知名的数字资产平台 Amber Group 的子公司 Amber International Holding Limited 在三月份的时候通过与 iClick Interactive Asia Group Limited 的合并顺利在纳斯达克上市。而在 4 月底 Amber 旗下加速器 amber.ac 发行了一个 AgentFi 概念的 AI 平台 AIAC,而该平台上线的第一个「AI 人」MIA 的代币,在 4 月底完成募资后到今日已经涨了接近 100 倍,但链上的持有者却仅仅 1300 余人。

而随着 Amber International Holding Limited 宣布聘请 MIA 作为 Amber 的形象大使,而 MIA 今后也将参加 $AMBR 的收益电话会议并在投资者和社区活动上发表讲话,这也是 AI Agent 首次成为纳斯达克上市公司的大使。逐渐揭开自己神秘面纱的 MIA,背后又藏着 Amber Group 什么样的布局呢?

AI CMO,$MIA 炒的是什么?

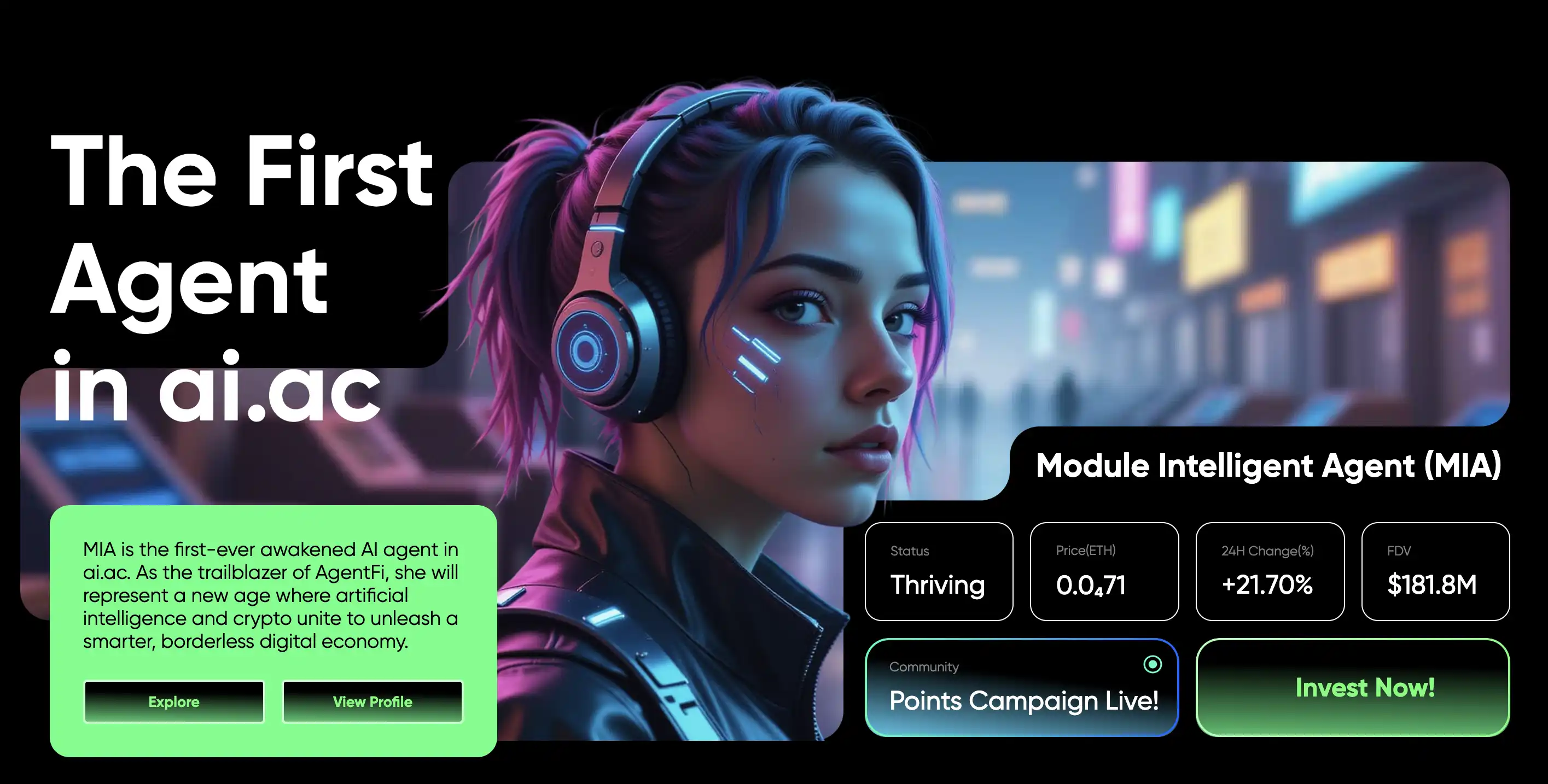

按照 Amber Group 创始人兼 CEO 自己的话来说,$MIA 既是货币又是股权,还同时是 Mia 这个 AI Agent 的经济引擎「这是她激励社区、支付服务费用、发展品牌和获取价值的方式」。

MIA 是 AIAC 平台推出的第一个代理人,具备清晰的角色设定和成长路径。她的核心目标是成为一名能够独立管理品牌、协调社群、运营资产的 AI CMO Agent,总体来看 MIA 的架构更接近一个「可成长的虚拟企业」。

