Everyone sees different facets, but they all point to the same future.

Author: Will A-Wang

Preface

The World is Flat

Our world has transformed from isolated local economies into a tightly interconnected global system through the global links of the internet, leading Thomas L. Friedman to state that "the world is flat." Although the internet has made the flow of information free and globalized, the infrastructure supporting the flow of capital still largely relies on frameworks established before the internet era, making the flow of capital/value still difficult and expensive.

While some regional financial innovations can accelerate the flow of capital, the financial tracks supporting Africa have not kept pace. The traditional financial system has failed to provide stability, accessibility, and efficiency, leaving people at risk of inflation and financial uncertainty, with limited control over savings and difficulty accessing global markets. Just as the region leaped from the desktop era directly into mobile, Africa is now ready to move beyond outdated banking infrastructure to actively embrace stablecoins.

We can no longer limit our vision to the trading use cases of stablecoins in the native crypto market; we should view stablecoins from a completely new perspective, considering their real-world use cases in non-crypto native scenarios. Stablecoins have become an important part of the crypto narrative in sub-Saharan Africa, serving as a popular hedge against long-term inflation and currency devaluation.

"Blockchain-based stablecoins are an answer. Stablecoins give us our first real opportunity to change money in the same way that email changed communication: making it open, instant, and borderless. This is a currency/value WhatsApp moment, where a global network built on blockchain and stablecoins can benefit everyone."

—— Chris Dixon,

1. The Stablecoin Revolution in Africa

Africa has the highest penetration of mobile money globally, demonstrating the demand for alternative financial solutions. Thus, the emergence of stablecoins is a natural progression, providing a way to access financial services seamlessly with just a mobile phone. Stablecoins can further develop on this foundation, expanding financial inclusion and enabling more efficient borderless transactions.

According to Chainalysis data, Africa is the fastest-growing region for cryptocurrency adoption, with a year-on-year growth rate of 45% from 2022-2023 to 2023-2024, surpassing other emerging markets like Latin America at 42.5%. This rapid growth highlights the immense potential for stablecoin applications, especially in Africa, where bank penetration remains among the lowest globally.

"Stablecoins have already become a reality in Africa's cross-border payments… the rest of the world is just catching up."

—— Zekarias Amsalu, Co-Founder of Africa Fintech Summit

One of the main drivers for the adoption of stablecoins in Africa is the foreign exchange (FX) crisis faced by many countries. About 70% of African countries are experiencing foreign exchange shortages, making it difficult for businesses to obtain the dollars needed for operations. In countries like Nigeria, where the local currency Naira (NGN) has significantly devalued, stablecoins provide a much-needed alternative. "Banks have no dollars, the government has no dollars, and even if they did, they wouldn't give them to you."

—— Chris Maurice, CEO & Co-founder of Yellow Card

Over the past three years, stablecoins have become an indispensable part of the African financial system, providing a reliable means of value storage, cross-border remittances, and trade without relying on highly volatile and unstable local currencies. Dollar-backed stablecoins like USDT and USDC are filling the gaps left by traditional finance, allowing people in dollar-scarce economies to access stable value storage.

From remittances and retail savings to B2B trade and cross-border payments, stablecoins are addressing issues of Dollar Access, Instant Settlement, and FX Inefficiencies on the African continent, particularly in markets where traditional payment channels are lacking.

Africa is the most vibrant growth market globally, with the fastest population growth, the youngest median age, and nine of the twenty fastest-growing economies. Africa has 400 million mobile payment users, and the scale of digital finance adoption is already significant. Stablecoins represent the next leap, transforming smartphones into globally connected dollar accounts. Looking ahead, in ten years, more people in Africa will own crypto wallets and use stablecoins for daily transactions instead of traditional bank accounts.

"You don't have to educate users; life will force them to use it."

—— Sky, Co-founder of ROZO

2. Projects Driving Future Stablecoin Adoption

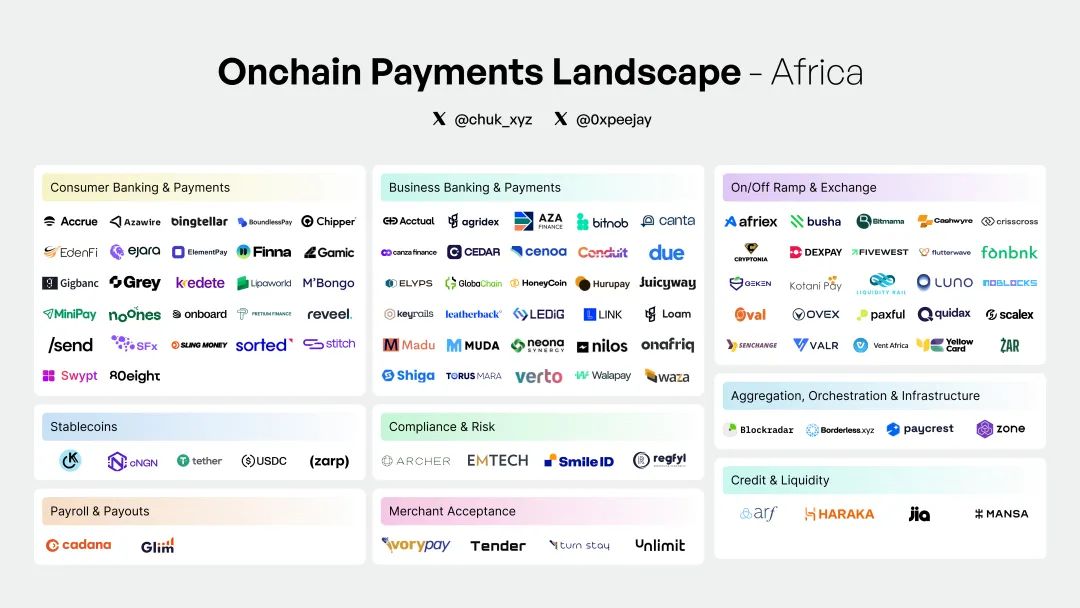

Chuk from Paxos has drawn a map of the ecosystem covering payment channels, use cases, and companies to showcase the depth of this transformation. While many market maps display the global stablecoin ecosystem, few focus on Africa's role in shaping its financial future. Therefore, we created this map to highlight the builders and use cases that are redefining the financial infrastructure of the African continent.

