AgentFi, as the next paradigm of the integration of "AI + DeFi," provides DeFi users with intelligent agent solutions that require no monitoring and automatically optimize.

Written by: 0xjacobzhao and ChatGPT 4o

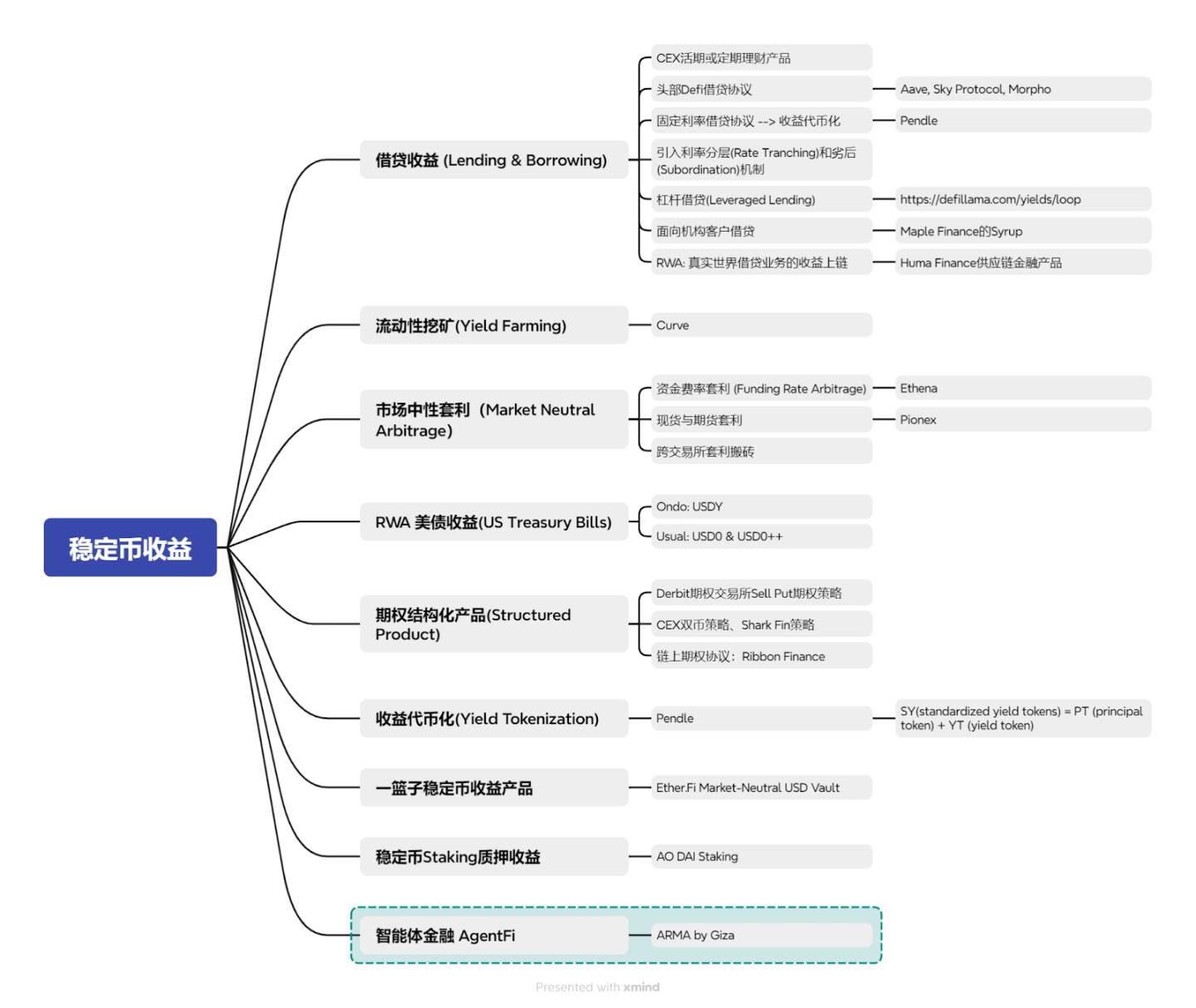

Last month, the article "Stablecoin Yield Guide" detailed the characteristics, sources of yield, and potential risks of eight stablecoin yield models: stablecoin lending & borrowing, yield farming, market-neutral arbitrage, US Treasury-backed RWA yields, structured products, yield tokenization, a basket of stablecoin yields, and stablecoin staking. This article became a recommended read in several Chinese media outlets in April, generating a certain level of influence in the Chinese crypto community. Many stablecoin teams reached out to me, providing new information, perspectives, and insights. Most projects can still be categorized into the existing eight yield models, and excitingly, I discovered a new paradigm of stablecoin yield generation that is emerging: AgentFi.

