Original Title: "Bancor Sues Uniswap for Eight Years of Infringing AMM Patent, Faces Backlash: Waste of Resources"

Original Author: Crumax, Chain News

The veteran DeFi protocol Bancor recently filed a patent infringement lawsuit against the decentralized trading platform giant Uniswap, accusing it of unauthorized use of Bancor's automated market maker (AMM) technology, which was applied for patent protection in 2017. This has sparked widespread discussion and outrage within the community. In response to Bancor's strong claims, Uniswap countered that the lawsuit is "baseless."

Bancor Accuses Uniswap: Unauthorized Use of Core AMM Technology

According to The Block, the lawsuit was initiated by the nonprofit organization Bprotocol Foundation behind Bancor, along with developer LocalCoin Ltd., and was submitted to the U.S. District Court for the Southern District of New York on May 20. The complaint states that since Uniswap launched its decentralized trading protocol in 2018, its core design has adopted Bancor's original "Constant Product Automated Market Maker (CPAMM)" architecture without ever obtaining legal authorization:

Bancor invented this automated market model as early as 2016, published a white paper in 2017, and applied for relevant U.S. patents. That same year, it officially launched the world's first DEX (decentralized exchange) based on CPAMM. According to a press release from Bancor, this technology has been granted two U.S. patents and is considered one of the cornerstones of the DeFi field.

Bancor: We Are the Original Creators of Automated Market Makers

Mark Richardson, the project lead for Bancor, stated that Uniswap has been using Bancor's patented technology for eight years without providing any compensation, which has forced them to take legal action:

"When an organization continuously uses our invention to compete with us without authorization, we have to defend our intellectual property through legal means." He added, "If companies like Uniswap can freely use others' technology, the entire DeFi industry's innovation will be at risk. This is not just for ourselves, but for the healthy development of the entire decentralized finance ecosystem."

Uniswap's Counter: Baseless, Waste of Resources

In response, a spokesperson for Uniswap Labs stated, "This lawsuit is baseless, and we will vigorously defend ourselves." They pointed out that the Uniswap protocol has been fully open-source since its launch, subject to long-term community scrutiny and validation, and does not involve any infringement issues:

"As DeFi reaches historic peaks, such lawsuits are merely a waste of resources and attention." Uniswap founder Hayden Adams even quipped, "This might be the dumbest thing I've ever seen."

The specific amount of damages sought in the lawsuit has not yet been determined, but the ruling in this case could become an important precedent for defining the boundaries of DeFi patent rights.

Bancor vs Uniswap: A Disparity in Strength

Although Bancor claims to defend its patented technology, the actual development results show a significant gap in the positions of the two in the DeFi market.

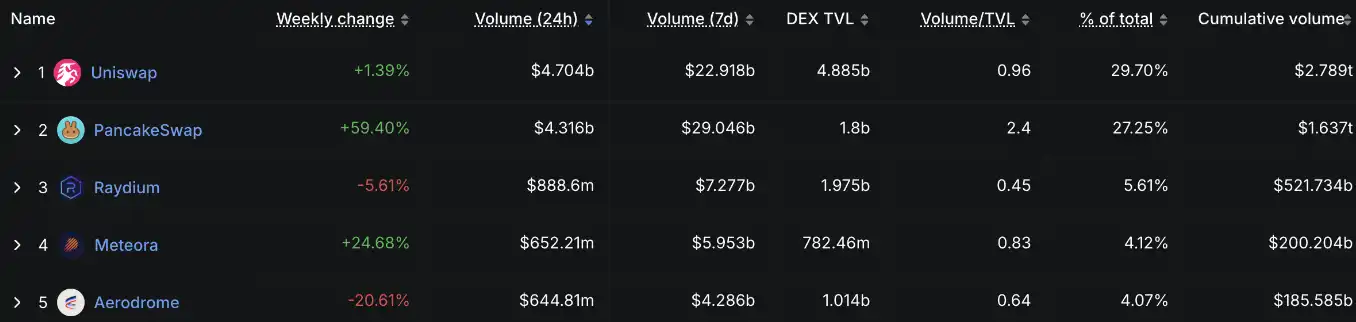

According to DefiLlama data, as of the time of writing, Uniswap's daily trading volume is nearly $4.7 billion, firmly holding the title of the world's largest DEX; since its inception, it has accumulated a trading volume of nearly $2.8 trillion. In contrast, Bancor's daily trading volume is only $500,000, ranking 128th, highlighting the disparity in strength.

