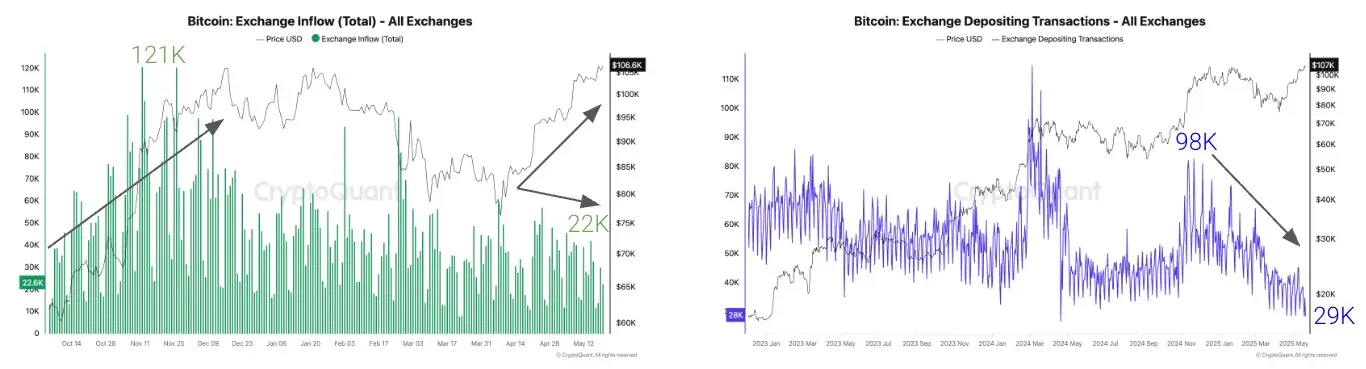

Cryptoquant’s findings suggest reduced selling pressure across bitcoin, ethereum, and XRP alongside record liquidity conditions, potentially setting the stage for further market gains. Bitcoin exchange inflows have dropped sharply to approximately 22,000 BTC daily, down 82% from November 2024’s peak of 121,000 BTC, the analytical firm’s data shows.

Individual deposit counts also fell from 98,000 to 29,000 over the same period, signaling diminished intent to sell even as bitcoin trades near all-time highs. Historically, elevated inflows correlate with heightened selling activity, making the current trend a bullish indicator. Ethereum mirrors this pattern, with daily inflows plunging 70% to 1 million ETH from 3.2 million ETH in November.

Source: Cryptoquant report.

Individual ETH deposits cratered 89%, dropping from 135,000 in early April to 15,000, per Cryptoquant’s report. The analytics firm further noted that investors appear reluctant to liquidate holdings despite extremely favorable market conditions. XRP experienced the most dramatic shift, with daily inflows collapsing to 46 million tokens from 4 billion in March after Ripple’s legal settlement with the U.S. SEC.

Deposits fell 99.5% to 9,000 from 2.1 million in December, reflecting improved investor sentiment, according to Cryptoquant’s research team. In contrast, tether ( USDT) reserves on exchanges hit a record $46.9 billion, showcasing surging liquidity. Cryptoquant emphasized that rising stablecoin balances typically support asset prices by providing readily available capital for trading.

The report concludes that crypto markets face low near-term selling risks amid robust liquidity, a combination Cryptoquant analysts describe as “structurally bullish” for the leading crypto asset bitcoin, and its cohort of altcoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。