Original authors: @mteamisloading, co-founders of @spire_labs

Original translation: zhouzhou, BlockBeats

Editor's Note: REV measures on-chain economic activity and reflects users' willingness to pay. Solana's REV is higher than Ethereum's, but REV has a lagging nature and can be easily manipulated. The FDV/REV ratio varies significantly, and the value of chains and tokens does not completely correspond, requiring a comprehensive multi-factor assessment of a chain's value.

The following is the original content (reorganized for better readability):

What is REV?

REV stands for Real Economic Value, which measures the total fees paid by users for using the entire chain. The REV generated by Solana is approximately 2 to 4 times that of Ethereum L1. So, why is this metric important? Are SOL and ETH severely undervalued?

REV Timeline:

REV is standardized by @Blockworks_ and widely promoted by the Blockworks Research team (@blockworksres). Jon Charb (@jon_charb) is also a significant contributor to promoting REV as an important metric for understanding blockchain.

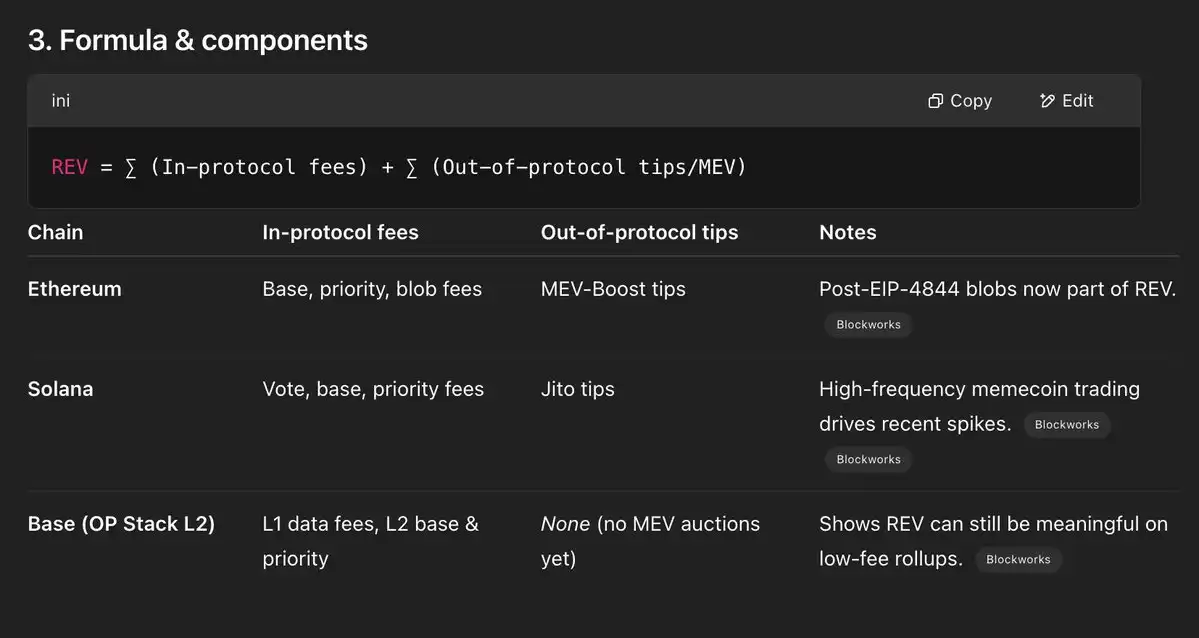

Revenue to a business is like REV to a blockchain.

"REV includes transaction fees within the protocol and tips paid by users for executing transactions outside the protocol, thus measuring the overall monetary demand for on-chain transactions." —@blockworksres

However, blockchains are not businesses, and equating the two can lead to significant misconceptions: while they share similarities, there are also differences. The key lies in the details.

Let's take a look at today's data, with charts provided by @blockworksres.

