The world's largest alternative asset management company, Blackstone, has publicly entered the cryptocurrency market for the first time. According to several authoritative media outlets, including The Block, Blackstone has purchased approximately $1 million worth of BlackRock's iShares Bitcoin Spot ETF (IBIT) through its Alternative Multi-Strategy Fund (BTMIX), holding 23,094 shares. This move marks the official entry of this asset management giant, which manages over $1 trillion in assets, into the crypto space.

Blackstone's Cautious Entry: A Million-Dollar "Test"

According to the latest portfolio documents submitted by Blackstone to the U.S. Securities and Exchange Commission (SEC), it held shares of BlackRock's IBIT valued at approximately $1.08 million at the end of the first quarter of 2025, which is a negligible proportion of its BTMIX fund (total assets of $2.63 billion), accounting for only about 0.04%. Additionally, Blackstone has made small investments in other crypto-related assets, including 4,300 shares of Bitcoin Depot Inc. (BTM), an operator of crypto ATMs, valued at $6,300, and 9,889 shares of ProShares Bitcoin ETF (BITO) valued at $181,000.

This action by Blackstone contrasts sharply with the past conservative stance of its founder and CEO, Stephen Schwarzman, towards cryptocurrencies. In 2019, Schwarzman publicly stated that he found it "difficult to understand" how Bitcoin works and expressed concerns that it could be used for illegal activities such as money laundering, claiming it was contrary to the principles of the traditional monetary system.

Market Background: The Bitcoin ETF Boom and Institutional Wave

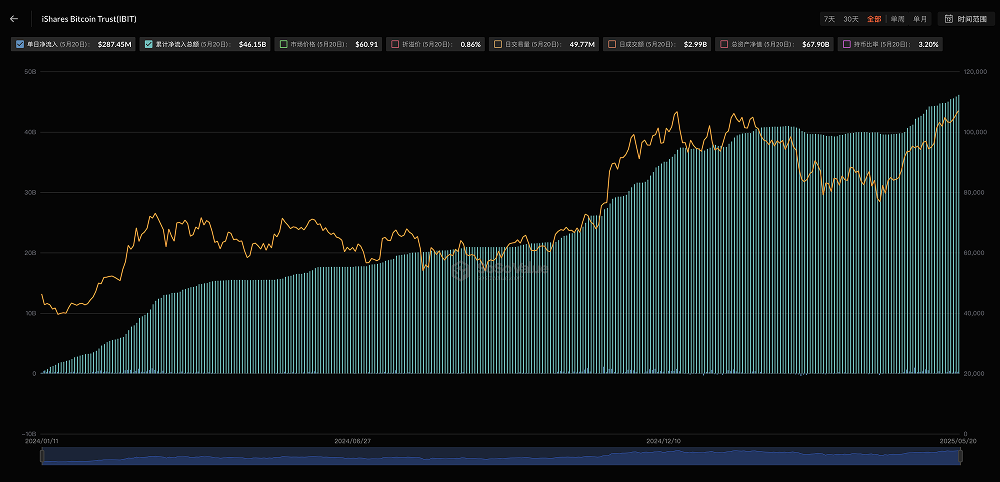

The BlackRock IBIT that Blackstone chose to invest in is one of the first Bitcoin spot ETFs approved by the SEC in January 2024, and it has performed strongly since its launch. According to SoSoValue data, as of May 20, 2025, IBIT saw a net inflow of $329 million in a single day, with a historical total net inflow reaching $46 billion, firmly establishing its leading position in the Bitcoin spot ETF market. Bloomberg ETF analyst Eric Balchunas noted that IBIT recorded net inflows for 20 consecutive trading days in 2025, accumulating approximately $5.1 billion, setting a record for similar products.

The successful launch of Bitcoin spot ETFs has greatly enhanced the liquidity and legitimacy of crypto assets, allowing them to gradually stand alongside traditional assets like gold. Data shows that the total assets under management of Bitcoin spot ETFs in the U.S. market have surpassed $121 billion, a significant increase from early 2024. Meanwhile, the improved regulatory environment has also paved the way for institutional entry. In 2024, the SEC approved Ethereum spot ETFs, and in 2025, there were reports of progress on applications for altcoin ETFs such as XRP and DOGE.

Blackstone's entry is not an isolated case. In the fourth quarter of 2024, 13F filing documents showed that while the allocation ratio of institutional investors to Bitcoin was low (with a median of only 0.13%), several financial giants, including Goldman Sachs and JPMorgan, have indirectly held Bitcoin assets through ETFs. Goldman Sachs' holdings in IBIT reached $2.3 billion, accounting for 0.37% of its investment portfolio.

Why Choose IBIT? Strategic Considerations Behind the Caution

Blackstone's choice of BlackRock's IBIT as an entry point is not coincidental. IBIT features direct ownership of Bitcoin, allowing it to accurately track Bitcoin prices, and is subject to strict SEC regulation, providing more transparent risk disclosure, making it suitable for institutional investors with lower risk appetites. In contrast, futures ETFs like BITO may experience price tracking errors due to contract rollovers, making them less attractive. Additionally, the custodian of IBIT, Coinbase, has significant influence in the crypto space, and its regulatory interactions with the SEC also provide assurance of the fund's compliance, despite some uncertainty stemming from Coinbase's past litigation.

While Blackstone's million-dollar investment may seem insignificant, it is viewed by industry insiders as a "testing the waters" signal. Analysts believe this may relate to adjustments in Blackstone's hedge fund strategies, such as capturing market inefficiencies through basis trading. The participation of quantitative funds and market makers has significantly enhanced the liquidity of the Bitcoin ETF market, narrowing bid-ask spreads and optimizing order book depth. As a leader in the alternative asset management field, Blackstone's investment decisions often serve as a bellwether, potentially signaling that more institutions will gradually increase their allocations to crypto assets.

Market Reaction and Future Outlook

Blackstone's entry has sparked heated discussions in both the crypto community and traditional finance circles. On platform X, accounts like @BlockBeatsAsia quickly shared related news, calling it a "symbolic event of Blackstone finally bowing to Bitcoin." @Mike19930312 commented, "Even Schwarzman can't escape the 'true fragrance' law," reflecting market expectations for a shift in the attitudes of traditional financial giants. However, some voices pointed out that Blackstone's cautious investment reflects its concerns about the volatility of the crypto market and regulatory uncertainties, making it unlikely to significantly increase its investment in the short term.

Looking ahead, as the regulatory environment in the U.S. continues to loosen, such as the GENIUS stablecoin bill entering the review stage and Texas promoting Bitcoin strategic reserve legislation, the trend of institutionalization in the crypto market will continue to deepen. Blackstone's small step may lay the groundwork for its subsequent layout. Industry insiders predict that if Bitcoin prices continue to break through (such as recently approaching $110,000), or if more altcoin ETFs are approved, similar asset management giants like Blackstone may accelerate their entry, driving a new wave of capital inflow.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。