1. Classification and Comparison of DeFAI and AgentFi

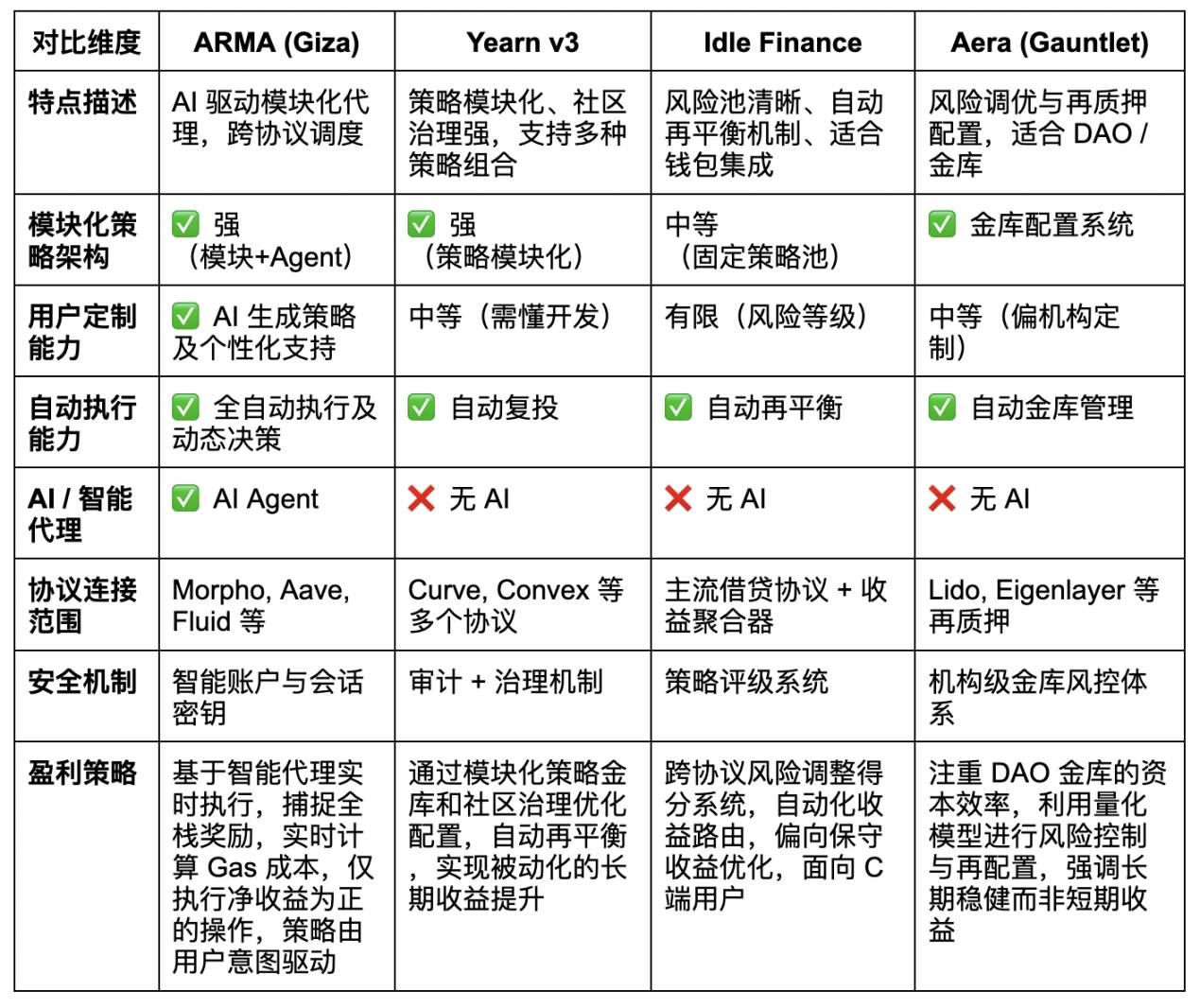

Although DeFAI and AgentFi both exist in the intersection of "AI + DeFi," their technical essence, product forms, and paradigm missions are entirely different. AgentFi distinguishes itself from traditional DeFi or generalized DeFAI projects, with its core feature being: the AI Agent is the primary executor and decision-making entity, making fully automated decisions and executing in a closed loop, rather than simply using AI as a decision support tool for data analysis and strategy enhancement.

DeFAI Category: Uses AI to assist or enhance DeFi-related functions, such as strategy optimization, data analysis, investment advice, etc., as tool applications where AI models assist human decision-making. Examples include Kaito, Numerai, and Gauntlet, which focuses on DeFi yield optimization. These financial automation products rely on explicit user instructions and strategies, executing a "from instruction to operation" process.

AgentFi Category: Constructs a financial system where on-chain AI agents are the primary executors, capable of independent reasoning, decision-making, and completing transactions or governance operations. Users authorize agents to act on their behalf, with the agent actively making decisions and executing. It adopts a "from intention to result" paradigm, where users only need to express their goals, and the system can formulate and execute strategies.

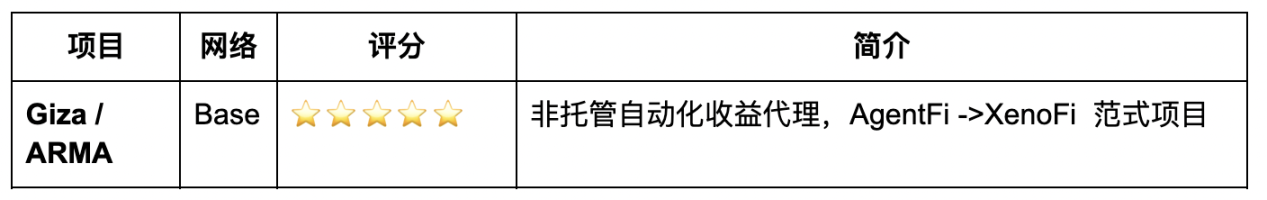

Currently, the market is flooded with numerous agent launch platforms or trading markets. Compared to purely speculative AI meme tokens with no practical use, there are only a handful of AgentFi projects that genuinely focus on the crypto-native DeFi world. Through extensive online research and filtering, we have categorized and rated the current AgentFi projects in the market after excluding overly early or obviously vaporware projects:

✅ Stablecoin Yield Optimization

✅ Strategy Portfolio / Liquidity Mining

✅ On-Chain Trade Execution

The above nine AgentFi projects have initially established on-chain execution closed loops, clear scenarios, and basic product viability. However, to be honest, the AgentFi space is still in its early stages, and the user experience of most products is lacking compared to mature DeFi protocols. We look forward to the future of the AgentFi space moving beyond the meme token speculation phase into a true product-market fit (PMF) stage.

