Original Title: Why is Bitcoin becoming an asset on corporate balance sheets?

Original Author: Maximiliaan Michielsen

Original Translation: Shenchao TechFlow

The accumulation of Bitcoin by corporations is rapidly shifting from a bold bet to a mainstream financial strategy. Bitcoin (BTC) is no longer merely synonymous with "HODLing" (a strategy of buying and holding for the long term), but is being viewed as a productive asset that can be used as collateral, gradually entering corporate balance sheets.

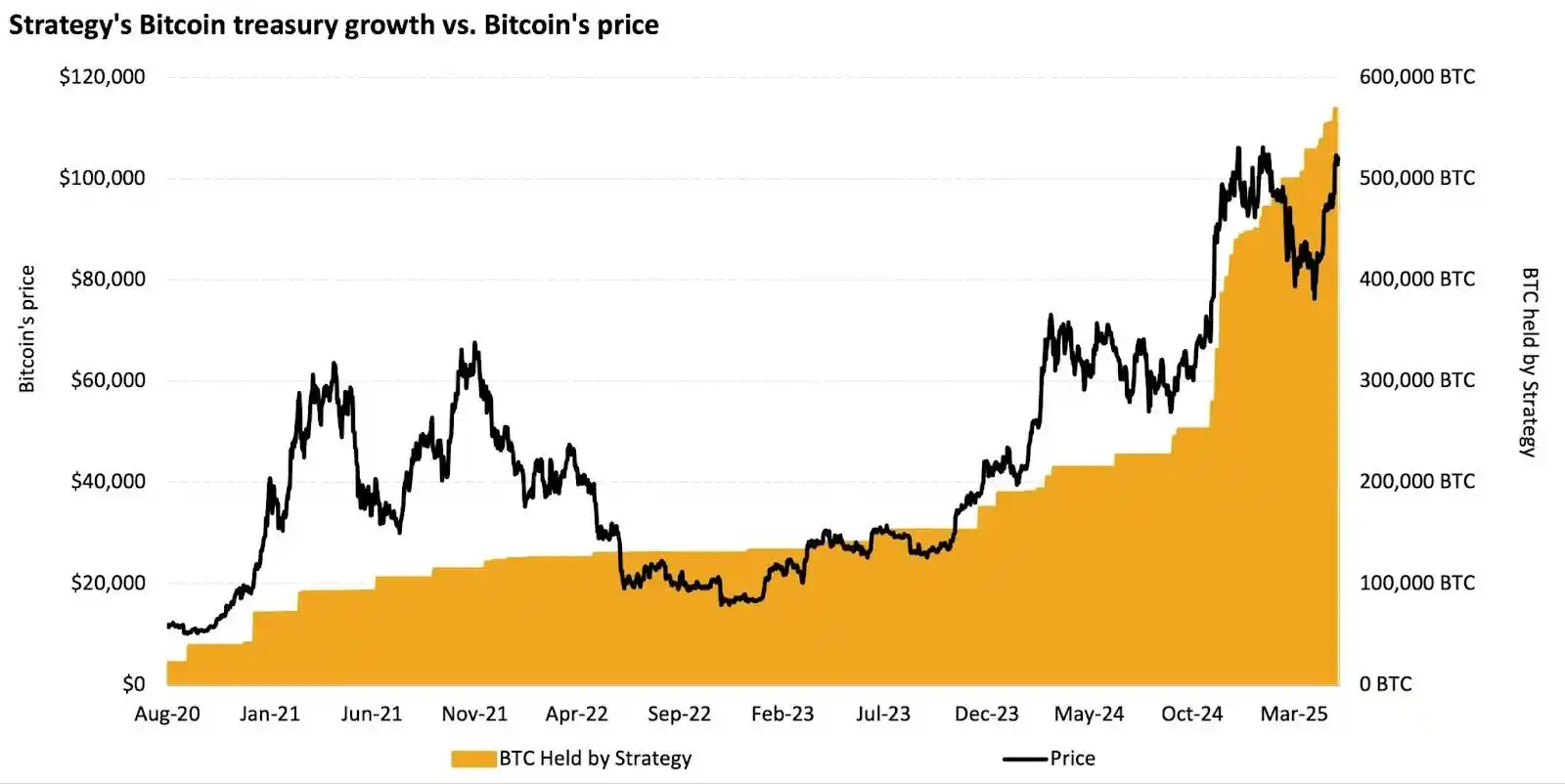

Last week, we explored how the trend of Bitcoin accumulation began with Michael Saylor's strategy and has gradually gained momentum in companies like GameStop and MetaPlanet. The latest example is Twenty One Capital's purchase of Bitcoin for $458 million. This momentum continues, with Strategy recently increasing its holdings to an astonishing 568,840 Bitcoins, accounting for 2.7% of the total Bitcoin supply, with a total value approaching $60 billion.