(Mobile Money to Global Money: Africa’s Stablecoin Revolution, Chuk @ Paxos)

In the past three years of investment in the African market, we have seen an increasing number of companies building around stablecoins, each playing a key role in driving the adoption and innovation of stablecoins. Below are some of the most noteworthy participants, along with key growth and funding data that highlight the rapid expansion of the industry.

Yellow Card: One of Africa's leading crypto asset exchanges, operating in 20 countries across the continent. The largest and first licensed stablecoin entry platform in Africa. Yellow Card allows users to seamlessly exchange fiat currency for cryptocurrency and vice versa. In 2024, the platform's annual transaction volume doubled from $1.5 billion in 2023 to $3 billion.

Conduit: Provides stablecoin payment services for import and export businesses in Africa and Latin America. Annualized TPV is expected to soar from $5 billion in 2023 to $10 billion in 2024.

Juicyway: A Lagos-based startup that facilitates cross-border payments using stablecoins. Since 2021, Juicyway has processed a total of $1.3 billion in payments.

Bridge: Founded in 2022, Bridge was acquired by Stripe for $1.1 billion just two years later. Bridge enhances the global stablecoin payment infrastructure. It serves most African payment companies and facilitates stablecoin payments in Europe, the US, and Asia.

Jia: A blockchain-based fintech company providing loans to SMEs in emerging markets. In 2024, Jia's cumulative loan issuance exceeded $10 million, up from $2 million the previous year, with an internal rate of return (IRR) of 24% and a default rate of 0.14%.

Onboard: A global P2P trading protocol that allows anyone to access on-chain finance from anywhere. Nestcoin raised $1.9 million in its last funding round to drive product growth.

KotaniPay: Provides stablecoin settlement solutions for businesses and users. KotaniPay is developing an API product that connects blockchain and local payment channels. In 2023, KotaniPay secured $2 million in seed funding.

Accrue: Builds a dollar stablecoin agency network to expand cross-border payment infrastructure. It has raised $1.58 million in seed funding to scale operations.

Convexity: Developed Nigeria's first regulated stablecoin, cNGN. The company has been collaborating with the Central Bank of Nigeria since 2021 and received a temporary license from the Nigerian Securities and Exchange Commission (SEC) in 2024.

Honeycoin: A platform for cross-border remittances, bill payments, purchasing call time, and online consumption. GTV surged from $40 million in the previous quarter to $500 million in Q4 2024.

Paycrest: A decentralized liquidity protocol that supports instant, low-cost payments powered by stablecoins. Additionally, they developed Zap, a DApp for seamless payments between cryptocurrencies and fiat, which won the Base 2024 Global Onchain Summer Buildathon. Today, Zap is ready to go into production as Noblocks, the first interface supported by a distributed liquidity node network for instant decentralized payments with any bank or mobile wallet.

Haraka: A stablecoin-driven micro-lending protocol aimed at underserved entrepreneurs in emerging markets. Haraka utilizes a reputation-based credit scoring system and has demonstrated early commercial validation through partnerships with Grameen Bank and Mercy Corps.

Many of these companies have experienced significant growth over the past two years and are at the forefront of stablecoin innovation in Africa.

For the global fintech community, the question is not whether stablecoins will go mainstream. The question is, what can we learn from where stablecoins have already become prevalent—Africa.

3. Stablecoins are Solving Everyday Problems in Africa

"In Africa, it's not a choice between stablecoins and other financial tools. It's stablecoins or nothing." — Samora Kariuki, Frontier Fintech

Across Africa, stablecoins are addressing real problems. From value preservation to facilitating trade, the adoption of stablecoins is driven by necessity rather than trading and speculation. Below are the most critical use cases based on real demand, along with the companies building to support these use cases.

3.1 Everyday Tools: Savings, Consumption, and Credit

In many African countries, inflation, currency devaluation, and limited access to banking services make establishing financial security exceptionally difficult. Stablecoins provide a more reliable path, becoming a dollar-denominated tool for savings, transactions, and credit.

A. Value Preservation

In regions where access to dollar banking services is limited, inflation rates are high, and the costs of fiat payment networks are excessive or unreliable, stablecoins are increasingly favored. The situation in Africa reflects these conditions, making stablecoins a key tool for protecting savings and maintaining purchasing power, especially in economies where local currencies are continuously devaluing.

Currency devaluation is one of the biggest financial challenges facing African markets. Take the Kenyan shilling as an example: despite Kenya's GDP doubling from 2008 to 2024, its exchange rate against the dollar has depreciated by 50% since 2021. The contradiction is evident: economic growth is rising, but confidence in the local currency has not strengthened. Similarly, in Nigeria over the past 18 months, inflation and the devaluation of the naira have been key drivers for the adoption of stablecoins. The naira fell to an all-time low in February 2024 and has struggled since, further highlighting the demand for stable alternatives.

(Stablecoins: Leapfrogging Africa’s Financial System, Ayush Ghiya and Uchenna Edeoga)

As local currencies continue to devalue, stablecoins are becoming the preferred hedging tool, providing a more reliable means of wealth transfer and storage. Unlike cash or gold, stablecoins offer a fully digital and widely available payment channel that does not rely on banks, payment networks, or central banks. They not only hedge against currency fluctuations but also provide higher yields than traditional savings accounts, making them an attractive option for Africans looking to preserve and grow their wealth. Traditional banks offer low interest rates, while stablecoin savings platforms leverage decentralized finance (DeFi) and cryptocurrency lending models to create higher returns for users.

Currently, dollar-backed stablecoins are the preferred choice for users in emerging markets. In much of Africa, USDT (based on TRON) has effectively become the digital dollar. Most users acquire stablecoins through centralized custodial applications like Binance, prioritizing speed and liquidity over Western concerns about reserves or transparency.

