Selected News

Final vote on the US Senate GENIUS stablecoin bill may take several weeks

US Bitcoin spot ETF cumulative net inflow hits all-time high, surpassing $42.4 billion

Binance Alpha will launch TGT and will airdrop to eligible users

Binance will airdrop 1,000 MERL to users with an Alpha score of 193

Current mainstream CEX and DEX funding rates indicate the market has returned to neutrality

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

Huma Finance: Huma Finance has gained attention for recently announcing the allocation of 0.5% of its token supply to the Kaito Yappers community, sparking widespread discussion about its strategic partnerships and innovative financial solutions. The project focuses on connecting DeFi and PayFi, providing income-based lending and payment financing services, and has raised $46 million before its TGE. The community is actively participating in voting activities to establish a DAO alliance with the Jupiter exchange, and the token allocation to Kaito Yappers is seen as a strategic move to enhance community engagement and promote content creation. ref0 ref1 ref2 ref3 ref4 ref5 ref6

XRP: Today's discussions around XRP focus on news that Circle (the issuer of USDC) is in informal sale talks with either Coinbase or Ripple. Ripple is reportedly in a stronger position in this bidding process, and this potential acquisition has drawn significant attention and discussion within the crypto community. Additionally, the regulated XRP futures launched by CME Group are viewed as an important milestone for institutional entry, further intensifying the topic's heat. Meanwhile, Ripple CEO Brad Garlinghouse's cancellation of a meeting with pro-Bitcoin Senator Cynthia Lummis also highlights the current divisions and tensions within the crypto industry. ref0 ref1 ref2 ref3 ref4

OKB: Today's discussions about OKB mainly revolve around its involvement in multiple projects and collaborations, including its support for the upcoming SOON token issuance on Binance Alpha and OKX Early Access platforms. OKB is also mentioned for its investment in the Camp Network project, which focuses on the integration of blockchain and artificial intelligence, and its incorporation into OKX's Web3 wallet functionality. The market activity of OKB is also under scrutiny, especially regarding its role in the clearing process on major exchanges. ref0 ref1 ref2 ref3 ref4

Pendle: Discussions about Pendle focus on its growing user adoption and strategic partnerships. Key points include its integration with MorphoLabs and support from DeFiance Capital, which have driven the enhancement of stablecoin yields. Users are leveraging Pendle's PTs (Principal Tokens) for various strategic operations, with some assets like $KAITO and $GHO showing impressive annual percentage yields (APY). Pendle's composability and yield trading capabilities are highly regarded, with its PTs module becoming a key pillar of the ecosystem. Additionally, Pendle's collaboration with Aave is emphasized, showcasing its significant position in the DeFi ecosystem, with its market performance surpassing mainstream crypto assets like BTC and ETH. ref0 ref1 ref2 ref3 ref4 ref5 ref6 ref7 ref8 ref9 ref10 ref11 ref12 ref13

Base: BASE has gained significant attention on Twitter due to its ecosystem expansion and technological advancements. Key discussion points include the launch of the Fraction AI mainnet on BASE, a continuous rise in active addresses, and its role as a leading EVM chain. Furthermore, collaborations with projects like PondGNN and Virtuals_io, as well as its integration in decentralized finance protocols, are hot topics within the community. Discussions also touch on BASE's transparency, economic impact, and its potential as a foundational layer for future blockchain economies. ref0 ref1 ref2 ref3 ref4 ref5 ref6

Selected Articles

In recent days, the meme coin PAYAI, an AI agent protocol that integrates ElizaOS, libp2p, and IPFS on Solana, has surged from zero to a market cap of $10 million, currently maintaining around $3 million, attracting market attention. However, its revival is not due to PayAI's technology or product, but rather a mention by Cuy Sheffield, head of Visa's crypto division, on the X platform.

The well-known digital asset platform Amber Group's subsidiary, Amber International Holding Limited, successfully went public on Nasdaq in March through a merger with iClick Interactive Asia Group Limited. At the end of April, Amber's accelerator amber.ac launched an AI platform concept called AgentFi, and the token for the first "AI person," MIA, has increased nearly 100 times since its fundraising at the end of April, yet there are only about 1,300 holders on-chain.

On-chain Data

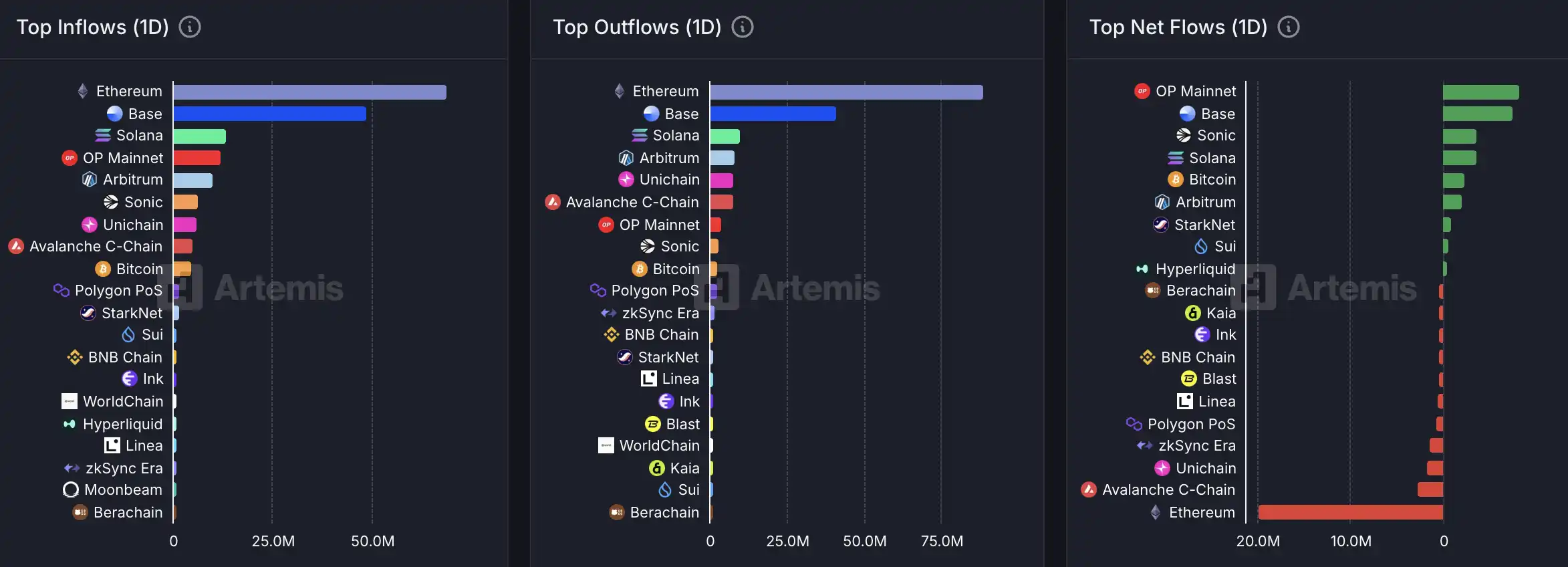

On-chain capital flow situation for the week of May 20

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。