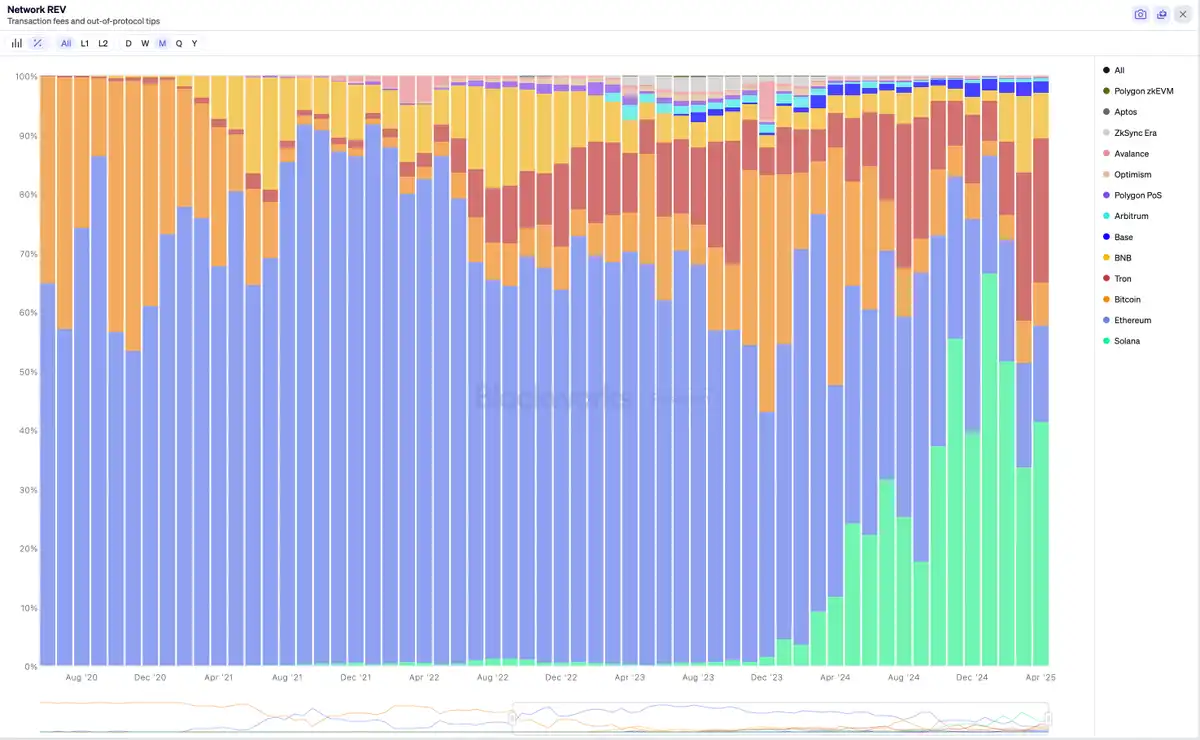

Comparison of REV proportions across chains over the past five years:

- Ethereum dominated during the 2021-2022 period

- Now, Solana ranks first, Tron second, both surpassing Ethereum

- Bitcoin's REV is nearly zero

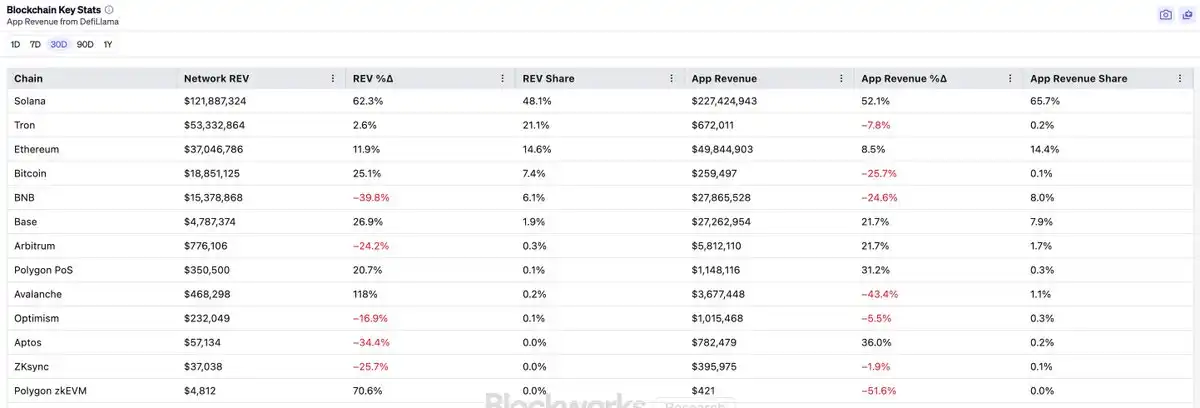

Here are some data from the past 90 days, including application revenue.