For users facing foreign exchange rationing and 30% inflation, the most important factor is that it works. Stablecoins help users preserve assets in marginalized areas and save in stable currencies. According to World Bank data, as of 2021, only 49% of Africans had bank accounts, but 400 million people use mobile payments, and stablecoins can meet user needs where banks cannot reach.

Platforms like Fonbnk enable instant top-ups to USDT exchanges on basic mobile phones, while Accrue provides a local community agent network for cash deposits and withdrawals of stablecoins. The Nigerian cryptocurrency platform Busha Earn allows users to save stablecoins with an annual yield of up to 7.5% (far exceeding the yields of most Nigerian banks). Sub-Saharan Africa leads the world in DeFi applications, likely due to the growing demand for convenient financial services in the region. This indicates that stablecoins are not just an alternative; they are crucial for financial stability in areas where traditional systems have failed.

This makes stablecoin savings an attractive option—not only because of higher interest rates but also because users can earn returns in addition to the value preserved through hedging against currency devaluation. These factors combine to make stablecoins a powerful tool for wealth preservation and growth.

"By converting everyday prepaid payments—mobile data, bank transfers, and mobile payments—into USDT, Fonbnk acts as a stablecoin settlement layer, providing 400 million unbanked and underbanked Africans with a means to hedge against currency devaluation and opening up new avenues for savings and credit beyond traditional banks." —Chris Duffus, Founder & CEO, Fonbnk

B. Expanding Access to Credit

Africa's micro, small, and medium enterprises (MSMEs) face a $330 billion credit gap, with a lack of banking services leading to an underdeveloped credit system for small businesses, leaving millions of individuals and small enterprises shut out by banks. In these markets, small businesses are often overlooked by traditional financial institutions due to high collateral requirements, lengthy documentation processes, and a lack of credit history. With limited access to affordable upfront capital, many MSMEs turn to informal lenders for financing, and the lack of affordable credit restricts their ability to maintain daily operations and promote economic growth.

In the Web3 space, stablecoin-based lending protocols have shown tremendous potential to address this issue over the past three years. However, most of these solutions still require excessively high collateral rates, needing about 150% of crypto assets as collateral, effectively excluding MSMEs in emerging markets. While low-collateral lending protocols like Goldfinch have emerged, they primarily serve as alternative debt providers for fintech lenders rather than directly serving physical small businesses.

Recently, two companies, Jia (which utilizes decentralized finance to provide factoring, supply chain financing, and other loans) and Haraka (which employs an innovative social credit system), have been actively working to disrupt this space and seize market opportunities in Africa. These companies offer blockchain-based loans to small businesses and empower responsible borrowers with ownership, enabling them to accumulate wealth and drive economic development in their communities.

Bringing this real-world economic activity on-chain benefits both investors and borrowers. Investors can democratically access real returns, while borrowers can gain blockchain liquidity and use ownership as a means to create long-term wealth for themselves and their communities. The use of blockchain also reduces the high transaction costs commonly found in private credit markets (which are often passed on to the end borrower) and allows borrowers to create on-chain credit histories, thereby building reputations over time.

These tools give users more control over their funds and unlock financial options that were previously out of reach.

3.2 Cross-Border Flow: Trade, Fund Management, and Remittances

As Stripe CEO Patrick Collison stated, stablecoins are "the room-temperature superconductors of financial services." They will enable businesses to seek new opportunities that would otherwise be burdened by existing payment channels or the friction of traditional gatekeepers. This is particularly evident in the cross-border payments space, where traditional systems are slow, costly, and rely on multiple intermediaries. High fees and long delays complicate transactions—especially in Africa, where the average remittance rate is about 8%, and financial infrastructure is often limited or absent.

Cross-border payments are foundational to the daily economy in Africa, from importing goods and sending remittances to repatriating profits and paying freelancers. However, the payment channels supporting these flows of funds remain fragile: 3-5 days of delays, 5-10% fees, and restrictions due to foreign exchange rationing. Stablecoins change this landscape, providing a solution to these issues by supporting real-time, low-cost transfers without the need for large capital reserves or bank intermediaries.

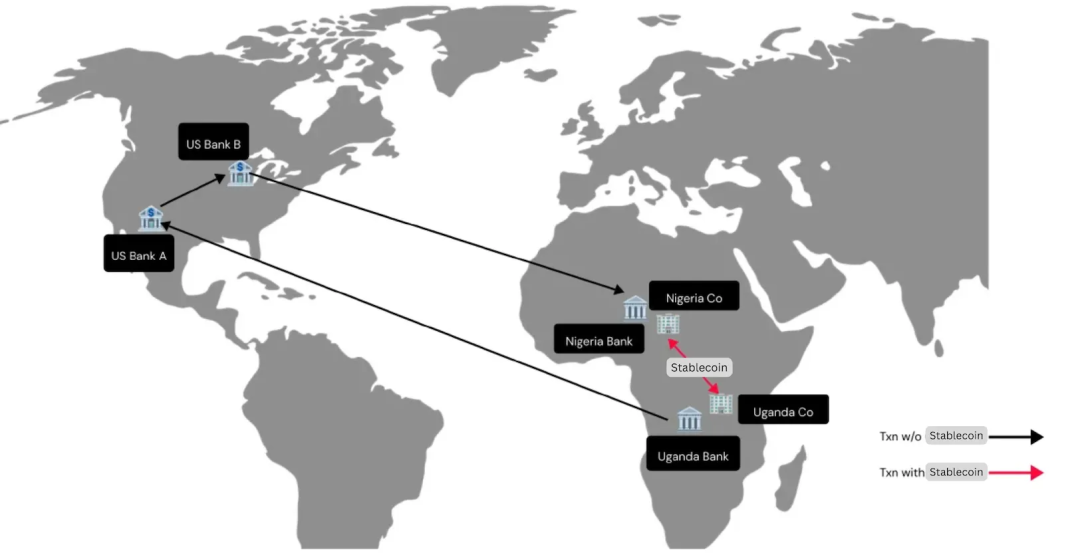

(Stablecoins: Leapfrogging Africa’s Financial System, Ayush Ghiya and Uchenna Edeoga)

In the scenario depicted above, a user in Uganda wants to transfer funds to a user in Nigeria. If the remittance is based on the SWIFT network, the user may have to route through an intermediary bank in the US due to the lack of a direct banking network between the two countries. However, once a stablecoin payment network is adopted, users can exchange local currency for stablecoins and send them directly to the Nigerian user, who can then convert them into Nigerian naira and access funds locally.