2. Stablecoin Yield Optimization in AgentFi

The track of stablecoin yield optimization is not new in the DeFi world. From the earliest Yearn Finance (YFI) automated yield aggregator and Idle Finance's automated asset rebalancing and strategy portfolio, to Gauntlet, a professional DeFi risk modeling and protocol-level yield optimization platform aimed at institutions, these are all representative automated yield optimization projects that predate AgentFi.

AgentFi has initially realized the vision of mutual integration between crypto and AI: that is, AI empowers users to better participate in the crypto-native DeFi world through on-chain information collection and decision-making capabilities, while utilizing the immutability of blockchain to retain transaction details in an on-chain log format, ensuring logical verifiability and traceability of actions. As a continuation of the stablecoin yield article, we will focus on the only product in the "stablecoin yield optimization" category that has received a five-star rating—ARMA.

3. Vision and Paradigm Concept of the Giza Project

Giza is a blockchain infrastructure project focused on building "Verifiable AI Agents," dedicated to promoting the emerging paradigm of Agent-native Finance. Unlike Modulus Labs or EZKL, which lean towards theoretical research or infrastructure development, Giza emphasizes engineering and practicality, being one of the earliest projects in the ZKML space to achieve a complete closed loop of "on-chain intelligent agents + verifiable execution + AI scheduling."

Giza proposes an innovative concept—Xenocognitive Finance, which introduces agents (AI agents) as new interfaces in decentralized finance to address the cognitive bottlenecks of human participants and reconstruct market intelligence and structure. Agents are not passive tools but "cognitive representatives" with independent reasoning capabilities and on-chain execution authority. Through a distributed agent network, they enhance the overall market's information processing capabilities, allowing market intelligence to expand with participation scale rather than collapse, and provide trustworthy results through zero-knowledge proofs (ZK). In short, Xenocognitive Finance is a new paradigm that extends human cognitive abilities through autonomous intelligent agents, achieving "cognitive offload" without sacrificing sovereignty in a non-custodial model, allowing for efficient participation in decentralized finance without the need for constant monitoring or manual protocol switching.