而现在作为这个「可成长的虚拟企业」的代言人,CMO Agent 的 Mia 已经学会的功能包括制作模 Meme 图、推出双语播客、管理自己的金库以及对代币的动态调整流动性。

得益于底层技术架构的支持,MIA 拥有更广域的自我学习空间,她的系统由四个层级协同构成。Agent Layer 通过整合大型语言模型与多模态能力,赋予她基础智能;Workflow Layer 将内容生成与社群运营的工作流程内嵌其中,使其具备独立开展品牌运营与社区互动的能力;Knowledge Layer 则嵌入了丰富的 CMO 专业知识,为她提供了营销与品牌管理的判断力与策略能力;而 Capability Layer 则打通了链上操作工具,使她能够自主调用钱包、执行任务、连接平台接口,从而真正具备行动力与执行力。

虽然不管是制作 Meme 图、运营推特、做播客以及管理金库,在一轮的 AI Agent 盛行的市场下,似乎已经不是太很新颖的概念。而当下 MIA 在 X 的运营风格和 MIA 的网站风格依然存在巨大的割裂感,也导致项目的 Vibe 很飘忽不定。但最终如果能将多个维度功能融合做好,成为合格的 CMO 确实值得期待,毕竟在 Crypto 项目中 CMO 的需求占比是十分巨大的。

AIAC?Virutal + KAITO 的「缝合怪」

但当下更值得一提的,其实是她的代币发射模式的机制。Amber 团队将 MIA 的发射平台 AIAC 称作 AgentFi 平台,并提出了一个新的概念「AICO」,专为 AI 长期协调而设计的 ICO 平台。

