Grayscale's research director Zach Pandl pointed out in an interview with Decrypt that Bitcoin dominance may stabilize in the range of 60% to 70%, rather than experiencing the sharp decline that the market expects to trigger an "Altcoin Season." Meanwhile, the rise of the Solana ecosystem is quietly changing the market landscape, with institutional accumulation, an influx of developers, and impressive on-chain data.

Bitcoin Dominance: Stability or Turning Point?

Data shows that as of May 17, 2025, Bitcoin dominance is approximately 60.4%, down from a peak of 64.4% on May 8. Zach Pandl analyzed that the changes in Bitcoin dominance are closely related to the market's focus: when investors concentrate on macroeconomic instability and dollar risks, Bitcoin's status as a "non-sovereign asset" drives its dominance up; conversely, when market enthusiasm shifts towards innovative applications of blockchain technology, the appeal of altcoins increases, leading to a decline in Bitcoin dominance.

Bitwise senior investment strategist Juan Leon further pointed out that the recent decline in Bitcoin dominance reflects an increase in investors' risk appetite. U.S. President Trump announced a 90-day suspension of tariffs, combined with easing inflation pressures, which has reduced market concerns about a slowdown in the U.S. economy and increased expectations for Federal Reserve interest rate cuts. A low-interest-rate environment typically benefits risk assets like stocks and cryptocurrencies, prompting funds to flow into altcoins. Leon emphasized, "The decline in Bitcoin dominance is not a crash, but a response from the market to technological innovation and diversified investment opportunities."

Coin Bureau co-founder Nic Puckrin poured cold water on the current altcoin market, stating that the spot trading volume of altcoins is far below the levels seen in January 2025 and March 2024, let alone the explosive scenes of the 2021 altcoin season. He bluntly stated, "There is still a long way to go before a true altcoin season." This judgment aligns with on-chain data: although the trading activity of altcoins has seen some recovery, overall liquidity has not yet reached historical highs, and market sentiment has not fully turned to euphoria.

Solana Ecosystem: Under Currents Before Altcoin Season

Although the altcoin season has not yet arrived, the strong performance of the Solana (SOL) ecosystem cannot be ignored. DeFi Development Corp (formerly Janover) recently disclosed that its SOL holdings have surpassed $100 million and that it has acquired a Solana validator node, managing approximately 500 million SOL (about $75 million) in delegated staking. SOL Strategies has also increased its holdings by over 120,000 SOL in the past week, demonstrating institutional confidence in Solana's long-term potential.

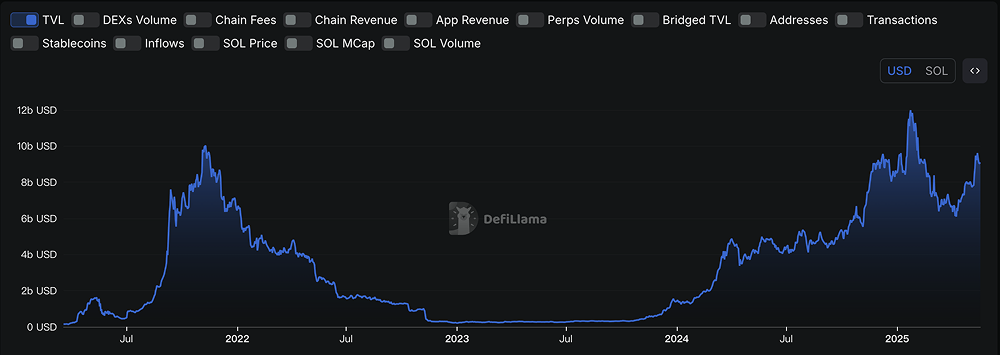

On-chain data further supports Solana's appeal. According to DeFi Llama, Solana's total value locked (TVL) in DeFi has climbed to $9.34 billion, nearing the historical high of $11.8 billion in 2021. The stablecoin market has surpassed $13 billion, indicating its core position in the DeFi space. A report from Coinbase noted that institutional funds are accelerating their inflow into Solana, partly due to its low-cost, high-throughput blockchain characteristics attracting institutional projects.

Even more noteworthy is Solana's developer ecosystem. According to Electric Capital data, in the first quarter of 2025, the number of new developers on the Solana chain increased by 83% year-on-year, surpassing Ethereum for the first time. 65% of SOL has been staked, and open interest is also steadily rising. The news of Alchemy acquiring the Solana development company DexterLab further confirms corporate optimism about Solana's development potential, aiming to accelerate the development of Web3 applications.

Market Outlook: A Game of Balance

Despite the vibrant Solana ecosystem, the market is not one-sided. Grayscale's report for the first quarter of 2025 pointed out that Ethereum, with its robust ecosystem and successful ETFs, remains the dominant player in the DeFi market. High-performance Layer-1 networks like Solana and Sui have shown excellent performance, but they still lag behind Ethereum in market share and developer stickiness.

At the same time, Bitcoin's macro narrative remains strong. The mayor of Panama City recently announced the acceptance of Bitcoin and other cryptocurrencies for payments and plans to follow El Salvador in launching Bitcoin reserves, further solidifying Bitcoin's status as a safe-haven asset. Trump's pro-crypto policies not only benefit Bitcoin but also create a favorable environment for mainstream altcoins like Solana.

Conclusion: Observe Calmly, Act Strategically

The current crypto market is at a delicate balance point between Bitcoin dominance and the rise of altcoins. Zach Pandl's prediction suggests to investors that the stability of Bitcoin dominance may indicate that the market is entering a consolidation phase rather than immediately welcoming an altcoin season. The vitality of Solana's ecosystem undoubtedly injects confidence into altcoins, but insufficient liquidity and historical data indicate that a true altcoin season still requires time to brew.

For investors, it is essential to closely monitor macroeconomic signals (such as Federal Reserve interest rate decisions) and on-chain data (such as Solana's TVL and developer growth) in the short term. The institutional accumulation and developer enthusiasm for Solana may be a prelude to an altcoin season, but as Puckrin stated, market euphoria has yet to ignite. Observing calmly and positioning accurately may be the wisest choice at present.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。