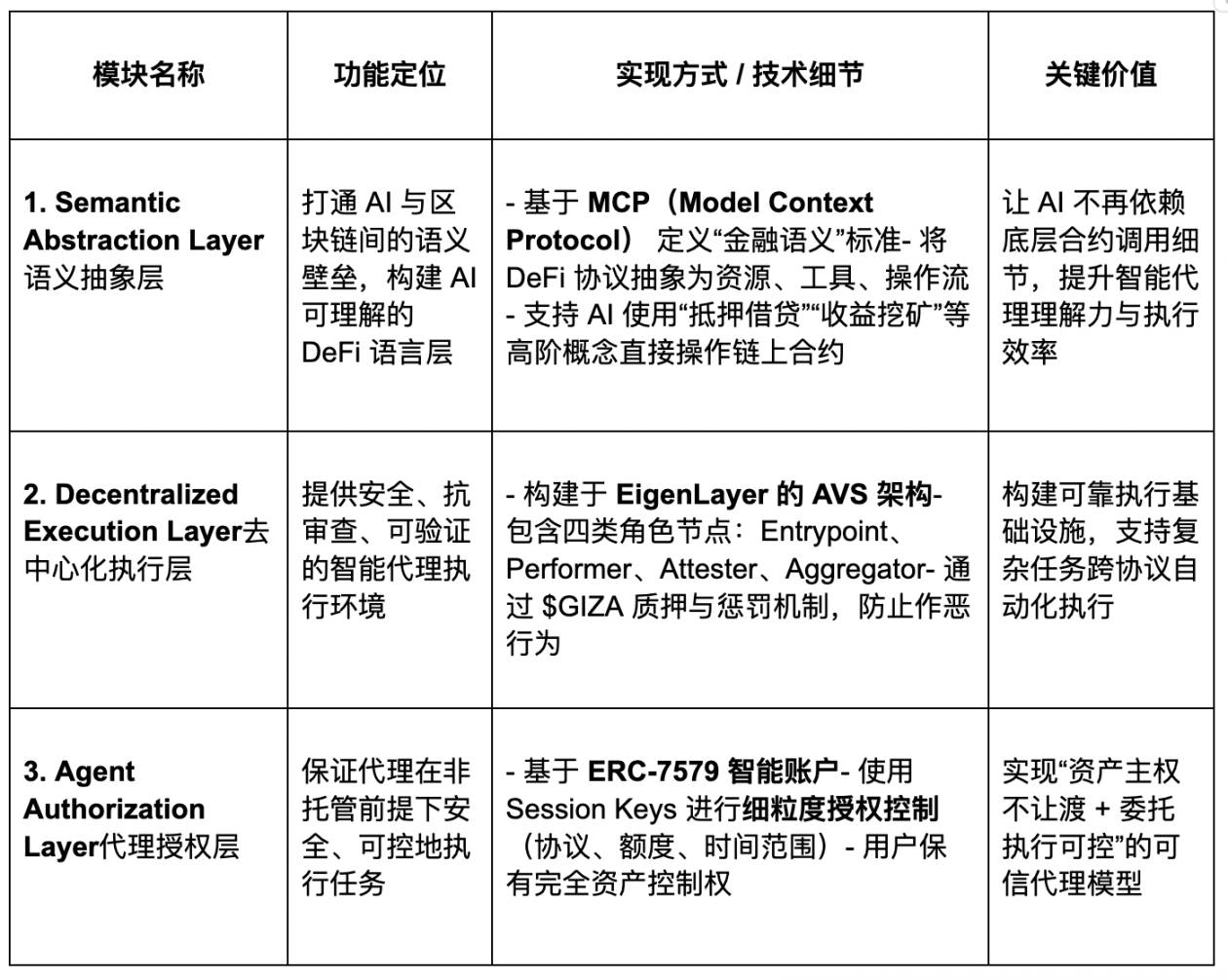

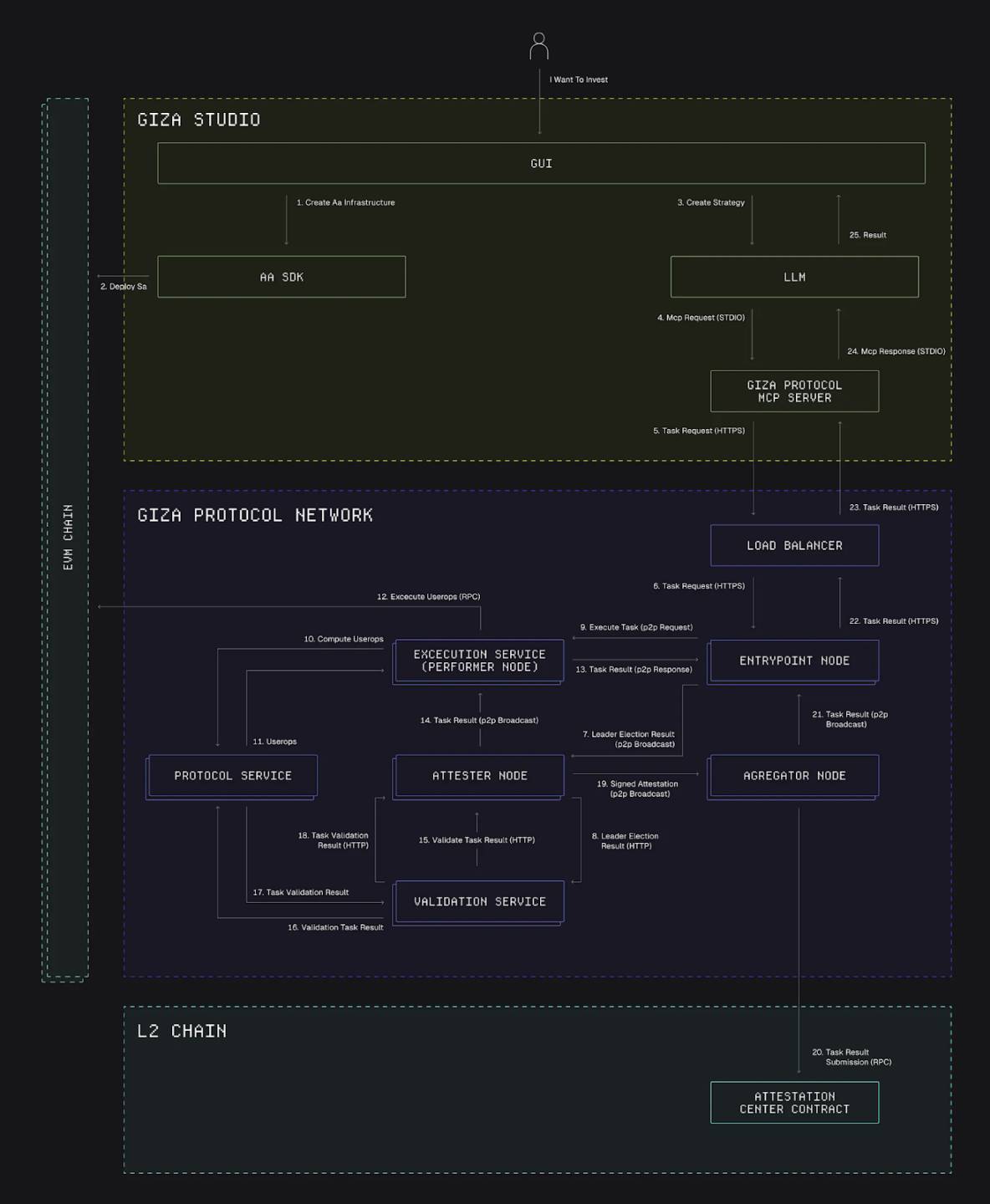

The architecture of the Giza Protocol includes the following three layers:

Semantic Abstraction Layer: Bridges the semantic gap between AI and blockchain, helping AI understand the blockchain world.

Decentralized Execution Layer: Provides a scalable, secure, and censorship-resistant execution environment for agents.

Agent Authorization Layer: Ensures that agents operate in a non-custodial, secure, and controllable manner.

The agent execution process of Giza is coordinated by three core modules and divided into four key steps:

Request Processing (Semantic Abstraction Layer): The AI agent initiates an operation request (e.g., "deposit USDC into AAVE") through the MCP protocol. The system parses the natural language strategy into standardized on-chain operation instructions while verifying the format, semantics, and permission boundaries to ensure the request is legal and executable.

Protocol Interaction (Decentralized Execution Layer): Execution nodes call DeFi protocols (e.g., lending, exchanging) to complete actual operations based on the instructions. The system dynamically optimizes the transaction path, considering gas costs, slippage tolerance, and protocol liquidity. After task execution, results and task proofs are generated for subsequent verification.

Execution Verification (Authorization Layer + Execution Layer): The system checks whether the operation complies with the user-defined Session Key authorization scope (protocol type, amount, time). Multiple attester nodes independently verify the operation, and the aggregator node collects signatures to reach consensus, ensuring the results are secure and trustworthy.