This process eliminates the inefficiencies of SWIFT and net settlement systems, as transfers occur directly through exchanges or blockchain wallets connected to currency acceptance and deposit service providers. These providers integrate with local payment systems to enable seamless conversion between stablecoins and local currencies.

Recently, Stripe acquired Bridge, a stablecoin API provider, for $1.1 billion, just two years after Bridge was founded in 2022 to enhance its global stablecoin payment network. Africa is a key market for Bridge, providing stablecoin payment services for most African payment companies operating in Europe, the US, and Asia. This highlights the growing demand for stablecoin infrastructure in the market and the rapid expansion of major players in this field.

While Bridge has laid the groundwork for the orchestration and issuance of stablecoins, there is still much work to be done in this subfield. Cross-border payments remain a huge opportunity, but there are also key issues that need to be addressed.

A. Trade and B2B Payments

China is Africa's largest trading partner, with imports from China reaching $176 billion in 2023, resulting in a trade deficit of $66.6 billion. This creates a continuous demand for dollar payments, which stablecoins meet efficiently and with high liquidity. Due to their deep liquidity and broad exchange support, USDT (based on TRON) has become the preferred channel for many commercial payments.

"Stablecoins are the new cornerstone of cross-border payments in Africa. Businesses using Conduit can settle payments almost instantly, reducing working capital, maintaining liquidity, and avoiding currency fluctuations." —Eric Wainaina, General Manager, Africa at Conduit

"Stablecoins have completely changed the situation for importers who cannot access dollars through banks—now their businesses are thriving." —Suleiman Murunga, Director, MUDA

Intra-African trade payments: Intra-African trade accounts for only 15% of the continent's total imports and exports, far below North America's 54%, Asia's 60%, and the EU's 70%. The main reason for this imbalance is the lack of direct currency exchange infrastructure—most transactions require converting local currencies into dollars, pounds, or euros before converting them into other African currencies. This inefficiency adds $5 billion in unnecessary costs to intra-African transactions each year. Addressing this issue is crucial for achieving smooth trade across the African continent.

Repatriating funds: Some large multinational companies selling goods and services in Africa can use stablecoins to repatriate funds back to their home countries. With stablecoin infrastructure, fund settlement times are under 30 minutes, while traditional payment methods take 2-3 days.

B. Remittances and Global Payments

Just as stablecoins can facilitate outbound payments, they can also bring funds into the African continent. This includes remittances, salary payments, and income for freelancers.

Remittances are one of the most common cross-border payment needs, but traditional remittance methods make them costly. In 2023, global remittance flows reached $883 billion, with fees having a particularly severe impact on low-income users. Today, the cost of remitting $200 from the United States to Nigeria using stablecoins is less than $0.01, while traditional methods require $7.60. Reducing these costs on a large scale remains a pressing priority.

"Sub-Saharan Africa remains the region with the highest remittance costs globally, with an average remittance cost of 8.37% in 2024. However, many Africans overseas are unaware that they can now use stablecoins to send money home faster and at a lower cost." —Xino Zee, Lead at Send Africa

Payments: For freelancers in the gig economy, cross-border micropayments remain costly and inefficient. In places like Kenya, some even choose to "rent" PayPal accounts because opening their own is too difficult—highlighting how access barriers exacerbate the already high costs of small international payments. The emergence of stablecoins can simplify payment processes, significantly benefiting these workers. Additionally, multinational companies can efficiently manage cash flow using stablecoins and seamlessly pay global employees, customers, or suppliers.

Global Aid: Currently, of every dollar donated to global aid organizations, only about 40 cents ultimately reaches the beneficiaries, with the rest going to multiple intermediaries. We clearly need a more efficient, low-cost system to provide global aid in a transparent and seamless manner.

A new wave of companies is rebuilding Africa's cross-border payment infrastructure around stablecoins. As exchanges, Yellow Card, Busha, VALR, and Luno provide liquidity for local currency acceptance for deposits and withdrawals. Conduit, Honeycoin, Shiga Digital, and Juicyway support commercial trade, collections, and payments, while Sling and Send drive consumer P2P payments.

These builders have quietly transferred billions of dollars in total. Many companies do not directly sell "stablecoins," but rather sell cheaper remittances, operational capital efficiency, and currency stability.

4. Opportunities for African Builders

"In Africa, if you kick a tree, three fintech companies using stablecoins will fall out… The strongest teams we support now have a single channel or industry liquidity—stablecoins are just hidden behind the scenes of fintech companies." —Brenton Naicker, Principal & Head of Growth (Africa) at CV VC

4.1 Four Levers for Value Creation

The first wave of stablecoin growth focused on infrastructure: deposits and withdrawals, channel liquidity, and basic wallet functionality. This layer is rapidly becoming crowded. The next phase is differentiation: who owns the users, who defines the standards, and how to profit from real use cases. Here are four levers shaping value creation across the African continent:

A. Distribution: Winning Users

Control over user interface and customer relationships determines the flow of transaction volume. The strongest companies do not lead with stablecoin infrastructure but rather solve payment, lending, or cash management issues, keeping stablecoins hidden behind the scenes.

B. Liquidity: Controlling Both Ends of the Channel

Local foreign exchange liquidity is uneven and difficult to replicate. Teams that can manage the flow at both the starting and ending points can offer better pricing, internal net trading, and lower fees. Liquidity accumulates, forming a defensive moat.

