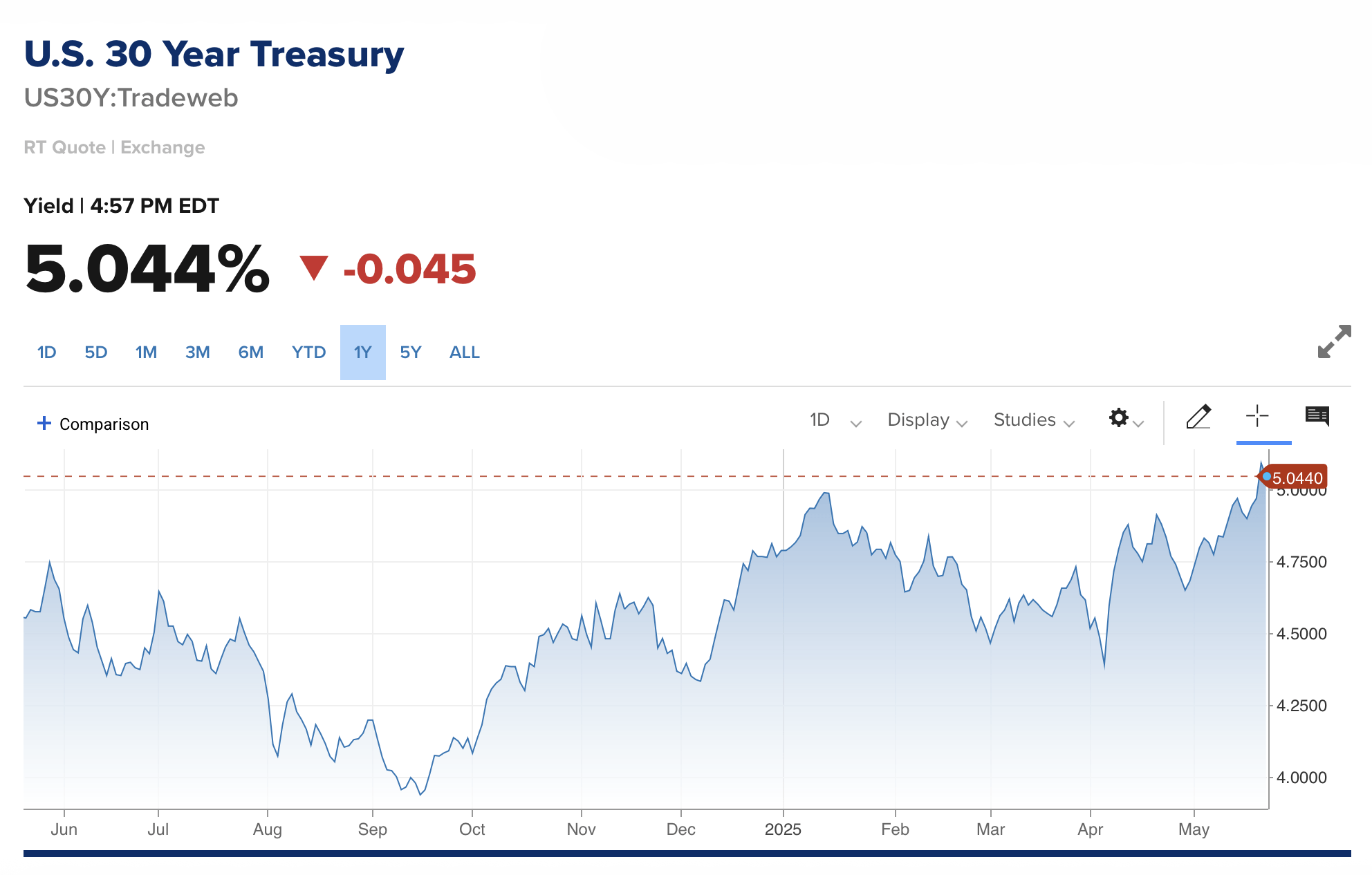

The 30-year U.S. Treasury bond yield surged to 5.18% on Thursday—its highest point since 2023—before easing slightly later in the session. The benchmark 10-year yield also climbed, hitting 4.593%. These movements have significant implications for borrowing costs across the economy, especially as they come on the heels of a weak 20-year bond auction and rising concerns about U.S. fiscal health.

The May 21 auction of $16 billion in 20-year bonds was met with tepid demand, producing a high yield of 5.047%—above pre-auction expectations. The bid-to-cover ratio fell to 2.46, the lowest since February, signaling softer investor appetite. The outcome sparked a market reaction: yields on 20-year bonds jumped to 5.127%, stocks slid, and the Dow Jones Industrial Average dropped nearly 800 points on Wednesday. The Dow and three other major U.S. indexes remained flat on Thursday.

Investor sentiment has been rattled by mounting U.S. debt levels, an ongoing debate over a new tax-and-spending package, and recent credit downgrades by Moody’s, Fitch and Standard & Poor’s. These concerns appear to be weighing heavily on confidence in long-term U.S. fiscal stability, with some traders demanding higher returns to hold government debt.