Result Feedback (Semantic Abstraction Layer): The execution results are transformed into structured semantic information (e.g., yield changes, asset distribution) and returned to the AI agent system for subsequent strategy adjustments and automatic cyclical decision-making.

In July 2023, Giza announced the completion of a $3 million Pre-Seed round of financing, led by CoinFund, with participation from StarkWare, TA Ventures, and Arrington Capital (founded by TechCrunch's founder). Angel investors include Rand Hindi and Julien Bouteloup. In May 2025, Giza completed a $2.2 million Seed round of financing, led by the Base Ecosystem Fund, with follow-on investments from CoinFund, Arrington Capital, Re7 Capital, and Contango Digital Assets. These two rounds of financing demonstrate the capital market's continued optimism regarding Giza's vision in the "AI + DeFi" field.

4. Representative Product ARMA: Stablecoin Yield Optimization Agent

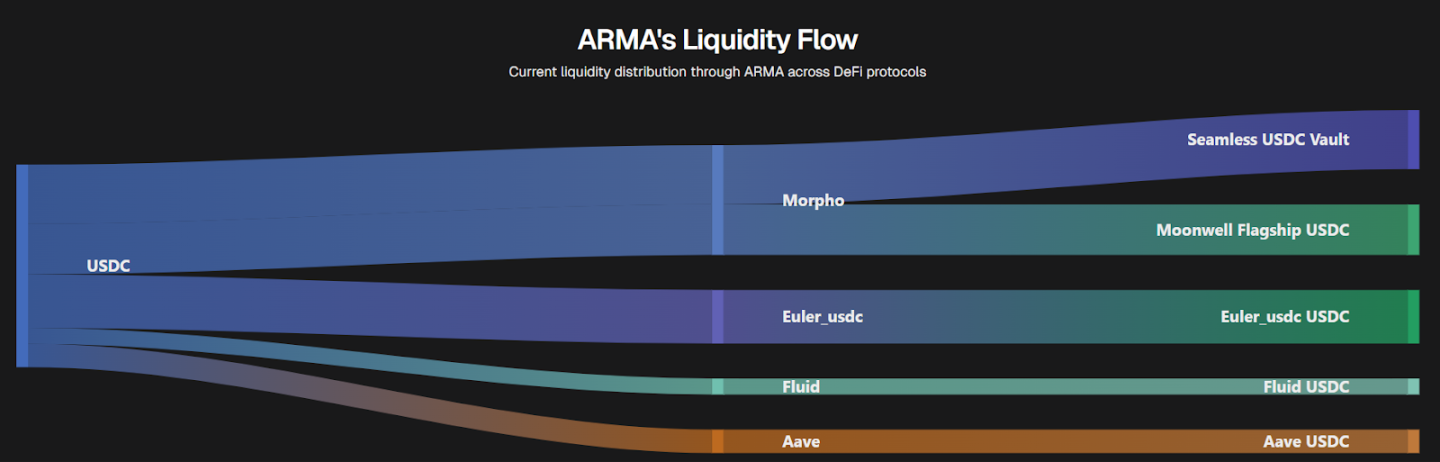

ARMA (Autonomous Revenue Management Agent) is a stablecoin yield optimization intelligent agent launched by Giza, aimed at maximizing automated yield across protocols for users. It is currently deployed on the Base network and plans to expand to more Layer 2 ecosystems, supporting mainstream lending protocols such as AAVE, Morpho, Compound, and Moonwell.

4.1 Overview of ARMA's Working Mechanism

Intelligent Strategy Scheduling: Real-time analysis of stablecoin yields (APR), transaction costs, and rebalancing timing across protocols, automatically executing optimal rebalancing operations.

APR Optimization System: Ensures that each operation generates net yield through comprehensive optimization of interest rate comparisons, cost assessments, and rebalancing logic; actual annual yields can reach up to twice that of traditional static holdings.

Automatic Compounding Mechanism: Automatically claims and reinvests incentive tokens, converting rewards back into original stablecoins; compounding frequency is dynamically optimized based on position size and transaction costs to enhance efficiency.

Intelligent Currency Exchange Logic: Supports dual currency operations with USDC and USDT, automatically and efficiently exchanging currencies through integrated DEX when necessary, ensuring users can always withdraw assets in the original currency, enhancing flexibility and experience.

