最近,Tether又搞了个“大动作”。

不到24小时前(2025年6月3日约5:21AM),它从自己的地址中转出了14,000枚比特币,市值将近15亿美元。这种级别的操作,不是简单的“调仓”,而是足以让市场情绪震动的“巨鲸级行为”。

但它真的会改变趋势吗?在我们进行分析之前,得先搞清楚一个概念:

“转出比特币”到底意味着什么?

很多读者看到“Tether转出14,000枚BTC”时,第一反应可能是:

“是不是要砸盘?要抛售了?”

但这里其实有个常见误区:

“转出” ≠ “卖出”

链上数据显示的“转出”,本质上只是 Tether 把比特币从一个它控制的钱包,转到了另一个地址。这个地址可能是:

- 冷钱包:为增强安全性,降低黑客攻击风险。

- 做市商或托管方钱包:如Bitfinex或Twenty One Capital,用于流动性支持或机构协调。

- 内部地址调拨:优化资产配置或应对2025年全球监管趋严。

类比一下:你把钱从储蓄卡转到支付宝,不代表你马上要花光它,对吧?Tether也是一样,转账只是手段,意图才是关键。

为什么市场还是紧张?

尽管我们不能直接判定“卖出”,但市场参与者并不会等待结果才做反应。在一个信息高度不对称的市场环境下,大资金的一举一动,往往会引发短期的情绪预期。特别是像 Tether 这样体量巨大的玩家,其资产调动往往被视作“系统级流动性信号”。哪怕它只是冷钱包迁移,也可能触发市场提前波动。

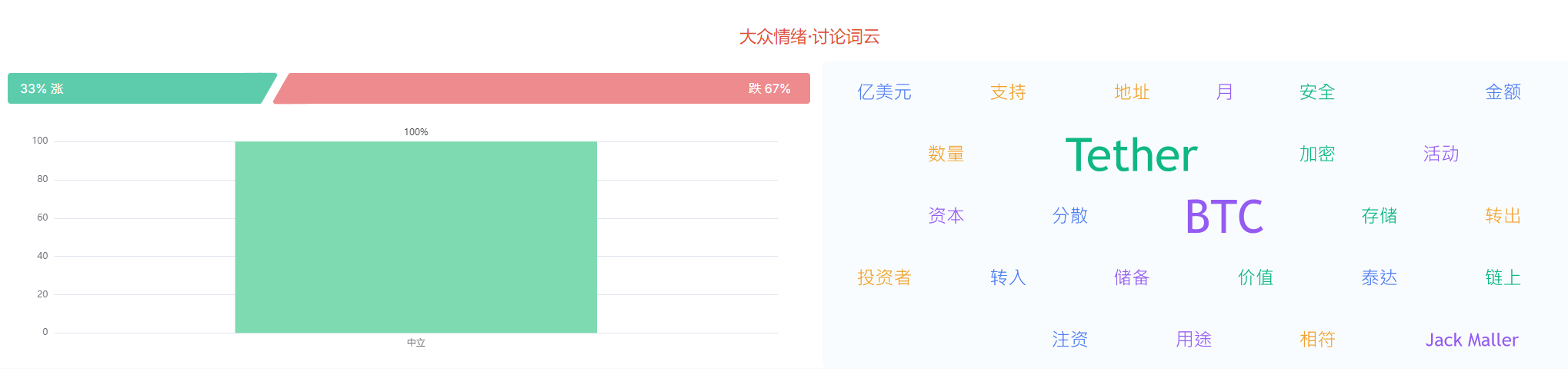

X平台上关于“Tether BTC转账”的帖子显示情绪两极化:约40%用户表达FOMO,认为转账可能是机构布局;约30%用户质疑Tether储备透明度,担心“隐秘操作”导致USDT脱钩风险。从我们Aicoin平台的词云分析来看,投资者对这笔“Tether转账+BTC”事件的情绪也呈现两极化。

我们真正该关注的是什么?

不是它到底有没有“卖”,而是:全球最大的流动性提供者,正在重新调整它的比特币仓位。这才是市场情绪紧张的根源所在。

我们不需要知道它具体在做什么,但我们必须意识到:

- 它的操作可能影响短期资金流动方向;

- 它的行为会被市场过度解读并引发超前反应。

技术图形与OBV:Tether转账后的第一波市场反馈

尽管Tether的大额转账只是地址之间的调仓,但市场并不会等你解释完链上结构再做决定。情绪往往比逻辑快一步走在前面。所以我们把时间拉近,来看6月3日Tether转账后,比特币的分钟级别反应。

① 高位放量回落:情绪从冲动转向谨慎

从图中可以看到,比特币在当天上午快速拉升至106470一线高点,但很快冲高无力,随后出现明显回落。这种“冲高—横盘—回落”的结构,在事件驱动下,往往意味着:

- 市场情绪尝试突破,但缺乏持续的跟进买盘;

- 多头信心开始松动,短线资金选择离场。

尤其在消息刺激下冲高却未能放量站稳,往往是主动买盘不够、被动抛压开始显现的征兆。

② OBV同步下滑:并非“洗盘”,而是真正的抛压

这时候,OBV指标给出了关键辅助信号:在价格横盘震荡期间,OBV未能持续上升,而在价格回落时,OBV也同步快速下滑,且跌破短期MA(均线)。

这说明,市场不是“洗盘”(情绪试探),而是资金真实流出。

确实,从日线看,目前市场只是一个小回调。但在事件突发当下,一分钟的情绪反应,就是市场最真实的直觉反应。

- 对短线交易者:它可能是一次短空或快撤的机会;

- 对中线投资者:当前回调幅度有限(1-2%),不是趋势反转信号,但可作为观察市场反应力的窗口。需警惕主力借Tether事件“假利好真出货”。

这不是Tether第一次转账,也不会是最后一次。

但这一次,我们看见了市场对“预期”本身的恐惧:不是恐惧Tether真的卖,而是恐惧“不知道它会不会卖”。所以别只盯着价格,看情绪、看结构,才是读懂行情的关键。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。