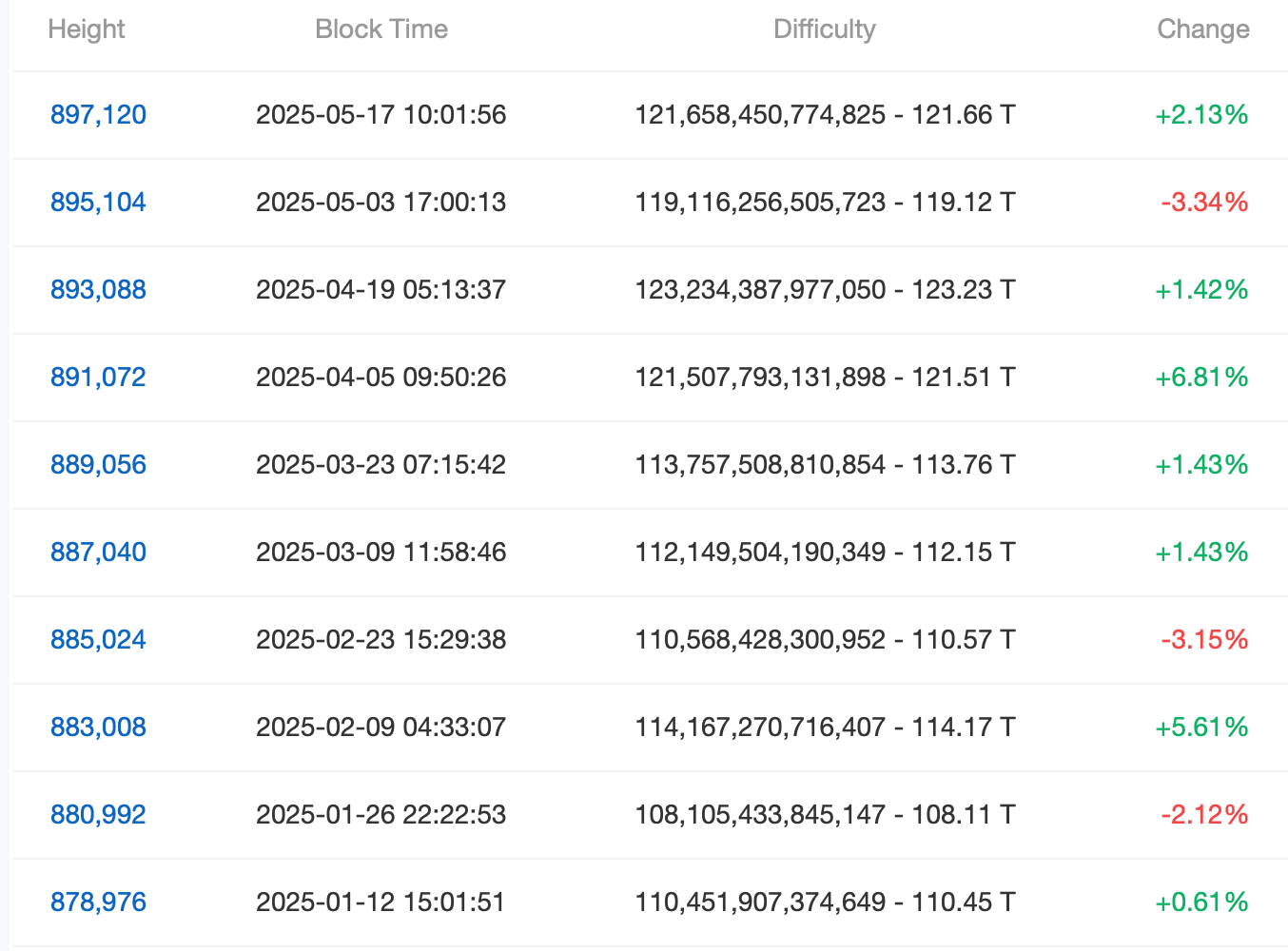

Miners now face slightly steeper odds in their efforts to solve blocks, with the adjustment making the process 2.13% more arduous. Although the current figure stands tall at 121.66 trillion, it remains shy of the peak difficulty set following block 893,088.

Source: Cloverpool.com Explorer.

Thus far in 2025, the network has experienced six upward difficulty adjustments, collectively amounting to a 13.83% increase, alongside three downward shifts totaling 8.61%. In parallel, Bitcoin’s aggregate processing power has receded from its zenith of 929 exahash per second (EH/s) to 848.53 EH/s, based on the seven-day simple moving average (SMA) tracked by hashrateindex.com—reflecting a contraction exceeding 80 EH/s.

Despite the dip in raw hashing force, miners have benefited from stronger profitability metrics as bitcoin’s price has remained above the $100,000 mark for ten straight days. Roughly one month ago, the hashprice—the projected revenue for operating 1 petahash per second (PH/s) over a single day—hovered near $44.29 per PH/s. As of today, that figure has improved substantially, now standing at $54.93 per PH/s.

Bitcoin’s difficulty adjustments and hashpower fluctuations offer a subtle glimpse into the evolving dynamics between miner incentives and network resilience. As economic conditions, energy costs, and price trajectories continue to influence mining economics, the delicate balance between participation and profitability will remain a key narrative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。