4.2 Overview of ARMA Component Modules and Security Architecture

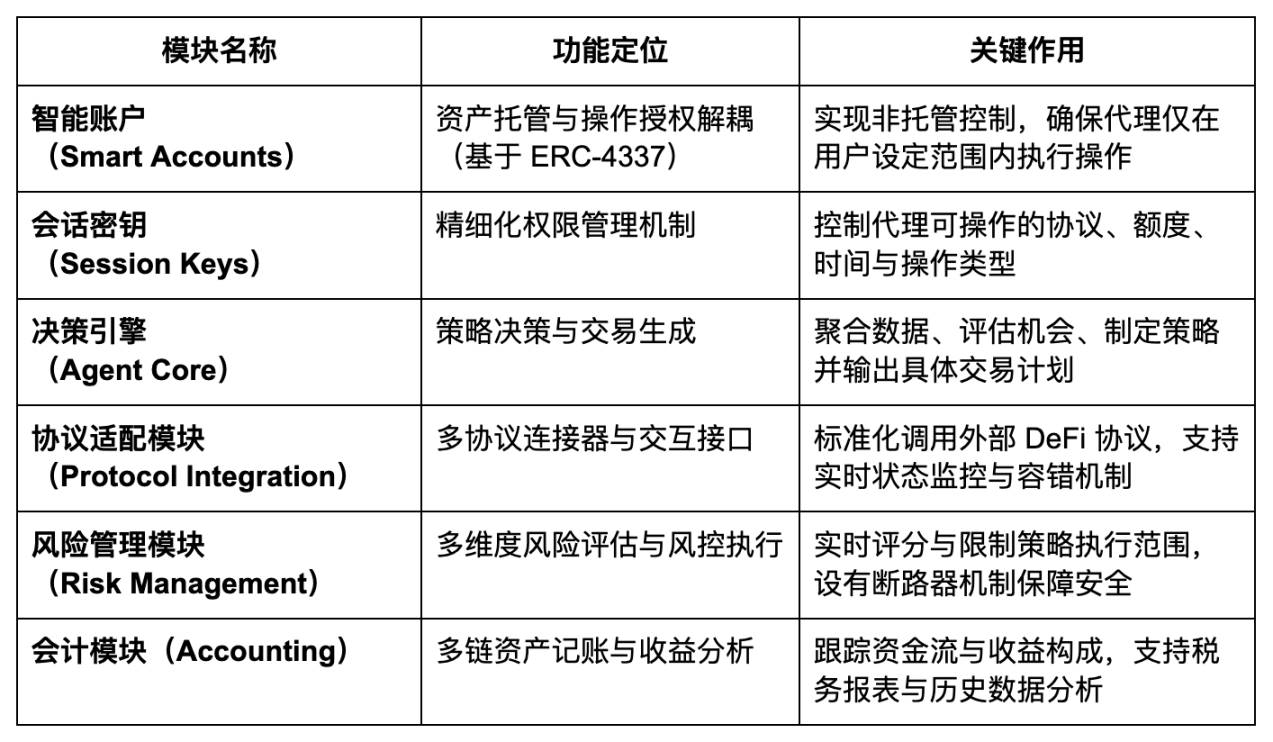

The Giza Agent architecture consists of six major modules: Smart Accounts, Session Keys, Agent Core, Protocol Integration, Risk Module, and Accounting Module, which collaboratively build a secure, efficient, intelligent, and verifiable on-chain automation execution system.

At the same time, ARMA ensures the safety of user funds and operations through a three-layer protection mechanism:

Smart Account Security: Based on self-custodial smart accounts, users always retain control over their assets, and Giza cannot access private keys; contracts are audited and support flexible permission management.

Access Control Mechanism: Fine-tunes agent permissions through Session Keys, limited to specific protocols, operation types, and validity periods, avoiding the risk of full authorization.

Risk Management System: Only connects to prudently selected protocols, focusing on stable yield scenarios; the entire transaction process is traceable, ensuring operational transparency and auditability, enhancing overall system security.

4.3 ARMA's Fee Mechanism and Yield Management

ARMA's fee and yield mechanism is centered on user-friendliness and transparency, covering three main aspects:

Fee Structure: Charges based on yield, transparent and verifiable, with a 10% success fee only on the actual yield generated. This fee is settled in a lump sum when users withdraw, and all fee calculation processes can be viewed in real-time through the dashboard.

Reward Management: Automatically claims and distributes rewards; the ARMA agent will automatically collect and aggregate all rewards from various integrated DeFi protocols, which will be returned to users along with the principal and yield upon withdrawal without requiring manual operation.

Asset Management: ARMA does not charge any deposit or withdrawal fees. Regardless of how many protocols are involved or what tokens are used, users will always withdraw funds in the original deposited tokens, ensuring the convenience of fund recovery.