C. Regulation: Shaping Rules Before They Are Formed

In competitive markets like Nigeria and Kenya, perfect execution is crucial. However, in less developed markets like Malawi or Cape Verde, first movers face less competition and can collaborate with regulators to define the rules of the game. Early investors in trust-building builders may win long-term policy consistency.

"US dollar liquidity has been tokenized through stablecoins in much of Africa. Policymakers should prioritize the large-scale tokenization of local currencies to accelerate economic sovereignty and trade." —Wale Ayeni, Managing Partner of Helios Digital Ventures

D. Vertical Domains: Customizing for Specific Workflows

Whether in agriculture (e.g., Agridex), logistics, education, or global aid, each industry has its own workflows, user expectations, compliance requirements, and payment rhythms. Specialized builders can use jargon, tap into existing tools, and solve problems that generalists cannot. Once trust is established, they can add additional financial services such as credit, cash management, or insurance. Focus brings user stickiness and profitability.

4.2 Major Crypto Economies in Africa

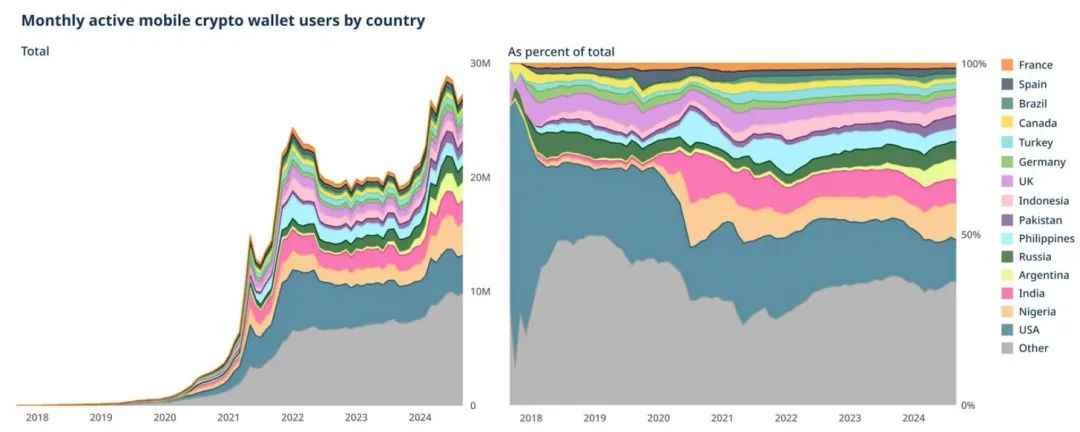

(State of Crypto Report 2024: New data on swing states, stablecoins, AI, builder energy, and more)

A. Nigeria—The Center of Crypto Activity in Africa

Driven by a booming fintech industry and severe economic challenges, Nigeria, Africa's most populous country, is leading in the adoption of stablecoins. In recent years, Nigeria's economy has faced a series of shocks. Low oil prices (a key driver of its export economy), combined with the impacts of the COVID-19 pandemic and supply chain disruptions, have led to prolonged financial uncertainty. Nigeria has one of the highest inflation rates in Africa, even surpassing the entire Francophone region. As the naira continues to devalue, stablecoins have become an important tool for Nigerians seeking to preserve wealth and engage in global transactions.

In Chainalysis's Global Crypto Adoption Index, the country ranks second overall. Between July 2023 and June 2024, the country received approximately $59 billion in cryptocurrency. Nigeria is also one of the leading markets for mobile crypto wallet adoption, second only to the United States. The country is actively working towards regulatory clarity, including through incubation programs, and the use of stablecoins in everyday transactions (such as bill payments and retail purchases) has significantly increased.

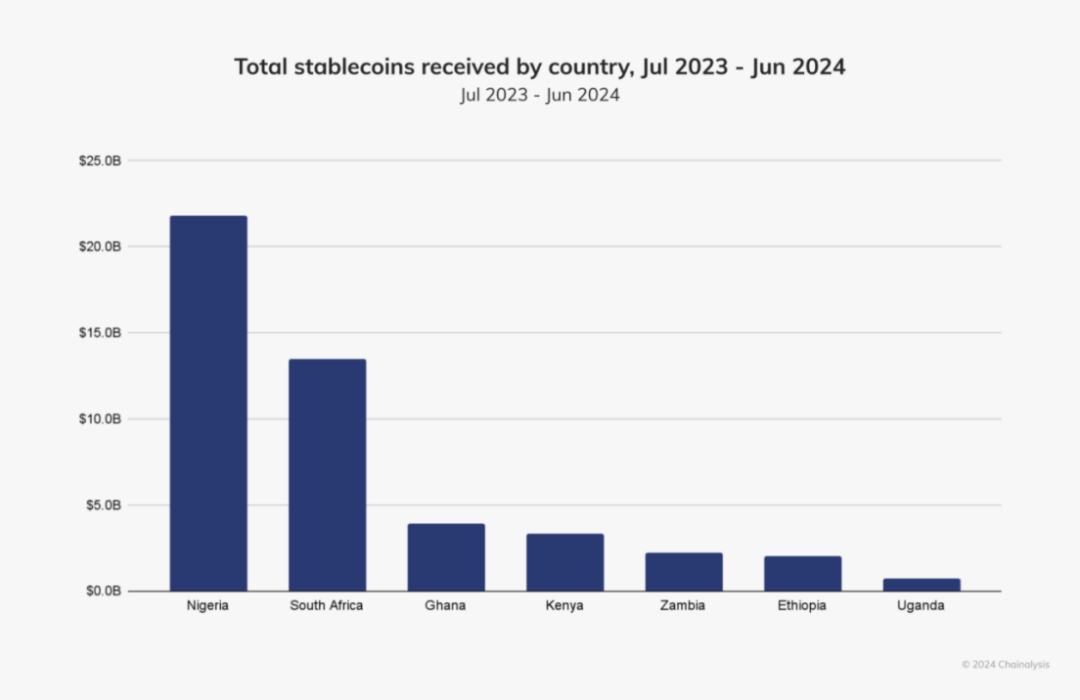

(Sub-Saharan Africa: Nigeria Takes #2 Spot in Global Adoption, South Africa Grows Crypto-TradFi Nexus, Chainalysis)

Like Ethiopia, Ghana, and South Africa, stablecoins are also a significant part of Nigeria's crypto economy, accounting for about 40% of all stablecoin inflows in the region—the highest in Sub-Saharan Africa. Nigerian users report higher transaction frequencies and a deeper understanding that stablecoins are a financial tool, not just an asset class.