This clash over technology patents and market power is not just a legal dispute; it also reflects the new challenges and games faced by the DeFi industry as it matures. How the court determines the validity of Bancor's patents will have far-reaching implications for the boundaries of DeFi technological innovation.

Appendix: Comprehensive Analysis of the U.S. Stablecoin Bill "GENIUS Act"

As stablecoins gradually become an important tool for U.S. dollar payments and settlements, the U.S. Congress recently proposed the "GENIUS Act" (Guiding and Establishing National Innovation for U.S. Stablecoins Act), aiming to establish a compliance framework through clear regulations on the issuance conditions, reserve requirements, and regulatory mechanisms for "payment stablecoins."

Core Concept of the "GENIUS Act": Regulating Only "Payment Stablecoins"

The bill explicitly limits the regulatory targets to "Payment Stablecoins," defined as follows: "Digital assets that the issuer promises to redeem at a fixed amount of legal tender and maintain a stable exchange rate."

Exclusions include:

· Legal tender itself (e.g., U.S. dollars)

· Bank deposits (even if recorded on the blockchain)

· Financial securities

· Decentralized stablecoins and algorithmic stablecoins (e.g., DAI, FRAX)

Who Can Issue Payment Stablecoins?

Only the following three types of institutions are authorized to issue regulated payment stablecoins:

Federally regulated banks or their subsidiaries

Non-bank institutions approved by the OCC (Office of the Comptroller of the Currency)

Issuers approved by state governments (with assets below $10 billion)

Other unlicensed institutions will not be allowed to issue or sell payment stablecoins to U.S. users after a three-year grace period.

Reserve Requirements: 1:1 Cash or Equivalent Assets, No Rehypothecation

Issuers must hold equivalent reserves, including:

· U.S. dollar cash and Federal Reserve account deposits

· FDIC-insured demand deposits

· Short-term U.S. Treasury bills maturing within 93 days

· Government money market funds

· Eligible repurchase agreements or tokenized government bond assets

Rehypothecation is prohibited unless for liquidity needs or permitted purposes.

Reporting and Compliance Obligations: Public, Transparent, Audited

All compliant issuers must:

· Publicly disclose reserve composition and issuance volume monthly

· Accept audits by registered accountants

· Have the CEO and CFO sign authenticity certifications

· If issuance exceeds $50 billion, annual financial reports must be prepared and disclosed in accordance with GAAP standards

· Comply with the Bank Secrecy Act (BSA) and anti-money laundering regulations

Exceptions: Protecting User Freedom and Privacy

The following situations are not subject to this bill:

· Peer-to-peer asset transfers (P2P)

· Transfers of stablecoins between the same person across domestic and foreign accounts

· Self-custody wallet operations (hardware/software wallets)

Dual Regulatory System for State and Federal Oversight

State-level issuers with assets below $10 billion can maintain state regulation but must obtain approval from the federal "Stablecoin Review Committee." Once they exceed the $10 billion threshold, they must fall under federal regulation or cease issuance.

Core Objective: Stable Payment System, Distancing from DeFi

The bill aims to create a compliant "payment infrastructure," clearly delineating itself from DeFi or algorithmic models. It does not intend to eliminate all stablecoins but rather to establish standards for "safe and redeemable" payment stablecoins to prevent systemic collapse risks (e.g., Terra/UST).

DAI and FRAX Are Not Within Regulatory Scope, but Exchange Policies Are Worth Watching

Although decentralized stablecoins like DAI are not subject to this bill's regulations, if U.S. exchanges or payment platforms only support compliant stablecoins in the future, it may still indirectly affect such assets.

Risk Warning: Cryptocurrency investments carry a high level of risk, and their prices may fluctuate dramatically, potentially resulting in the loss of your entire principal. Please assess risks carefully.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。