4.4 ARMA's Integrated DeFi Protocols and Data Performance

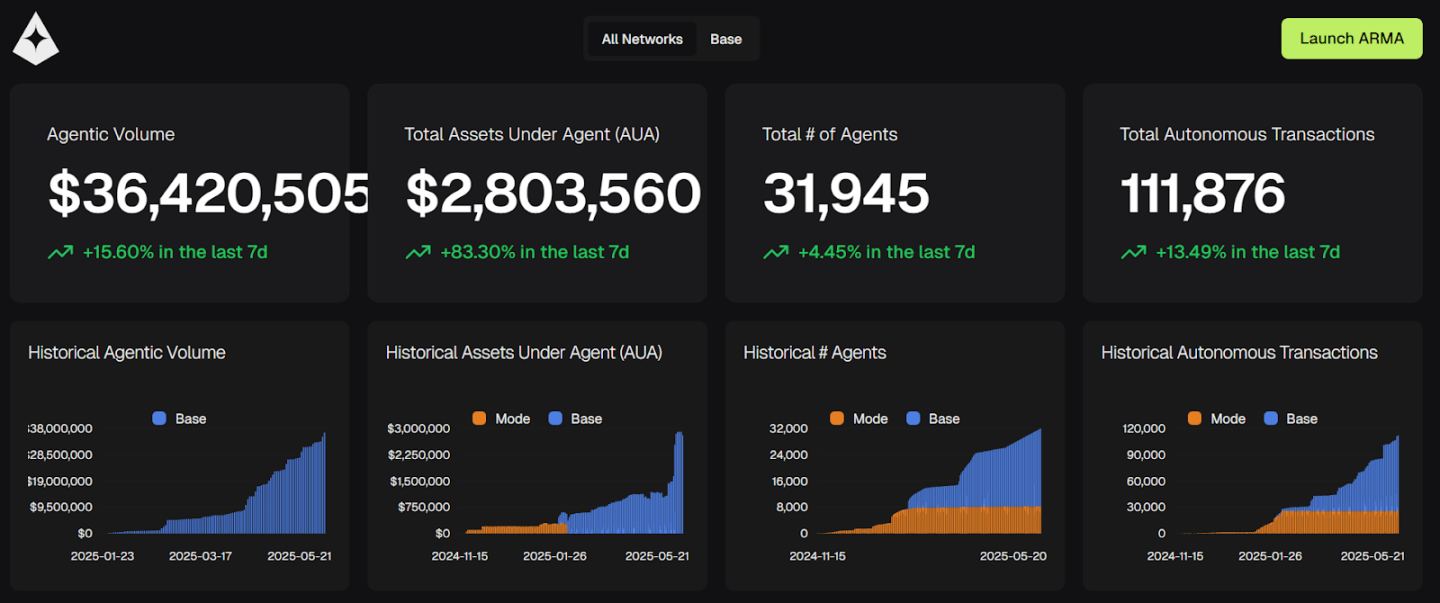

Through ARMA's official data dashboard (metrics.gizatech.xyz), we can intuitively observe the continuous growth of its asset management scale and the number of intelligent agents within months of its launch. The dashboard also displays the dynamic flow of assets among mainstream lending protocols such as Morpho, Aave, and Fluid. We believe that as ARMA integrates more DeFi protocols, increases the number of active agents, and expands its capital scale, it will further strengthen its positive growth flywheel effect.

5. Core Positioning and Incentive Mechanism of the Token

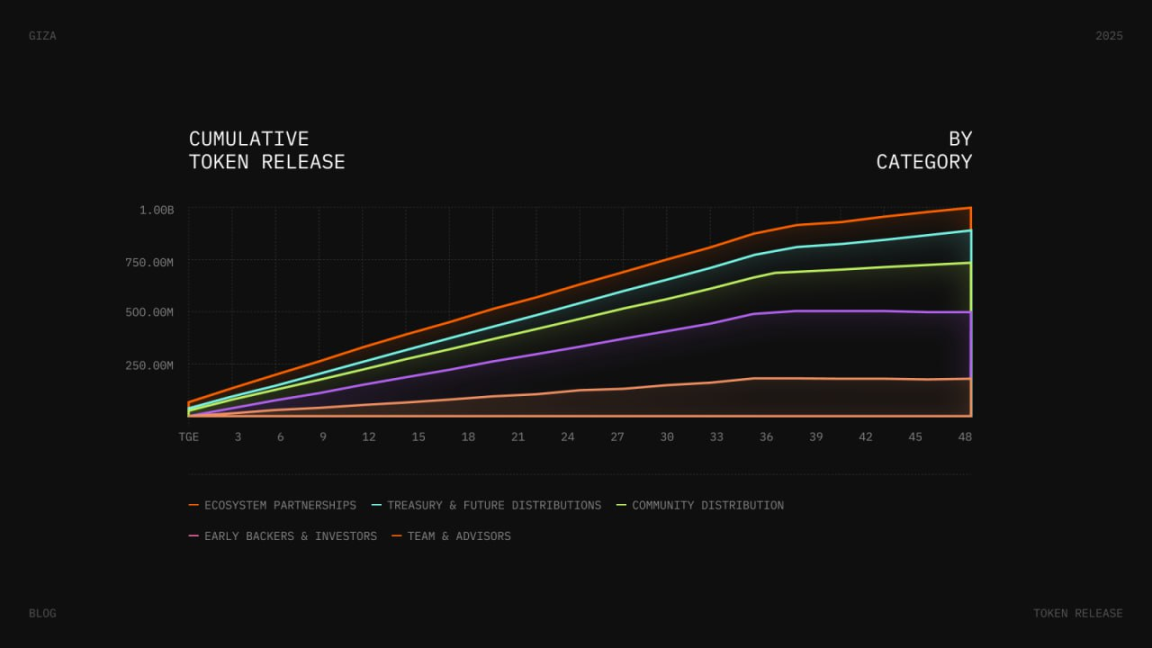

Giza has recently announced the complete details of its token economic model, with the Token Generation Event (TGE) being an important milestone to watch. $GIZA is the native asset of the Giza intelligent agent network, possessing immediate utility, long-term value capture capability, and is designed with community priority, product-driven, and mechanism restraint as core principles.

Key Points Summary

Reasonable Initial Valuation: The initial FDV at TGE is $70M, significantly lower than similar AI projects, providing substantial upside potential.

Zero Unlock at Launch: No token unlock for the team and investors at TGE, avoiding initial selling pressure and ensuring high community alignment.

Product Already Launched: The ARMA intelligent agent has managed over $30M in on-chain assets, with market demand supported by real use cases.

Clear Token Utility: $GIZA is used for staking validation, permission control, protocol governance, and agent incentives, making it a core asset.

Incentives and Security Binding: Agent nodes must stake $GIZA, with malicious actions subject to penalties, ensuring execution is safe and reliable.

Value Reflow Mechanism: A portion of agent operation income flows into AMM for $GIZA buybacks or redistribution, creating a sustainable incentive loop.

Community-Oriented Distribution: Tokens are prioritized for allocation to real users and participants, emphasizing fair distribution and long-term co-creation of value.

Dual Staking Mechanism: Node operators and regular users can both stake $GIZA, receiving execution rewards and governance rights, respectively.

Time-Weighted Design: The longer the staking period, the higher the reward multiplier and governance rights, up to 5 times, incentivizing long-term participation.

Gradual Governance: The governance mechanism progresses in phases, transitioning from a security committee to representative governance and professional committees, ultimately achieving decentralized autonomy.

Giza Points Incentive System:

To encourage users and developers to participate in building the Giza intelligent agent ecosystem, Giza launched the Giza Points System (GPS) at the end of 2014, which will serve as one of the bases for future native incentive distribution. This points system emphasizes "long-term contributions" over "short-term actions" and is open to the following key participants:

User Side: Continuously accumulates points through on-chain behaviors such as using agent products, providing feedback, and stress testing.