Crypto activity in Nigeria is primarily driven by small retail and professional-scale transactions, with about 85% of transfer values being below $1 million. Due to the inefficiencies and high costs of traditional remittance channels, many Nigerians rely on stablecoins for cross-border remittances. Sodipo notes: "Cross-border remittances are the primary use case for stablecoins in Nigeria. They are faster and more affordable."

"Daily activities such as bill payments, mobile top-ups, and retail shopping are increasingly driven by cryptocurrencies. People are starting to see the practicality of cryptocurrencies in the real world, especially in everyday transactions, which contrasts with the previous view of cryptocurrencies as a means to get rich quickly." —Moyo Sodipo, CEO & Co-founder of Busha, a Nigerian cryptocurrency exchange

In addition to the traditional financial system, DeFi platforms also provide Nigerians with new opportunities to earn interest, borrow, and participate in decentralized trading. Sodipo states: "DeFi is a key growth area as users explore ways to maximize returns and access financial services they might not otherwise obtain."

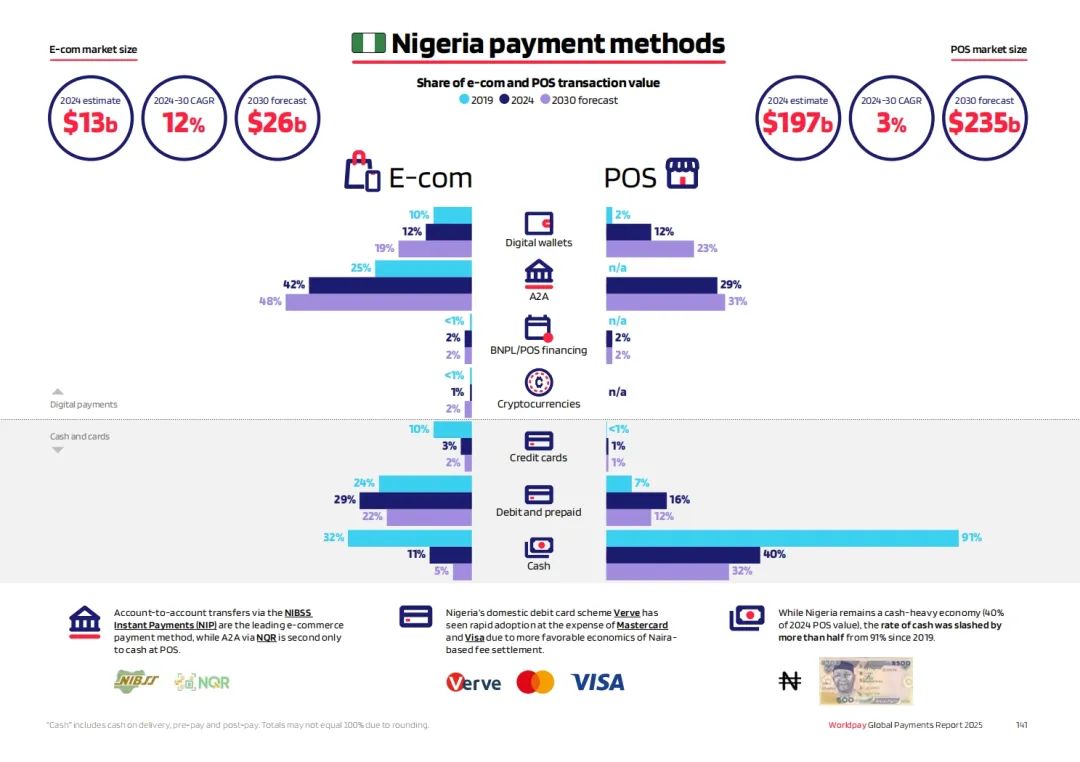

(GPR 2025: the past, present and future of payments, WorldPay)

We can see in the above image that cryptocurrencies as a payment method account for 1% of online e-commerce and offline point-of-sale (POS) transactions in Nigeria, categorized under Digital Payments. In WorldPay's report, similar countries include: Argentina, Brazil, India, Nigeria, Philippines, Singapore, Turkey.

Against the backdrop of inflation, remittances, and financial channels driving stablecoin adoption, it is believed that the use of stablecoins will be reflected across various scenarios. Nigeria has become an ideal testing ground for stablecoins in Africa. The role the country plays in building stablecoin infrastructure will determine the direction of this technology's development across the continent.

In December 2023, the Central Bank of Nigeria lifted the ban on banks providing services to cryptocurrency companies, which has also played a key role in the popularization of cryptocurrencies. "Since the lifting of the banking ban, it has opened up many possibilities for collaboration and smoother transactions," Sodipo explains. Building on this, in June 2024, the Nigerian Securities and Exchange Commission (SEC) launched the Accelerated Regulatory Incubation Program (ARIP), requiring all Virtual Asset Service Providers (VASP) to register and undergo evaluation before obtaining full approval. "The industry is optimistic about ARIP; it marks a shift away from uncertainty and is a positive step towards regulatory clarity," Sodipo says.

These policy initiatives will enable companies across various sectors to consider transitioning from traditional payment channels to stablecoin infrastructure. While compliant solutions are not without flaws, every business adopting stablecoins can demonstrate to existing enterprises that stablecoins are a reliable, secure, compliant, and more comprehensive solution to traditional payment problems.

B. South Africa—TradFi Institutional Adoption Drives Market Development

As Africa's largest economy, South Africa has positioned itself as one of the continent's most advanced Web3 markets, boasting a sophisticated regulatory framework and strong institutional investor interest. The country has become one of Africa's largest cryptocurrency markets, with a trading volume of $26 billion over the past year. Unlike many African countries where cryptocurrency adoption is primarily driven by retail investors, South Africa's institutional investor participation is steadily increasing, with licensed companies and traditional financial institutions entering the space.