While the scale of these acquisitions is impressive, the real highlight is how Strategy has built a whole new corporate financial architecture around Bitcoin.

Source: 21Shares, Bitcointreasuries. Data as of May 9, 2025

The Bitcoin Native Transformation of Corporate Finance

In the earnings call for the first quarter of 2025, Strategy not only reported ongoing Bitcoin accumulation but also unveiled a strategic roadmap. This roadmap could become a blueprint for a Bitcoin-native corporate financial model and has the potential to reshape capital markets.

Although the report showed a year-over-year decline in traditional earnings, reflecting broader macroeconomic headwinds, Strategy emphasized its firm commitment to Bitcoin in its first-quarter update for 2025. In just the first four months of this year, the company raised $10 billion to support its acquisition strategy:

· Raised $6.6 billion through At-the-Market (ATM) stock offerings

· Raised $2 billion through convertible bonds

· Raised $1.4 billion through preferred stock

To support its long-term Bitcoin strategy, Strategy announced the "42/42 Plan," aiming to raise $42 billion in equity capital and $42 billion in fixed-income capital by the end of 2027.

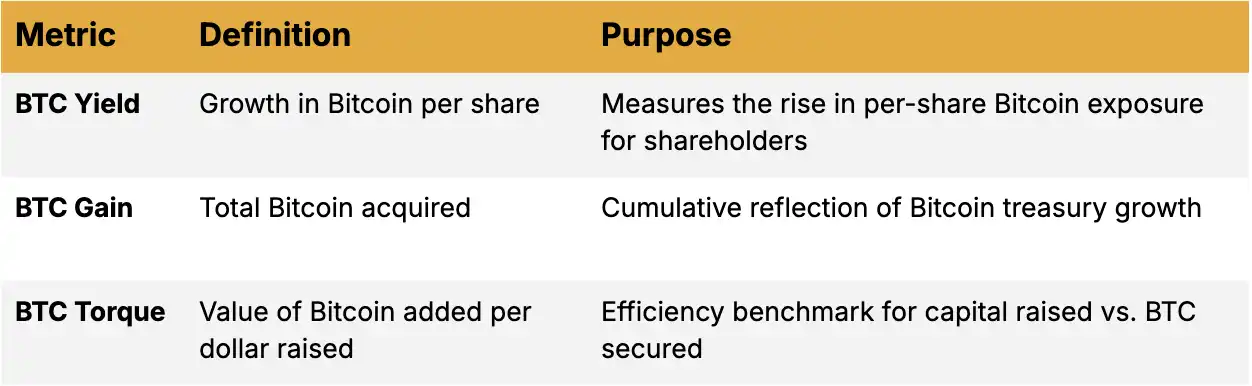

This structured roadmap is designed not only to drive Strategy's own Bitcoin accumulation but could also serve as a replicable model for other companies considering similar financial policies. Notably, Strategy no longer uses traditional key performance indicators (such as earnings per share EPS or earnings before interest, taxes, depreciation, and amortization EBITDA) to assess performance, but instead evaluates through a Bitcoin-native financial perspective, employing three proprietary metrics to guide:

· Bitcoin Yield: Target increased from 15% to 25%

· Bitcoin Gain: Target increased from $10 billion to $15 billion

These targets indicate that despite recent macroeconomic fluctuations, Strategy remains committed to maximizing Bitcoin-adjusted shareholder value. As more companies seek to replicate this model, Strategy is at the forefront of a new financial era.