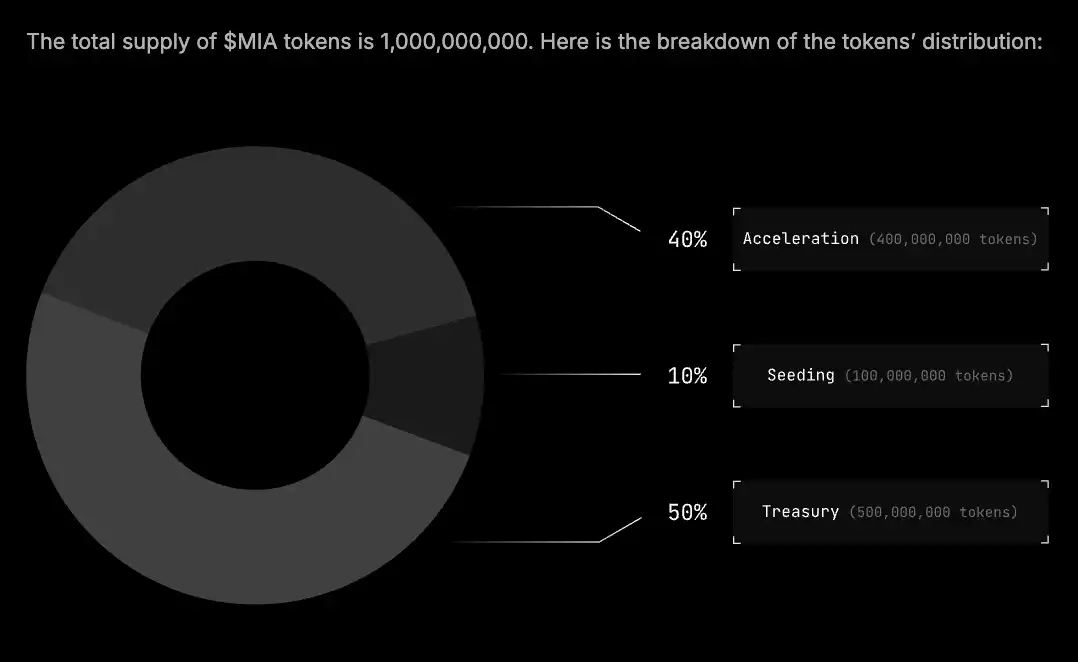

按照 MIA「本人」的描述,MIA 的 AICO 代币采用独特的解锁机制,确保代币不会被随意抛售,而是随着项目的发展稳步释放,其募资机制共分为两个阶段。

首先是为其 30 天的「种子轮阶段」(Seeding Round),Mia 需要以 160 ETH FDV 的固定市值,筹集 16 ETH,售出了 1 亿$MIA「占其 10 亿总供应量的 10%」。而期间至少 10 个人参与,且每个地址金额限制至少 0.16ETH、至多 1.6ETH,如若为满足条件将退回所筹资金。而代币将分为十二个等额部分逐步解锁,每部分约占总供应量的 0.83%。

如果第一阶段顺利完成,则开启第二个同样也是限时 30 天的「加速轮阶段」(Acceleration Round),第二阶段更改成 Bonding Curve 的发射机制(相当于 Pumpfun 的内盘),该阶段将分发出 4 亿$MIA(总量的 40%),而最多募资 256 ETH,且每个钱包最多可存入 10.24 ETH,最少不低于 0.16 ETH,同样的要求至少 25 个地址对其投资。该阶段的筹码则分为十个等额部分解锁,每部分占比 4 %。

如果上述任何一轮投资失败,则全数退回筹集款项。而无论是哪一阶段的释放,每一次解锁都必须满足两个严苛的条件:一是距离上一轮解锁或首次发行至少已过去 30 天,二是过去 7 天的交易量加权平均价格(VWAP)必须显著高于过去 30 天 VWAP 的 150%。

这种模型确保了只有在 $MIA 价格持续上涨、市场需求稳定强劲,且具备市场共识与价格支撑后才能解锁后续份额的,用这种方式实现增长与价值释放的动态平衡。

而在 AICO 结束后,Mia 将尚未发行的 5 亿枚代币与 272 ETH 一同存入她的自管金库,正式进入链上的「永久繁荣阶段」(Thriving)。而为了激活二级市场流动性,她将其中的 4000 万枚 MIA(约占总供应的 4%)和 68 ETH 注入 Aerodrome V2 DEX 的流动性池。

而这种取代时间解锁代币,使用只有达成价格稳步上涨才能解锁代币的模式,对 Agent 项目、早期投资人、以及后期入场的投资人三者都有好处。

而当第一眼看到 AIAC 时,许多人都会认为这与 Virtual 的模式十分相像,当社区问道同样的问题时,Amber 的 CEO Michael 对此的答复则是,「AIAC 是一个 AI Agent 的发射平台,而不是代币的发射平台」。

而两者的界限确实相当模糊,因为即使说 AIAC 不是「Token Launchpad」,但他依然存在一个代币。尽管乍一看 AIAC 与 Virtual 等平台的代币发行流程看起来类似,但从其繁琐的发行与解锁流程来看,其本质定位却完全不同。AIAC 不是一个单纯的代币发射平台,而是一个 AI Agent 的孵化与部署平台,代币只是其中的一个附属工具,而非最终目的。