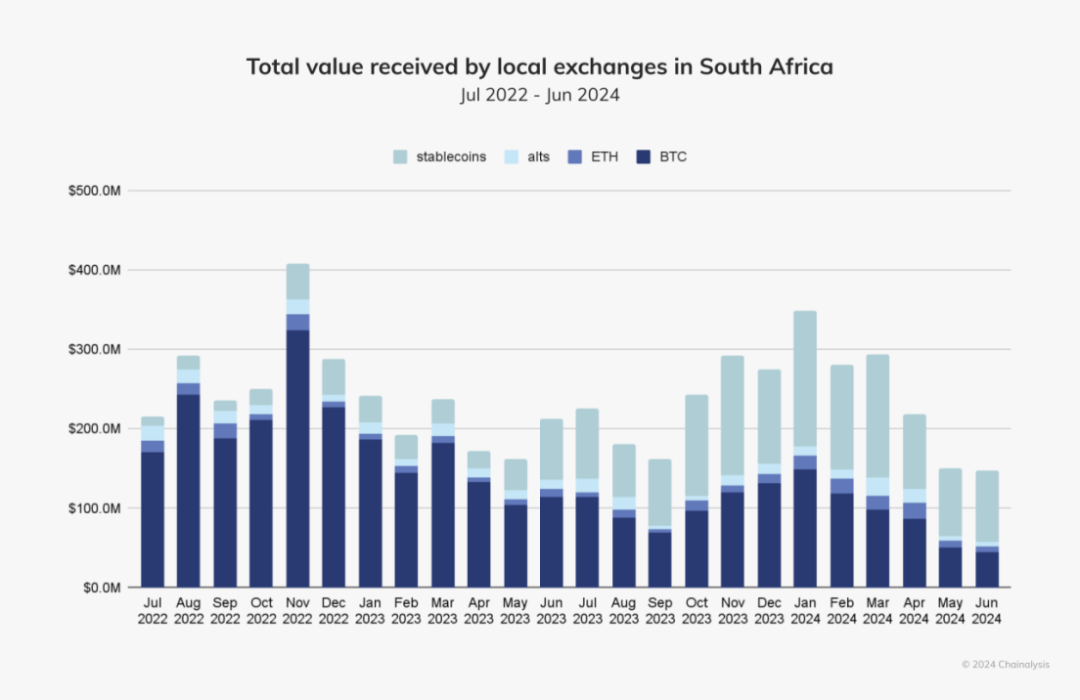

Since the end of 2023, stablecoins have been continuously growing on local exchanges in South Africa, with a month-on-month increase of over 50% in October 2023. Stablecoins have replaced Bitcoin as the most popular cryptocurrency in recent months.

(Sub-Saharan Africa: Nigeria Takes #2 Spot in Global Adoption, South Africa Grows Crypto-TradFi Nexus, Chainalysis)

The key driver of cryptocurrency growth in South Africa is its clear regulatory stance. The country has classified cryptocurrencies as financial products, thereby creating a structured legal environment that provides a clear regulatory framework for businesses and investors. In March 2024, South Africa approved 59 cryptocurrency operation licenses, paving the way for broader adoption of stablecoins. By setting regulatory guardrails, the government aims to attract investment, protect users from cybercrime, and expand channels for low-cost digital asset trading.

The South African intergovernmental fintech working group is actively refining its regulatory approach to stablecoins and plans to formally classify stablecoins as a unique subset of crypto assets. This move aligns with the country's broader financial modernization and digital payment initiatives, aiming to ensure that stablecoins can be properly integrated into the financial ecosystem. The 2024 budget review further emphasizes the government's commitment to structural reforms, improving public financial management, and developing new policies focused on stablecoins and blockchain-based digital payments.

The growing interest from institutional investors has also sparked discussions around bank-issued stablecoins. As traditional financial institutions explore stablecoin models, South Africa may soon see regulated, bank-backed digital assets, further driving the mainstream application of stablecoins. Led by startups like VALR, Luno, and Altify, South Africans have begun using stablecoins to diversify investments, make payments, and access financial services more efficiently.

With a developed financial sector, clear regulations, and the increasing integration of cryptocurrency with traditional finance, South Africa is becoming a leader in the application of stablecoins on the African continent. As the government refines its policy framework and institutions become more involved, South Africa is laying the groundwork for stablecoins to play a central role in its evolving digital economy.

C. Kenya—Emerging as the Stablecoin Hub of East Africa

Kenya has long been at the forefront of financial innovation in Africa. From being the first to launch mobile money to early adoption of Web3, the country has consistently moved beyond traditional banking systems towards more efficient digital solutions. Today, Kenya is positioning itself as a key player in the stablecoin revolution, leveraging its strong fintech infrastructure, open regulatory environment, and growing demand for alternative financial services.

One of Kenya's greatest advantages is its deep-rooted mobile money culture. M-Pesa, launched by Safaricom in 2007, has become a pillar of Kenya's financial system, handling about 60% of the country's GDP and reaching over 90% of the adult population. Its success lies in providing banking services without the need for physical banks, enabling millions of Kenyans to deposit, withdraw, transfer, and even access credit via mobile devices. Stablecoins complement this ecosystem by allowing users to hold value in stable currency and conduct frictionless transactions globally.

In addition to mobile money, Kenya's regulatory environment has been a significant driver of fintech and Web3 development. Unlike many countries that take a restrictive stance on digital assets, the Capital Markets Authority (CMA) in Kenya actively promotes innovation through regulatory sandboxes, allowing blockchain-based companies to test and refine their products.

The demand for stablecoins in Kenya stems from the lack of formal financial services. Small and medium-sized enterprises (SMEs) face significant barriers to credit, with Kenyan businesses seeking approximately $1.1 billion in loans in 2021 alone. Stablecoin-driven lending solutions can fill this gap, providing cheaper, faster, and more convenient credit options for businesses and individuals.