Redefining the Corporate Credit Market with Bitcoin as Collateral

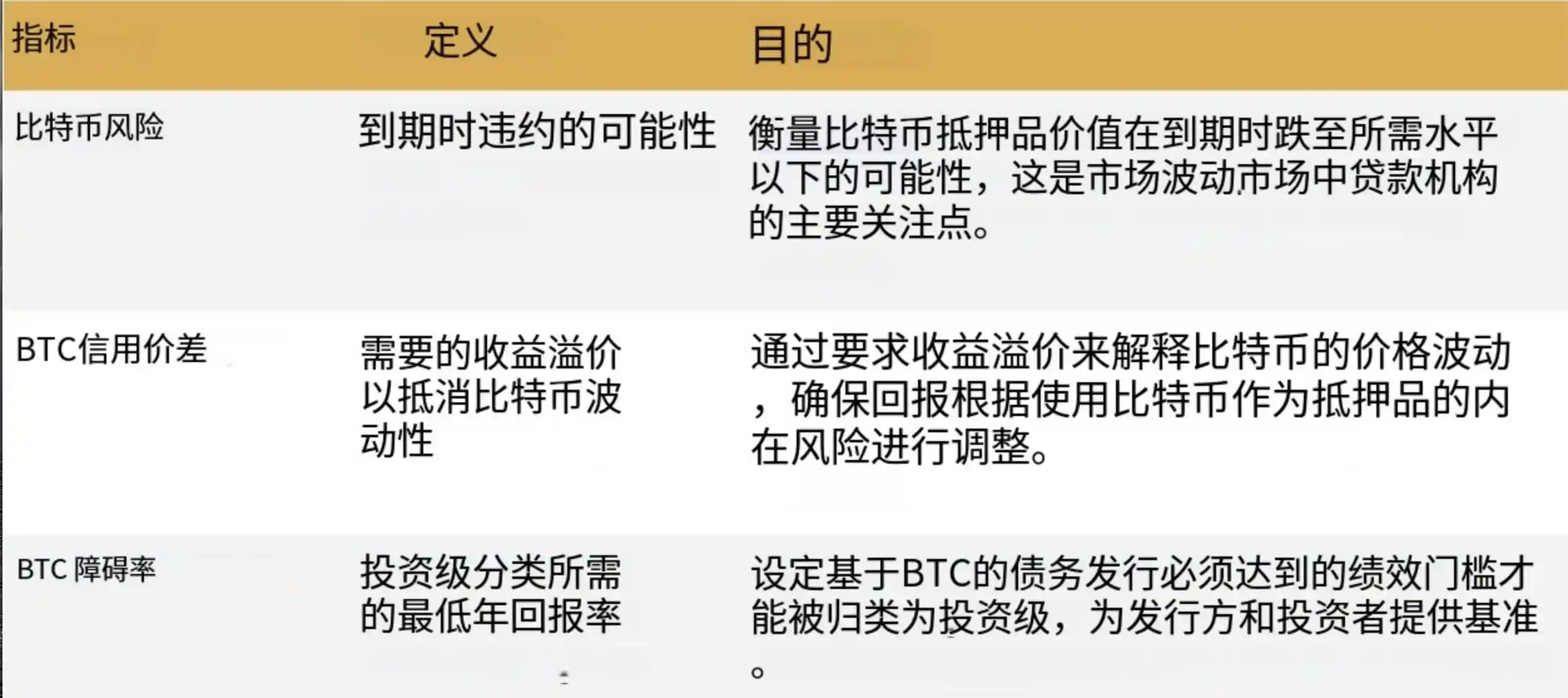

One of the most transformative pillars of the Strategy framework is its initiative to use Bitcoin as collateral in the corporate credit market. In addition to capital-raising efforts, the company has introduced a financial instrument structure specifically designed for the unique risk characteristics of Bitcoin:

Translation: TechFlow

By using Bitcoin as over-collateral for convertible bonds and preferred stock, Strategy is actively pushing credit rating agencies to adopt a new framework that may view Bitcoin as a high-grade reserve asset.

If this attempt is successful, it could lay the foundation for a Bitcoin-backed bond market, allowing companies to issue debt secured by their Bitcoin holdings. This would also enable institutions to enter a whole new asset class based on collateralized digital assets. Strategy's approach is leading the way, paving the path for Bitcoin finance to move from experimentation to standardization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。