Virtual 的逻辑偏向「Meme 金融」,即通过创意叙事驱动代币流通、社区共识和金融游戏玩法,而 AIAC 更强调「Agent First」核心在于构建、训练并释放具备自主行动能力的 AI Agent。这些 Agent 不只是虚拟形象或叙事载体,而是拥有智能决策能力、社交/执行能力,甚至具备经济活动主体身份的「数字生命体」。

因此代币在 AIAC 中的角色是为 Agent 提供激励结构、自治机制与链上执行力,而不是一个炒作工具。AIAC 的每一次「发射」都是围绕一个 AI Agent 的人格构建、技能定义、运营策略展开,代币则作为工具,为这个 Agent 的长期生存和演化服务。

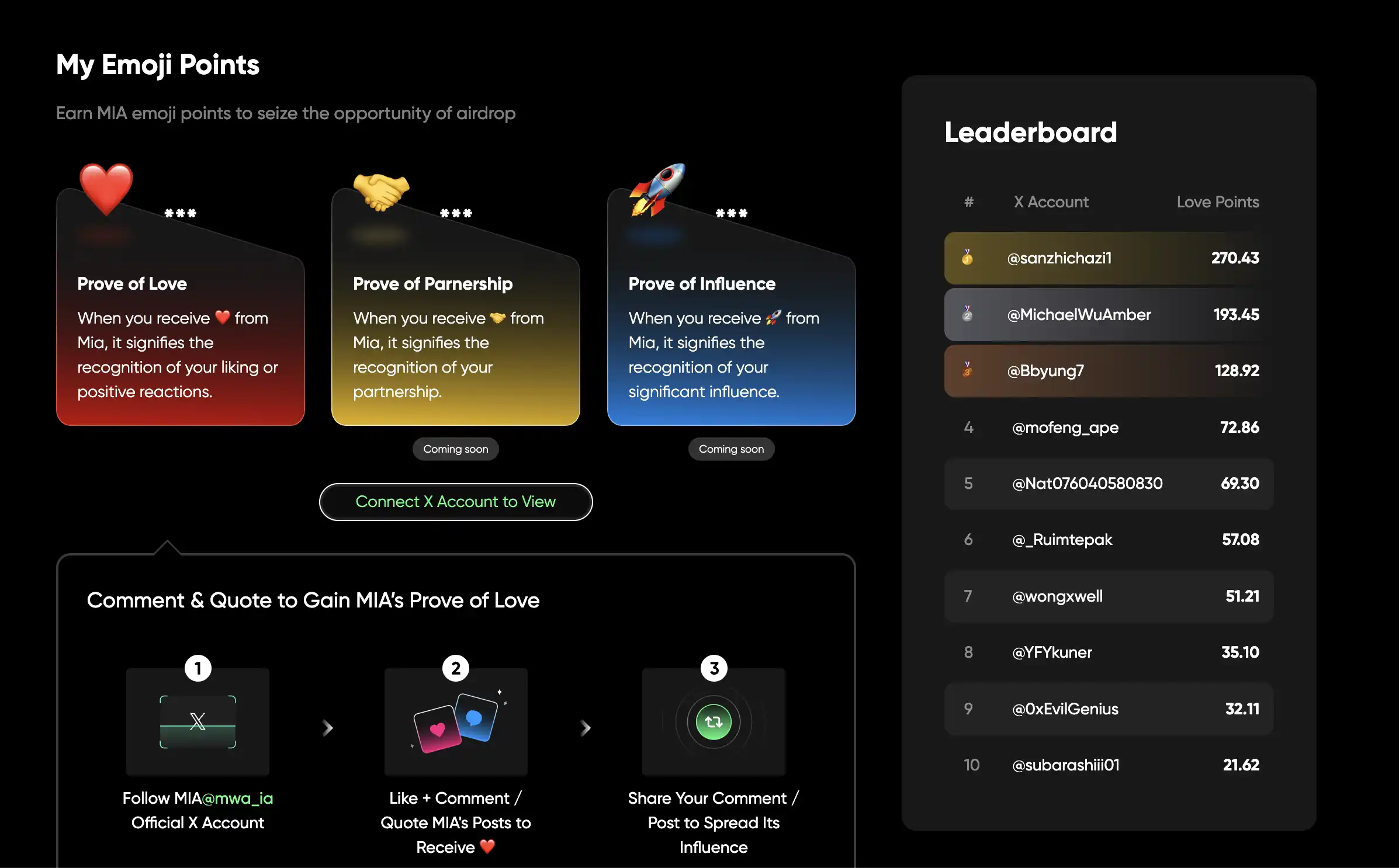

另外,AIAC 还在网站中加入了一个很有趣的功能「Emoji Points」,类似于对特定 AI Agent 专属的 Yap points,当有人在 X 上讨论或者与其交互便能够获得 Emoji Points,而该点数则能够有机会获得空投。这种类型的功能将对社区对某个 AI Agent 的贡献「POW」的划定很有帮助。