Developer Side: Receives rewards for technical contributions such as integrating new agents, optimizing execution logic, and submitting security improvement suggestions.

Community Members: Can also earn points recognition by participating in educational promotion, governance discussions, and ecosystem co-construction activities.

Currently, ARMA is in the high token subsidy phase of its launch period, where users depositing stablecoins can earn a fixed annual yield of 15% for the first three months, composed of base interest and additional rewards. In addition to fixed yields, users who deposit the first $10M will proportionally receive a share of 1% of the total $GIZA token supply, which will be released linearly over nine months. There are no lock-up periods or penalties, making it suitable for users seeking both short-term stable yields and long-term potential in $GIZA.

Giza Growth Flywheel Effect

Giza has built a growth flywheel driven by the practicality of agents, protocol usage, token value, and ecosystem participation: intelligent agents enhance user fund management and strategy execution efficiency, driving more DeFi operations and protocol interactions, generating continuous income that flows back to stakers, enhancing the value of $GIZA tokens, attracting more nodes and developers to join, further expanding the capabilities of the agent network, ultimately achieving a positive cycle of "the more you use → the higher the value → the stronger the security → the broader the capabilities," propelling Giza to become a scalable and trustworthy Agent-native financial infrastructure.

Giza Token Governance Mechanism and Community Participation Design

Giza's governance mechanism adopts a phased evolution model, combining professional committees and community representation to ensure that the protocol gradually achieves decentralization on a secure and stable foundation. Initially led by a security committee, the community provides input through voting and discussions; in the mid-term, key matters will open for on-chain governance; ultimately, governance will be fully managed by a professional committee elected by the community. Token holders can participate in decision-making by delegating representatives with technical or economic backgrounds and enhance their voting influence through a time-weighted staking mechanism, encouraging long-term participation and shared responsibility, creating a safe, efficient, professional, and democratic governance system.

6. Investment Analysis Logic and Potential Risks

The author first encountered the Giza team during ETHcc in Paris in 2023. Giza initially entered the market with the concept of ZKML and gradually evolved into a more engineering-oriented and DeFi practical AgentFi project in 2024. After extensive research and careful evaluation of mainstream stablecoin yield projects and the emerging AgentFi projects, we can still assert that Giza's ARMA is one of the very few AgentFi projects with a real product refinement and on-chain execution loop. This "product-first" approach stands in stark contrast to the DeFi hype filled with concepts, lacking practicality, and ultimately evolving into meme coins that are essentially worthless. At the same time, we must acknowledge that compared to other channels for earning yields on stablecoin assets, the AgentFi model is still in its very early stages, and the protocol has yet to undergo a complete market cycle verification, remaining in the "early mining" phase, characterized by high volatility and experimental nature. For DeFi Degen users accustomed to exploring frontier opportunities, it may be worthwhile to allocate a portion of stablecoin assets for experimentation, but risk diversification should still be a priority.

Investment Logic

Paradigm Innovation Narrative: The Giza project is located at the intersection of AgentFi, ZK, and AI technologies, uniquely proposing the theory of "Xenocognitive Finance," which envisions a future financial architecture that achieves "cognitive offloading" through on-chain agents, possessing a clear first-mover advantage and philosophical depth.

Leading Product Practicality: Giza's ARMA is one of the very few AgentFi products currently on the market that has launched and achieved an automated agent execution loop, offering a product experience superior to most projects that are still in the conceptual stage or purely token-driven "air projects."

Early Mining Yield Window: The yield from stablecoins inherently possesses relatively controllable risk attributes under the premise of protocol security, combined with the current stage's token subsidy mechanism provided by ARMA, offering early participants a "mining" opportunity.

Potential Risks

User Trust Building Still Early: The AgentFi model is still in the exploratory phase, and market trust in on-chain AI agents remains limited, particularly regarding fund custody and strategy execution transparency, with psychological barriers that have yet to form a user growth flywheel in the short term.

Complex System Combined with Security Risks: The ARMA protocol integrates multiple high-complexity modules, including AI reasoning, on-chain account abstraction, and multi-protocol integration, with security relying on the dual correctness of contract design and reasoning logic. If any link fails, it may pose asset risks.

Unclear Token Value Release Path: The current crypto market is strongly speculative, with token performance largely driven by sentiment and liquidity. The Giza team does not adopt a speculative style, and the incentive structure, staking mechanism, and value reflow model of the $GIZA token still require further market validation, posing higher demands on long-term investors.

Conclusion

In the context of increasingly diverse stablecoin yield strategies, but limited user attention and execution efficiency, AgentFi represents the next paradigm of "AI + DeFi" integration, providing DeFi users with intelligent agent solutions that do not require constant monitoring and automatically optimize. This article, represented by Giza and its core product ARMA, systematically outlines the current development status, technical characteristics, and yield potential of the AgentFi track. Giza, based on the concept of "Xenocognitive Finance," has taken the lead in achieving a complete loop of AI strategy + non-custodial execution, making it one of the few AgentFi projects that combine conceptual depth with product practicality. ARMA focuses on stablecoin yield optimization, has launched on multiple chains, and integrated mainstream lending protocols, supported by a structured token incentive mechanism, exhibiting early mining effects.

Of course, we should also be clear-headed about the fact that AgentFi is still in its very early stages, with user trust, execution stability, and token value capture mechanisms all awaiting further market validation. However, precisely because of this, for users and builders who value product prospects and are willing to position themselves for early dividends from paradigm shifts, AgentFi, especially Giza/ARMA, may represent the vanguard and opportunity of the era of intelligent finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。