Prediction markets are also signaling rising anxiety. According to Polymarket, traders now place a 40% probability on a U.S. recession in 2025—a 21 percentage point jump in recent weeks. That figure reflects growing fears that higher borrowing costs, tariff-related inflation, and government spending risks could trigger an economic contraction.

Despite these signals, Polymarket speculators expect the Federal Reserve to keep rates unchanged in June. Polymarket odds show a 92% chance the Fed holds steady, with only a 7% chance of a 25 basis point cut and less than 1% odds of either a larger cut or rate hike.

On Thursday, bitcoin ( BTC) tapped exactly $112,000 on Bitstamp, reaching an all-time price high.

Reports noted, however, that foreign investors showed solid participation in the latest bond sale, accounting for 69% of indirect bids. But the 20-year bond’s lower liquidity and benchmark status compared to 10- or 30-year maturities may have added to the weaker overall demand.

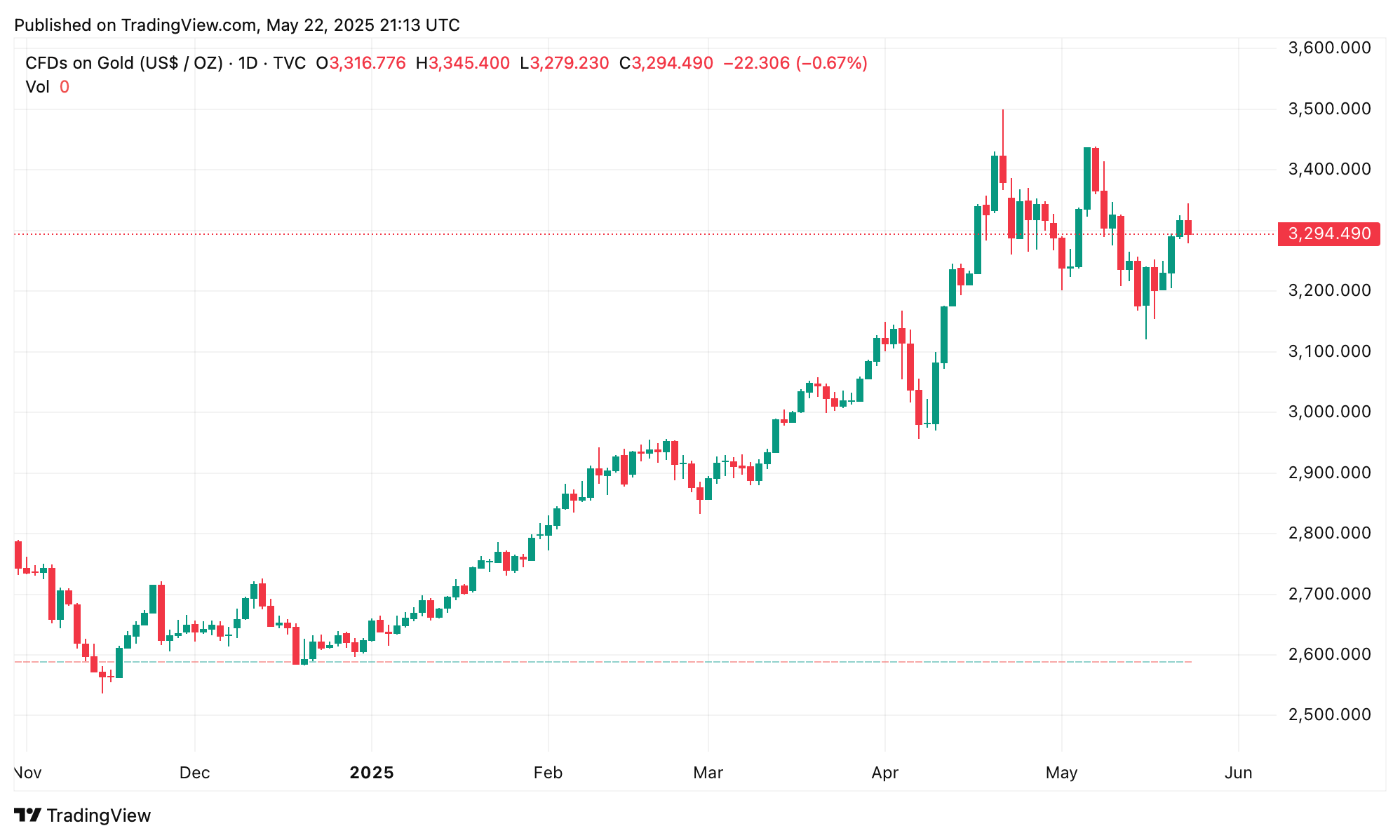

Gold has risen 2% against the U.S. dollar over the last week.

As borrowing costs rise and fiscal pressures mount, both markets and forecasting tools are hinting that the economic foundation may be less stable than it appears. Meanwhile, both bitcoin and gold have held their ground in the aftermath of the lackluster 20-year Treasury auction—gold gleaming in its usual safe-haven role, while bitcoin proved sturdier than stocks, even if its path was a bit bumpier.

Gold’s climb to record highs and bitcoin’s knack for dodging steep drops amid market chaos hint that both assets are managing the economic jitters with surprising poise, though they carry distinctly different levels of risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。