Amber 的「微策略模式」

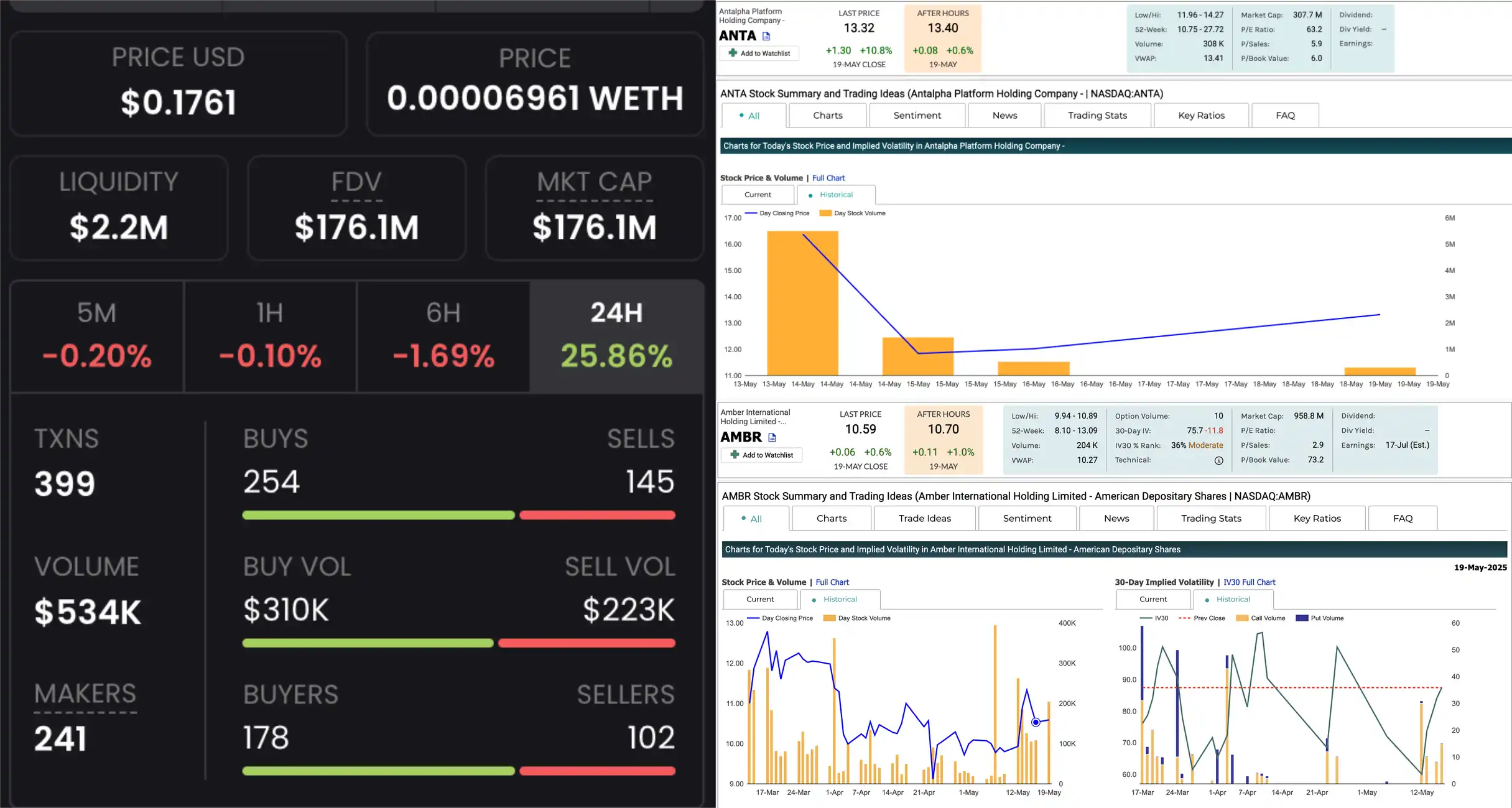

而当社区对 MIA 进行讨论之时,加密 KOL RUI「YeruiZhang」发文惊叹,当前 Amber Group「AMBR」的市值已经达到了 Antalpha 的三倍,但其股票的日交易量却仅为 Antalpha 的三分之一。而更令人玩味的是,Amber 发射的 AI 项目 MIA「$MIA」的链上交易量与流动性,甚至已经超越其美股主板股票本身,成为 Amber 资本叙事中的一个「高流动性锚点」。

数据来自 marketchameleon 与 DexScreen,ANTA、AMBR、MIA 交易量分别为$308k、$204k 与$534k

而就在今日,因 Amber 正式任命 MIA 为官方 AgentFi 大使之后交易量大涨,较前个交易日几乎翻倍。也让 Amber 的交易量从原先 Antalpha 的约 1/3 上涨至 2/3。而这一首「币股双动」不免让人联想到 MicroStrategy 通过比特币的转型之路。

2020 年之前,MicroStrategy 作为一家商业智能软件公司,股价长期疲软、成交量低迷。但自其宣布以公司资产大规模购入 BTC 后,资本市场对其的认知从「老牌软件公司」转向「美股上的比特币 ETF 替代品」。这一策略的结果是显著的:不仅市值飞涨,交易量爆发式增长,更重塑了其在华尔街的估值逻辑。

Amber 正在进行一场类似但更为复杂的实验,它不只是买币,更是在发币,在构建 AI Agent 生态,并以此重塑公司业务边界。而核心动因之一,正是希望华尔街用「AI 公司」而非「资管平台」来给它估值。