So, what does REV really tell us about a chain?

It is one of many metrics, each with its pros and cons:

Advantages:

- Compared to the number of active addresses or transaction volume, REV is harder to manipulate, especially when some REV is burned.

- Historically, it has been a good reflection of retail user activity.

Disadvantages:

- Historically, it is often a lagging indicator.

- Like all core metrics, REV cannot reflect the entire situation.

- Like other metrics, REV can also be manipulated.

- MEV (Maximum Extractable Value) generated by certain activities can far exceed REV from other activities.

- REV is often affected by the immaturity of on-chain MEV infrastructure.

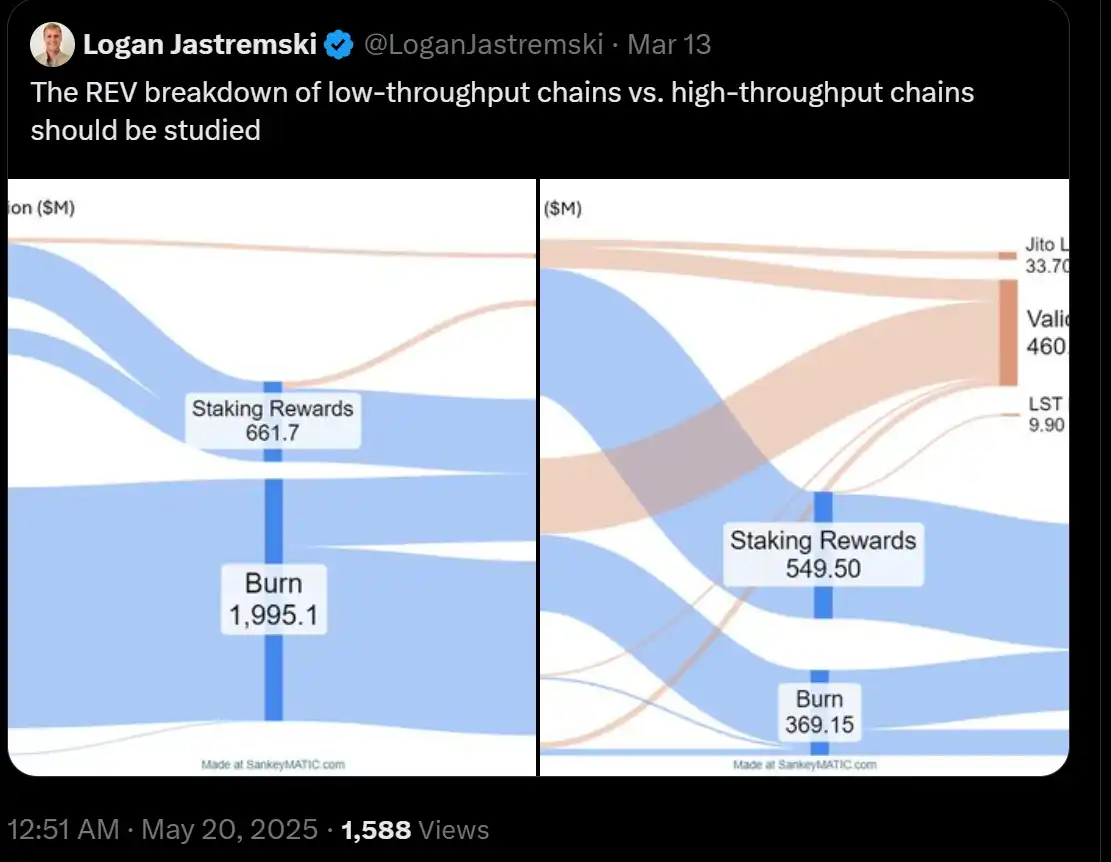

@_bfarmer summarizes this very well:

o3 also pointed out several more nuanced aspects of REV as a metric:

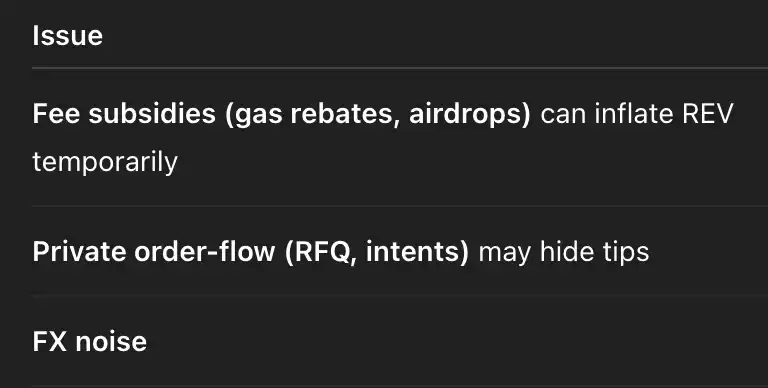

If we use REV to compare the financial performance of various chains, similar to comparing businesses, their FDV to REV ratios are as follows:

- Bitcoin: 10,000 times

- Ethereum: 593 times

- Solana: 85.5 times

- Tron: 39 times

By this logic, is Solana severely undervalued compared to Ethereum? No.

At least, REV (or FDV/REV ratio) is not sufficient on its own to assess the reasonable value of a chain's native token. There are three reasons:

- REV ≠ value capture of the chain's native token. Often, REV is burned, returned to users through incentive mechanisms, or paid as operational costs to validator node operators, etc.

For example: (data may be outdated):

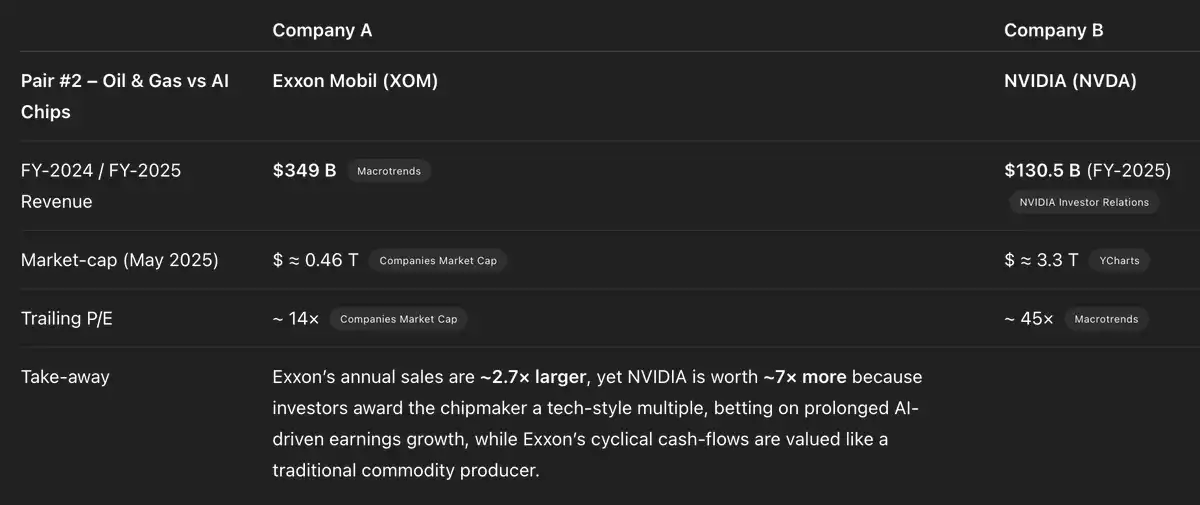

- The FDV/REV ratio (similar to the P/E ratio) will inherently vary between different chains (and businesses). For tokens, factors like yield and currency premium can significantly affect prices. Moreover, the quality and sustainability of REV differ across chains.

See:

- Blockchains are not businesses, and native tokens are not equity shares.

This should be very clear.

By the way, the discussions about REV in the past few days have had some interesting logical errors on both sides (the minimalist camp on REV may be more severe).

In the long run, maximizing REV indeed has many aspects worth emphasizing:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。