Kenya has also become a global leader in tokenized private credit. According to data from RWA.xyz, Kenya ranks first globally in tokenized real-world asset lending, with loans amounting to $73.8 million, surpassing larger economies like India and Brazil. This not only reflects Kenya's strong demand for alternative financing solutions but also demonstrates the country's ability to integrate blockchain-based credit models into its financial ecosystem.

With a mature mobile money landscape, advanced regulatory bodies, and the increasing adoption of stablecoins, Kenya is rapidly becoming an important stablecoin hub in East Africa. As more fintech companies build stablecoin-based solutions, Kenya's role in shaping the financial future of the region will continue to grow.

(Nika, taken in downtown Kenya, May 2025)

Five, Adoption Barriers to Overcome

Although we can see many builders making strong progress in Africa's ideal testing ground, the stablecoin infrastructure still faces structural challenges. To expand further, builders must tackle difficult barriers, some of which are technical, while others are political.

5.1 Policy Risks and Regulatory Ambiguity

While the largest countries have made progress in regulation, most others remain in a regulatory gray area. Stablecoins are neither banned nor fully legalized, which slows down the pace of adoption by businesses and hinders the entry of institutional capital.

As trading volumes grow, enforcement may increase regarding capital controls, taxation, anti-money laundering, and reporting. Progress in this area will come from active engagement with regulators. Founders, industry associations, and regional sandboxes can help shape the rules.

"Busha is proud to be the first licensed exchange in this market, and we are leading this transformation by providing the necessary liquidity, trust, and infrastructure to drive a stablecoin-driven economy. This is not the future; it is already here." —Michael Adeyeri, Co-Founder & CEO of Busha

5.2 Monetary Sovereignty

Governments are increasingly concerned that stablecoin wallets are creating a "shadow dollar economy." Some countries are exploring local alternatives, such as ZARP (Zimbabwe Digital Asset Reserve Platform) and cNGN (Naira-backed stablecoin), or piloting central bank digital currencies (CBDCs) to maintain monetary control.

"The dominance of dollar stablecoins reflects a crisis of trust… Without decisive policy innovation and encouragement for regulated, competitive naira-backed stablecoins like cNGN, African countries may hand over their financial control to offshore stablecoin issuers." —Adedeji Owonibi, Founder & COO of Convexity (cNGN Issuer)

5.3 Liquidity Gaps

Rapid cross-border payments require capital to be available at the right time, place, and currency. Providers like Wise and Thunes address this issue through pre-funded accounts, but as stablecoin liquidity flows, this responsibility shifts to market makers, over-the-counter desks, and other liquidity providers. As trading volumes increase, capital remains a limiting factor in each channel.

Payment finance (PayFi) companies like MANSA and Arf are filling this gap. By using stablecoins as a transmission layer, they provide real-time liquidity for fintech companies, coordinators, and SMEs.

"Real-time, low-cost liquidity not only makes payments faster but also unlocks new models, such as timely supplier financing. For founders who have built businesses around settlement risk, this is a game changer.

The next step is to embed this dollar liquidity directly into the applications and tools that emerging market businesses are already using, so that value can flow as easily as a WhatsApp message." —Mouloukou Sanoh, CEO & Co-Founder, MANSA

5.4 Fraud, Scams, and Consumer Trust

The adoption of cryptocurrencies brings new risks, from phishing scams and counterfeit wallets to poorly secured applications. These vulnerabilities undermine user trust, especially for first-time users. The responsibility for ensuring security falls on consumer applications. Trustworthy design, risk tools, and education must be integral parts of core products.

"Users are the biggest victims of malicious behavior. Users will only continue to use and recommend platforms they perceive as safe." —Zach Bijesse, CEO & Co-Founder at Archer

5.5 Awareness and Education

Outside the crypto-native circles, many merchants and agents still find stablecoins difficult to understand. Ongoing "last mile" adoption depends on usability, training, and demonstrating real value.

"In many rural areas and even urban communities, awareness of cryptocurrencies remains low because they seem too technical." —Xino Zee, Lead at Send Africa

These barriers are real, but they are gradually being overcome every day. Successful teams do not wait for perfect conditions; they build resilience, earn trust, and adapt to various channels and communities as regulations improve.

Six, Stablecoins are Redefining Finance in Africa

Stablecoins are fundamentally changing the financial landscape of emerging markets by providing a convenient, efficient, and reliable alternative to traditional banking systems. Unlike the institution-driven adoption seen in Western economies, Africa has not waited for a global consensus on stablecoins but has already begun building. Emerging markets like Sub-Saharan Africa are experiencing grassroots growth driven by retail users participating in micropayments, remittances, peer-to-peer payments, and value storage. At the same time, with the push from fintech companies, practical applications are being developed in areas such as remittances, trade, credit, and savings.

The experiences of the past few years have shown that stablecoins are not just an alternative but an inevitable trend for the future of African currencies. They can bypass fractured financial tracks, provide stable value, and enable instant, low-cost transactions, making them important tools for individuals, businesses, and even institutions. As more infrastructure is built and regulatory transparency increases, stablecoins will become more deeply integrated into Africa's financial system.

This is the prototype for the future of programmable money. It is a region worth learning from, building in, and investing in.

We are producing a series of documentaries to tell these stories—the stories of how humans use stablecoins in the last mile—because to fully realize the opportunities of stablecoins, we need to better understand the conditions driving their development and continue to push for their adoption in markets where the technology has found product-market fit. —Justin Norman, Founder of The Flip

He points out that to understand stablecoin adoption in Africa, one must see the "last mile" people, not just the technology.

Africa's demographic structure is in place, demand is evident, and this momentum will only accelerate with the gradual improvement of global regulations. Stablecoins are no longer just a buzzword in the crypto market but a system-level transformation that decouples from traditional finance and reconstructs on-chain.

Everyone sees different facets, but they all point to the same future—a world where banks are not needed, but everyone can "have a bank."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。