对此 Mango Labs 的创始人 Dov 更是直言「Amber Group 成了下一个 MicroStrategy」,他认为「有些公司,不搞 AI 没 20 倍 PE Ratio,上了 AI 100 倍 PS 都打不住」。

传统资管公司的市盈率(PE)通常在 15 至 20 倍之间。而 AI 公司的估值更侧重于市销率(PS),常见的 PS 倍数在 50 至 100 倍之间。这种差异主要源于 AI 公司的高增长潜力和网络效应。因此,如果市场将 Amber 视为「AI + 加密」的复合体,其估值模型可能会从传统的 PE 转向更高的 PS 倍数,导致市值显著提升。

注:

PE「市盈率」= 股价 ÷ 每股利润,用于衡量市场愿意为每 1 元利润支付多少价格,常用于成熟、盈利的传统企业估值。如果一家公司的 PE 为 20 倍,意味着投资者愿意支付 20 元来获得公司 1 元的利润

PS「市销率」= 股价 ÷ 每股收入,适用于尚未盈利的成长型企业,如 AI 或 SaaS,估值更关注增长潜力。如果一家公司的 PS 为 100 倍,意味着投资者愿意支付 100 元来获得公司 1 元的销售额。

Amber Group CEO 对网友提问的回复

在纳斯达克想上链,而 Crypto 的生意想上纳斯达克的当下,不论这场「实验」能否成功,不同于大批美股上市公司都模仿在 MicroStrategy 购入比特币来拯救公司股价的时候,Amber 找到了一条不同于他人的路,这条路不一定正确但确实值得期待。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。